Few sectors have been unaffected.

Commercial property supply-and-demand dynamics have been altered by transformational changes to the way we live, work, shop, and do business. These have lasting implications for risk and return.

In the initial stages of the pandemic, CBDs were suddenly deserted as office workers traded the meeting room for the living room.

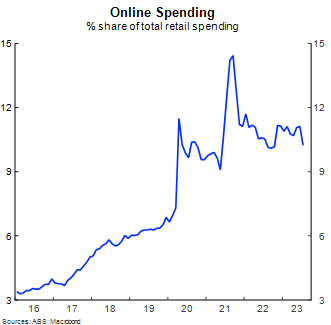

Online shopping surged as we were locked in our homes.

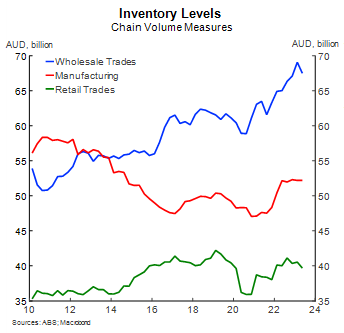

Supply-chain disruptions meant businesses stocked up on whatever they could get their hands on in a shift from ‘just in time’ to ‘just in case’ inventory management.

Demand for fulfilment centres and storage facilities skyrocketed as the ‘last mile’ of the supply chain became increasingly important to get products to customers.

And while some unwind has occurred as normality returned, these trends will likely be somewhat enduring.

Take the next steps

-

Explore BT Panorama

Increase efficiency and client value with online consent, our award winning mobile app and more.

-

Questions about BT Panorama?

Speak to a BDM or

call 1300 784 207

Commercial Property Valuations Impacted

During this tumultuous period, many commercial property investors have seen the value of their investments fall as these challenges are increasingly reflected in underlying asset values. Additionally, the surge in interest rates and the expectation they are likely to remain higher for longer has weighed on valuations.

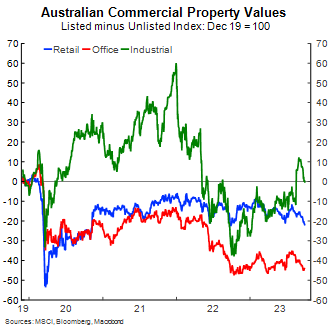

The office sector has been hardest hit and faces the most challenging environment ahead. Weak demand against a backdrop of rising supply has led to vacancy rates increasing, weighing on returns.

Retail properties, such as shopping centres, have also been impacted. However, fortunes have been mixed as some segments, such as smaller neighbourhood retail centres, have benefited.

Industrial property has bucked the trend – demand skyrocketed and rents and valuations rose sharply. Some cooling of demand from scorching hot levels has occurred and more is expected. However, the picture is more reflective of moving from ‘red hot’ to ‘hot’, rather than ‘hot’ to ‘cold’.

Differing Investor Experience

Investors who choose to allocate to commercial property have different ways they can obtain that exposure. Outside of direct investment, investors can combine their funds with others via pooled investment vehicles, of which there are listed and unlisted alternatives.

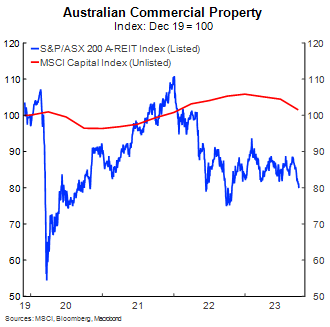

If you only looked at reported valuation changes, the experience looks more like a rollercoaster for those invested in listed Australian Real Estate Investment Trusts (A-REITs) compared to those investing in unlisted funds.

Listed values were hard hit during the pandemic – plunging almost 50%. On the other hand, unlisted valuations barely budged – only slipping around 5%. While listed values recovered after the initial shock, they have since fallen as the sector has come under pressure. Listed valuations are currently around 20% below pre-pandemic levels. In contrast, unlisted valuations remain just above pre-pandemic levels.

Investors in unlisted funds have a key disadvantage to those in listed funds – the lack of liquidity. Investors value liquidity and financial theory suggests that illiquid assets should earn a higher return for this additional risk – the illiquidity premium.

At first blush, it may seem that investors are earning this illusive illiquidity premium.

However, there is more than meets the eye.

Risks taken by investors in unlisted funds can show up in other ways and investors need to consider all risks taken, not just those front and centre on financial statements.

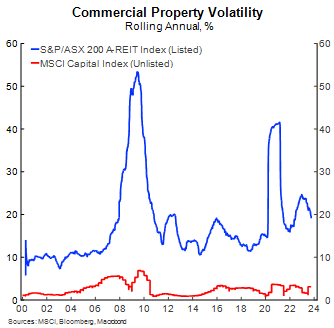

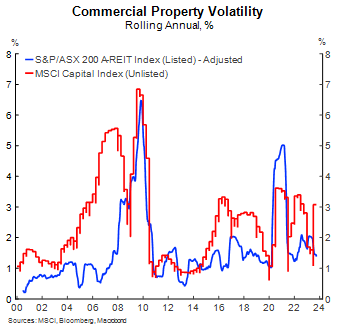

The smoother ride for unlisted investors doesn’t just cover the post-pandemic period, but extends further in history, as returns on unlisted funds exhibit much lower volatility than their listed cousins.

However, a large part of this reflects an artificial smoothing effect, rather than an underlying difference in risk.

Listed funds are marked-to-market (i.e. revalued) every day by the financial market. On the other hand, unlisted funds are revalued only infrequently (typically quarterly). This has the effect of making unlisted valuations appear less volatile and less correlated with other investments. It also improves standard risk-adjusted measures of return. But if we adjust listed valuations using a quarterly moving average (to simulate smoothed quarterly returns) and compare volatility, the difference goes away. This adds weight to the view that the smoothing effect is artificial, rather than an underlying characteristic.

Investing With Eyes Wide Open

Comparing the returns of listed and unlisted assets is not as easy as it may first seem. There are other challenges that need to be accounted for, such as choosing an appropriate benchmark.

Researchers have sought to answer these questions. Pagliari et al. (2005) and Ang et al. (2013) undertook detailed investigation of differences between returns of listed and unlisted commercial property exposures in the US. Their investigations found no meaningful divergence between the risk and return characteristics once accounting for key variations between listed and unlisted indices. This includes different geographical and sector exposures (e.g. office, industrial, and retail), and leverage.

This suggests there is little to no illiquidity premium for unlisted compared to listed commercial property exposures.

Investors should consider all risks they take when they choose to allocate to a particular part of the market. In the long run, the risk and return characteristics are likely to be driven by the underlying fundamentals of the investments made, not whether the vehicle chosen is listed or unlisted.

The choice between listed and unlisted funds should be made with eyes wide open and with consideration of the requirements and risk tolerance of the investor. Research shows that chasing an illiquidity premium for its own sake should not be a deciding factor.

See our detailed special report for a deeper dive into the commercial property sector and more insights on the differences between listed and unlisted exposures.