Access a range of annuities

I have an Asset Administrator adviser account

- Online annuity quotes can be accessed via a single sign-on from Asset Administrator.

- You can enter your client’s details into Asset Administrator from the Open an account screen, selecting ‘annuity’ as the product type. This information will prepopulate the annuity quotes and applications.

- Select your annuity client from your client list and select Apply for a Challenger annuity to apply for a new annuity, or move a maturing Challenger annuity to Asset Administrator.

- Select or create a quote and complete the remaining questions on Challenger’s e-application, including online identity verification.

- After lodging the electronic application and client approval, the annuity will be funded using the approach that you specified in the application.

- Once funded, Challenger will issue the welcome pack, and we’ll let you know that this is available in the Asset Administrator document library, for you and your clients to access.

At this stage, we’ll issue a welcome email to your client, and if they are new to Asset Administrator, they will also receive the registration details to access their annuities online.

Ongoing management is also made simpler, with email notifications for key transactions, easy maintenance of linked bank accounts, and access to annuity correspondence via the document library.

I don’t have an Asset Administrator adviser account

If you don’t have an Asset Administrator account, check that your dealer group licensee offers Asset Administrator and register for an Asset Administrator adviser account.

To set up an annuity please follow the instructions under “I have an Asset Administrator account”.

Questions? For step-by-step instructions on how to set up an Asset Administrator account, or how to set up clients via Asset Administrator, attend a quick online training session or contact us on 1300 784 207 or professional@panorama.com.au.

Challenger

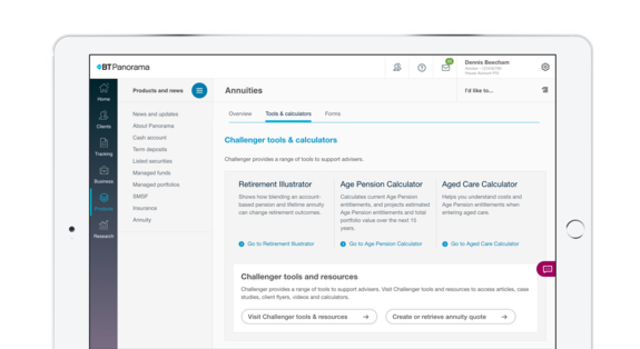

There is a range of support available from Challenger to assist you with talking to your clients about how annuities may fit into their retirement portfolio. View the latest technical articles to explore the challenges retirees face, legislation impacting this area, and what solutions you can provide. Simply login to your BT Panorama adviser account, find annuities under the product section and visit ‘Challenger tools and resources’.

Asset Administrator platform

Access Challenger’s full range of market-leading annuity solutions via Asset Administrator, in addition to PDS and policy documents, support tools for advisers, calculators, forms and more.

BT Portfolio Services Ltd (ABN 73 095 055 208, AFSL No. 233715 (‘BTPS’) provides administration services to and for Challenger Life Company Limited (ABN 44 072 486 938) in respect of Challenger annuities via BT Panorama. BTPS is not issuing, selling, dealing or arranging the sale of Challenger annuities via BT Panorama and BTPS is not providing any custody service, any advice or any other financial service or function in relation to Challenger’s customers. Related parties of BTPS (like Westpac Banking Corporation ABN 33 007 457 141 AFSL 233714) (Westpac) and their representatives may be authorised to provide retail clients with personal financial advice in respect of Challenger annuities via BT Panorama, although such persons would need to appoint them pursuant to separate terms.

This information is also provided by Challenger Life Company Limited ABN 44 072 486 938, AFSL 234670 (Challenger Life), the issuer of Challenger annuities. This is general information for advisers only and is not intended to be advice. Clients should consider the relevant product disclosure statement available at www.challenger.com.au/panorama and the appropriateness of the product before making any investment decision. All references to guaranteed income refers to the payments Challenger Life promises to pay under the relevant policy documents. Neither the Challenger Group nor any company within the Challenger group guarantees the performance of Challenger Life’s obligations or assumes any obligations in respect of products issued by Challenger Life.

This information is given in good faith and has been derived from sources believed to be accurate at today’s date. However, it is general information or an overview only and should not be considered a comprehensive statement on any matter or relied upon as such. No company in the Westpac Group nor any of their related entities, employees or directors gives any warranty of reliability or accuracy or accepts any responsibility arising in any other way including by reason of negligence for errors or omissions. This disclaimer is subject to any requirement of the law.

This information has been prepared for use by advisers only. It must not be made available to any retail client and any information in it must not be communicated to any retail client or attributed to BTPS.

© BT - Part of Westpac Banking Corporation 2018