Information for advice professionals only.

What is private debt?

Private debt, or private credit, is the provision of debt finance to companies from funds, rather than banks, bank-led syndicates, or public markets. In established markets, such as the US and Europe, private debt is often used to finance buyouts, though it is also used as expansion capital or to finance acquisitions.

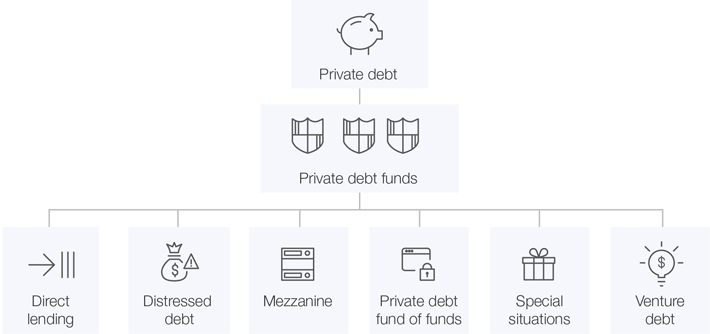

Private debt funds pursue a range of strategies, for example, direct lending, venture debt, or special situations, as well as by the type of debt provided, such as senior, junior, or mezzanine. Lending by private debt funds can be to both listed or unlisted companies, as well to real assets such as infrastructure and real estate.

Assets under management in private debt has now surpassed $1.5tn, with the number of active fund managers rising above 2,500

Test your knowledge and earn CPD

Take this short, multiple-choice quiz to test your private markets knowledge and earn CPD.

The history of private debt

Bank lending remains a traditional source of debt, despite the decrease in activity following the Global Financial Crisis (GFC) in 2008 and the tightening of various banking regulations. Traditional lenders cut back financing following the GFC, which created space in the market for investors such as private debt fund managers to provide alternative sources of lending. Debt strategies were previously a sub-category of private equity investing, becoming an established asset class in its own right post-crisis.

| Date | Dry Powder ($bn) | Unrealized Value ($bn) | Assets under Management ($bn) |

|---|---|---|---|

| Dec-10 | 104 | 193.1 | 297.1 |

| Dec-11 | 116.6 | 210.8 | 327.4 |

| Dec-12 | 120.8 | 237.5 | 358.3 |

| Dec-13 | 176.7 | 247.1 | 423.8 |

| Dec-14 | 160.9 | 275.8 | 436.7 |

| Dec-15 | 188.2 | 308.5 | 496.8 |

| Dec-16 | 200.1 | 361.2 | 561.3 |

| Dec-17 | 225.3 | 392.7 | 618 |

| Dec-18 | 280 | 443.3 | 723.3 |

| Dec-19 | 263.8 | 560.8 | 824.6 |

| Dec-20 | 355 | 657 | 1012 |

| Dec-21 | 382.9 | 808.4 | 1191.3 |

| Dec-22 | 400.6 | 1028.4 | 1429 |

| Dec-23 | 491.2 | 1225.5 | 1716.8 |

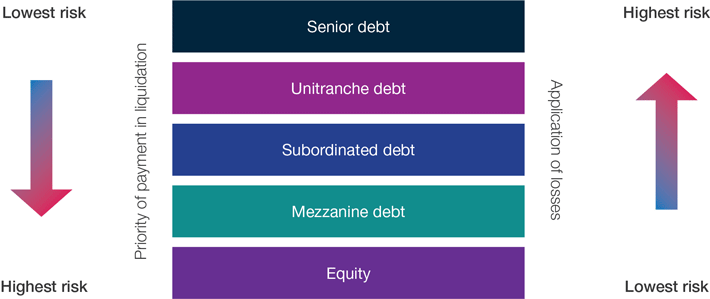

Understanding the capital structure

Capital structure refers to the way a corporation is financed based on the proportion and type of debt, and equity on its balance sheet. This determines how, and in what order, capital is repaid in the event of bankruptcy. Senior debt is at the top of the capital structure and repaid first, making it the lowest risk. Equity is ranked the lowest in the capital structure and is repaid last, making it the highest risk.

Senior debt

Senior debt has priority over more junior debt within the capital structure. Typically secured by collateral or assets over which the lender has 'first lien' (first claim). Less risky than more junior debt or equity. The interest rate charged by the lender is often lower than for junior or subordinated debt.

Unitranche debt

A combination of senior and subordinated debt in one instrument.

Issued by one debt provider and usually used to facilitate a leveraged buyout. Created to simplify the debt structure, as one lender can satisfy the whole debt requirement. As a combination of senior and subordinated debt, the interest rate charged often falls between the two.

Subordinated debt

Also called 'junior debt' – a loan that is repaid after senior debt in the event of bankruptcy.

More risky than senior debt and attracts a higher interest rate. Sits above equity in the capital structure meaning lenders are repaid before shareholders or owners.

Mezzanine debt

Also known as 'hybrids' - a hybrid of equity and debt finance.

Senior only to common shares and equity in the capital structure. Debt capital with rights to convert to equity ownership if the borrower defaults. Contains 'embedded equity options' or 'kickers' such as stock call options, rights, or warrants. Unsecured debt issued without collateral, therefore demanding a high interest rate.

Equity

The shares of a company are repaid last in the capital structure. This is therefore the highest risk for shareholders in the event of bankruptcy.

Investment strategies

The majority of investors allocating capital to private debt focus on commitments to unlisted private debt funds. These unlisted private debt funds differ according to strategy, for example direct lending or fund of funds. They also differ depending on the type of debt provided, such as senior debt or mezzanine debt.

Direct lending

Non-bank lenders extending loans to small and medium enterprises (SMEs).

- A direct lending fund issues loans directly to companies.

- The type of debt issued, such as senior or subordinated, depends on the fund’s strategy.

Distressed debt

Buying the debt of companies that are in bankruptcy or likely to enter bankruptcy.

- A distressed debt fund is similar to direct lending, but only targets distressed opportunities.

- The debt issued tends to be senior, and therefore high in the capital structure, due to the substantial threat of liquidation.

- Debt may be bought at a significant discount, with the goal being that the value of the company improves after the debt investment.

Mezzanine

A hybrid of equity and debt finance.

- A mezzanine fund only issues mezzanine debt to companies.

- Debt issued has conversion rights to equity with embedded equity options if the borrower defaults.

Private debt fund of funds

A private pool of institutional investor capital that invests in several private debt funds.

- A private debt fund of funds invests in a variety of third-party debt funds depending on the fund strategy.

- Provides greater portfolio diversification for institutional investors.

Special situations

A loan based on a ‘special situation,’ referring to something other than underlying company fundamentals.

- A special situations fund focuses on companies whose value may be impacted by a certain event, including company spin-offs, mergers & acquisitions, or tender offers.

- This can include both debt and equity investments.

Venture debt

A loan provided to a start-up or early-stage company.

- Provides loans to act as growth capital for equipment financing, or as accounts receivable finance.

A borrower defaults when:

They fail to repay debt and/or interest to loan distributors. This includes missing one or more scheduled payments or the inability to complete any payments at all.

Private debt risk and return

Each of the private debt strategies’ risk/return profiles are dictated by the investment and its position within the capital structure. Strategies with lower risk tend to yield lower returns than those with higher risk.

| Fund Type | Return - Median Net IRR | Risk - Standard Deviation of Net IRR | AUM ($bn) |

|---|---|---|---|

| Direct Lending | 9.1 | 5.1 | 850 |

| Distressed Debt | 9.9 | 16.6 | 314 |

| Mezzanine | 11.2 | 6 | 223 |

| Special Situations | 10.8 | 12.4 | 299 |

The size of the circle represents AUM as of December 2023

Why invest in private debt?

Private debt is widely regarded as a relatively lower risk investment compared to other alternative asset classes, and a viable alternative to fixed income investing. Investors commonly invest in private debt through commitments to unlisted private debt funds, which offer attractive risk-adjusted returns.

| Reason | Private equity | Venture capital | Private debt | Real estate | Infrastructure | Natural resources | Hedge funds |

|---|---|---|---|---|---|---|---|

| Diversification | 68% | 47% | 72% | 64% | 75% | 62% | 63% |

| High risk-adjusted returns | 62% | 45% | 39% | 35% | 30% | 21% | 26% |

| High absolute returns | 57% | 63% | 25% | 15% | 9% | 7% | 34% |

| Low correlation to other asset classes | 20% | 9% | 32% | 36% | 41% | 24% | 39% |

| Inflation hedge | 5% | 2% | 14% | 51% | 54% | 38% | 5% |

| Reliable income stream | 6% | 0% | 58% | 55% | 55% | 10% | 0% |

| Reduce portfolio volatility | 22% | 3% | 42% | 31% | 36% | 10% | 32% |

What are the key benefits for an investor investing in private debt?

A private debt portfolio presents the following attractive characteristics for an investor:

- Portfolio diversification.

- Low correlation to public markets.

- Attractive risk-adjusted returns and protection from interest rate rises through floating rate structures

- Predictable and contractual returns based on interest rate charged.

- Lower risk than private equity, since debt sits higher than equity in the capital structure.

- Potential to acquire debt in companies at below par value.

- Higher yielding alternative to fixed income investments.

What is a Collateralised Loan Obligation (CLO)?

A security backed by a pool of debt, which typically includes several levels of credit ratings and repayment structures.

Test your knowledge and earn CPD

Take this short, multiple-choice quiz to test your private markets knowledge and earn CPD.

Information current as at June 2024. This content was produced by Preqin Ltd and adapted with permission by BT Financial Group. This document may contain material provided by third parties derived from sources believed to be accurate at its issue date. While such material is published with necessary permission, the Westpac Group and Preqin accept no responsibility for the accuracy or completeness of, nor does it endorse any such third party material. To the maximum extent permitted by law, we intend by this notice to exclude liability for this third party material. The content is based on the best data readily available at the time of creation, however the accuracy, completeness or timeliness of such data is not guaranteed. Content may include general financial information and examples; however, these are for illustrative purposes only, and may not be applicable to your personal circumstances or needs. The content does not constitute financial or investment advice and the content hereunder should not be considered as a substitute for professional advice. Any projections or forecasts presented may involve risk and uncertainty, and actual results may differ materially from those presented, projected or forecast. Past performance is not a reliable indicator of future performance. This communication has been prepared for use by financial planning professionals only. Except as permitted by the copyright law applicable to you, you may not reproduce or communicate any of the content on this website, including files downloadable from this website, without the permission of the copyright owner.