What it’s like for you

-

Build model portfolios consisting of cash, listed securities (including ETFs) and managed funds.

-

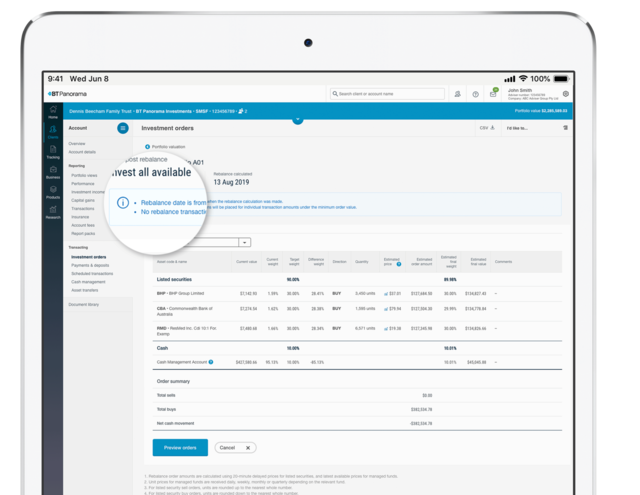

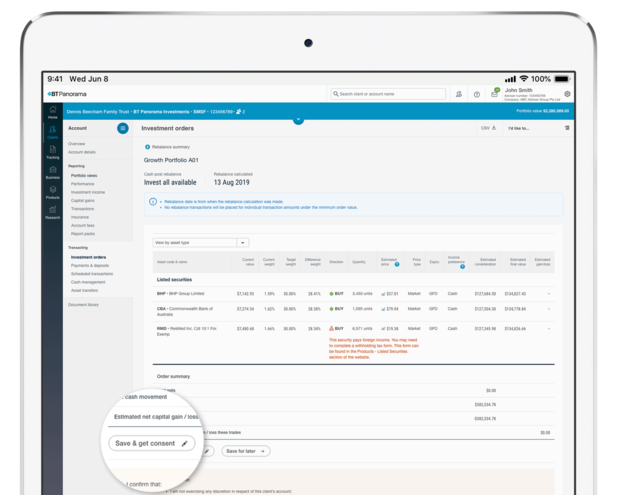

Create a rebalance order and generate a Record of Advice – with records of the consent and ROA sent directly to Iress Xplan and automatically uploaded to client files (if you choose to).

-

View and manage model portfolios from your adviser account on BT Panorama.

What it’s like for your client

-

Transparency and visibility of their investments via their BT Panorama desktop or mobile app.

-

Consent to rebalance requests can be actioned from their BT Panorama desktop or mobile app.

Learn more about adviser portfolios

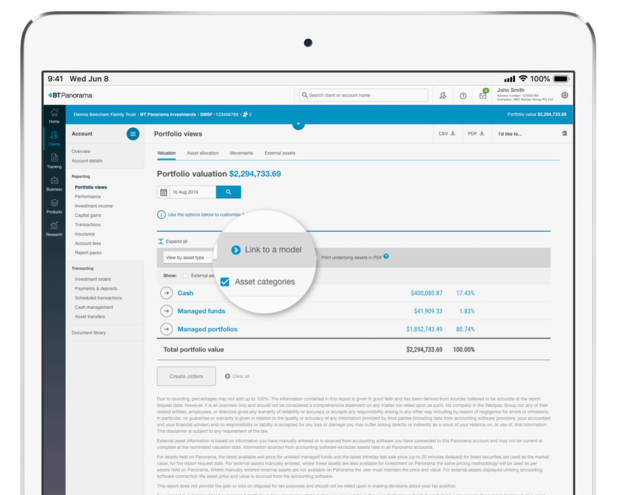

Take a closer look at adviser portfolios, a simple, efficient portfolio construction solution that allows you to set up and manage model portfolios – all from your adviser account on BT Panorama.

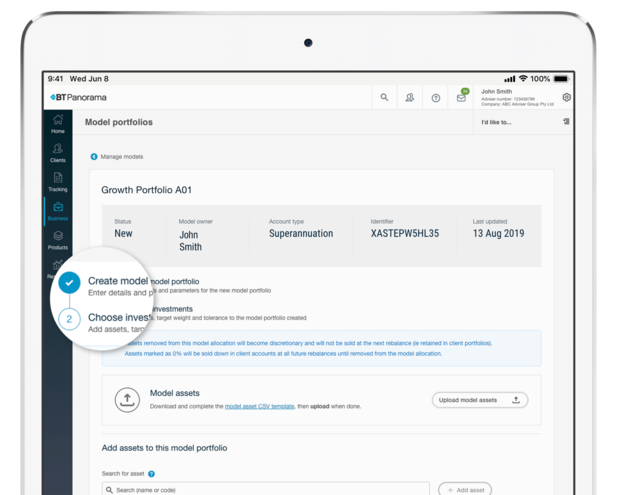

How to create a model portfolio

1. Select create a model portfolio

2. Set up automated rebalance instructions

3. Link a client to the model portfolio

4. Seek client consent

5. The client consents and the portfolio is actioned automatically

"Model portfolios gives us about two full time employees back in business efficiencies."

David Price, Director, Representative and Financial Planner, Strategy First

Benefits for your business

Create business efficiencies

Streamline the advice and investment management process by implementing adviser portfolios across multiple clients, instead of having to manage individual investment portfolios.

Spend less time on admin

No ROA/SOA required for ongoing rebalances within the portfolio, allowing for a more effective and paperless way of working with your clients.

Build stronger relationships with your clients

You can exclude certain assets and use tax optimisation tools to tailor the managed portfolios to better suit individual clients. In addition our BT Panorama mobile app helps drive client engagement delivering portable, easy access to key portfolio information.

Benefits for your clients

Individual tax positions

In respect of BT Panorama Investments, as your clients beneficially own the underlying assets, they have direct access to any franking credits and dividend payments on these assets. They will not inherit any embedded tax positions as may be the case with a managed fund.

Rich reporting functionality

BT Panorama’s rich reporting functionality gives your clients the ability to view the positions and performance of all underlying assets in their licensee portfolio at a glance. And with BT Panorama’s mobile app your clients are kept actively engaged with their wealth, even when they are on the go.

Automatic rebalancing

Your clients investments can be setup to automatically rebalance to keep them aligned to their pre-determined asset allocations or automatically re-investing excess cash.

Let's get started

Speak to a BDM to see what adviser portfolios on BT Panorama can do for your practice or open your account with the registration forms.