How long does a pension refresh take?

Pension refreshes can take between 5 and 23 business days, depending on the circumstances. For a more accurate estimate of your client’s circumstances, you can contact us. After a request has been submitted, you can check the status.

My client didn’t receive a registration email. Can you resend it?

Yes. Contact us, and we’ll resend the registration email to the client.

My client would like to place trades on their own account. How can I set this up?

Your client can request to be the primary authorised user, instead of the adviser, by completing the “Change primary authorised user” form. The adviser can continue to have access to view their account.

Alternatively, the adviser can be delinked from the account and the client can manage their own account entirely, by completing the ‘Advice relationship opt-out' form. The adviser would no longer have any access to their account.

Both forms are available on BT Panorama by navigating to Tracking > Service requests. For more details, navigate to Help and Support> Advice Fees > FAQs.

What are the differences between the Nominee, Custodial and Sponsored HIN holding types?

You can find a summary of the differences by navigating to Help and Support > Managing your clients > Listed securities > Holding types.

How do I transfer asset into a BT Panorama account?

Assets can be transferred into a BT Panorama account, or from one type of investment holding to another within a BT Panorama account (known as an intra account transfer). More information on how to do this is available on on BT Panorama by navigating to Help and Support> Managing your clients >Asset transfers.

How do I know if my clients need to re-consent to fee arrangements due to the ASIC changes?

In July, we sent an email to advisers with impacted clients, titled ‘Advice fee re-consent required’. It includes:

- A link to the full client list

- Pre-filled forms for submission

If you didn’t receive this email, you can call us — your clients may not be affected.

How can I check the expiry details of my client’s W-8BEN form?

You can find this information on BT Panorama by navigating to: Tracking > Withholding Tax Expiry.

Does my client need to meet the minimum pension payment requirements for a pension account established close to the end of the financial year?

The minimum pension payment is calculated on a pro-rata basis determined by the number of days remaining in the financial year.

However, pension minimums are not enforced if a pension account is opened after 1 June. Members may elect to have their initial pension payment after 1 July in the new financial year.

The BT Panorama pension refresh form has a section for 'downsizer' contributions, is my client still required to complete the ATO downsizer form?

No, the ATO downsizer form is not required, but sections 4 and section 8 of the pension refresh form need to be completed.

Does BT Panorama allow my client to merge their own pension with their death benefit pension?

What is the process for my client to organise a Small Business CGT Exemption Contribution?

Please complete the Capital Gains Tax (CGT) Election form and send it to us by email or post. You can find this form under ‘Service requests’ on BT Panorama. Once this form is received and processed, your client can send the funds via EFT by using their BT Panorama BSB and account number, which you can find by navigating to the 'Account Details' section and include the reference 'CGT 15 Year' in the description.

For more information, please navigate to BT Panorama Help & Support > Products & Investments > Manage Contributions > Make a One-Off Contribution > Small Business/CGT Exemption Contribution.

Where can I view the status of investment orders for all of my clients?

When logged into BT Panorama, navigate to ‘Tracking’ > ‘Order status’. Select the time period and you can view all orders, or orders for an individual account.

Does BT have a Technical team that can help with complex strategy and tax questions?

BT has a technical team that can assist with strategy and tax related questions. Although they are unable to give direct advice, they can provide you with all the necessary resources to help you make informed decisions. You can email technical@btfinancialgroup.com or login to the BT Panorama mobile app to call.

From January 2025, we are making a change to our BT Technical Services team hotline and support email services. This service will be available to BT Panorama advisers and their support staff only.

When will my clients’ tax statements be ready?

All tax statements for the 2023/2024 financial year are now available in the Document Library. Please contact us on 1300 784 207 if you require assistance.

Can my client add an international mobile phone number on their account?

Yes, the primary contact number can be an overseas number. They can contact us on 1300 881 716 or +612 9155 4030 if calling from overseas, should they require assistance.

My client wishes to transfer assets, including cash, from their BT Panorama Super account to a newly established pension account, however the value of the pension would be over $1.9M. How do I ensure the transfer balance cap is not breached?

You can request a partial internal rollover and in specie transfer between a super and pension account, using the 'Partial transfer within Panorama Super’ form. You can find this form on BT Panorama by navigating to Tracking > Service requests > Submit new request > Transfers. You can specify the quantity of assets, in units, and a cash amount if applicable, to be transferred to the new BT Panorama pension account. Due to changes in the value of assets between when the form is submitted and when the transfers are processed, there is a risk that the purchase price of the pension is above the transfer balance cap. If this happens, you can request a commutation of the excess back to the BT Panorama Super account. Please review and act on instructions from the ATO.

Why is my client’s tax statement taking longer than the time indicated by the estimator tool?

The tax statement estimator tool calculates an approximate date using information we receive from fund managers and share registries or, if we haven’t yet received that information, then information from the previous financial year. The dates provided in the estimator tool are subject to change as more information is received over the financial year end.

How do I generate a Centrelink Schedule for my client's BT Panorama pension account?

- Log into BT Panorama and go to the client’s account page, then select ‘Service requests’

- Select ‘Submit new request’

- Select ‘Centrelink Schedule’

- Select ‘Submit’

- You can then download the Centrelink Schedule either via the Document Library or the BT Panorama service request tracker. It may take up to 2 business hours to become available.

Can I use an external broker on BT Panorama accounts and, if so, how do I set this up?

Yes, this is possible; you can find a list of approved external brokers on BT Panorama Help & Support > Managing your clients > Investment Orders > Trading through an external broker.

To set your client up with one of these approved brokers, contact the broker and let them know your client wishes to settle the transactions through their BT Panorama account.

Does BT Panorama allow participation in dividend reinvestment plans (DRPs) and if so, how can I request this for my client’s account?

Participation in DRPs is available for BT Panorama Investment accounts with the nominee holding option or sponsored holding option. This is not available with the custodial holding option or for BT Panorama Super accounts. To participate in DRPs, select the client's account, then go to Portfolio views > expand the Listed securities section to view the relevant security > under Dividend, select ‘Cash’ to change the dividend preference from 'cash' to 'reinvest’.

What is a cash investment strategy and how can I set it up for my client?

A cash investment strategy, or 'automatic reinvesting', allows surplus cash to be reinvested into existing managed funds, managed portfolios, or tailored portfolios. For more information on how to set this up, please visit BT Panorama Help & Support > Managing your clients > Cash Management > Cash Investment Strategy.

How is the 'Gross Annual Payment' in the Centrelink Schedule for my client’s pension account calculated?

You can find the formula in the footnotes of the Centrelink Schedule. For reference, the formula is (Sum of all Payments expected for that FY ÷ Number of Days from Commencement date until 30 June) x 365 (366 for leap years).

For BT Panorama pension accounts, is there a chance my clients may experience delays with their pension payments in July?

Where there’s insufficient cash to cover a pension payment, we’ll sell down a proportion of a client’s investments to generate the required cash.

During the EOFY period, there can be delays in the striking of unit prices, in distribution and dividend payments, and in asset redemptions, which can impact a client’s cash balance.

The combination of these factors can cause pension payments to be delayed.

If I submit a notice of intent to claim for my client for FY23, when does the tax start getting deducted from the client’s account?

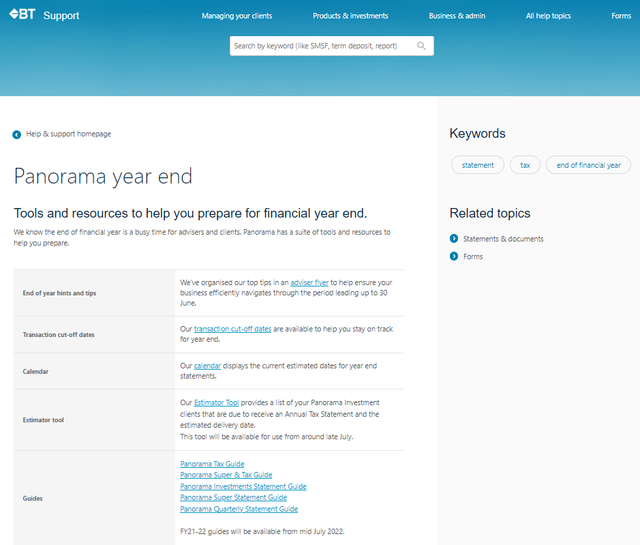

Once a PTDN (Personal Tax Deduction Notice) has been submitted, we begin deducting tax from the client's account in the following month's Monthly PAYG Instalment. Please login to BT Panorama and refer to Help & Support > Panorama Year End > Panorama Super and Tax Guide for further information on when tax is deducted from Panorama Super accounts.

Does BT Panorama have a tool whereby advisers can estimate when Tax and Annual Statements will be released for FY24?

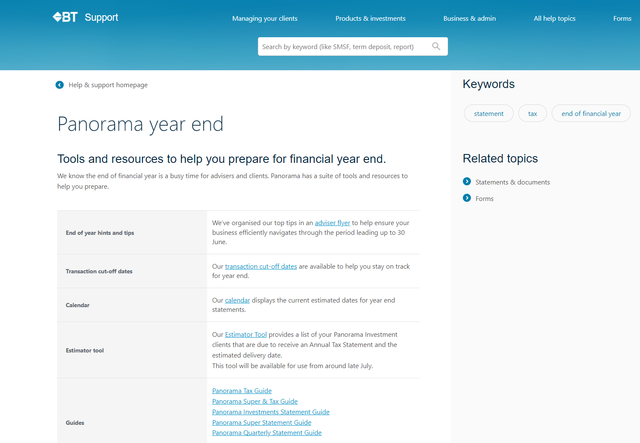

Please login to BT Panorama and visit our Help & Support page > Business and Admin > Panorama Year End > Statement Dates > click the link to our 'Calendar', to find a list of our Annual and Tax Statements for Super and Investment accounts, and PAYG Statements for Pension accounts.

BT recently sent us communications regarding our client's pension payments and general EOFY awareness – are we required to take any action or is this just for our information?

During the EOFY period, there can be delays in the striking of unit prices, in distribution and dividend payments, and in asset redemptions, which can impact a client’s cash balance and cause pension payments to be delayed. If any of your clients have pension payments scheduled for July 2024, we recommend checking they’ll have sufficient funds in their transaction account. And if they don’t have sufficient funds, you should consider selling down assets before 28 June to generate the required cash.

Why can’t I select reinvest as a distribution option for my clients?

Distribution reinvestment may not be available, due to the following reasons:

- The fund manager does not offer a reinvestment option.

- Your client is a foreign resident.

- Your client is an Australian resident but have not provided a TFN.

- The fund is removed from the APL (Approved Asset List).

- The fund has been closed to new and existing clients.

How can I ensure my client’s pension payment in July won't be delayed due to EOFY activities?

During the EOFY period, there can be delays in the striking of unit prices, in distribution and dividend payments, and in asset redemptions, which can impact a client’s cash balance.

If any of your clients have pension payments scheduled for July 2024, we recommend checking they’ll have sufficient funds in their transaction account, to make their pension payment.

To avoid a delay to any pension payments, you should consider selling down assets before 28 June to generate the required cash.

How do I find a client's existing account application, that was created over a year ago?

When you’re logged into BT Panorama, go to the ‘Tracking’ tab and select ‘Account Applications’. Select the filter icon and ensure that ‘Active’ is also ticked. Then select ‘Apply Filters’. Finally, from the ‘Last Updated’ menu, select ‘More than 12 months ago’.

Where can I find the Annual Audit report for a BT Panorama Investment account?

Annual Investor, Tax & Audit Reports are all found in the Document Library on BT Panorama. Simply search for the client’s account and then you can navigate to Document Library> locate the relevant Annual Investment Statement > select the action menu option called ‘Download Annual Audit Report’.

If my client’s account is linked to their Westpac Banking profile, will a change in their residential address flow through to their BT Panorama account?

Yes. Any changes that are made to a client’s residential address on their Westpac Banking profile will also be reflected on their BT Panorama account. In this case, only clients have access to change their residential address. It cannot be changed by the adviser.

How can I tell if my client’s BT Panorama account is linked to their Westpac Banking profile?

From the BT Panorama home page, search for the client’s account, then navigate to Account Details> select the client’s name > Username. If the Username appears blank this means the client’s BT Panorama account is linked to a Westpac Banking profile. They can use the same login details that they use for Westpac Online Banking to also login to BT Panorama.

Can I add a linked bank account to my client’s super/pension account, and have it automatically verified?

Yes, if the digital consent method is selected and is accepted by the client. For more information, please head to the Help & support section on BT Panorama > Managing your clients > Digital consent > Request consent for bank accounts.

I have clients that need to claim tax treaty benefits, including a reduced rate of withholding tax from foreign sources. How do I do this on BT Panorama?

Withholding tax forms can be found on BT Panorama by navigating to Products (left hand side) >Listed securities> Withholding tax documents. To determine which form you need, you can download “Instructions detailing withholding tax forms applicable to specific assets”.

If my client withdraws from a term deposit early, what’s the reduced interest rate factor the client receives?

The applicable rate reductions can be found in the relevant ‘Terms and Conditions, fees and general information’ booklet. These booklets are available on BT Panorama, under Products (on the left-hand side menu) > select Term Deposits > select the relevant booklet.

How can I register for or amend access for support staff or an adviser on BT Panorama?

You can do this online via BT Panorama. Login as a Dealer Group or Practice Managers, navigate to Business > User and business entities. If registering for new access, select ‘Register user’. If amending existing access, find the user from the list and select the relevant action from the drop-down menu on the right-hand side.

Alternatively, a form is available on BT Panorama Help & support> Forms > Adviser Access / Support Staff Access Form.

For more information regarding managing users, please head to Help & support > Business & Admin > Users & Business Entities > Manage Users

When and how are franking credits distributed to pension accounts?

The benefit of franking credits is allocated to pension accounts annually once the Fund tax return has been finalised, which is usually around January to March each year. More information including how franking credits are distributed, please read page 6 of the BT Panorama Super Tax Guide and you can get the copy by heading to the Help & ).port > Business & Admin > Panorama year end > Panorama Super and Tax Guide (refer to page 6).

For investment products, franking credits are reported on the annual tax statement which can be lodged with the ATO as part of your client’s individual tax return.

Can I place trades on a pre-commenced pension account?

Yes, you can. However, any trades placed in this phase will have the tax implications of an accumulation account. Also, the pension cannot be commenced until all pending orders have settled.

If the account is a pension account that was migrated from BT Wrap, you will not be able to place trades until the pension has commenced.

Note: To know whether an account was migrated from BT Wrap, go to your client’s account on BT Panorama, and head to Account details. where you’ll find the migration date, if applicable.

What funds can my clients access under the condition of release (COR), 'I have ceased a gainful employment arrangement on or after reaching age 60'?

They can access the accumulated funds in the account up until the date that COR is valid for, i.e., the date your client signs as ceasing employment under this COR.

Regardless of whether the balance is pushed higher due to any contributions, income or even market movement, the original value of the accumulated funds in the account as at the signed date is all that can be released under this particular COR.

Visit the ATO website, www.ato.gov.au and search for “Conditions of Release“ for more information

How can I help my client find their username to login to BT Panorama?

To find your client’s username, you’ll need to log into BT Panorama. Navigate to the BT Panorama home page> Clients> Select a client’s account> Click on the blue bar at the top of the screen> Select your client's name> Scroll to find your client's username.

Note:

- If the username field is blank, your client can login to BT Panorama by using the same login details they have for the Westpac Online Banking.

- If the username field displays a mix of letters and numbers, then this is likely a registration code they can use to register for BT Panorama access via www.panoramainvestor.com.au/uam/app/register

- If your client has forgotten their password, they can reset this via: www.panoramainvestor.com.au/uam/app/forgot-password

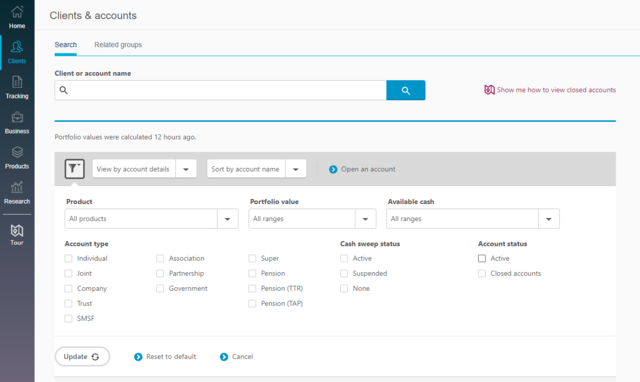

How can I add my client's account to a related group for fees and reporting?

From the BT Panorama home page, navigate to Clients > Related Groups > Create a Related Group

For more information, head to BT Panorama Help & support and navigate to > Managing your clients > Fees > Administration fee - related groups pricing

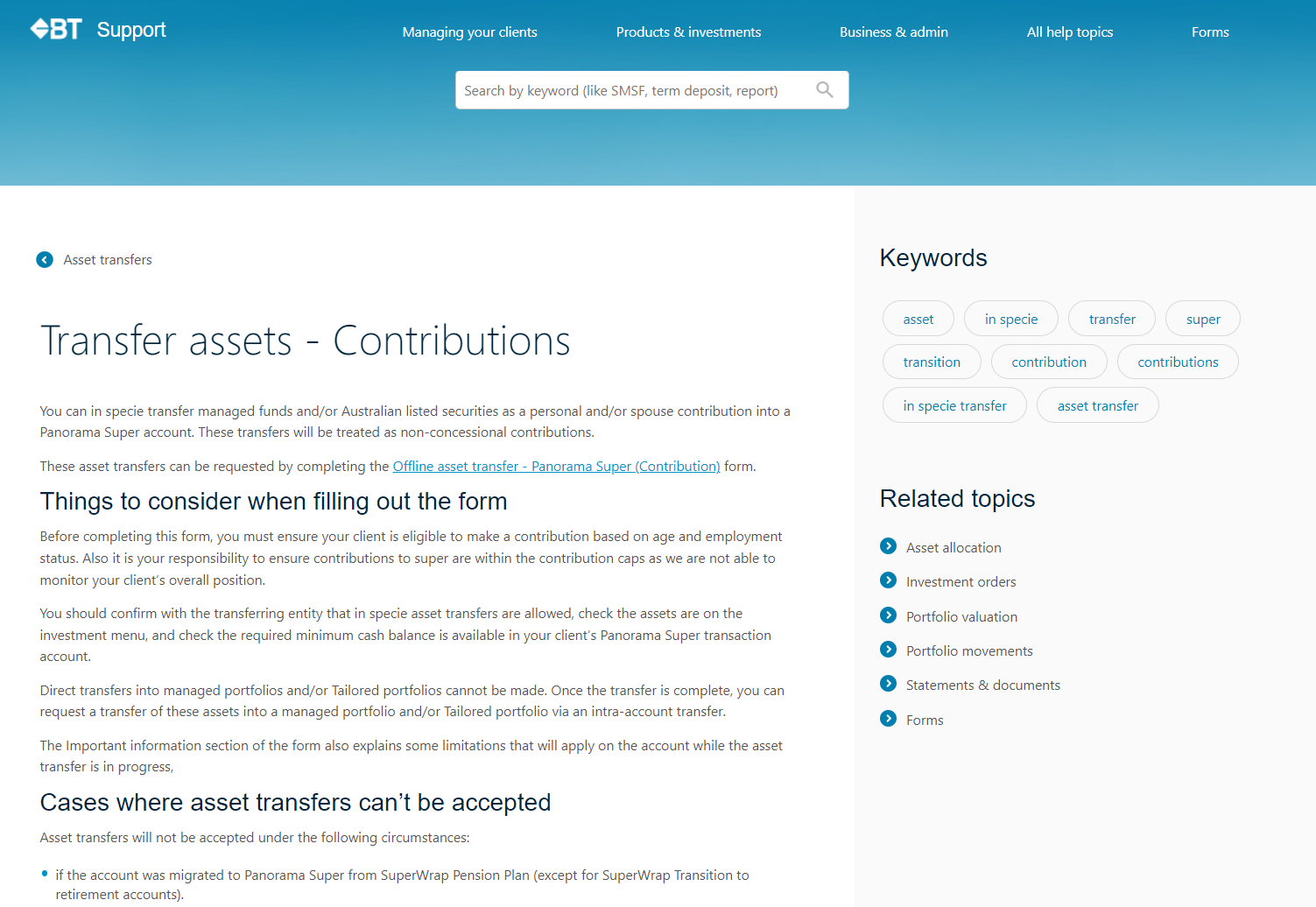

How do we make an in-specie asset transfer into BT Panorama for my clients?

Head to BT Panorama Help & support, navigate to > Managing your clients > Asset transfers (Asset transfers (westpac.com.au)) > Select the type of BT Panorama account you're transferring into > see procedure described in detail.

What investment options are available to clients for Super/Pension and Investment?

The Product Disclosure Document (PDS) for each managed fund contains information on the redemptions for that particular fund.

To download the PDS for a managed fund, please log into BT Panorama, navigate to Products > Managed Funds > Investment Options > Search for the relevant Managed Fund. Under the ‘Download’ column, select ‘Product Disclosure Statement’.

When are dividends and cash interest expected to be received?

For Super/Pension, the available investment options are listed in the Investment Options Booklets. You can download the Investment Options Booklets from BT Panorama. Please navigate to Products > About Panorama > BT Panorama Super > select Panorama Super Investment Options Booklet - Focus and Compact menu OR Panorama Super Investment Options Booklet - Full menu

For Investments, you can view the available investment options when you navigate to Products > Managed Funds or Managed Portfolios > Investment Options

For Listed Securities available on both Super/Pension and Investment products, you can navigate to Investment Orders > Place an order > Search code. If it does not appear, that listed security is not available.

How can I transfer a client's account from super to pension phase?

Expected payment dates for dividends and cash interest for cash, listed securities and managed portfolios can be viewed in the Investment income reports on BT Panorama.

Select the relevant client account, then navigate to Investment Income > Accrued > Expand the report under the relevant asset type (e.g., cash). You will then be able to view the upcoming payment date(s) — income might be received after this payment date.

Expected payment dates for managed fund distributions are not available as these are only released at the discretion of the fund manager.

How can I see which client accounts hold a certain asset on BT Panorama?

You can complete the Full Transfer Within Panorama Super form on BT Panorama.

Please log into BT Panorama, navigate to Tracking > Service requests > Submit new request > Transfers > download the ‘Full Transfer Within Panorama Super’ form

What reference should my client include when making a contribution via EFT to their account?

When making direct contributions to BT Panorama Super, the type of contribution will need to be identified using a reference in the description field. For a list of the references for contributions, please navigate to Help & support > Products & investments > Manage contributions > About biller codes & bank accounts.

How can I show my clients how to add a linked bank account?

Please navigate to BT Panorama Help & support and click 'BT Panorama investor demo site’ listed under ‘Resources’. From here, select a Pension account, then navigate to Linked accounts > Add linked account.

Why does my client have a taxable component in their pension account where everything is unrestricted non-preserved?

Tax components and preservation components have no relationship to each other; rather they’re separate concepts in the payment of benefits. From 1 July 2007, pension benefits have two components – a tax-free component and a taxable component.

Where can I find the audit report for my client's annual investment statement?

Navigate to the client’s document library and locate the relevant Annual investment statement. Then on the right, select the menus action button, and select ‘download Annual audit Report'.

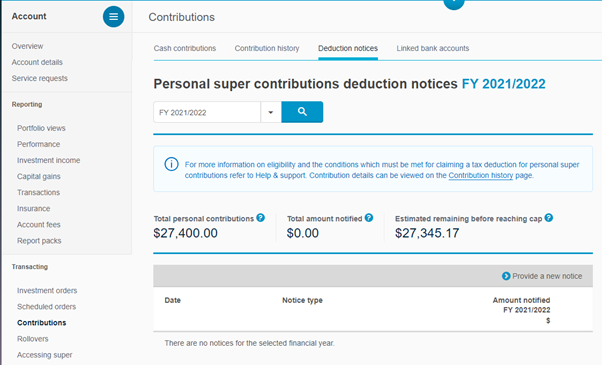

How do I submit a Personal Tax Deduction Notice for my client?

From the BT Panorama desktop, select ‘Contributions’ and then ‘Deduction Notices’. Complete the drop-down prompts and select ‘Download’ for an optional form that can be signed by the client. Once submitted the acknowledgment letter will be available in the client’s document library within 24 hours.

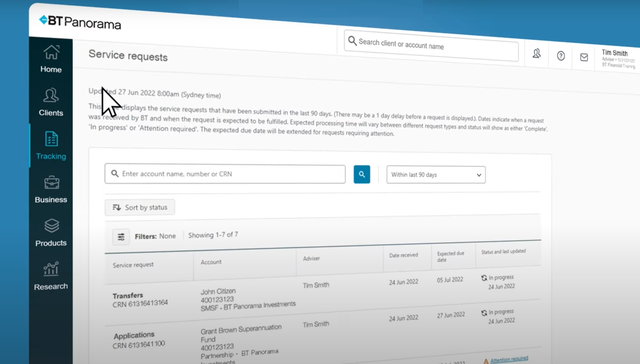

How long will it take to complete my client’s account closure / withdrawal / asset transfer?

The current status of your client’s account closure / withdrawal / asset transfer is available on the BT Panorama Online Service Request Tracker, which you can locate by going to Tracking > Service Requests.

Please note, if your client’s withdrawal or account closure involves any of the following, the transaction requires action with a third party and therefore, this may cause a delay in completing the request.

- Managed funds – Some Managed Funds price only on a monthly or quarterly basis. Where your client’s account holds this type of fund, the completion of an account closure will be delayed until the fund manager releases the price.

- Shares – Where a client becomes entitled to a dividend through holding an asset on record date, the completion of the account closure will be delayed until after the payment date for that dividend.

- Asset transfer - Third party confirmation is required before the transaction can be completed.

These conditions also apply when the above assets are held within a Managed Account (including Managed Portfolios, Tailored Portfolios and Adviser Portfolios) or an asset transfer is being processed for a Managed Account.

Where can I find my client's cash management and term deposit statement?

For applicable accounts, all cash management and term deposit statements are now available in your client's document library.

I mistakenly uploaded the wrong form for my client's advice fee. How can I upload the correct one?

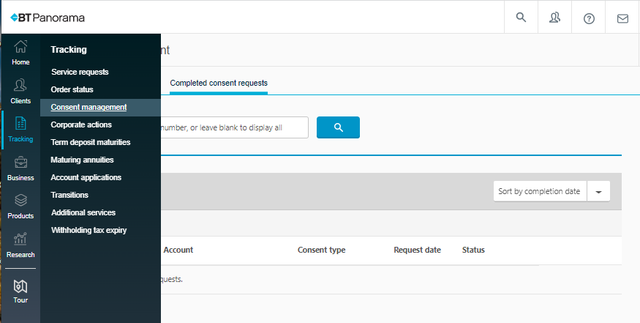

Once a fee form is uploaded in the consent management tool, it can’t be changed in the same request. You can fix this by ending the current consent request, and setting up a new request with the correct form.

My client received a letter from another financial institution about receiving a remediation payment being paid to their BT Panorama account. However, the amount they have received is different from what is stated in this letter. What may be the reason for this?

When a payment is received by us, we may be required to apply certain adjustments such as income tax, GST and Reduced Input Tax Credits, and this can result in a difference between the amount stated by the other financial institution and the amount received into the BT Panorama account.

I’d like to remove myself as the adviser for my client's account. How can I do this?

To remove your details from the account, please contact us on 1300 784 207 and we can send you the documents to complete. Or you can use our Virtual Assistant 'Blue', which you can find by pressing the purple chat icon once you login to BT Panorama — and one of our consultants can send you the documents.

I’d like to complete a pension reset for one of my clients. How do I do this and are there any important considerations?

The 'Pension reset' form is available when you sign into BT Panorama via the forms section in ‘Help & Support’. If your clients were migrated as an account-based pension from BT Wrap, there are important considerations that are listed on page one of the form.

Can clients transfer assets into a BT Panorama Super account from external sources?

BT Panorama Super can now accept asset transfers as a rollover or contribution from external sources. Rollovers are only acceptable from external SMSFs and super funds as well as BT Panorama SMSFs.

For more information on asset transfers into Panorama Super and requirements head to Help & Support>>>Managing Your Clients>>>Asset Transfers>>>Transfer assets – Super.

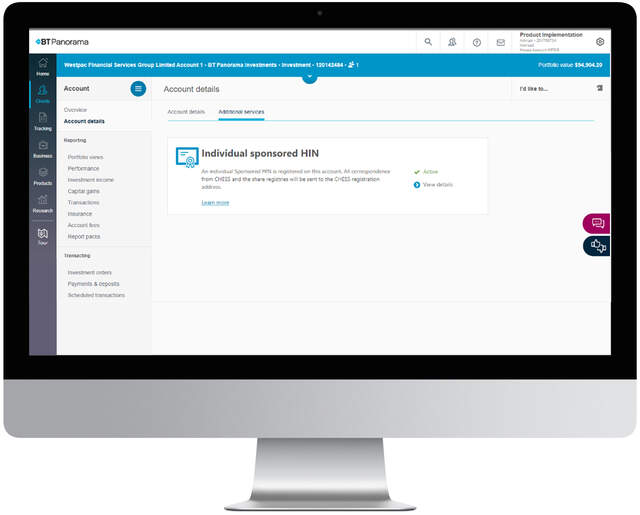

How do I view the Holder Identification Number (HIN) structure of my client and learn more about these features?

If your client has an individual HIN (Sponsored or Custodial) you can view this by following the below pathway on Panorama.

Account Details>>>Additional Services

If the client does not have an individual HIN, then they utilise the default option which is a Nominee HIN.

Further information to understand the key differences and benefits of each HIN structure is available in Help & Support>>>Managing Your Clients>>>Listed Securities>>>Holding Types.

Can I add a new linked account to my client’s Panorama account from either a BPAY biller code or a Pay Anyone option?

For Panorama Investments accounts, support staff and advisers can add a new linked account, Pay Anyone or BPAY biller to a Panorama account through Payments & Deposits>>>Accounts and Billers. For the new account, a consent request will be sent to the client for them to login and accept the change.

For Panorama Super accounts, only the client can add a new linked account through the Linked Accounts screen when they log in to Panorama.

More information is available including how to verify a linked account on Help & Support>>>Managing Your Clients>>>Payments & Deposits.

If I end an Ongoing Advice Fee, will the fee still be deducted for that month?

When a fixed term or ongoing advice fee is ended, the fee will be payable up to the end of the month prior to the fee ending. Fees are not payable for the month the fee ended, even if the fee was ended on the last day of the month. For example, if a fee is ended mid-month on 15 July, fees will not be payable for the month of July.

For fees to continue when a fee is ended, ensure you set up a new fee with client consent checked by BT (if not submitted digitally) within the same month the advice fee is ended. For example, if a fee is ended mid-month on 15 July, and a new fee is set up and relevant account approvals are received and checked by BT by 31 July, fees will be payable for the whole month of July.

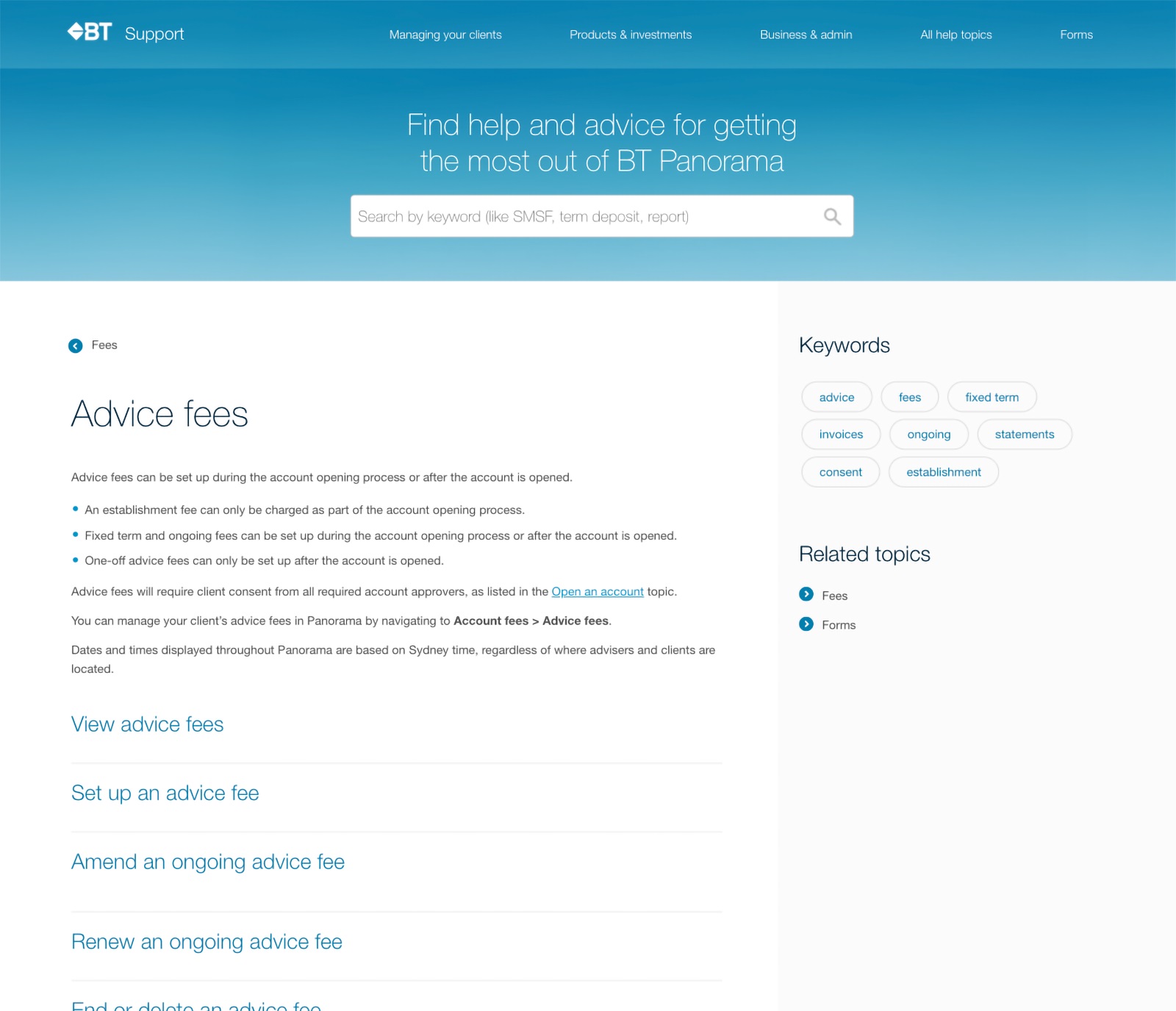

For more information on advice fees go to Help & Support>>>Managing Your Clients>>>Fees>>>Advice Fees.

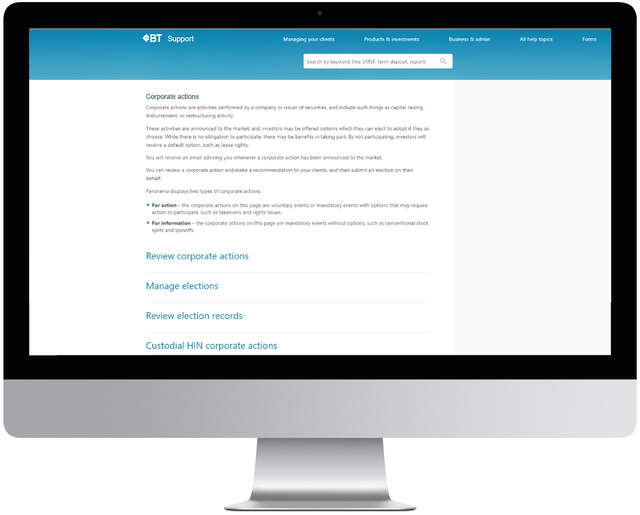

What is the difference between ‘For action’ and ‘For information’ when reviewing corporate actions for clients?

‘For action’ corporate actions require an election to be made by the adviser to participate, whereas ‘For information’ corporate actions are mandatory events without options.

The Corporate Actions page under Tracking only displays corporate actions that your clients are eligible for.

It is important to remember sponsored HIN clients participate directly with the share registry for corporate actions with the exception of takeovers and buybacks which will be available for election through Panorama.

For more information regarding corporate actions go to Help & Support>>>Managing Your Clients>>>Listed Securities.

How do I manage fee submissions on BT Panorama?

You can find information about fee submissions by clicking on the help and support section on your BT Panorama desktop and then choosing the following options: Managing your clients -> Monitoring and reporting -> Fees.

Can I transfer the cash held within my client’s managed portfolio to their Panorama transactional cash account?

Yes you can, simply submit an online Intra account transfer when you are logged into Panorama.

More information is in Help & Support>>>Managing Your Clients>>>Asset Transfers>>>Intra account transfer.

Where can I find the previous financial year’s annual and tax statements for a previous BT Wrap client ?

Historical annual and tax statements have been uploaded to the document library on BT Panorama for migrated accounts. The annual and tax statement for financial year 2020/2021 has been split into two parts to account for relevant information that occurred on Wrap and Panorama due to the migration.

More information is found in Help & Support > Business & Admin > Panorama Year End.

To view the BT Panorama transaction cut-off dates for this financial year end, from the BT Panorama desktop, head to 'Help & support' > ‘Business and admin’ > ‘Panorama year end’ > ‘Transaction cut-off dates’. Download your copy of the EOFY guide.

Are there any tips that my clients and I may find useful, with end of financial year approaching?

It is important to be aware of transaction cut off times for contributions, asset transfers and other transactions to ensure they are processed prior to 30th June, along with estimated statement release dates.

Furthermore, due to the annual pension calculation taking place each year on the 1st of July, ad-hoc pension and lump sum payments are unable to be made for typically the first 10 days of the month.

More information is found in Help & Support > Business & Admin > Panorama Year End.

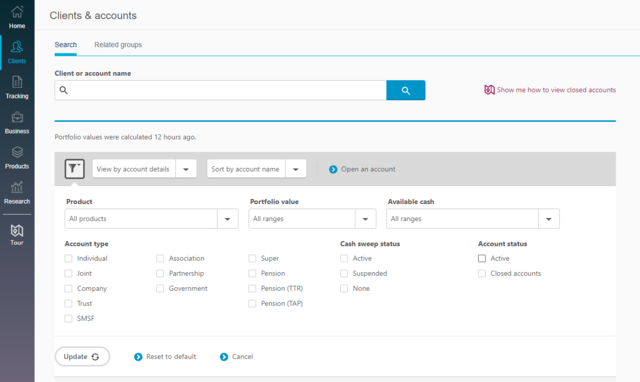

How do I view closed or pending closure accounts through my online access?

Closed or pending closure accounts won’t be visible when inputting the details in the main search bar on the ‘Clients & accounts’ page. To view these accounts select the filter icon, untick all parameters and click update, the result will be a list of all active and inactive accounts and the search bar will allow you to search accounts individually. You can also select ‘Closed accounts’ as a filter if you want to view a list of all closed accounts.

What forms of identification are required to open a BT Panorama account?

Depending on the type of BT Panorama account being opened, identification requirements can differ in line with AML/CTF purposes. To understand the different requirements and instructions for each account type, navigate to Help & Support > Managing Your Clients > Proof of Identity.

How do I obtain revenue and commission statements for our adviser practice?

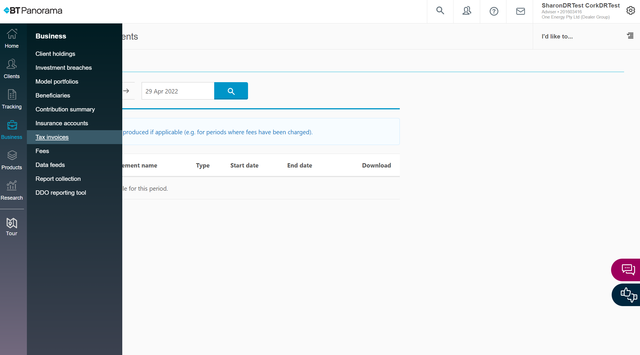

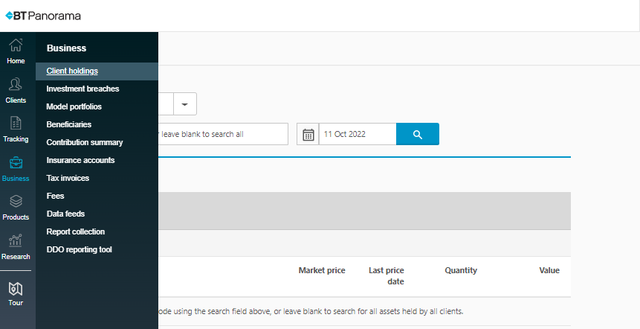

Revenue and commission statements on a business level are only able to be obtained by an individual with ‘Dealer Group Manager’ access via the BT Panorama desktop by navigating to the ‘Business’ tab and then ‘Tax Invoices’. If you do not have this access, you should consult an authorised representative from your dealer group.

Who needs to sign the BT Panorama Advice Fee Consent form for each account type?

Below is a summary of who needs to sign the Panorama Advice Fee Consent form for each account type:

| Account Type | Signatory |

|---|---|

| Individual (includes Investments, Super & Pension accounts) |

The client must sign the consent. |

| Joint |

All clients must sign the consent. |

| Company |

The company must be an Australian Proprietary Company (Pty Ltd) or Australian public listed company; we cannot accept publicly listed companies or companies registered outside of Australia. Australian Proprietary CompaniesIf there is a sole director of the company, the sole director must sign the consent. Otherwise, the consent must be signed by a minimum of two company directors, or a combination of a director and a company secretary. Australian public companiesA minimum of one authorised signatory needs to be identified and sign the consent. Where that authorised signatory is not a director, an accompanying letter on letterhead signed by 2 directors confirming that person's authority must be provided. |

| Trust/SMSF |

Trusts and SMSFs with a corporate trusteeTwo directors (one if a sole director exists) must approve the account. Trusts and SMSFs with individual trusteesAll trustees must approve the account. |

| Association |

A minimum of a Chairman/President or equivalent must sign the consent. |

| Partnership |

For unregulated partnerships, all partners must sign the consent. For regulated partnerships, at least one authorised partner must sign the consent. |

| Government body |

The authorised person on the account must sign the consent. |

How do I get a view of what our clients see when they log into their BT Panorama account?

A new BT Panorama investor demo site has been released to give advisers a perspective of what the BT Panorama UI looks like for their clients. This will assist in explaining pathways and steps to your clients such as updating linked bank accounts, managing consent requests and much more.

Go to Help & Support through the BT Panorama UI for more information.

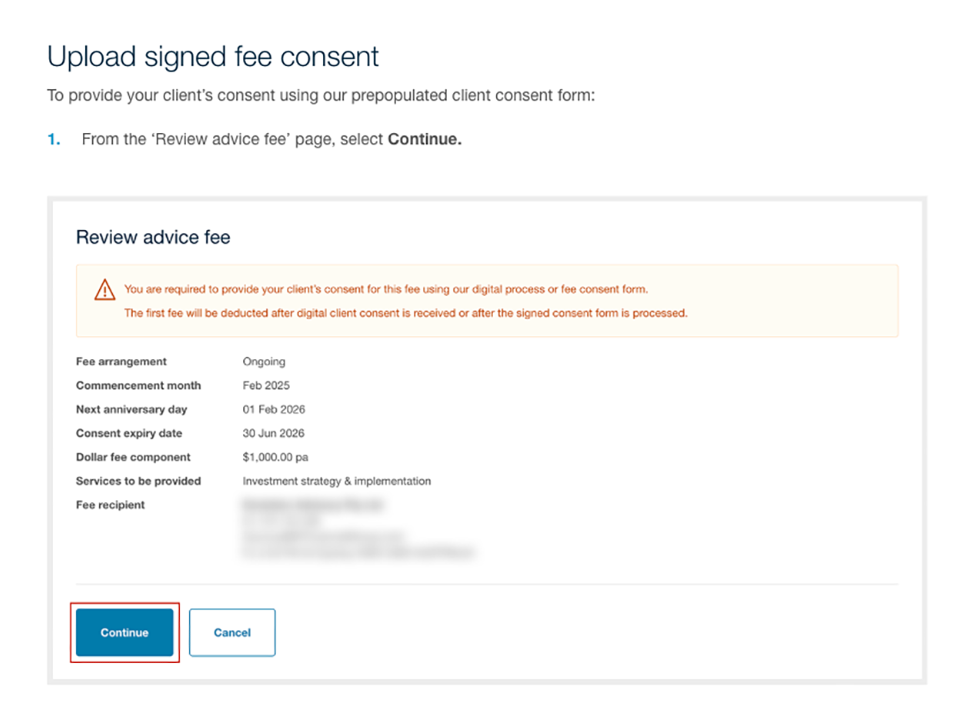

How do I upload an offline Fee Consent Form?

This is done through the Tracking > Consent Management screen on BT Panorama. For further detail on this process refer to Help and Support> Managing your clients> Monitoring & Reporting> Fees> Advice Fees.

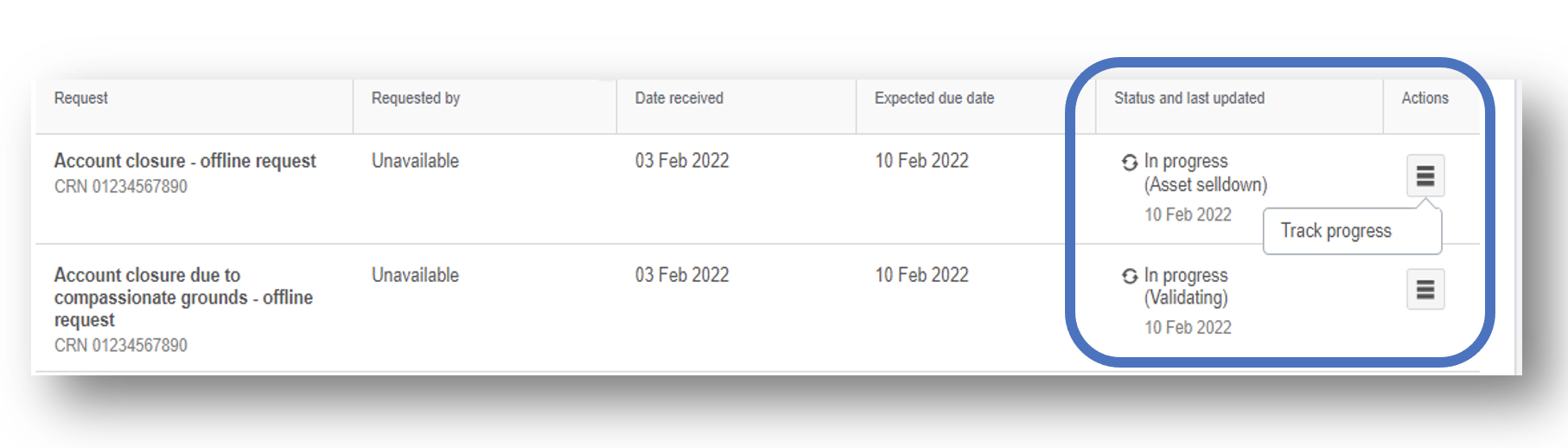

How can I check the status of a form I’ve submitted for my client?

You can search and filter by date or status type, a submitted request on BT Panorama.

Requests can be viewed at a business level or account level:

• Business level - Select 'Tracking' > 'Service requests'

• Account level - Search for the client's account > Select 'Service requests' from the left-hand menu

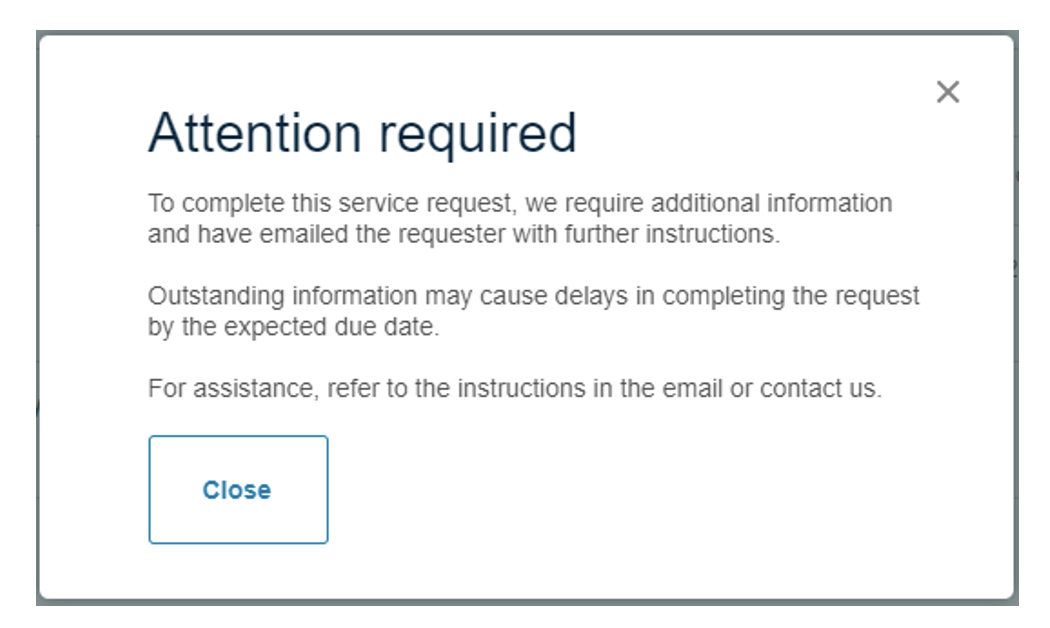

If your request shows as 'Attention required', our team will attempt to contact you via email and SMS to request the missing information or documentation.

Where can I find additional information to assist with updating advice fees being charged to my clients?

Information about advice fees is available on the Help & Support page on BT Panorama desktop. To navigate to this page, select the question mark icon in the top right-hand corner of your screen. From here, select Managing Your Clients > Fees (under Monitoring and Reporting) > Advice Fees.

On this page you can see information about setting up, amending, renewing and ending advice fees on a clients account — along with information on the consent process for adding fees.

If you have any questions, please contact our Panorama Support team on 1300 784 207, email professional@panorama.com.au or BT's virtual assistant, Blue, is available to chat online.

My client wants to rollover funds into their superannuation account as an in specie transfer — what do I need to do?

You can make a transfer into Panorama Super and Pension accounts (not yet commenced) as a Rollover from:

- external super funds

- external SMSF

- Panorama SMSF

You can request a rollover by completing the ‘Offline asset transfer - Panorama Super (Rollovers)’ form.

BT will need a Rollover Benefit Statement (RBS) from the transferring fund, accountant, or adviser as soon as possible, once BT has notified them of the total consideration value to be used for the RBS.

The form and further information can be located on Help & Support page, under Managing your Clients > Asset transfers > Transfer assets - Super > Transfer assets - Rollovers.

Where can I find the fees consent form for my client?

You can locate the form when you are logged into Panorama via Tracking > Consent management > locate the relevant account > select the Actions menu > ‘Download consent form’. The form will be displayed and prepopulated with all the information you have entered.

How can I see which clients hold a specific investment?

When you are logged into Panorama, navigate to Business > Client holdings and search for the specific asset you are after.

Why can’t I group my client’s accounts, to reduce administration fees?

Some accounts may have a special rate or discount applied to their administration fees which means they aren’t eligible to be grouped — for example, a trustee or custodial fee exemption applied upon migration from BT Wrap. You can remove the special rate or discount by calling us on 1300 784 207 and completing the relevant form.

I have received a notification from Panorama about one of my clients, however it does not specify the account number. Where can I find the account number?

Some accounts may have a special rate or discount applied to their administration fees which means they aren’t eligible to be grouped — for example, a trustee or custodial fee exemption applied upon migration from BT Wrap. You can remove the special rate or discount by calling us on 1300 784 207 and completing the relevant form.

Where can I locate any investment breaches for my clients?

When you log into Panorama, click on the mail icon at the top right of the screen. Here you can locate all the recent notifications that have been received for your clients, along with the account numbers.

Is there a paper form for opening BT Panorama accounts?

Generally, applications for BT Panorama need to be made online. However, there are certain circumstances where an application can be made via a paper (PDF) form, such as investment accounts for some entity types (e.g. partnerships) and super/pension accounts for a minor under 18 years of age. You can find these forms on BT Panorama by navigating to Help and support >Forms > Applications.

How do I change my practice name on BT Panorama?

Submit an 'Adviser group registration form' via email or post. You can obtain this form through your BDM or by contacting us.

How do I set up advice fees for a sophisticated or wholesale investor?

When you set up a new advice fee on BT Panorama, when uploading the signed consent form, you can also upload thevalid Wholesale Certified Accountant Certificate or a completed Panorama Wholesale Client Declaration Form. This form is available on BT Panorama under Service requests > Account maintenance.

For more details, navigate to Help and Support> Advice Fees > FAQs.

How do I update the business address of my dealer group?

You can mail your updated address to panoramaadviserregistration@btfinancialgroup.com.

How does BT Panorama calculate the ongoing monthly adviser fee instalments? Why do amounts vary by month?

The ongoing advice fee is calculated as follows:

Monthly advice fee amount = Annual Amount/365 days (366 for a leap year) x number of days in the month.

For example, an annual amount of $4,500 equals $12.33 per day. In February (28 days), the amount is $345; in March (31 days), the amount is $382.19.

Are there any daily limits for BPAY contributions into BT Panorama Super?

There are no daily limits for BPAY contributions into BT Panorama Super. However, each transaction is limited to $100,000. Contributions exceeding $100,000 must be split into multiple transactions.

Will I get a confirmation email after submitting a fee re-consent form?

No. Due to feedback we’ve received, we’re no longer emailing these confirmations. If you’d like to confirm your submissions, you can call us.

Is there a delay in portfolio valuations showing updated unit amounts after trades settle?

Valuations are updated daily.

Can I link a model portfolio if the client holds assets outside the portfolio’s allocations? Do I need to separately sell these assets before linking to the portfolio?

When linking a model portfolio to a clients account, you will be asked whether you would like to:

- retain those assets outside the model, or

- include them in the rebalancing, in which case those assets will be sold and the proceeds reinvested according to the model’s allocations.

How can my Dealer Group Manager (DGM) get access to transact on accounts under our dealer group?

The Dealer Group Manager role does not have permission to transact on accounts. The Dealer Group Manager would need to apply for additional access, such as an adviser or support staff role. This can be done by logging onto BT Panorama or completing the 'Support Staff Access Form'.

My clients have received communications about a 'Focus' menu option. What investment options will be available for this new menu?

A list of available investment options will be provided in the Investment Options Booklet from 1 October 2025. In the meantime, you can find out more about the Focus menu on our website, including administration fees.

Can you transfer an account from Full to Compact menu and if it holds an asset that is not available on the Compact menu?

No. The asset will need to be sold or transferred out of the Panorama account before we can proceed with the transfer to the Compact menu.

I forgot to download the personal tax deduction notice for a client signature and our records after submitting it online. Can I generate one now?

Unfortunately, the notice can only be downloaded before finalising the submission online. We cannot re-generate this notice.

What level of access does a Third Party Authority (TPA) have?

A TPA is granted read-only access to the specified Panorama account.

While they may request account related information, they are not authorised to make any changes to the account.

What is the BIC / SWIFT code for BT?

The BIC or SWIFT code used for overseas payments is WPACAU2S.

Some banks may require an 11-character code. If so, please use WPACAU2SXXX by adding "XXX" to the end.

I’ve submitted a pension refresh request. Do I also need to to commence the pension?

No, you don’t need to commence the pension. We will process the pension refresh request in accordance with the instructions you’ve provided on the form. Once this is processed, we will commence the pension for the account.

How long does an Intra account transfer take?

Intra account transfers requested online are usually complete within a couple of minutes. If you need help with an intra account transfer, you can email the request to our team (assettransfers@panorama.com.au).

What should I do if I need to process a payment over the daily limit?

Please call us and we’ll help you process the payment.

Where can I find the establishment date for my client’s account?

When you login to BT Panorama, search for the client’s account, and then navigate to Account details and you’ll see a date for “Registered since”.

The account application has been in "Processing" status for several hours. Is there any additional action required?

Account applications generally progress from “Processing” status within a few minutes, but in some cases, it may take up to 24 hours.

If it remains in “Processing” status for more than 24 hours, contact us.

How long is a certified copy of an identity document valid for?

A certified copy remains acceptable for as long as the original identity document is valid.

Birth certificates do not have an expiry date. Expired passports are acceptable, as long as they have not been expired for more than 2 years. Other documents, such as a driver’s licence, are only acceptable if they have not expired.

Can I cancel a trade with the status "In progress - sent to fund manager"?

Once an order is sent to the external fund manager, we cannot cancel it. Once submitted, an order may only be cancelled when the status is "In progress". Navigate to the actions tab > "cancel this order".

How do I find the original application information for an active client account?

You can view the application information by logging into BT Panorama. If the account was approved by the client online, navigate to Tracking > Account application > Filters > Tick "Active" > Apply filters > Actions tab > View application.

If the application was approved by the client offline (i.e. by signing a form), select the account then navigate to Document library and locate a copy of the application form.

Will my client’s account number change if changes are made to the product type?

Your client’s account number won’t change in the following scenarios:

- Pension refresh

- Switching between super and pension phases

- Changing from Transition to Retirement (TTR) pension to retirement phase pension

- Changes in badge, menu or admin fees.

What’s my SMSF ESA (Electronic Service Address)?

Please contact your SMSF Administrator or tax accountant.

Can my clients claim a tax deduction on contributions made into a pension account once it has commenced?

The ATO requires members to acknowledge that the super fund currently holds these contributions and has not begun to pay a superannuation income stream based in whole or in part on these contributions.

How do I switch my profiles or roles on BT Panorama?

When logged into BT Panorama, navigate to the top right-hand corner where your name and role appears. Select your name and then select the role you wish to switch to.

What is changing for BT Panorama Ongoing Fee Arrangements (OFA) from March 2025?

Due to the Quality of Advice (QAR) legislative changes that were effective on 10 January 2025, BT Panorama will be updated in March 2025 to enable advisers to:

initiate the renewal process 60 days prior to the Next Anniversary Date (NAD)

obtain consent up to 149 days after the NAD (an increase from 119 days)

select a new NAD within the following 12 months as part of the renewal

add a service description to the ongoing advice fee consent form (mandatory)

In addition, we will now accept consent forms signed by clients within 90 days of submission (an increase from 30 days).

For more information, watch the replay of our BT Learning Lab session.

When were dealer groups and advisers notified of the changes to OFAs?

Impacted dealer groups and advisers were sent an email communication about the OFA changes in December 2024. We also communicated the changes in the December 2024 Product Newsletter, and online via BT Panorama on 10 January 2025.

To view online communications for BT Panorama, please navigate to Products > News & Updates > Recent Articles

Do these OFA changes impact both Super and Investment accounts?

Yes, the OFA changes apply to Super, Pension and Investment clients who use accounts with ongoing fee arrangements.

What if the account is a joint account and only one account holder has renewed their fee consent?

If the account has more than one account holder, such as a joint account or trust, each account holder will need to renew their fee consent. An exception to this is where a shared primary email address is held on the joint account, only one fee consent renewal is required. Noting for these accounts the fee consent renewal response must contain the names of all the account holders.

How do I open a Death Benefit Pension Account on BT Panorama?

After logging in to BT Panorama, navigate to the top right-hand corner and select ‘I'd Like To’. Choose 'Open an account' > pre-fill details, such as the account type and menu type (Full/Compact/Focus). You’ll then need to provide the client's eligibility information, by confirming that all of the client's superannuation benefits are unrestricted non-preserved, and the condition of release is 'Death'.

Are there account types on BT Panorama that are exempt from completing the W-8BEN Forms, to claim tax treaty benefits for foreign income?

The W-8BEN Form is mandatory for all BT Panorama Investments account holders who need to make a claim. The W-8BEN Form is not required for BT Panorama Super account holders as we can make this claim on behalf of account holders.

What forms can be signed with a typed signature?

The signature formats we can accept will be specified above the signature panel in each form.

Forms with a client's typed signature must be emailed to us from a primary authorised user’s email address or uploaded via the BT Panorama ‘Service requests’ page. These forms must also be accompanied by a digital signature certificate issued by trusted certification authorities, such as Docusign.

Why can't you transfer assets in specie from BT Panorama accounts that have previously transferred from BT SuperWrap or Asgard platforms?

If a BT Panorama pension account has previously been transferred from BT SuperWrap or Asgard, we no longer hold the original cost base information. If you want to transfer assets to another BT Panorama account, the assets will need to be sold down.

For more information, please navigate to BT Panorama Help & Support > ‘Products and Investments’ > ‘Manage Pension Accounts’ > ‘Pension Refresh’ > Before submitting the Pension Refresh Form.

How do I view closed or pending closure accounts on BT Panorama?

Closed or pending closure accounts won’t be visible when using the main search bar on the ‘Clients & accounts’ page. Instead, select the filter icon, untick all filters and select 'Update' to view all active and closed accounts. The main search bar can then be used to search individual accounts.

You can also select ‘Closed accounts’ as a filter to view a list of all closed accounts.

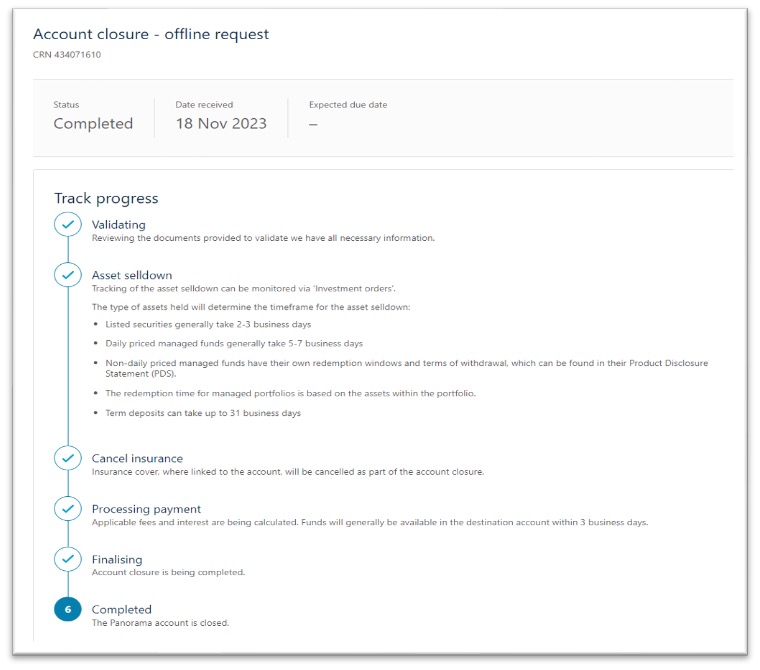

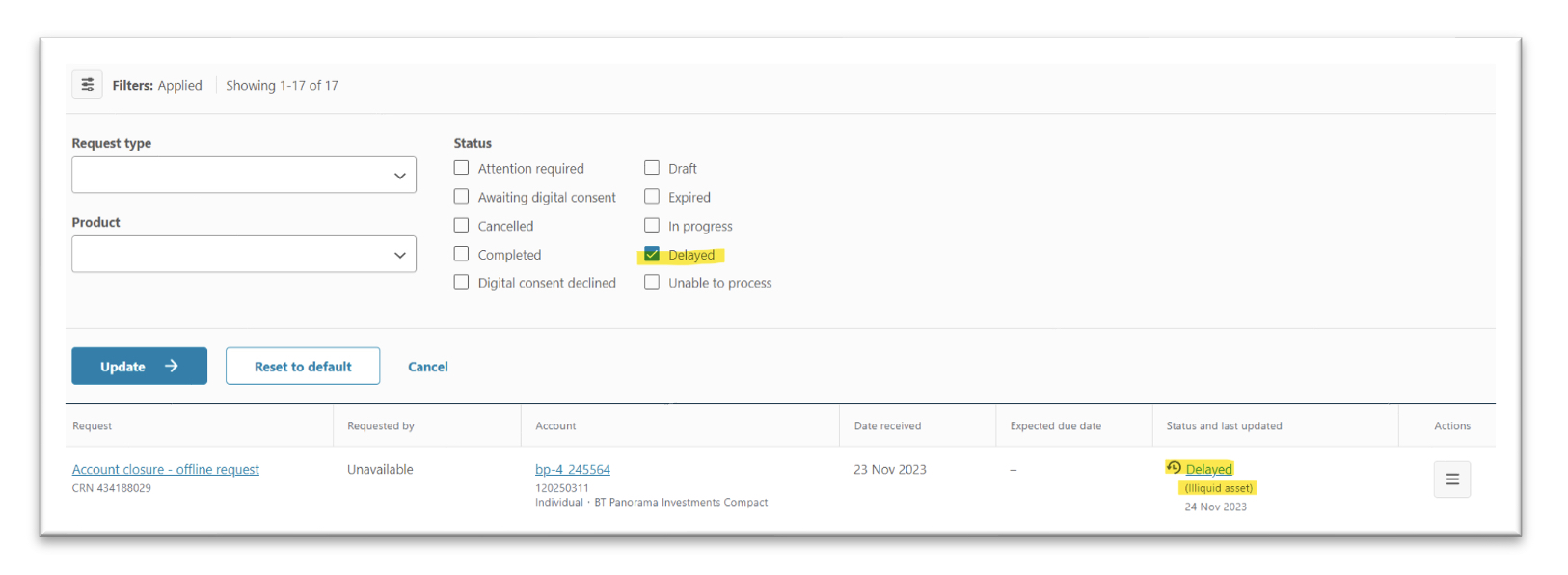

Where can I get information on the status of a request to close an account?

You can track account closure requests on the BT Panorama mobile app and website from the Service Requests page. You can view the expected due date for the account closure, providing you with up-to-date details on progress from the initial validation stage, through to asset selldowns and final payments.

To view each step of the account closure, from the Actions menu, select Track progress.

If the status is ‘Attention Required’, we have emailed you to request further information.

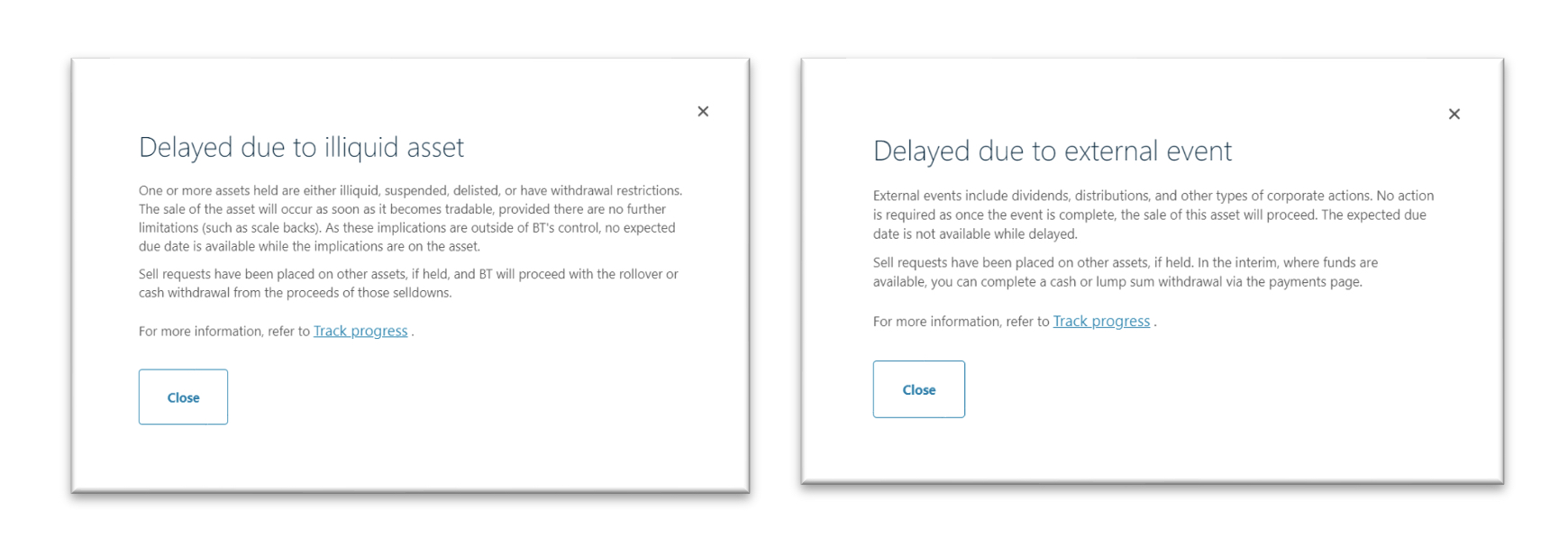

If the status is ‘Delayed’, you can view the reason for the delay by clicking on this status or on the ‘Track progress’ page.

To search requests with a status of ‘Delayed’, you can use the filter to select ‘Delayed’.

Does BT Panorama have a fee calculator to compare admin fees?

You can access our calculators via Professional > Support resources > Tools & calculators

Does BT Panorama allow for accounts to be established with a parent/guardian on trust for a minor?

As BT Panorama accounts cannot be issued to applicants under the age of 18, to open an account for a minor, the account would need to be opened as a trust with an adult serving as the trustee. For more information, please visit BT Panorama Help & Support > Managing your clients > Opening & Updating Accounts > Trust Accounts.

What are the key dates for setting up and renewing an ongoing advice fee with BT Panorama?

An ongoing advice fee must be renewed each year starting from 60 days before the 'Next anniversary day' (NAD), or to a maximum period of 149 days after the NAD. If the ongoing advice fee is not renewed within 149 days of the NAD, the fee will terminate and can no longer be renewed and a new ongoing fee needs to be set up. For more information, visit BT Panorama Help & Support > Managing your clients > Fees > Advice Fees.

What’s the final cut-off date for direct debit contributions this financial year?

For direct debit contributions to be reflected within the FY2024 statements, we must receive the payment by 5pm Friday 28 June 2024 (AEST). We recommend submitting the payment by 5pm Tuesday 25 June 2024 (AEST).

More information about cut-off dates for other transactions is available on BT Panorama. When you login, go to BT Panorama Help & support > Panorama year end > Transaction cut off dates.

What are the types of drawdown strategies on BT Panorama?

A drawdown strategy is the order and manner in which your client’s listed securities, managed funds or managed portfolio investments will be sold to generate sufficient cash to fund the payments due (including fees and costs) or maintain the minimum transaction account balance required.

There are 3 drawdown strategies:

- Highest value asset (default) - drawdown from the highest value asset in your client’s account.

- Pro rata - drawdown of your client’s assets across their investment options.

- Individual asset priority - drawdown from individual assets or portfolios you nominate.

More info can be found on BT Panorama Help and support > Managing your Clients > Cash Management.

What is the default Tax Preference on BT Panorama?

The tax preference for BT Panorama defaults to ‘Minimum Gain/Maximum Loss’. Advisers can view this and change it, on BT Panorama.

If you wish to change Tax preferences on a client’s accounts, log into BT Panorama, search the clients account, click on ‘Account detail’s and then select the pencil icon near the ‘Tax preference’.

Does a Term Deposit (TD) get sold down as part of a drawdown strategy?

No, Term Deposits will not be sold down as part of any automated drawdown strategy. However, term deposits may be cancelled in certain circumstances (for example, to meet outstanding fees).

For more information, please refer to the relevant disclosure document available on BT Panorama under Products> About Panorama.

Which forms can you accept Docusign on?

Information on the types of signatures we can accept on our forms is available on Help & support, when you log into BT Panorama. Head to Help & support > Managing your clients > Service Requests (subheading) > Signature Acceptance on Forms.

Are term deposits guaranteed by the government?

Term deposits invested in via BT Panorama may be entitled to a payment under the Financial Claims Scheme (FCS) in certain circumstances. More information can be found at www.fcs.gov.au.

What is the current PAYG rate for BT Panorama?

For the latest PAYG rate, please navigate to Products > News and updates > Key rates and thresholds.

The Super and Tax Guide can help provide clarity into how tax is deducted for your client. When considering monthly tax instalments, the current PAYG rate is used.

Visit Help and Support > Panorama Year End > Super and Tax Guide.

If I withdraw from a term deposit early, what is the interest rate reduction?

These rates are available in the relevant ‘Important Information and Terms and Conditions’ documents (Section 14, page 22). When you are logged into BT Panorama, go to ‘Products’ on the left-hand side menu > select Term Deposits. From here, select the document for the term deposit relevant to your client (e.g. BT, Westpac, St George).

Which browser will help my clients have the smoothest experience when using the BT Panorama website?

We recommend clients use the “Google Chrome” web browser as to ensure the optimal experience on BT Panorama.

What can Blue do to help me?

Blue, BT’s Virtual Assistant is designed to answer navigation and process questions about BT Panorama such as “Where can I find an update of a service request?”, “How can I update contact details?”, “How do I request for a new Centrelink schedule?” etc. The technology behind Blue uses machine learning known as Natural Language Processing to improve understanding of users’ questions and model updates are performed twice a year to train and improve Blue’s accuracy.

There are over 130 questions about BT Panorama that Blue can help with. For personal and complex queries, Blue offers to connect users to BT consultants during business hours as click-to-chat is integrated into Blue’s service. Alternatively, BT Panorama users can type “Chat with consultant” or “Speak to human” to connect the chat to a BT consultant.

Where can I check the term deposit rates on BT Panorama?

Select ‘I’d like to’ on the top right-hand side of the BT Panorama homepage. Then select ’Check term deposit rates” from the dropdown list.

How can I find out who my BDM is?

Please contact us on the 1300 784 207 regarding this request and we can confirm with you either via phone or email.

Why does the advice fee amount entered on the fee consent form / application form, differ to the amount deducted from the client's account prior to 1 July 2024?

The adviser fee is inclusive of 10% GST, while the fee the client is charged is net of RITC (less 75%).

Note:

Advice fee calculation = Fee inclusive of GST less RITC = Net Fee charged to Client

Here’s an example:

Fee of $110 includes GST of $10 (10%)

RITC refund of 75% of GST= $7.50

$110 (total) - $7.50 (RITC) = $102.50

Why does the adviser fee requested differ on the client’s transaction history screen prior to 1 July 2024?

The adviser fee is inclusive of GST (10%), while the fee the client is charged (displayed) is net of RITC (less 75%).

How is the percentage fee component calculated when setting up ongoing advice fees?

The fee will be calculated based on the account's average daily balance for the month for the specified holdings. You can set a different percentage for each investment type including managed portfolios, managed funds, listed securities, term deposits and cash.

How can I find the redemption windows and other terms of withdrawal for Managed Funds?

The Product Disclosure Document (PDS) for each managed fund contains information on the redemptions for that particular fund.

To download the PDS for a managed fund, please log into BT Panorama, navigate to Products > Managed Funds > Investment Options > Search for the relevant Managed Fund. Under the ‘Download’ column, select ‘Product Disclosure Statement’.

My client needs to make a personal contribution to their account via EFT. What reference do I need to include?

They can download the access form from the BT website. Or they can find a list of the references for contributions via BT Panorama, select Help & Support > Products & Investments > Manage Contributions > About biller codes, EFT & Bank accounts. The current USI will stay active for at least 12 months and client contributions will be redirected to the new fund during this time, to give your clients time to contact their employer and advise them of the new fund details.

How do I create a Record of Advice (RoA) on BT Panorama?

You can create an RoA online using your licensee template or by using our BT Panorama template. To opt into this functionality, call us on 1300 784 207. For more information, visit the full BT Panorama website and go to Help & support > Managing your clients > Digital consent > Request consent for investment orders.

My colleague would like to register for access to the BT Panorama platform. How can they do this?

They can download the access form from the BT website. Or they can contact their Dealer Group Manager, who can give them access.

How do I locate the HIN structure my client is on?

Look up your client on BT Panorama, head to: Account details > Additional services.

If you’re given the option to register your client for a HIN, this means your client is under our nominee option. If under a custodial or sponsored option, there’ll be a green tick mark that says active with an option to view the details of the HIN.

For more information, go to the BT Panorama desktop, and click: Help & support > Managing your clients > Listed Securities > Holding types.

Where can I find more information regarding the year-end tax deduction or credits that have been applied to my client’s BT Panorama Super accounts?

When the fund completes the annual tax return a calculation is performed for the fund as a whole and any final tax adjustments for that financial year are made and allocated to client’s accounts. Factors that are considered in this calculation include but not limited to capital gains or losses, investment income (received or accrued) and concessional contributions. For more information refer to the BT Panorama Super & Tax Guide located in Help & Support>>>Business & Admin>>>BT Panorama Year End.

What notifications are received by the adviser and investor and how are they received?

Panorama gives you the visibility to see what’s happening with your clients’ accounts to help you manage your business more efficiently. You can view the notifications sent directly to you, as well as notifications Panorama has sent directly to your clients.

Notifications are either sent to the Message Centre (located in the top-right corner of Panorama Online) or to your nominated email address. Supporting users will have visibility over these online notifications only and can view these in their Message Centre.

For a full list of what notifications are sent to advisers and investors head to Help & Support>>>Business & Admin>>>Online and email notifications

I’m having trouble logging into BT Panorama, how do I get support?

There is a great tool “Forgot Username” which can help users self serve their username if they are unsure. If your customer uses the “Forgot password” tool and it comes up with an error, it is most likely their username is incorrect so please refer them back to the “Find Username” self serve option. Also, if you are a Westpac customer, have previously been a Westpac customer or hold a Westpac product – the login details for Panorama will be your Westpac Online Banking details.

Notifications are either sent to the Message Centre (located in the top-right corner of Panorama Online) or to your nominated email address. Supporting users will have visibility over these online notifications only and can view these in their Message Centre.

For a full list of what notifications are sent to advisers and investors head to Help & Support>>>Business & Admin>>>Online and email notifications

How long does it take to process the BT Panorama fee consent form?

If the fee consent request is received by our Customer Service Delivery team within five business days before the end of the month, with all the required information provided correctly, we’ll process the request before the month ends. In the unlikely event there’s any complete fee consent request received in time but not processed by the end of the month, the correct effective date can still be used.

Is there a guide that indicates the types of requests or forms that can be sent by email or post to the BT Customer Relations team?

We have a guide detailing whether a particular request or form can be submitted via email, post, online or via calling the Customer Relations team and what additional documentation is required. You can find the guide in the ‘Help & support’ section on the BT Panorama desktop by selecting the following options: ‘Business & admin’ > ‘Guides’ > ‘Digital Signatures’.

Why can’t my client’s account be added to a related fee group?

Grouping of accounts for ‘fees and reporting’ is not available to accounts on the Focus menu.

Also, if your client has a historical individual fee arrangement applied, their account isn’t eligible to be added to a related fee group. You can request to change to the standard pricing by completing the ‘Change administration fee rates’ form on BT Panorama by navigating to Tracking > Service requests > Submit new request > Account maintenance.

How do I update my client’s primary and secondary contact details?

For changes to the primary contact's mobile phone number and email address, the client must call us on 1300 881 716 (Monday to Friday, 8:30am – 6:30pm Sydney time). Other changes, such as address, can be made online.

Hint: Any secondary contact details on BT Panorama online with a pencil icon next to them, means you can edit and update them online on behalf of your client.

How do I provide account access for a member of my team?

If you’d like a team member to have access to your client accounts, they will need to be given the appropriate permissions. They can only access client accounts under the adviser or dealer group they are linked to. Your Dealer Group Manager can provide access by logging into BT Panorama and entering the required details. More information is available by clicking on the help and support section on your BT Panorama desktop and then selecting: Business admin -> Admin, users & permissions -> Users and business entities.

How do I check my client’s rollover status?

You can find out the status of a rollover request on BT Panorama online. How? On the left-hand side menu when you’re viewing a client’s account, you’ll see ‘Rollovers and contributions’. Once submitted the task will move through three stages:

- Submitted - successfully submitted

- In progress - sent to the other fund

- Received - the funds have come in

Once the rollover has been received into the account, you’ll see this in the transaction history.

Why can’t I claim the full amount of personal non-concessional contributions made for that financial year?

Special rules apply if you made a withdrawal or rolled over part of your super during the year.

Panorama will no longer hold a contribution, or at least a part of it, if the member has chosen to rollover or withdraw a part of their super account held by Panorama. In such a case, a notice of intent cannot be given for the entire contribution.

A valid notice of intent will be limited to a proportion of the contribution that remains after the rollover or withdrawal. The proportion remaining is calculated by taking the tax-free component remaining and multiplying by the contribution, then dividing this by the tax free component of the interest before the rollover.

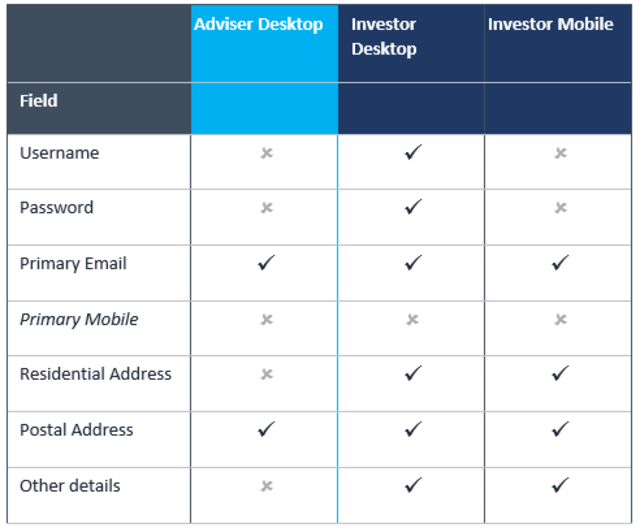

What contact details can be updated online on BT Panorama by advisers and clients?

Advisers and clients are now able to update their contact details online on Panorama, please see the table below for a summary.

Does the regular pension payment need to be adjusted when my client has made a one-off pension payment this FY that has met or exceeded their minimum requirements?

One-off pension payments do not have any effect on the nominated regular pension payment, they will contribute towards the minimum pension payment for the financial year, though the nominated regular pension payment will still be paid even if it is set to the minimum. It’s integral that any remaining regular pension payments set are amended for the client’s intentions.

To amend or end the regular pension payment, select the client’s account, and then select Pension Payments. More information is available in Help & Support>Products & Investments>Manage Pension Payments.

Can the Super Partial Withdrawal Form be submitted via email?

The Super Partial Withdrawal Form is acceptable via email to professional@panorama.com.au in all cases except for when requesting a rollover to an SMSF. It is important when requesting a rollover to an SMSF that certified ID and certified copy of the SMSF bank statement are provided along with Super Partial Withdrawal Form via post to: BT Panorama, GPO Box 2861, Adelaide SA 5001.

Are tax statements produced for BT Panorama Super clients?

Tax statements are not provided for BT Panorama Super clients. Instead, clients will receive an Annual Statement for each financial year. For estimated statement release dates head to Help & Support>Business & Admin>Panorama Year End.

Will my BT Panorama Super client receive a PAYG Summary statement this financial year?

The following BT Panorama Super Pension clients will receive a PAYG Summary statement:

- Clients who turned 60 during the financial year and received income payments prior to turning 60, but the statement will only include income payments received by the client prior to their 60th birthday.

- Clients who were 59 or less during the whole financial year, including details of all the income payments they received over the year

The following BT Panorama Super Pension clients will not receive a PAYG Summary statement:

- Clients who were aged 60 or over as of 1 July 2022

- Clients who turned 60 during the financial year and did not receive any income payments prior to turning 60

- Clients who received income payments consisting of 100% tax-free components

For more information regarding end of financial year statements head to Help & Support>Business & Admin>Panorama Year End

Does BT Panorama provide sustainability scoring and information for listed securities and managed funds available on the platform?

BT Panorama provides sustainability scoring and information for the top 200 ASX listed companies as well as managed funds that invest primarily in Australian and international shares. To find out the scores for each asset head to their relevant profile when viewing through the BT Panorama UI. More information about the sustainability scores used on BT Panorama is available through Help & Support>Business & Admin>About Sustainability Scores.

Where do I find the Target Market Determinations (TMDs) for Managed Portfolios or Managed Funds on BT Panorama?

You can find the TMDs by logging into BT Panorama and selecting the following options for Managed Portfolios; Products>Managed Portfolios>BT Managed Portfolios> Overview> Target Market Determination. If you would like the TMDs for Managed Funds navigate to Products>Managed Funds>Select the fund you want>Download>Target Market Determination.

When will my client's Tax Statement be available?

Tax Statements for BT Panorama Investments accounts will be released in tranches. To see an estimate of when a particular client’s statement will be released, advisers have access to an estimator tool through the Help and Support page that will list the account numbers and their anticipated release dates. To access this tool navigate to Help & Support -> Business & Admin -> Panorama Year-end. You can log in to the estimator tool using your User ID (e.g. 201…..) and Panorama username.

Why has my clients pension payment for July not been paid out?

Due to the end of financial year, we generally experience delays with fund managers in distributions as well as the redemption of managed funds. Since we are expecting these funds into the account, a drawdown will not be triggered to fund the pension payment, and as a result there may be insufficient cash to make a scheduled pension payment.

It is particularly important around end of financial year for advisers to ensure their clients pension accounts have sufficient cash available for upcoming pension payments. Alternatively, advisers are able to process a one-off pension payment when sufficient cash becomes available. Also, the adviser is also able to change the date for when the scheduled pension payment will go out.

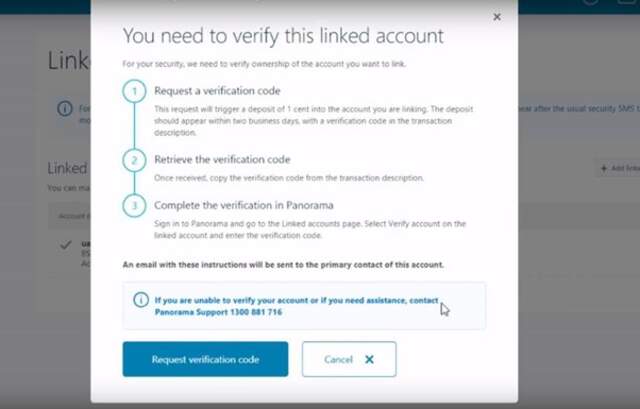

How does my client complete the verification steps when adding a linked bank account?

Once a bank account has been linked, when the client views their linked accounts on BT Panorama, they will see the account marked as Unverified . If the verification code has not been requested, they will have the option to request a new verification code. The client will need to click Request Verification Code. This will trigger a transfer of 1 cent to the clients linked bank account.

Once the client can see the 1 cent deposit in their linked bank account, they can log in to BT Panorama again and select Verify account next to their linked account. A screen will pop up asking them to input the verification code from the transaction description in their linked bank account. After the client inputs the code and they click Verify account.

Some important things for you to be aware of:

• The code appears in the transaction description as BTXXXXXX. When entering this code on Panorama, only include the 6 digits that appear after “BT”.

• The code will be valid for 10 days from the request.

• Once the code expires the client will need to request a new code on Panorama.

I have submitted a rollover on Panorama, but want to cancel it. How can I do this?

As it’s a rollover in from an external fund, you will have to contact them to cancel the request, as we have already sent the message.

The redemption for my managed fund is taking too long. How can I escalate it?

Managed funds can take 5-7 business days, for daily priced managed funds. This time frame is subject to the fund managers discretion and may vary. Unfortunately we aren’t able escalate a request by an external party.

Does the new BT Panorama Focus menu minimum fee of $50 p.a. apply if the entire account balance is held in cash?

Yes, the administration fee – asset based is subject to a minimum amount of $50 p.a., even if the entire account balance is held in the transaction account. For more information, please refer to the relevant disclosure document, which can be found when you log into BT Panorama and navigating to Products > About Panorama.

Does BT Panorama deduct or apply tax to any rollovers that come into super accounts?

Tax is generally not applied to rollovers into accounts in accumulation phase. However, if the Rollover Benefits Statement indicates an untaxed element, then tax of 15% is applied. For details refer to the Panorama Super Tax Guide, which can be found by navigating to BT Panorama Help and Support > Business and Admin > Managing your Business > Panorama Year End.

Funds were deposited to my client’s Panorama Super account by mistake. Can they be returned?

To request a return you can complete the ‘Return of Contribution(s)’ form. Login to BT Panorama and navigate to Tracking>Service requests>Deposits and contributions. BT Panorama, navigate to Tracking>Service requests>Deposits and contributions

Ensure you include all required supporting evidence listed on the form.

What is the difference between the existing non-lapsing nomination band the new three year binding death benefit nomination?

The existing non-lapsing nomination does not expire and does not require the same formalities as a three-year binding death benefit nomination. It is generally binding under the Trust Deed for BT Panorama, however it can be invalidated by significant life events. The three year binding death benefit nomination is valid for three years and must be renewed with a signed, witnessed form. If not renewed, it reverts to trustee discretion (non-binding) nomination. The three year binding death benefit nomination is binding under the Trust Deed for BT Panorama and significant life events do not automatically invalidate it.

What contributions can be split?

Contribution types that may be split include:

- employer contributions

- salary sacrifice contributions

- personal contributions for which a tax deduction has been claimed

- contributions made by family and friends (other than those made by the member's spouse or for a child under 18 years old)

- allocations from reserves that are assessable, such as allocations to meet an employer's obligation to contribute.

For more information, visit the ATO website.

Does BT Panorama Super allow my client to link and nominate a bank account that is not in their own name?

No, the bank account must be in the client's own name, or a joint account where the client is an owner of the account. This is to help comply with section 62 of the Superannuation Industry (Supervision) Act 1993 (SIS).

How does BT Panorama treat capital losses on superannuation accounts, and how are they applied?

BT Panorama Super members who have sold assets and realised any capital losses will have these losses applied against any capital gains within their account, to reduce the capital gains tax payable. If a member has not made sufficient capital gains to offset these losses, the losses will be applied against other capital gains derived at the fund level, or else they’ll be carried forward to future years.

For more information, log into BT Panorama, navigate to Help & Support > Business & Admin > Panorama Year End > Super and Tax Guide, Page 7-8.

Does BT Panorama accept a Wholesale Declaration and Accountant Certificate for Superannuation accounts?

BT Panorama can apply the Wholesale and Sophisticated Investor Status to Investments accounts (both individuals and entities). We cannot accept the certificate for BT Panorama Super accounts as superannuation accounts are regulated and governed by the Superannuation Industry Supervision (SIS) Act 1993.

Why are SMSFs required to have $10 million of net assets to be classified as wholesale clients in a superannuation product, rather than $2.5million?

Under the general test, the circumstances in which the trustee will be a wholesale client include if the trustee has a certificate from a qualified accountant stating they have net assets of $2.5 million or if the value of the investment is $500,000.

Where can I view the available assets for a client's BT Panorama Super account on the Focus, Compact or Full menu?