The Reserve Bank (RBA) Governor, Philip Lowe, delivered a speech to the Press Club earlier this week.

Make no mistake, Lowe has a tough job. Navigating the economic outlook amid heightened uncertainty from the pandemic is no easy feat.

The speech followed a pivotal RBA meeting. The central bank dropped its quantitative-easing program and made dramatic revisions to its economic forecasts, notably sharply lifting its inflation forecasts.

The meeting and the speech reaffirmed our expectation that the RBA will begin hiking the cash rate this August.

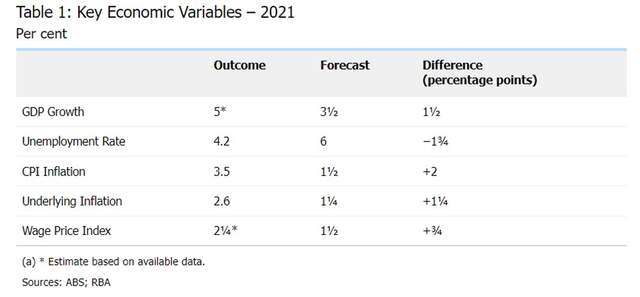

As part of his speech, Lowe displayed a table of forecasts for 2021. These forecasts were compared against actual outcomes. There were five key variables listed. Every single variable had outperformed the RBA’s expectations. Wages were the laggard in the “outperformance” stakes.

The outperformance relative to the RBA’s forecasts (table 1 below) is testament to the resilience of the Australian economy. Indeed, resilience was featured several times in his speech to describe the Australian economy.

Take the next steps

On the economic outlook, Lowe appeared cautiously upbeat. He opened his speech by saying he was “optimistic” about the economy’s prospects, but he added there were some challenges and uncertainties ahead. These included the pandemic not yet being behind us, although Lowe thought the worst of Omicron was at least behind us. Furthermore, the RBA cannot be sure how the pandemic will evolve. Challenges also included the sharp lift in inflation in the United States.

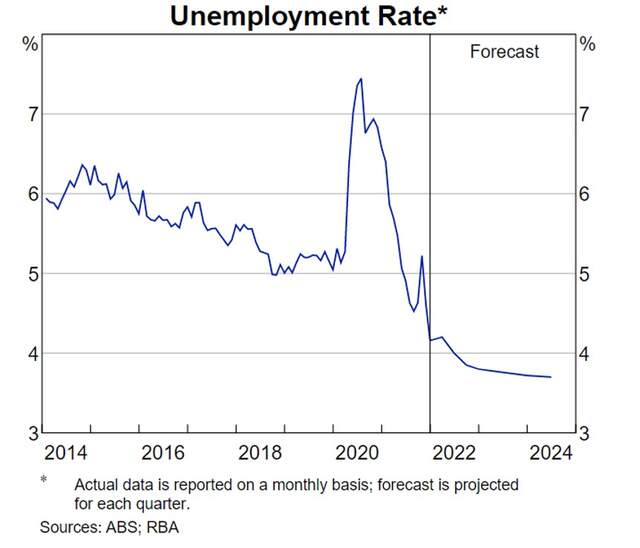

These uncertainties were used as one of several reasons why the Governor felt the RBA could be patient and wait in raising rates. Indeed, the RBA Governor stressed that for the first time in nearly 8 years inflation has only just recently entered the band. And unemployment is heading to 3¾ per cent and staying there for the foreseeable future. More people having jobs is a good thing and Lowe seemed prepared to push the envelope by being patient with rates.

The RBA’s business liaison program encouragingly suggested Omicron had not changed the story of rising job vacancies and job ads. Most businesses are still looking to hire staff, supporting the ongoing tightening in the jobs market.

The RBA estimates that full employment in the economy is when the unemployment rate is in the low 4s, so unemployment with a ‘3’ in front is beyond full employment. When an economy is beyond full employment, wage pressures can be expected to grow.

Wages and inflation are growing strongly in the US, UK and other major economies. But inflation and wage growth in Australia has been lagging these economies. In fact, US inflation is growing at an annual rate twice that of Australian inflation (7.0% vs 3.5%).

Lowe wants to see more evidence of a pick-up in wages growth, to a pace fast enough that will sustainably leave inflation in the target band.

Lowe appears concerned about the possibility of inertia in wages growth. He wants proof because (1) unemployment has not been sustainably below 4 per cent in “contemporary times”, that is, since the 1970s and (2) because the only examples we have of unemployment near full employment in contemporary times is in NSW and Victoria in 2019 when wage pressures simply did not mount. Lowe wonders if there is a structural element that could prevent wages growth picking up in the same way it has in the US and UK for example.

The premier measure of wages in the economy is the wage price index (WPI). We receive an update later this month for Q4 of 2021 and another in May. If these numbers print to the high side, a rate hike this year becomes a closer bet. And sooner rather than later in 2022.

A key pivot in the speech was Governor Lowe noting that the RBA is not targeting a specific level of the WPI before it moves on rates. In previous speeches, Lowe noted that wages would likely need to have a ‘3’ in front of them to move inflation sustainably within the band.

Another key pivot was the consideration of broader measures of wages growth, including compensation of employees from the national accounts and the bank’s own liaison with businesses. These measures capture bonus payments and compositional changes in the labour force (like job switching). Wage pressures are more likely to first emerge in such measures before they translate into increases in base wages. A broader assessment of wage pressures in the economy is likely to support an earlier move in the cash rate.

Crucially, Lowe conceded in the questions session that there could be a “plausible scenario” that rates go up “later this year”. And that “faster progress to unemployment and inflation does bring forward the timing of rate rises”. Lowe added that as inflation is not that high now, the RBA can be patient and wait. And this is where it gets very interesting. Can the RBA really afford to wait?

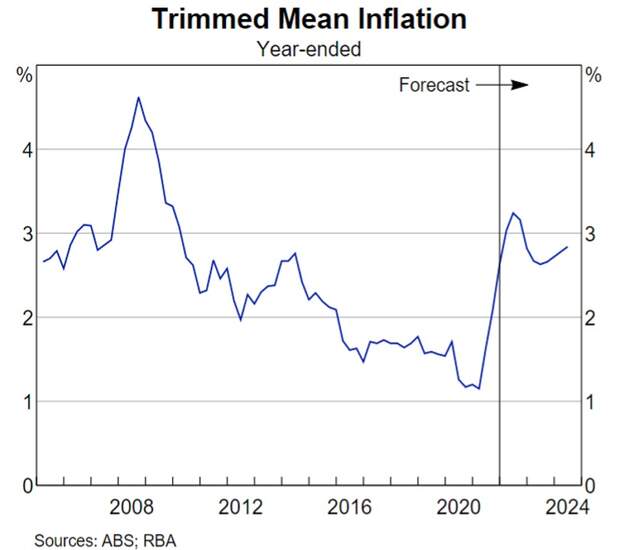

On the RBA’s very own forecasts, underlying inflation moves above the inflation target band over the next few quarters and remains in the top half of the inflation target band thereafter over the forecast horizon period.

On the RBA’s very own forecasts, unemployment is below full employment by end of this year and for the rest of the forecast horizon period.

And these forecasts are considering market pricing on the cash rate. Market pricing has four cash rate hikes priced in this year for Australia, beginning in July.

Lowe expressed his puzzlement as to why interest-rate markets have four priced in when four are also priced in for the US, where inflation and wages growth are a lot higher, and unemployment lower.

Interest-rate markets had a 15-basis-point hike fully priced in for June as recently as January 28, but now there is only a 50% probability attached. July has a 99% probability and August is more than fully priced at 145%.

Clearly, there is some risk that the inflation genie could be let out of the bottle. Lowe seems prepared to take that risk. If that risk comes to fruition, then we can expect more and/or sharper rate hikes to tame inflation and perhaps a higher terminal rate in the cash rate than otherwise would be the case. That would have implications for swap rates and fixed borrowing rates. Indeed, Lowe also admitted that if they are wrong about wages growth, rates will have to go up more quickly.

Lowe sees the risk of inflation getting out of hand as low. But as Lowe also acknowledged “actual outcomes can be different to forecasts”.

And since the start of the pandemic, the RBA has repeatedly underestimated inflationary pressures. In our view, the risks to the RBA’s inflation forecast are, again, tilted to the upside.

But Lowe wants more evidence of the persistence of price pressures and an upturn in wages growth. On prices, the RBA believes some normalisation of goods prices is likely to occur. This is because as pandemic restrictions ease, consumer spending will rotate back towards services and away from goods. People are eager to travel, attend concerts and events, and as a result will be spending less money on goods than when they were stuck at home. However, we think this normalisation will take time.

Interestingly, the RBA has said many times that it will move the cash rate lever when inflation is sustainably in the midpoint of the RBA’s target band of 2-3 per cent. Lowe during question time articulated that the RBA does not have a particular definition of what is “sustainable”, making picking the timing of lift off more challenging for economists.

Last year in September, the Governor said what we thought provided some colour around what might be characterised as “sustainable”. And that is, “it won't be enough for inflation to just sneak across the 2 per cent line for a quarter or two. We want to see inflation around the middle of the target range and have reasonable confidence that inflation will not fall below the 2–3 per cent band again.”

Lowe said they have no rule or benchmark on wages and floated the idea that it’s possible to have high inflation with low wages growth, as happened in the UK a few years ago.

We already had two quarters with underlying inflation at 2.1% for the September quarter and 2.6% for the December quarter of last year. We will receive two more updates in April and July. We also get two more wage prints in February and May. In amongst all that, the Federal election is shaping up for May, which the RBA will likely want to steer clear of. We think that combination of factors leaves June as the first possible “live” date for an RBA rate hike. But we believe the RBA will ease off the accelerator by lifting rates by 15 basis points at its board meeting in August. The RBA’s patience might not have worn thin enough by June.

A journalist did ask Lowe about whether households should lock in their mortgage rate and Lowe said the best advice he could offer is to make sure you have buffers and are prepared for interest rates to go up. Most households were paying off mortgages faster than they have needed to, which means higher interest rates (at least initially) may not thwart growth in consumer spending.

BT Economics

BTeconomics@btfinancialgroup.com

Superannuation income streams types

Calculating the rate of income support payments

This document has been created by Westpac Financial Services Limited (ABN 20 000 241 127, AFSL 233716). It provides an overview or summary only and it should not be considered a comprehensive statement on any matter or relied upon as such. This information has been prepared without taking account of your objectives, financial situation or needs. Because of this, you should, before acting on this information, consider its appropriateness, having regard to your objectives, financial situation and needs. Projections given above are predicative in character. Whilst every effort has been taken to ensure that the assumptions on which the projections are based are reasonable, the projections may be based on incorrect assumptions or may not consider known or unknown risks and uncertainties. The results ultimately achieved may differ materially from these projections. This document may contain material provided by third parties derived from sources believed to be accurate at its issue date. While such material is published with necessary permission, Westpac Financial Services Limited does not accept any responsibility for the accuracy or completeness of or endorses any such material. Except where contrary to law, Westpac Financial Services Limited intends by this notice to exclude liability for this material. Information current as at 10 December 2021. © Westpac Financial Services Limited 2021.