Information for advice professionals only.

What is real estate?

We break down the different types of real estate below, from listed to private equity real estate.

Real estate

The catch-all term used to describe property in general. This can include all aspects of real estate investment and ownership, from residential housing (including buy-to-rent investment and land for development) to commercial real estate (such as offices, retail, or industrial/logistics assets owned by companies or investment firms). Often, there is no limit on who can own real estate in a given country. The broader real estate market is generally domestically focused (due to the size of residential markets driven by owner-occupiers), but often has a large component of international ownership across commercial real estate markets.

Listed real estate

Investment in property through vehicles, which are listed on public markets. These companies list shares, which are freely traded by investment firms or individuals. Many real estate firms list in the form of real estate investment trusts (REITs), which tend to pay a large proportion of their rental income received from tenants in the form of a dividend. Generally REITs offer investors exposure to a range of underlying assets, and can be multi-sector or specialist in their focus.

Private real estate (PRE)

Often categorised as unlisted real estate, PRE involves the acquisition of property outside of public markets (listed real estate). It can include residential owner-occupied real estate, and operates at both the individual and institutional level, with individuals and companies participating in the market. For more institutional PRE owners, acquisitions are generally funded by a combination of direct capital investment, supplemented by debt – in a similar mechanism to a domestic mortgage. While terms can vary, debt generally held against an asset at the institutional level is primarily non-recourse and tied specifically to the asset, rather than the ultimate owner. Assets are largely held in special purpose vehicles (SVPs), which are limited companies set up only for holding property, and domiciled in tax-friendly jurisdictions.

Private equity real estate (PERE)

The term is often used interchangeably with PRE within alternative assets. But Preqin defines PERE as investment in real estate through private equity fund structures, involving general partners and one or more limited partners. Investment tends to follow a similar structure to PRE more generally, but within PERE there is potential to utilise increased leverage at the fund level, depending upon the type of asset being acquired, the strategy pursued, and the returns required.

There are three main categories of real estate – residential, commercial, and industrial – although there are many sub-categories within these groupings (Preqin currently tracks 54 distinct private real estate property types). As the economy develops, new types of property are created for private equity real estate to take advantage of. For example, data centres have recently emerged to form a new and growing category of real estate investment. Alternative property types such as senior homes, self-storage, and student accommodation are also increasingly important components of real estate investor portfolios.

Test your knowledge and earn CPD

Take this short, multiple-choice quiz to test your private markets knowledge and earn CPD.

The history of private real estate

Real estate is a well-established private investment asset. Following the private equity boom and leveraged buyouts of the 1980s, new categories of private investment emerged, with a growing number of private equity funds targeting opportunities in real estate. Over time, private real estate institutionalised to become an independent asset class.

Preqin data shows that private real estate assets under management (AUM) have grown from $64bn in 2000 to over $1.6tn at December 2023.

| Date | Dry Powder ($bn) | Unrealized Value ($bn) | Assets under Management ($bn) |

|---|---|---|---|

| Dec-10 | 144.5 | 277.9 | 422.3 |

| Dec-11 | 154.4 | 369.7 | 524.1 |

| Dec-12 | 132 | 433.3 | 565.4 |

| Dec-13 | 193.4 | 483.7 | 677.1 |

| Dec-14 | 187.9 | 530.9 | 718.8 |

| Dec-15 | 217.7 | 551.6 | 769.4 |

| Dec-16 | 224.9 | 517.4 | 742.3 |

| Dec-17 | 274 | 514.3 | 788.2 |

| Dec-18 | 319.6 | 594.7 | 914.3 |

| Dec-19 | 340.9 | 666.1 | 1006.9 |

| Dec-20 | 376.7 | 734.6 | 1111.3 |

| Dec-21 | 394.2 | 921.2 | 1315.4 |

| Dec-22 | 457.7 | 1096.5 | 1554.2 |

| Dec-23 | 495.9 | 1181.4 | 1677.3 |

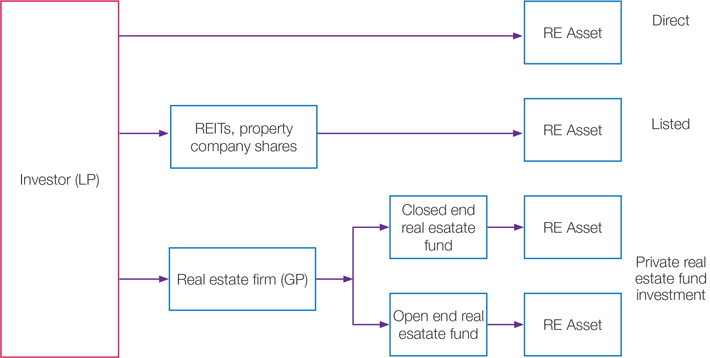

Routes to market

The private real estate industry is structured around the relationship between investors and real estate assets. Generally, there are three routes to market for investors: direct real estate investment, listed real estate securities, and private real estate funds (unlisted funds).

As you can see in the image above, when investing in real estate through listed securities, it involves purchasing shares in a real estate investment trust (REIT), or a listed property company.

Direct investment is the most common form of investing in real estate. Any rental income from the asset goes directly to the investor, as do any realised gains or losses from the sale of the asset. This form of investment is considered less liquid than traded REITs.

Investment strategies

There are six key strategies for real estate investing, each with varying levels of risk: core, core-plus, value-added, opportunistic, distressed, and debt. Each strategy has different characteristics.

1. Core

Investment in a core fund is the most stable and low-risk form of real estate investment, with the expectation of generating lower returns relative to the other styles described. Key characteristics include:

- Investment in high-quality buildings that are fully leased, multi-tenant properties in strong, diversified metropolitan areas. (Class A)

- Typically have long hold periods and are therefore commonly seen in open-ended funds.

- Produces predictable cash flows and income.

- Generally require little-to-no leverage or debt on the investment (0-30% leverage, typically targeting low single-digit returns).

- Example: a fully leased, modern office building located in Midtown Manhattan.

2. Core-plus

Core-plus investments are similar to core investments, but the ‘plus’ allows a fund to invest in improvements. Key characteristics include:

- Investment in core properties, though many will require enhancements, such as renovations, repositioning, and re-leasing. (Class B)

- Typically located in both primary and secondary markets.

- Moderate-risk/return strategy and may require a modest amount of leverage (30-55% leverage, typically targeting mid-single-digit returns).

- Example: a stabilised multi-family building located in metropolitan Boston, US, that is undermanaged.

3. Value added

Investing in value added involves buying a property and making improvements with the aim of selling the asset at an opportune time for gain. Key characteristics include:

- Investment in lower-quality buildings that exhibit management, operational problems, or require physical improvement. These assets need capital to bring buildings up to Class A quality.

- Common strategy for closed-end funds.

- Typical hold periods ranges from 3-10 years.

- Value-add investments are more moderate-to-high risk and are expected to provide moderate-to-high returns. They require a high amount of leverage (50-70% leverage, typically targeting low double-digit to mid-teen returns).

- Example: a 50-year-old multi-family property in need of renovation. Post-renovation, it would be repositioned as a higher-quality asset, with new tenants, higher leases, and asset value.

4. Opportunistic

Opportunistic investments involve the most risk and thus have the potential for the highest returns. Key characteristics include:

- Substantial re-development of existing properties, construction of new developments, or investment in raw land and niche property sectors. The fund may also invest in international property or emerging markets.

- Common strategy for closed-end funds.

- These assets require a heavy amount of capital to move up to class A quality. Generally have a high amount of leverage embedded in the investment (60%+ leverage, typically targeting high-teen returns).

- Example: purchase of land and construction of new office building.

Distressed and debt investments can encompass similar risk and return profiles to any of the other four strategies, because the investments vary across property types.

Distressed

Involves investment into distressed buildings. Key characteristics include:

A building priced at a significant discount due to problems with the building, building management, or tenants.

Distressed investments tend to vary more widely in terms of their risk/ and return profiles, depending on the circumstances surrounding a distressed property.

A distressed investment can also aim to improve a property's efficiency and performance.

Example: investing in a real estate asset at a significant discount due to the original owner declaring bankruptcy.

Debt

Involves the origination or acquisition of loans that are secured by real estate. Key characteristics include:

Providing investment capital to real estate developers or owners in the form of debt, which could be senior, mezzanine, or other debt.

Common in both closed-end and open-ended fund types.

Debt investments tend to vary more widely in terms of their risk/ and return profiles, depending on the circumstances surrounding the type of debt provided – whether it is subordinated or unsubordinated debt.

Example: provision of a bridge loan to a real estate developer for a construction project.

Why invest in real estate?

Real estate has traditionally been considered an investment for large investors due to its capital-intensive nature. In more modern fund structures, however, ownership can be broken into more digestible portions that require lower commitment sizes.

Large institutional investors – such as sovereign wealth funds, pension funds, and insurance companies – continue to underpin the real estate investor base. The low-risk, stable, income-yielding nature of real estate is a good match for these investor types, as an investment typically offers capital preservation and regular pay-outs, two key attractions. Due to the assets at their disposal, large investors can generally invest in a fund structure, co-invest with GPs, or make direct investments. This therefore allows them to take on entire portfolios of office blocks, logistics parks, and student housing.

Investors such as wealth managers and family offices also seek direct ownership of properties, although their smaller AUM means they also turn to funds – both to diversify and to access assets that would be otherwise out of reach.

From a portfolio perspective, real estate can help achieve diversification and hedge a portfolio against inflation. A real estate asset is not highly correlated to traditional assets traded on the stock markets. Here we summarise the key reasons why real estate is attractive for investors:

| Reason | Private equity | Venture capital | Private debt | Real estate | Infrastructure | Natural resources | Hedge funds |

|---|---|---|---|---|---|---|---|

| Diversification | 68% | 47% | 72% | 64% | 75% | 62% | 63% |

| High risk-adjusted returns | 62% | 45% | 39% | 35% | 30% | 21% | 26% |

| High absolute returns | 57% | 63% | 25% | 15% | 9% | 7% | 34% |

| Low correlation to other asset classes | 20% | 9% | 32% | 36% | 41% | 24% | 39% |

| Inflation hedge | 5% | 2% | 14% | 51% | 54% | 38% | 5% |

| Reliable income stream | 6% | 0% | 58% | 55% | 55% | 10% | 0% |

| Reduce portfolio volatility | 22% | 3% | 42% | 31% | 36% | 10% | 32% |

- Reliable income stream/dividend yield

Properties generate monthly or quarterly rental income for their owners, which provides a valuable and reliable stream of cash. This income, also known as dividend yield, usually provides 3-5% annual return to investors and is the focus of core and open-ended funds. In assessing the level of potential income, investors and managers rely on a metric known as ‘capitalisation rate’ (cap rate for short).

For example, in an economic downturn, the stock market and hedge funds may go down, but owners of office properties continue to benefit from rental income, as most tenants are locked in multi-year contracts.

- Inflation hedge

Inflation is a rise in the cost of living. Housing rentals make up part of the Consumer Price Index, which is used to determine inflation. Tenancy contract rises are usually linked to inflation – therefore, their value rises with inflation.

- Diversification

Because of both qualities mentioned above, real estate acts as an effective diversification tool in an investor’s total portfolio. Investors benefit from diversification within real estate as an asset class, as it offers a wide range of strategies, property types, and geographies to choose from.

What is cap rate?

Cap rate is the net operating income divided by property value.

Test your knowledge and earn CPD

Take this short, multiple-choice quiz to test your private markets knowledge and earn CPD.

Information current as at June 2024. This content was produced by Preqin Ltd and adapted with permission by BT Financial Group. This document may contain material provided by third parties derived from sources believed to be accurate at its issue date. While such material is published with necessary permission, the Westpac Group and Preqin accept no responsibility for the accuracy or completeness of, nor does it endorse any such third party material. To the maximum extent permitted by law, we intend by this notice to exclude liability for this third party material. The content is based on the best data readily available at the time of creation, however the accuracy, completeness or timeliness of such data is not guaranteed. Content may include general financial information and examples; however, these are for illustrative purposes only, and may not be applicable to your personal circumstances or needs. The content does not constitute financial or investment advice and the content hereunder should not be considered as a substitute for professional advice. Any projections or forecasts presented may involve risk and uncertainty, and actual results may differ materially from those presented, projected or forecast. Past performance is not a reliable indicator of future performance. This communication has been prepared for use by financial planning professionals only. Except as permitted by the copyright law applicable to you, you may not reproduce or communicate any of the content on this website, including files downloadable from this website, without the permission of the copyright owner.