Over recent weeks, Chinese property developer, Evergrande, has hit the headlines for all the wrong reasons. The developer is the second largest in China and has the dubious honour of being the most indebted property developer in the world. It has over US$300 billion in outstanding liabilities. To put that into context, Evergrande’s liabilities are greater than the outstanding debt of all the state governments in Australia put together.

Concerns have been growing for months over the financial stability of the firm. In recent weeks it became clear that the company is heading towards bankruptcy. The news caused a stir in global markets, as investors considered the risk of financial contagion and the possibility of a sharp slowdown in the Chinese property market.

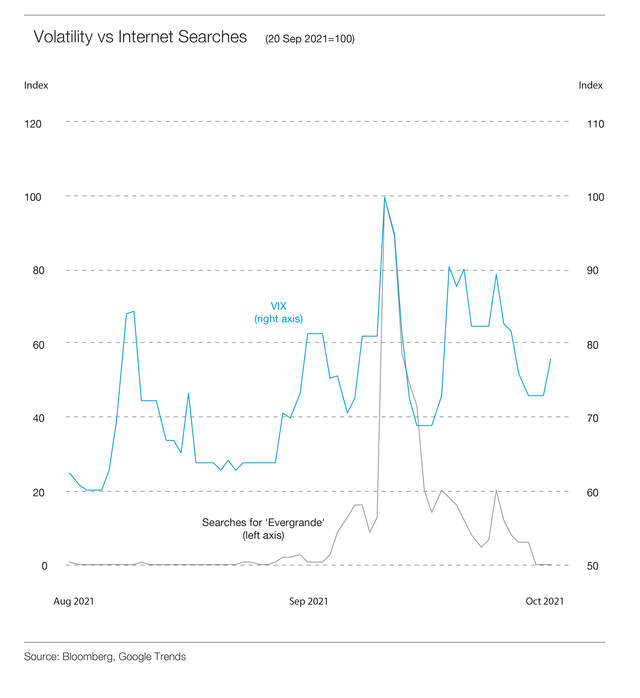

The VIX – which captures market risk sentiment by measuring expected share market volatility – shot up just as internet searches for ‘Evergrande’ hit their peak. Both measures reached a near-term peak on 20 September 2021 but have subsided since then.

The intervention of Chinese authorities has helped to temper concerns in global financial markets. Chinese authorities and policymakers are expected to manage the resolution of the firm and limit spillovers to the broader economy. But it is a complex problem to manage. The key risk now for global markets is that Chinese policymakers miscalculate the resolution.

Real estate reforms

Property construction has been a major driver of growth in the Chinese economy for many years. However, in recent years the Chinese authorities have sought to clamp down on excessive speculation and risk taking in the sector. In 2017, China’s President Xi Jinping famously said that ‘houses are built to be inhabited, not for speculation’.

In this vein, Chinese authorities introduced the ‘three red lines’ policy in 2020. The policy limits how much property developers can grow their debt by assessing their debt levels relative to assets, equity, and cash.

Another key goal is to reduce the construction of high-end property and provide more affordable housing for a greater share of the population. This is part of the authorities’ efforts towards ‘common prosperity’ in the country.

These changes foster sustainable, longer-term growth in China. But navigating this transition is a complicated task. Over the short‑term, these reforms could contribute to volatility in markets and dampen Chinese and global economic growth.

Evergrande concerns

Actions to clamp down on excessive leverage have caused issues for heavily indebted borrowers. While Evergrande is the most public example, other highly indebted property developers are also facing problems of their own.

Evergrande’s concerns have prompted fears that a collapse would have knock-on contagion effects to other developers in China. This could lead to a sharp slowdown in the sector and a subsequent reduction in Chinese economic growth. There are also fears around investors’ potential losses, including Chinese households and retail investors.

Chinese authorities are expected to prioritise the completion of outstanding housing projects, and ensuring workers and suppliers are paid. There are around 1.5 million buyers waiting for finished homes and authorities are reportedly supervising projects.

China’s central bank has injected liquidity into the financial system to support the functioning of markets and limit spillovers.

Other actions authorities may take include breaking up portions of the company and selling them off to other developers, to ensure that projects are finished.

Evergrande’s equity and bond investors are likely to receive less support from authorities. International bond investors are already bracing for losses; Evergrande’s US dollar bonds trading at less than 30 cents in the dollar.

Bailing out equity and bond investors would work against the authorities’ aims of reducing risk in the financial system. It is because investors are much more likely to take up risky investments if there is a belief the government will cover their losses if things go pear-shaped.

Impact on Australia

The direct implications for Australia of Evergrande’s woes are relatively limited, assuming the resolution remains orderly. The key risk is that Chinese policymakers miscalculate the support that is needed to implement an orderly resolution of the company.

In the worst-case scenario, a disorderly resolution could trigger a large fall in China’s property prices and construction activity, in addition to the failure of other heavily indebted developers. Such a situation could lead to greater levels of social unrest and a broader slowdown in the Chinese economy.

Australia would be impacted through a few channels if this scenario was to eventuate. Demand for Australia’s resource exports, particularly iron ore, a key ingredient in steelmaking, would fall. A slowing Chinese economy would also weigh on global growth. This would likely prompt a tightening in global financial conditions: equity prices would fall, corporate credit spreads would widen and it would become more difficult for businesses to issue debt. The Australian dollar could face selling pressures also.

These scenarios are unlikely.

The most likely outcome is that households and suppliers are somewhat protected; unfinished apartments are completed by other developers over time; assets are sold off; and equity, bond and other institutional investors take significant haircuts.

However, these steps are unlikely to be implemented quickly, meaning that the resolution is expected to be prolonged. A slower, but more orderly, resolution is likely to be preferred by the government.

Encouragingly, China’s policymakers have significant resources at their disposal and strong incentives to avoid a disorderly outcome.

For more information, visit BT Academy to stay up-to-date with events, articles, news and the latest trends.

Superannuation income streams types

Calculating the rate of income support payments

Information current as at 27 September 2021. This information was prepared by BT, a part of Westpac Banking Corporation ABN 33 007 457 141 AFSL and Australian Credit Licence 233714 (‘Westpac’). This information does not take into account any personal objectives, financial situation or need and so you should consider its appropriateness, having regard to these factors, before acting on it. This information provided is factual only and does not constitute financial product advice. Before acting on it you should seek independent advice about its appropriate to your and your clients’ objectives, financial situation and needs. Apart from any interest investors may have in Westpac term deposits, Westpac securities, the BT CMA or the BT CMA Saver acquired through the Panorama operating system, an investment acquired using the Panorama operating system is not an investment in, deposit with or any other liability of Westpac or any other company in the Westpac Group. These investments are subject to investment risk, including possible delays in repayment of withdrawal proceeds and loss of income and principal invested. Westpac and its related entities do not stand behind or otherwise guarantee the capital value or investment performance of any investments acquired through the Panorama operating system. This communication has been prepared for use by advisers only. It must not be made available to any client and any information in it must not be communicated to any client. This document provides an overview or summary only and it should not be considered a comprehensive statement on any matter or relief upon as such.