Information for advice professionals only.

Different product structures have evolved to cater for the unique requirements of institutional and private wealth investors. This lesson explores the different types of fund structures used to gain access to private markets and key considerations for investors.

Private capital fund structures

There are various routes to market available for investments in private capital. As in public markets, investors can access private capital asset classes through listed funds available from an exchange, but the most common route is through private unlisted funds. Alternatively, they can invest directly in an asset. See a brief overview of the fund structures below.

- Commingled funds / Managed funds

A commingled fund is when capital from multiple investors is pooled to form a fund that is invested in aggregate. - Fund of funds

A fund of funds is a two-tier commingled fund structure, in which capital from multiple investors is pooled together to form a fund that invests in other private capital funds, as opposed to making direct investments. - Investment Mandate / Separate account

An investment mandate is when capital from one investor is managed by one fund manager.

Commingled funds

In this section, we are going to explore the most common fund structure: the 'commingled fund', also commonly referred to as a managed fund.

In a commingled fund structure, fund managers raise pools of capital from multiple external investors to form a fund. Fund managers use this pooled capital to invest in companies or assets.

Most private capital funds are structured as closed-end investment vehicles, which have a finite lifespan and typically do not allow redemptions or the entry of additional investors after the initial fundraising period. These vehicles are organised as a limited partnership, with two key parties:

The fund manager, or general partner (GP), whose role is to raise capital from investors, and to source, execute, and manage investments in order to realise returns for the investors in a fund.

The investor, or limited partner (LP), which commits capital to the fund, but has no influence over investment decisions. Types of investor typically include institutions such as pension funds, endowment plans, foundations, and insurance companies, as well as high-net-worth individuals.

The terms of the partnership will be documented in a limited partnership agreement, which outlines the details of investments to be made, any specific requirements from the investor (for example restrictions on the scale or geography of investments), the duration of the fund, and the fees to be awarded to the fund manager. For closed-end vehicles, the partnership generally has a 10-year life span, during which investors will not be able to redeem their capital. There are five core stages in the life cycle of the fund:

1 Organisation and formation

The fund formation phase is the first stage in the fund lifecycle. During this time the fund manager develops the fund’s strategy, determines fund terms, and prepares the offering materials, including the limited partner agreement. Fund managers will incur costs associated with setting up the fund, including legal and other organisational expenses. These expenses will usually be offset by profits the fund generates when the fund closes, but if the fund is unsuccessful in reaching a close, the partners are liable to cover costs. This is therefore an anxious time for most managers, especially for emerging managers (those seeking to raise their first fund).

2. Fundraising (1-2 years)

During this time the fund manager will approach potential investors, answering due diligence questionnaires to try and secure capital commitments for the fund. Once the GP has obtained sufficient interest from investors, it will hold an initial closing for the fund, at which point the GP can start making investments. However, for many funds the fundraising period will continue past the initial close, allowing the fund to generate additional capital commitments for subsequent closings until its overall fundraising target has been met. The time taken to raise a fund can vary from a few months (for established managers) to a few years (for emerging managers). According to Preqin data, time spent on the road for private capital funds is an average of 18 months.

3. Deal-sourcing and investing (1-4 years)

In order to generate returns for investors, GPs must find and complete successful transactions. During the deal-sourcing and investing period, capital from the fund commitments will begin to be deployed into investments. GPs will source and evaluate potential investment opportunities, conduct valuation due diligence and close deals, determining an appropriate level of capital commitment for each opportunity. GPs will not request (call) all the capital from LP commitments in one go, but as needed to fund new investments. During this time the fund will still be in deficit, and so investors must be prepared for losses in the first few years prior to the fund generating cash inflows.

4. Portfolio management (3+ years)

Once the fund manager has made investments they will work to manage and grow the companies or assets within their portfolio. At this point the fund will begin to generate returns for its investors. The types of activities undertaken by a fund manager during this time will vary depending on the type of asset and strategy pursued, but the overall goal will be to support the development and growth of the company or asset in order to secure strong returns for investors and to position it for an eventual sale. The time from an initial investment to exit (when the fund sells its position in the asset) can range from months to years.

5. Exit or harvest (4+ years)

The final stage in the life cycle of the fund is the exit or harvest phase. During this time the fund manager begins to sell its positions in the companies or assets in which it has invested. The GP will seek to produce a rate of return that will meet or exceed the expectations of its investors. This liquidation will not happen all at once, but over several years following the end of the investment period. Exit strategies vary by asset class, and this might include a sale to a strategic buyer, sale on the secondary market, or in the case of companies a manager might hold an initial public offering (IPO), issuing shares on the public market.

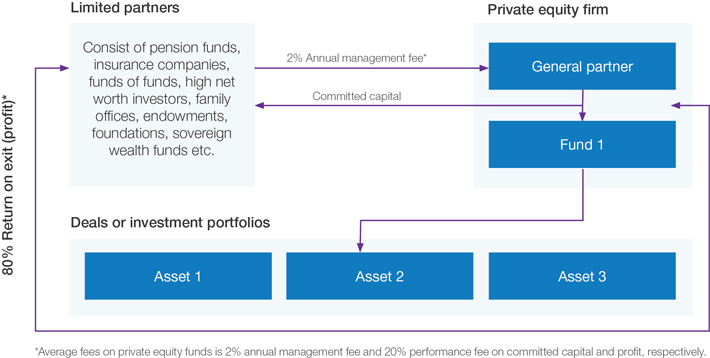

The diagram below is a simplification of the flow of capital between LPs, GPs, funds, and investments.

A fund of funds aggregates capital from multiple investors to form a fund that invests in other private capital funds. A fund of funds manager therefore acts as both an LP and a GP, raising capital from investors in the same way as a GP, while making capital commitments to limited partnerships as an LP. The life-cycle for a fund of funds will be similar to that of a commingled fund, the only difference being the types of investments made (in other funds vs. directly in the asset).

Funds of funds allow investors to create a highly diversified and comprehensive portfolio of investments with fewer risks compared to direct investment. They also give smaller investors access to larger private capital funds that would usually be out of reach for them due to capital constraints. We will explore some of the pros and cons of fund of funds vehicles below:

Pros |

Cons |

Higher levels of diversification: investments made by a fund of funds manager give an investor access to several funds consisting of varying underlying assets. |

Higher fees: funds of funds charge their own fees, as well as passing on those from the underlying funds being invested in, creating a double layer of fees owed by investors. |

Lower levels of risk and volatility: risk is reduced through greater diversification. |

Lack of transparency: visibility of underlying assets of funds invested in is limited for investors. |

Management expertise: a fund of funds manager will provide an investor with professional due diligence, manager selection, and oversight over the funds within its portfolio. |

|

Access to top funds/managers: by pooling capital alongside other investors through a fund of funds, LPs can access funds or managers that might otherwise be out of reach to smaller LPs due to their high minimum investment thresholds. |

Typically an open-ended commingled fund where the manager has an allocation to both listed and private market asset classes (for example a global equities fund which also invests in private equity / unlisted companies). The fund will typically have a target allocation to public and private assets with acceptable ranges to offer the manager some flexibility.

Pros |

Cons |

Flexibility: Manager can use liquidity of public markets to help manage cashflow requirements or shift allocations depending on relative value. |

Diversification dilution: The strategy is likely to have a higher correlation to listed beta therefore removing some of the diversification benefits associated with private market assets. |

Increased investment universe: Access to both public and private markets can enable a manager to identify attractive investments across each. |

Exposure to public market drawdowns: this may inhibit the manger’s ability to invest in a private asset at an opportune time and can cause challenges in managing the allocation between listed and unlisted assets. |

A type of commingled fund structure that enables investors to continuously add funds into the vehicle whilst also providing some exit liquidity, typically with predefined thresholds. The amount of capital within the fund can increase and decrease depending on the net flows and net asset value of the underlying holdings. This fund structure has proven to be widely popular with private wealth investors due to the liquidity features, ability to offer lower minimum investment thresholds, removal of capital calls and diversification benefits.

Pros |

Cons |

Entry and exit liquidity: unlike closed ended funds which have a point in time capital raise, new investors can enter throughout the life of the fund. Moreover, investor wanting to exit the fund can do so subject to the terms of the product (typically monthly or quarterly, subject to gating provisions). |

Cash drag: The fund typically has a cash or liquid allocation to provide periodic liquidity windows. This can subsequently impact returns. |

Mitigate J-curve effect: Once the fund is established, investors benefit from investing into an existing pool of assets, mitigating the deal sourcing and investing period which would otherwise result in negative returns. |

Continuous investment: Managers must constantly allocate to new investments as existing investments mature and new applications enter the fund. It is therefore important the manager has access to consistent, quality deal flow. |

| Diversification: Depending on the fund’s strategy, investors can benefit from exposure to both primaries and secondaries across a range of vintages, sectors and geographies thus providing significant diversification in a single fund. | Liquidity conditions: Liquidity is not guaranteed, and it is possible that the fund can be gated for an extended period of time. |

Listed funds are pools of investor capital raised by an IPO on a public stock exchange such as the ASX, as opposed to being privately raised. Like any other public or listed security, interests in these funds are tradeable. The capital raised is invested in private assets and investors may receive a periodic dividend.

Pros |

Cons |

Investment ease: investors are able to access private market assets by simply purchasing shares in the listed investment trust with a small initial investment. |

Discount to Net Asset Value (NAV): Potential to trade at a discount to the trust’s NAV value. This discount can widen during distressed markets as investors seek liquidity. |

Increased governance: Subject to listing rules which can assist with governance and transparency. |

Correlation to equities: Returns tend to have a higher correlation with equities, relative to unlisted funds, which removes some of the diversification benefits. |

| Liquidity: Ability to trade at the prevailing stock price provides investors with a relatively higher degree of liquidity in entry and exit. Importantly, the manager is free to make investment decisions without concern of future redemption windows. | Heightened volatility: As the stock price is mark-to market daily, returns can be more volatile relative to unlisted funds. |

An investment mandate is a fund structure between one fund manager and one investor. The fund manager will oversee the account, making multiple investments in order to meet the strategic and other portfolio management needs of the investor.

Pros |

Cons |

Customised to individual: a separate account addresses the needs of the individual investor, taking into account their goals and risk tolerance. Other types of funds will invest according to the objectives of the fund as a whole. |

Access: certain strategies and funds will require large initial investments, so may not be accessible to separate accounts that cannot meet these minimum thresholds. |

Higher levels of transparency and control: an investor will have maximum visibility and control over investments made and is likely to receive a regular report on their account. |

Direct investing is where an investor purchases ownership in a company or asset without the use of a fund manager or fund investment vehicle. Deal sizes and structures vary, and investments can be in a single asset or a portfolio of assets. Direct investment is typically only possible for the largest, most experienced investors (e.g. a large super fund). Although, private wealth investors may also hold direct assets at a smaller scale (e.g. individual who owns an industrial property).

Pros |

Cons |

Greater control in decision-making: direct investment gives the investor complete autonomy over the selection and timing of investments and exits. Investors can select assets themselves, customising their portfolio according to criteria such as location, asset type, and strategy, with full transparency of information. Likewise, a direct investor is not locked into a fund’s fixed lifecycle, granting them autonomy when it comes to exiting an investment. This would allow them to invest over the long term if desired. |

Not available to all investors: most investors lack the expertise and resources necessary to source, structure, and monitor investments, which means that direct investing is only possible for more experienced or larger investors that may have their own in-house investment teams. One possible solution to this is for an investor to co-invest alongside a fund manager. This has all the benefits of direct investing, while allowing them to utilise a manager’s skill in asset selection. |

Lower fees: an investor will not be subject to the management fees associated with fund investments and gets to keep all of the net profits that are generated from investments. |

Limited diversification: due to the large size of investments, many investors will not have scale necessary to develop a diversified portfolio equivalent to that of a private equity fund portfolio. This can leave an investor exposed to asset-specific risk. |

Higher operating costs: while direct investment will mean an investor can avoid some of the management fees associated with fund investments, they will be subject to substantial operating costs in sourcing and executing direct deals. |

What is co-investing?

A subset of direct investing. An investor invests directly in an asset alongside a fund manager, making an allocation to the fund as well as investing directly in assets.

Information current as at June 2024. This content was produced by Preqin Ltd and adapted with permission by BT Financial Group. This document may contain material provided by third parties derived from sources believed to be accurate at its issue date. While such material is published with necessary permission, the Westpac Group and Preqin accept no responsibility for the accuracy or completeness of, nor does it endorse any such third party material. To the maximum extent permitted by law, we intend by this notice to exclude liability for this third party material. The content is based on the best data readily available at the time of creation, however the accuracy, completeness or timeliness of such data is not guaranteed. Content may include general financial information and examples; however, these are for illustrative purposes only, and may not be applicable to your personal circumstances or needs. The content does not constitute financial or investment advice and the content hereunder should not be considered as a substitute for professional advice. Any projections or forecasts presented may involve risk and uncertainty, and actual results may differ materially from those presented, projected or forecast. Past performance is not a reliable indicator of future performance. This communication has been prepared for use by financial planning professionals only. Except as permitted by the copyright law applicable to you, you may not reproduce or communicate any of the content on this website, including files downloadable from this website, without the permission of the copyright owner.