-

Challenger Guaranteed Annuity (Liquid Lifetime)

-

Challenger Guaranteed Annuity

-

Challenger CarePlus

-

Adviser and accountant collaboration

-

Investment of SMSF funds

-

Set up and manage pensions

Features

-

Seamless transition: Transitioning clients from accumulation to pension phase is easy and streamlined. Clients can build savings in their Panorama Super account before receiving a potentially more tax-effective income from their Panorama Pension account in retirement.

-

Invest for income: Select the investment options that best suit your client and their risk profile from either a Focus, Compact or Full investment menu including term deposits, equities, managed and tailored portfolios, and annuities.

-

Flexibility: Your clients can choose their desired pension payment date and frequency, and make partial withdrawals at any time as either an income payment or a lump sum.

-

Related group pricing: Allows your clients to combine their accounts with eligible accounts of family members to potentially reduce the administration fees paid.

-

Estate planning options: Your clients can make non-lapsing beneficiary nominations, as well as auto-reversionary nominations with the flexibility of a secondary beneficiary nomination, for extra peace of mind.

-

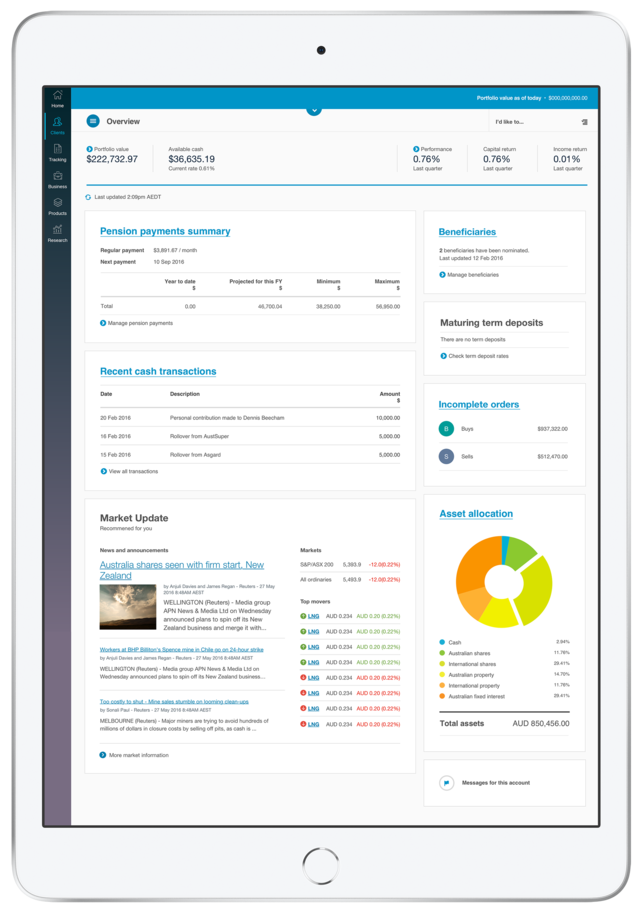

Rich online functionality: Reduce your admin time by gaining digital consent from clients via SMS and email. Also access key information with intuitive dashboards and flexible, real time reporting.

Access to a range of options:

-

Challenger Guaranteed Annuity (Liquid Lifetime) – a guaranteed regular income for your client’s lifetime

-

Challenger Guaranteed Annuity – a guaranteed regular income for a fixed term your client chooses

-

Challenger CarePlus – a specialist investment designed to help people moving into residential aged care.

Planning for retirement

Your guide to means testing

Setting a tax strategy for your clients before they start their TtR pension is an important step in helping them increase both their savings and their super.

Retirement lifestyle calculator

This calculator allows you to estimate the annual income you might need to support a retirement lifestyle based on the expenses you input.

In retirement

Granny flat tax implications

Granny flat arrangements within the context of the gifting rules

Income streams: social security income test (including defined benefits)

Later life

Your guide to aged care

Assessment for entry into an aged care facility

Superannuation death benefits

Ready to get started?

Speak to a BDM

Find out how BT’s super solutions can meet your clients' retirement needs at any life stage.

Information current as at 1 April 2023.

This communication has been prepared for use by advisers only. It must not be made available to any client and any information in it must not be communicated to any client. This document provides an overview or summary only and it should not be considered a comprehensive statement on any matter or relied upon as such. This information does not take into account your personal objectives, financial situation or needs and so you should consider its appropriateness, having regard to these factors before acting on it.

BT Portfolio Services Ltd ABN 73 095 055 208 AFSL 233715 (BTPS) administers Panorama Super. BT Funds Management Limited ABN 63 002 916 458 AFSL 233724 (BTFM) is the trustee and issuer of Panorama Super, which is part of Asgard Independence Plan Division Two ABN 90 194 410 365. Westpac Financial Services Ltd ABN 20 000 241 127 AFSL 233716 (WFSL) is the responsible entity and issuer of interests in BT Managed Portfolios. BTPS operates Panorama Investments. Westpac Banking Corporation ABN 33 007 457 141 AFSL and Australian credit licence 233714 (Westpac) is the issuer of the BT Cash Management Account (BT CMA) and the BT Cash Management Account Saver (BT CMA Saver). Together, these products are referred to as the Panorama products. BTFM is the trustee and issuer of Asgard eWRAP Super/Pension, Asgard Infinity eWRAP Super/Pension, Asgard Open eWRAP Pension, Asgard Infinity eWRAP Pension, Asgard Managed Profiles and Separately Managed Account – Funds Super and Asgard Elements Super (collectively, Asgard Products). Asgard Capital Management Limited ABN 92 009 279 592, AFSL Number 240695 (Asgard) is the administrator and custodian of the Asgard Products.

A Product Disclosure Statement or other disclosure document (PDS) for the Panorama products can be obtained by contacting BT on 1300 783 143 or by visiting bt.com.au. A PDS for the Asgard Products can be obtained by contacting Asgard on 1800 731 804or by visiting asgard.com.au. A retail client should obtain and consider the relevant PDS before deciding whether to acquire, continue to hold or dispose of interests in a Panorama or Asgard Product.

BTPS, BTFM, Asgard and WFSL are subsidiaries of Westpac. Apart from any interest investors may have in Westpac term deposits, Westpac securities, the BT CMA, or the BT CMA Saver acquired through the Panorama operating system, an investment acquired using the Panorama operating system or an Asgard Product or is not an investment in, deposit with or any other liability of Westpac or any other company in the Westpac Group. These investments are subject to investment risk, including possible delays in repayment of withdrawal proceeds and loss of income and principal invested. Westpac and its related entities do not stand behind or otherwise guarantee the capital value or investment performance of any investments acquired through the Panorama operating system or any investments in, or acquired through, Asgard generally.

BTPS provides administration services to and for Challenger Life Company Limited ABN 44 072 486 938, AFSL 234670 (Challenger Life), in respect of Challenger annuities via BT Panorama. BTPS is not issuing, selling, dealing or arranging the sale of Challenger annuities via BT Panorama and BTPS is not providing any custody service, any advice or any other financial service or function in relation to Challenger’s customers. Related parties of BTPS (like Westpac) and their representatives may be authorised to provide retail clients with personal financial advice in respect of Challenger annuities via BT Panorama, although such persons would need to appoint them pursuant to separate terms. This information is also provided by Challenger Life, the issuer of Challenger annuities. This is general information for advisers only and is not intended to be advice. Clients should consider the relevant product disclosure statement available at www.challenger.com.au/panorama and the appropriateness of the product before making any investment decision. All references to guaranteed income refers to the payments Challenger Life promises to pay under the relevant policy documents. Neither the Challenger Group nor any company within the Challenger group guarantees the performance of Challenger Life’s obligations or assumes any obligations in respect of products issued by Challenger Life.

Superannuation is a means of saving for retirement, which is, in part, compulsory. The Government has placed restrictions on when you can access your investments held in superannuation. The Government has set caps on the amount of money that you can add to your superannuation each year and over your lifetime on both a concessional and non-concessional tax basis. There will be tax consequences if you breach these caps. For more detail, speak with a registered tax agent or visit the ATO website.

Each of BTPS, BTFM, WFSL and Westpac cannot give tax advice. Any tax considerations outlined in this document are general statements, based on an interpretation of current tax laws, and do not constitute tax advice. As such, you should not place reliance on any such taxation considerations as a basis for making your decision with respect to the product.

This information may contain material provided by third parties derived from sources believed to be accurate at its issue date. While such material is published with necessary permission, the Westpac Group accepts no responsibility for the accuracy or completeness of, nor does it endorse any such third party material. To the maximum extent permitted by law, we intend by this notice to exclude liability for this third party material.

Speak to a BDM

Find out how BT’s super solutions can meet your clients' retirement needs at any life stage.