Turning the Ship Towards Earlier Hikes

The Reserve Bank (RBA) released its quarterly Statement on Monetary Policy (SoMP) this morning. The statement is a bookend to a big week for the bank as it slowly turns the ship and prepares for earlier than previously indicated rate hikes. It includes an updated set of forecasts following the Board meeting earlier this week where it dropped its bond-buying program, and a speech from the Governor Lowe, where he acknowledged rates hikes this year are “plausible”.

The forecasts are often the clearest signal we get from central banks on their thinking about the economy, and in turn, the expected path of monetary policy. They are particularly important at critical junctures, such as communicating a change in when the policy rate is expected to move.

Economic Growth

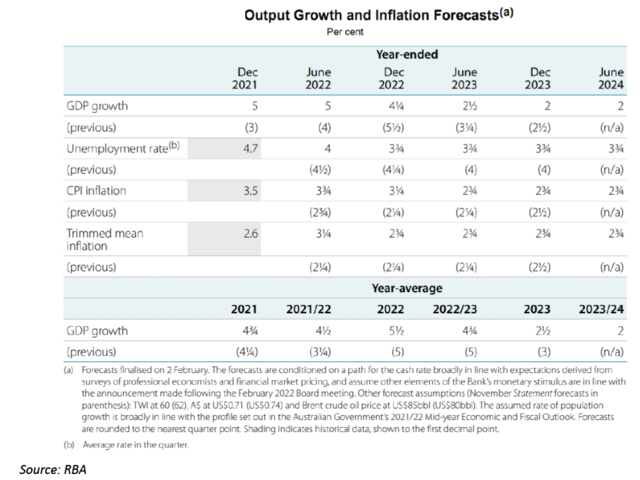

GDP is expected to have grown by 5 per cent over 2021 (previously 3 per cent). The revision up reflects the stronger rebound from Delta and the robust path of the economy. However, future growth rates were trimmed, accounting for the stronger starting point. GDP is forecast to grow by 4¼ per cent in 2022 (previously 5½ per cent) and 2 per cent in 2023 (previously 2½ per cent).

On the impact of the Omicron variant, the RBA noted that signs point to the impact on spending being relatively small. The spread has been “disruptive but is not anticipated to have a large or sustained impact on growth.” Growth is expected to slow in the March quarter but is forecast to regain momentum in coming quarters. The impact of Omicron is expected to be smaller than previous COVID-19 waves.

Labour Market

The RBA expects the unemployment rate to fall to 3¾ per cent by the end of 2022 (previously 4¼ per cent). Unemployment is then forecast to remain at this level. The Omicron outbreak is expected to significantly impact hours worked in January and into February. However, it is not expected to have a large impact on employment.

Governor Lowe previously noted that full employment is when the unemployment rate is in the low 4s. So, unemployment with a ‘3’ in front is beyond full employment. When an economy is beyond full employment, wage pressures can be expected to grow.

Wages are expected to pick up faster than previously expected. The Wage Price Index (WPI) is forecast to grow 2¾ per cent over 2022 (previously 2½ per cent) and 3 per cent over 2023 (unchanged). While the pick-up is expected to be gradual, broader measures of earnings (which include bonuses and other payments) are expected to increase faster than the WPI.

Governor Lowe noted in his speech that broader measures of wages growth, including the bank’s liaison with businesses, would be watched by the Board in its decision making. RBA Policy

Inflation

Inflation in the December quarter was higher than the RBA expected. The Governor mentioned in his speech that supply-chain disruptions and changes in consumption patterns contributed to increases in inflation. However, the SoMP noted that “There is also some evidence of inflation pressures recently broadening beyond goods prices into services prices.” This is an indication that inflation pressures are becoming less transitory than may have been previously expected.

The biggest shift was in the forecast for underlying inflation, which the RBA expects will break above the upper end of the target range. It is expected to hit 3¼ per cent by the June quarter of 2022, before returning to 2¾ per cent to stay in the top half of the band for the foreseeable future. In November, the RBA expected underlying inflation to hit 2¼ per cent at the end of 2021 and remain there until the June quarter of 2023.

Another notable change is the RBA’s view on inflation in their upside and downside scenarios. In the upside scenario, underlying inflation increases above 3¼ per cent and trends higher throughout the forecast period. In the downside scenario, inflation falls but remains above 2 per cent for most of the forecast period.

Monetary Policy Outlook

The potent combination of above-trend growth, unemployment below full employment and underlying inflation above or in the top half of the target band reinforces our expectations that a rate-hike cycle will start in August. We expect the cash rate will continue to lift through to 2024. In our view, the messaging in today’s SoMP backs up this forecast.

A critical line in the SoMP that caught our eyes: “If realised, the staff forecasts imply that the Bank's policy goals would be achieved sooner than previously envisaged”. In central bank speak, that is a strong endorsement for bringing forward rate hikes.

It wasn’t long ago the RBA was sticking to its “central scenario” that the cash rate wouldn’t lift before 2024. But this week we have seen major revisions to the forecasts, the Governor’s acknowledgement that rate hikes in 2022 are “plausible”, and the above statement in the SoMP. In combination, these constitute a strong signal from the RBA: get ready for higher rates.

The RBA sensibly wants to see more data before committing to a particular date, as we manage supply disruptions and ongoing challenges from the pandemic. We already had two quarters with underlying inflation at 2.1% for the September quarter and 2.6% for the December quarter of last year. We will receive two more updates in April and July. We also get two more wage prints in February and May. In amongst all that, the Federal election is shaping up for May, which the RBA will likely want to steer clear of.

We think that combination of factors leaves June as the first possible “live” date for an RBA rate hike. But the RBA has continued to emphasise it is prepared to be patient, so we still think an August lift-off is more likely.

BT Economics

BTeconomics@btfinancialgroup.com

Superannuation income streams types

Calculating the rate of income support payments

This document has been created by Westpac Financial Services Limited (ABN 20 000 241 127, AFSL 233716). It provides an overview or summary only and it should not be considered a comprehensive statement on any matter or relied upon as such. This information has been prepared without taking account of your objectives, financial situation or needs. Because of this, you should, before acting on this information, consider its appropriateness, having regard to your objectives, financial situation and needs. Projections given above are predicative in character. Whilst every effort has been taken to ensure that the assumptions on which the projections are based are reasonable, the projections may be based on incorrect assumptions or may not consider known or unknown risks and uncertainties. The results ultimately achieved may differ materially from these projections. This document may contain material provided by third parties derived from sources believed to be accurate at its issue date. While such material is published with necessary permission, Westpac Financial Services Limited does not accept any responsibility for the accuracy or completeness of or endorses any such material. Except where contrary to law, Westpac Financial Services Limited intends by this notice to exclude liability for this material. Information current as at 10 December 2021. © Westpac Financial Services Limited 2021.