Prior to 1 July 2017, when a spouse received a death benefit pension, it was industry practice for them to commute the pension and roll the benefit back to accumulation if it was outside the prescribed period. This was generally the later of:

-

three months from grant of probate, or

-

six months from date of death.

The ATO views this industry practice as a breach of the compulsory cashing requirement that applies to death benefit pensions. However, the ATO issued Practical Compliance Guideline 2017/6 allowing for relief in relation to this practice for commutations which took place before 1 July 2017.

Since1 July 2017, if a death benefit is taken as an income stream, it can’t be commuted and rolled back to accumulation at any stage. It can be commuted and rolled over to another fund if the beneficiary is eligible to receive a death benefit income stream.

Once the death benefit is rolled over to the new fund, it must immediately be taken as a death benefit income stream or a lump sum and can’t be held in accumulation phase.

If a death benefit is rolled over and received in another super fund, the tax treatment for the beneficiary won’t change. This provides a significant benefit to clients who hold insurance and accumulated monies within super funds that don’t pay death benefit income streams.

Transfer balance cap

Since 1 July 2017, the transfer balance cap (TBC) limits the total amount a person can roll over to superannuation retirement phase (RP) income streams. The general TBC is currently $2 million and this is applicable to people who had not commenced a retirement phase pension before 1 July 2025, except where the person has made structured settlement contributions. For those who have already started a retirement phase pension between 1 July 2017 and 30 June 2025, they will have a personal TBC of between $1.6m and $2m. The TBC also applies to recipients of death benefit pensions.

A death benefit pension may be payable to a:

-

spouse including de facto and same sex)

-

person who was financially dependent on the deceased

-

person who had an interdependency relationship with the deceased person, and

-

child (including adopted, step and ex-nuptial) who is:

- under age 18

- over age 18 with disability, or

- aged18 to 24 and were financially dependent on the deceased just before the deceased passed away.

Death benefit income streams if paid to a dependant other than a child

Superannuation death benefits received as a pension count towards the receiving beneficiary’s transfer balance account (TBA). If a client has a superannuation RP income stream and therefore, has a TBA and they then receive a death benefit pension, the total rolled over to a RP income stream cannot exceed the client’s unused TBC amount.

Where the recipient spouse will exceed their TBC upon receiving a death benefit income stream, they can roll their own pension back to accumulation if they want to retain the money in superannuation. Alternatively, they could either receive the death benefit as a lump sum or commute their own pension as a lump sum and then receive the death benefit as an income stream.

Example 1

Harry and Jemima are a married couple. On 1 July 2017, they both commenced an account based pension with a balance of $1.6 million each.

On 1 September 2025, Harry passed away. At this time, both of their account based pensions were valued at $1.5 million each. If Jemima receives Harry’s account based pension as a death benefit income stream whilst still holding her own account based pension, she would exceed her personal TBC of $1.6m.

Jemima commuted and rolled back her account based pension of $1.5 million to accumulation phase. She then commenced a death benefit pension from the proceeds of Harry’s $1.5 million death benefit account. This means she stayed within her personal TBC.

Example 2

Tim and Janine are a married couple. On 1 July 2017, they both commenced an account based pension with a balance of $1.6 million each.

On 1 September 2025, Tim passed away. At this time, both of their account based pensions were valued at $1.7 million each. If Janine receives Tim’s account based pension as a death benefit income stream whilst still holding her account based pension, she would exceed her personal TBC.

Janine commuted and rolled back her account based pension of $1.7 million to accumulation phase. This reduced Janine’s TBC to negative $100,000. She then received Tim’s death benefit account based pension of $1.7 million. This allowed her to stay within her personal TBC of $1.6 million..

Reversionary pensions vs non reversionary pensions

The starting balance of a non-reversionary death benefit pension counts towards the TBC of the recipient as soon as the death benefit pension commences.

On the other hand, when a reversionary death benefit pension is received, the balance of the pension at the time of death of the original account holder will be credited to the beneficiary’s TBA, 12 months after the date of death. This provides the death benefit recipient some time to work out how they would like to receive the death benefit, and perhaps move some of their own pension monies back to accumulation phase if necessary.

Death benefit income streams paid to a child

A death benefit income stream (child pension) can be received by a child of the deceased as long as the child:

-

is under age 18

-

is between ages 18 and 24 and they were financially dependent on the parent, or

-

has a permanent disability.

Child pensions can only be commenced for an amount up to the available TBC of the minor beneficiary. This is referred to as a ‘transfer balance cap increment’.

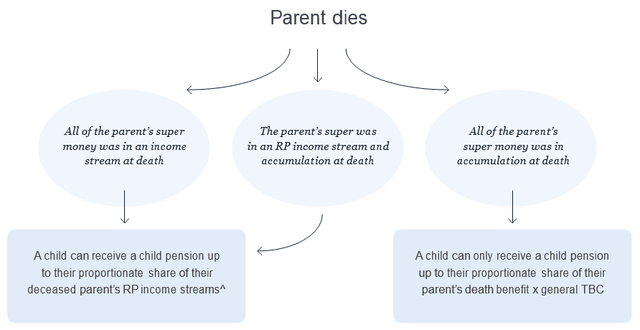

The amount which can be paid to an eligible child without exceeding the child’s TBC increment depends on whether or not the parent had a TBA, which in turn depends on whether or not the parent had already commenced a RP income stream.

When the deceased parent does not have a transfer balance account

If a death benefit income stream is paid to a child or children from the parent’s accumulation benefits, and the parent does not have a TBA then the child/children can receive an income stream for an amount up to their proportion of the death benefit multiplied by the general TBC. This means that the total amount rolled over to their income streams cannot exceed the general TBC at that time.

A transition to retirement income stream does not count towards a person’s TBC. For this purpose, it is considered to be in accumulation phase and is not a retirement income stream.

Example 3

Janine was a single mother who had $2.2 million in super benefits, which were all in accumulation phase. She passed away on 1 August 2025 when the general TBC equalled $2 million. She nominated her two children, Angela (age 12) and Marcus (age 15) to receive her death benefits equally (50% each).

The children can receive a death benefit pension of $1,00,000 each (i.e. $2 million x 50%) without exceeding their TBC. The remaining amount of $200,000 needs to be paid out as a lump sum death benefit.

Example 4

Bill is aged 57 and has $900,000 in a transition to retirement income stream. He has a de-facto spouse and also one child from a former marriage, who is aged 16.

He nominated his child to receive his entire super death benefit. He passed away on 1 October 2025. His child was able to receive a death benefit income stream for $900,000 without exceeding their TBC.

When the deceased parent had a transfer balance account

If a parent had a TBA at the time of their death and a death benefit income stream is paid to a child or children, then the child/children of the deceased parent can receive a death benefit income stream up to their proportionate share of the deceased parent’s RP income stream monies.

They cannot receive any amount from accumulation phase as a death benefit pension.

Any insurance proceeds paid from super will always be deemed to be sourced from the accumulation phase. This means that a child can only receive the insurance benefit as a lump sum in the case where the deceased parent had a TBA.

Example 5

David is age 62 with two children. He had $1 million in an account based pension. He also had $500,000 in accumulation phase. He passed away on 1 September 2025. He had nominated his two children, Adrian and Melissa to receive his superannuation benefits. Adrian was nominated to receive 60% whilst Melissa was to receive 40% of the total benefits. Adrian can receive a death benefit income stream of $600,000 while Melissa is able to receive a death benefit income stream of $400,000. Adrian and Melissa will need to take the amount of $500,000 from accumulation as a lump sum benefit.

Example 6

Mary passes away at age 52 on 1 December 2025. Mary had previously commenced an account based pension on 1 July 2017 with a balance of $1.6 million, due to being totally and permanently disabled. At death, her pension was valued at $2.1 million and the general TBC was $2 million. She had no monies in accumulation phase. She left her superannuation death benefit to her 14 year old daughter, Amelia. Amelia was able to receive the entire amount as a death benefit pension.

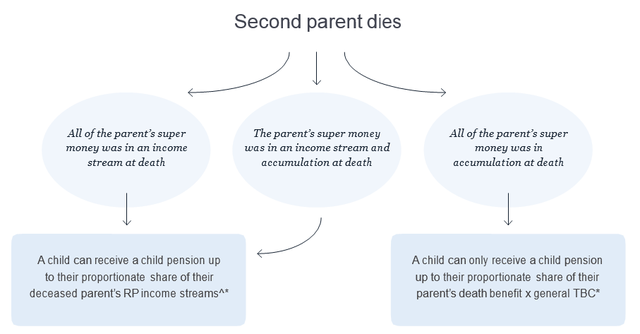

Where both parents pass away

Where both parents of a child pass away, the child’s TBC increment is the sum of the amounts worked out in relation to each parent.

If a child receives a death benefit income stream from one parent and subsequently receives another death benefit income stream from their other parent at a later date, the child’s TBC increment is the total of the income stream benefits they receive from all parents, provided:

-

the death benefit income streams are paid from the parent’s income stream monies, if the parent had a TBA, or

-

from accumulation phase if the parent didn’t have a TBA and the amount is the child’s proportionate share of the death benefit multiplied by the general TBC.

Example 7

On 1 June 2025, Emma (aged 16) received a death benefit income stream of $1.6 million when her father passed away. The income stream is within Emma’s TBC increment as her father had $1.6 million in an account based pension at the time he passed away.

On 1 July 2025, Emma’s mother also passed away. Emma’s mother had $500,000 in accumulation phase only. As Emma’s mother did not have a TBA, Emma can receive the amount of $500,000 as a death benefit income stream and this will be within her own TBC increment.

^ This is regardless of whether this amount is over the general TBC amount.

* This is regardless of how much the child already has as an income stream if the income stream/s were received as a result of the death of their other parent.

Advice considerations

The changes introduced on 1 July 2017 mean that many clients, particularly those who have yet to commence a retirement phase pension and with more than $2 million in super, may need to revise how their superannuation death benefits will be paid to their beneficiaries.

Depending on their circumstances and the amount of money they have in super, clients should consider:

-

how best to leave any death benefits to their spouse and children to enable them to keep as much benefits they can within the super environment

-

having a reversionary beneficiary in place instead of a binding death benefit nomination

-

having some of their death benefits paid out as a lump sum and held in a family trust

-

starting an account based pension with their maximum TBC amount before they die so that they can leave as much as possible to their child/children as death benefit pensions.

Take the next steps

-

Explore retirement solutions for your clients

Efficiently manage your clients’ super portfolios as they prepare for retirement with our flexible pension, annuity and SMSF solutions.

Contact BT Technical Services

-

Email BT Technical services

-

Login to the BT Panorama mobile app to call.

Your guide to means testing

Income streams: social security income test (including defined benefits)

Superannuation and divorce

FOR ADVISERS USE ONLY

This information has been prepared by BT, a part of Westpac Banking Corporation ABN 33 007 457 141 AFSL 233714 (Westpac), for financial advisers only and must not be made available to any client or any other person, or attributed to Westpac or any other company in the Westpac group.

The information is an overview only and it should not be considered a comprehensive statement on any matter nor relied upon as such. Any graph, case study or example is for illustrative purposes only and is not an indication of future performance or result. Where past performance is used, please note that past performance is not a reliable indicator of future performance. Any taxation information is a general statement based on current laws and their interpretation. The article is current as of the date of the article unless stated otherwise. The article does not contain, and should not to be taken to contain, any financial product advice and it does not take into account any person’s financial situation, needs, objectives or taxation situation. Because of this, you should, before acting on the information, consider its appropriateness to your clients, having regard to their financial situation, needs and objectives, and your clients should seek independent professional taxation advice on any taxation matters. It is not the intention of Westpac or any member of the Westpac group that the information be used as the primary source of readers’ information but as an adjunct to their own resources and training and should therefore not be relied on for the purposes of making any financial recommendations or an investment decision. To the maximum extent permitted by law: (a) no guarantee, representation or warranty is given that any information or advice in this website is complete, accurate or up to date or fit for any purpose; and (b) no member of the Westpac group is in any way liable to you (including for negligence) in respect of any reliance upon such information.

This page may also contain links to websites operated by third parties (‘Third Parties’) who are not related to the Westpac Group (‘Third Party Web Sites’). These links are provided for convenience only and do not represent any endorsement or approval by the Westpac Group of those Third Parties or the information, products or services displayed or offered on the Third Party Web Sites.