A whitepaper for financial advisers

Why Lean Six Sigma, why now?

The issues facing advice firms have been covered extensively in the past couple of years, all boiling down to a need for increased efficiency to maintain profitability. To achieve this, businesses will need to streamline and innovate. But unless a firm knows which issues are causing inefficiencies and can identify the specific pain points, it can be difficult to make meaningful progress.

There is a real need for businesses to have the tools to analyse processes and measure the impact of any changes made. This might sound like a requirement to develop or implement a new piece of technology. While technology can have a part to play, it’s as much about changing the whole approach to problem solving.

This change in mindset required to strive for continuous improvement by highlighting inefficiencies and minimising waste can empower a business to make enhancements now and into the future instead of waiting for technology or wholesale business transformation projects to take effect. The name for this methodology is Lean Six Sigma. This paper explores why it can be a powerful tool to enhance the performance of an advice business.

Take the next steps

-

Explore BT Panorama

Increase efficiency and client value with online consent, our award winning mobile app and more.

-

Questions about BT Panorama?

Speak to a BDM or

call 1300 784 207

Background

The Royal Commission in 2018 enforced changes for advice firms that generally had the effect of higher costs due to increased compliance and administrative tasks. This has increased the cost to serve a client, exposing a few issues for the typical Australian advice firm.

These increased costs have raised the break-even point for a client, resulting in many more clients falling into the unprofitable category and essentially costing the firm more money to service. This is amplified due to technology not being used as effectively as it could be, leading to the extra time and higher costs associated with manual compliance and administrative tasks. Overall, this means advisers, on average, have 142 clients versus successful, profitable firms in the UK that have 1601.

This comes at a time when Australia is about to enter a significant risk/reward moment in the advice market, with $3.9tn at stake in inter-generational wealth transfer over the next 5-10 years, according to CoreData modelling2. The winners will be those with a product offering that customers are looking for, at a compelling price point, resulting in sustainable profit for the advice business.

1. CoreData – Australian and UK Licensee Research June 2022

2. CoreData – Market Intelligence modelling April 2022

Helping quality advice to thrive

On top of these challenges, there is a clear directive from the regulator to improve the quality of advice. Conversations with advisers demonstrate their own commitment to delivering financial advice to a high standard. However, there are more and more obstacles to achieving this for a reasonable cost, such as meeting education standards and increasing compliance demands. These circumstances are reducing the time advisers can spend with clients, potentially resulting in a lower quality of service than the regulator requires.

While none of these issues, and the associated need for efficiency, are new to advisers, practical follow-through is something advice firms have struggled to execute. For quality financial advice to thrive, advice practices need to remove the barriers to becoming more efficient. Achieving these efficiencies will help remove tasks that limit an adviser’s capacity to spend time with clients.

But this does not have to mean implementing a whole new suite of technology. Often the tools required to fix problems or find efficiencies are already present in a firm’s set of technology solutions. Important changes can come from an adjustment in the thought process used to tackle problem-solving for an advice business. BT has been working with practices to pivot their strategy towards customer-centric outcomes, taking time to truly understand the root cause of the issues they are facing, often with surprising results.

What is the Lean Six Sigma methodology?

Put simply, “Lean Six Sigma is a way of thinking about finding improved quality and reducing waste.”1 It is a practice consisting of continuous improvement to ensure our customers are receiving what they expect. As a customer-centric approach to running a business, Lean Six Sigma (LSS) advocates continuous improvement ‘as long as value is imperfectly created, and waste exists’. While its background lies in manufacturing, for the last 20 years it has been applied to any business where efficiency gains can lead to growth.

While the LSS methodology is a relatively new concept outside of manufacturing firms, its origins can be traced back to 1913 and Henry Ford’s Model T before Toyota’s more modern iteration the ‘Toyota Production System’. It is now used by many of the world’s most successful companies, including Microsoft, Tesla and Apple. In recent times, it has been successfully adopted by a small selection of advice firms in the Australian market in response to the raft of changes the industry has seen in the past few years and the need to find efficiencies to keep costs down.

This paper outlines the history of LSS, the core methodology, the process of implementation and the role it can play in the advice industry using case studies from businesses BT has worked with.

The core methodology

LSS thinking begins with an understanding of the value-driven purpose of the organisation or the problem they are trying to solve.

As LSS is a socially conscious methodology, it focuses on the value created for customers – much like a successful advice practice will focus on customer outcomes first while ensuring that they can maintain sufficient profitability.

In order for this methodology to work, every employee must be able to answer the question of purpose and value and be engaged in working towards it. From there, the business needs to be able to answer these five questions:

-

What is the problem to be solved?

-

How big is the problem?

-

What is causing the problem?

-

How can I improve my process to solve the root cause?

-

How do I know if the improvements have worked?

A diagnostic tool for working through these issues is included at the bottom of the page in the Appendix. It is to help advice practices bring this approach to life.

It is essential to monitor and measure this process to understand which elements are making the desired changes and which are not. Understanding which changes are having the highest impact on the problem you are looking to solve ensures maximum efficiency and reduces wasted effort as much as possible.

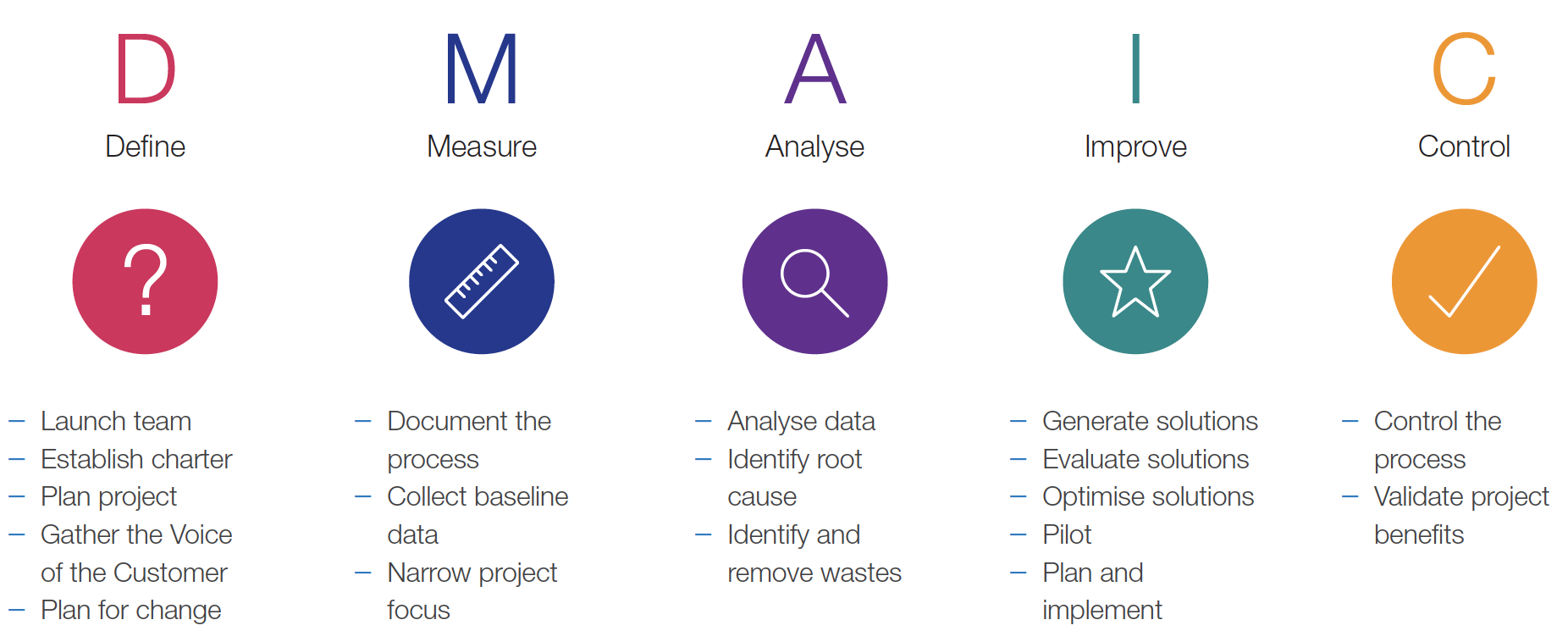

An effective framework for achieving this is DMAIC – Define, Measure, Analyse, Improve, Control.

Implementing Lean Six Sigma (LSS)

Implementing this methodology starts with identifying the problem. This may sound straightforward, but is often more complex than it seems. Below are some tips on how to pinpoint the problem facing your business. It’s important to go through these steps with all key stakeholders in the business for an accurate picture of where the business is currently.

1. Identify the goals of the business

What does success look like for the business? There are many metrics that can help measure success, such as an increased client base, more time per client or increased revenue. It is important to decide which is most valuable and the strategic growth path required to achieve this measure of success.

2. Identify the barriers to success

Once a definition of success is established, the focus changes to issues holding the business back from achieving these metrics of success and the overall business goals. For example, is under-resourcing a problem, are processes taking longer than expected or are staff simply burnt out? Identifying the true barriers to success can prove vital to moving a business in the right direction.

3. Blue sky thinking

After analysing these details, it’s time to explore what good looks like in an ideal world. If the business could change any one thing, what would it be and why? When asking this question, it can help to ignore the current resources available or any other existing barriers to implementation. This can be a very helpful exercise in identifying the most important problem.

Becoming more efficient is not about trimming the fat in an organisation but understanding and rectifying the cause of our inefficiency, then reallocating resources to ensure time is spent meaningfully and provides value to the end-client.

4. Complete the problem definition framework

Provided as an appendix is a problem definition framework. Management teams often find that by writing down the answers on paper, the picture of where the business is at and where they would like to take it becomes clearer, as do the solutions.

The goal of this ‘problem define’ stage is to create a problem statement. An example could be:

‘In 2022, the average onboarding time for a new client was two months, resulting in $40,000 in lost revenue opportunity.’

This is just one example, however, other businesses may be struggling to move an elderly client base to new technology or are spending an inordinate amount of time chasing clients for information. Whatever the individual problem is, it’s important to define a problem statement that the whole practice can get behind and be motivated to solve.

Take time to identify the root cause

So how does an advice practice put LSS into practice? DMAIC provides a problem-solving approach that drives LSS. The role of this framework is to help improve existing processes and solve problems with unknown causes.

Many advice businesses may, for example, highlight that their advisers do not service enough clients to be profitable within the current fee structure. It could be tempting to think this is a skill deficiency on the part of the adviser, and that running sales training for them will fix this.

However, the real issue might be that the adviser is already capable in business development but too busy with administrative tasks to dedicate time to this important task. In this scenario, the outcome is wasting resources on developing a skill that was already proficient and not getting any closer to identifying the real cause. This is why spending sufficient time on the Measure and Analyse phases is where much of the value of the DMAIC framework can be realised.

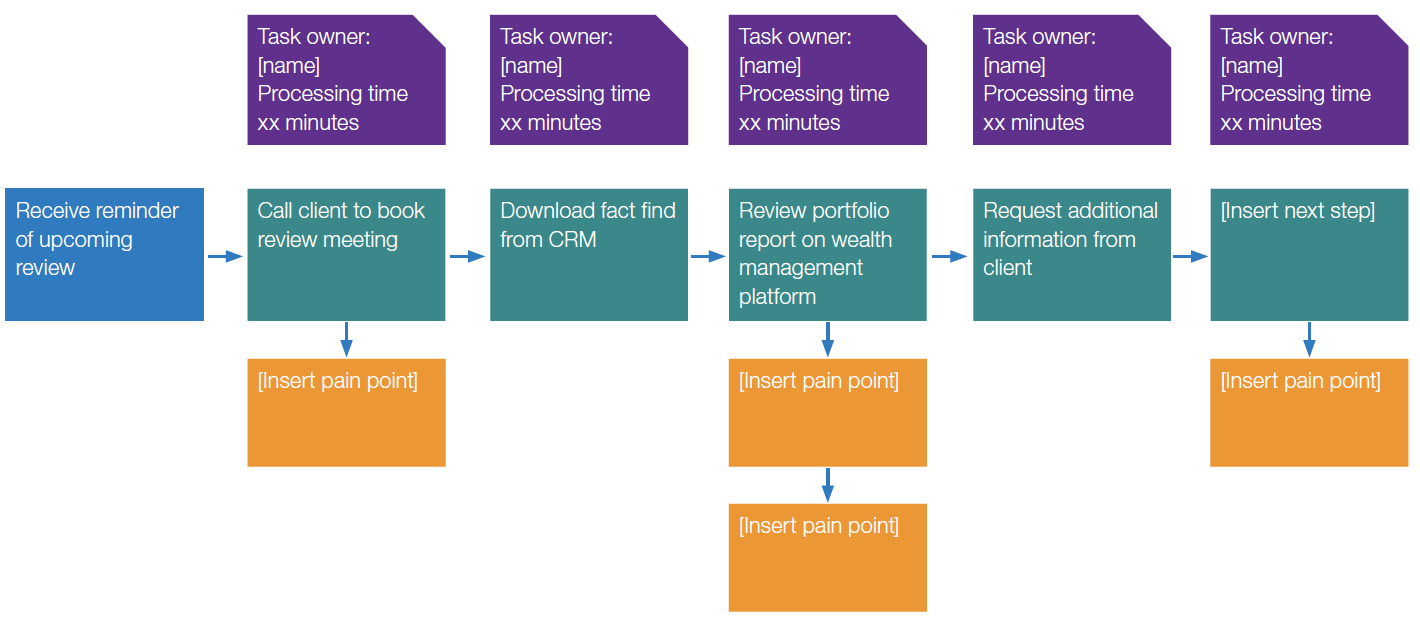

Measure and Analyse: mapping processes to value

For the Measure phase, advice practices can conduct a value stream map. The purpose of this tool is to understand who does what and how long does it take them to do it. Using this approach involves asking the following questions for each task completed within a specific advice process:

-

What is the task?

-

Who is responsible for completing the task?

-

How long does it take the person to complete it?

-

What is the lead time before commencing the next step?

-

What are the pain points (if any) for the task owner when completing the task?

As Albert Einstein said,

“If I had an hour to solve a problem, I’d spend 55 minutes thinking about the problem and five minutes thinking about solutions.”

Based on previous engagements with advice firms, BT has found that serving an ongoing client from end-to-end ranges from 12 to 30 steps, which consumes 5 to 8 hours. Servicing a new client is typically double this range.

The practical step for the Analyse phase is to review the information collected from the value stream map. Advisers can then look at the most time-consuming processes, and most common pain points. Once they have identified these focus areas, they can begin to reveal the root cause. This approach also has the benefit of highlighting processes you are currently doing that are helping retain clients.

This can be equally as valuable, as the last thing you want to do is make a change to the reason your clients are still with you.

An overview of a value-stream map review process

Lean Six Sigma in action

Background

A medium-sized advice firm BT worked with in WA provides a good example of how LSS can be put into practice. This practice had six advisers each serving an average of 100 clients, with one-to-two support staff per adviser. The principal adviser and practice manager identified a bottleneck with the support staff in the preparation and implementation of advice for ongoing clients, causing significant strain on staff capacity. However, they did not know whether they simply needed to hire more staff to solve the capacity issue or find a way to save time with the people and technology already in place.

Issue

A thorough analysis of the business processes revealed that the adviser was losing visibility over the progress of advice tasks after conducting the review meeting. Plus, there was no consistent approach for the support staff to follow for prioritising tasks effectively, creating not one, but two issues to solve. Without understanding the capacity of a given function, there was no way to determine whether the firm had sufficient resources in place. Lack of oversight for ongoing tasks, meant there was no way to identify inefficiencies in the process.

The result was employees repeating tasks and delaying advice implementation for the client. In some cases, ongoing advice tasks touched four different people before processing.

Solution

By automating the allocation of tasks, the company was able to gain oversight of the process, identify the root cause of their resourcing issues and increase the capacity of their team without increasing their headcount. To ensure this additional capacity was not wasted, the firm implemented agile meetings to prioritise tasks and projects and optimise team capacity.

Outcome

As a result of these changes, the practice saved approximately 660 hours (82.5 days) per year. This translated to almost $50,000 saved in non-value add administrative work. This capacity can now be used to follow through on their growth initiatives and goals.

Benefits to a business

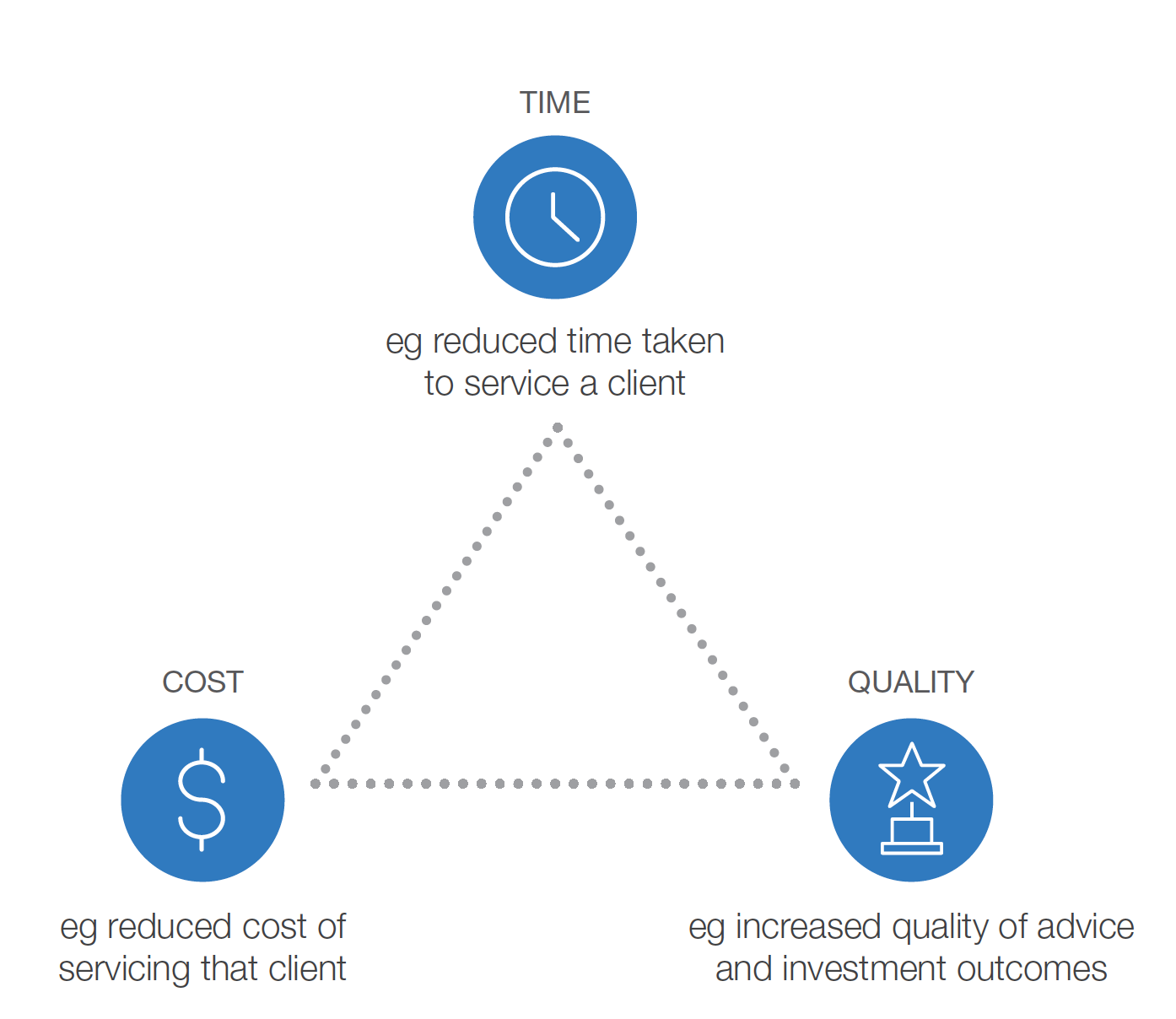

The common benefits to the business from implementing the Lean methodology can be categorised into three interlinked categories, known as the ‘Golden Triangle’:

The secondary benefits can be seen in areas such as staff satisfaction, with people having the opportunity to upskill and/or do more meaningful work. A positive outcome our BT team had not thought of when implementing Lean Six Sigma principles with our clients was the benefit to individual careers. For example, one more junior adviser in a practice we worked with recently was excited and optimistic about what these changes would mean for their career and their future.

One key consideration for any business is the lasting impact of any change or transformation project. A common phrase heard whenever a business tries to implement change is, ‘you’ve no idea how many people have tried to change or improve this before’. The benefit to a business of implementing the Lean Six Sigma methodology is that it involves a complete change in thinking across the business and a transfer of skills and knowledge from people like our team at BT to the business we are working with. The result is change that has a habit of sticking as people have seen and experienced the benefits, and they also feel empowered to continue to apply this going forward.

This should, ultimately, mean the business is able to not only get ahead of the competition but achieve the arguably harder task of remaining there, as can be seen with Toyota.

“These changes… translated to almost $50,000 saved in non-value add administrative work.”

Barriers to successful adoption

If this all seems too good to be true, there are a few considerations to keep in mind for a successful experience with the LSS approach. Accurately defining the problem is vital – try to be as specific as possible as too broad a scope can result in change taking too long, or not achieving the objective. Beware of trying to apply this to every problem at once. Remember, Lean Six Sigma focusses on continuous improvement over time rather than a step-change of everything at one point in time.

Allocating adequate time and patience to the analysis of identifying the root cause is also critical. In a world of ever shorter attention spans, this can be easier said than done, particularly when there are many demands on time and resources for an advice practice. Setting time aside to focus on the problem with the relevant people in the room is important – whether as part of an off-site or time blocked out in a calendar.

Bringing this into the business

For advice practices looking to harness the benefits of LSS methodology, there are some different approaches to consider depending on their situation and goals.

One of these is to organise for advisers to be accredited. There are four standard levels of accreditation, with the first course, the ‘yellow belt’ certification, achievable through a one-day course. This will ensure staff are educated on the LSS principles in just seven hours.

Either following this step, or as an exercise to assess the value of the Lean Six Sigma approach, advice practices can work through a current problem using the Lean Six Sigma methodology and begin to analyse problems through a customer-centric lens. By continually addressing the fundamental question of purpose, process and people, a advisers can make use of the LSS methodology and start to see its impact.

To dig a little deeper or seek more support, the BT team may be able to work with your advice practice to train staff in Lean Six Sigma methodologies and analyse what may be causing the problems identified. This can help an advice practice find the true root cause of an issue as well as transfer the Lean Six Sigma knowledge and skills to team members.

Appendix

|

Why |

Why do I say it is a problem? |

|---|---|

|

Where |

Where is it occurring in the organisation? |

|

Who |

Who is affected by the problem? |

|

What |

What is the nature of the problem? |

|

When |

When does the problem happen? |

|

How |

How do you know it’s a problem? |

|

How many |

How many times does this problem occur in the advice process? |

This document has been created by Westpac Financial Services Limited (ABN 20 000 241 127, AFSL 233716). It provides an overview or summary only and it should not be considered a comprehensive statement on any matter or relied upon as such. This information has been prepared without taking account of your objectives, financial situation or needs. Because of this, you should, before acting on this information, consider its appropriateness, having regard to your objectives, financial situation and needs. Projections given above are predicative in character. Whilst every effort has been taken to ensure that the assumptions on which the projections are based are reasonable, the projections may be based on incorrect assumptions or may not consider known or unknown risks and uncertainties. The results ultimately achieved may differ materially from these projections. This document may contain material provided by third parties derived from sources believed to be accurate at its issue date. While such material is published with necessary permission, Westpac Financial Services Limited does not accept any responsibility for the accuracy or completeness of or endorses any such material. Except where contrary to law, Westpac Financial Services Limited intends by this notice to exclude liability for this material. Information current as at 10 December 2021. © Westpac Financial Services Limited 2021.