Information for advice professionals only.

What is infrastructure?

Infrastructure as an alternative asset class encompasses investment in the facilities, services, and installations considered essential to the functioning and economic productivity of a society. The infrastructure market comprises a wide variety of industries and sectors, each categorised as either economic or social infrastructure.

As infrastructure is a relatively new asset class, its definition has evolved over time to include a more diverse range of assets including data centres, motorway service stations and facilities management companies.

Test your knowledge and earn CPD

Take this short, multiple-choice quiz to test your private markets knowledge and earn CPD.

The history of infrastructure

While investors have had buildings, railways, and ports in their portfolios since the early 20th century, an asset class for private infrastructure only fully emerged in the 1990s, following the privatisation of state utilities, telecommunication, and transportation companies in the previous decade. This development began in Australia, followed by the UK and Canada, with further expansion occurring across Europe and the US during the 2000s.

Since the Global Financial Crisis (GFC) of 2008, the private infrastructure market has grown more than tenfold, with alternatives investors now owning or operating a large proportion of economic infrastructure globally. More than $1tn has been raised by unlisted infrastructure funds over the past ten years – evidence of the sector’s growing importance in investor portfolios. The delivery of strong risk-adjusted returns within this asset class, across varying market conditions and regions, has continued to appeal to investors.

Infrastructure investment can be made through unlisted funds, listed funds, or direct investment. Unlisted infrastructure funds tend to have longer lifespans than traditional private equity funds, at up to 15 years with possible extensions.

Infrastructure project stages

There are three core stages of project development in infrastructure: greenfield, brownfield, and secondary stage.

1. Greenfield

An asset or structure that does not currently exist and needs to be designed and constructed. Investors fund the building of the infrastructure asset, as well as maintenance once it is designed, built, and operational. The costs involved in planning and development, coupled with uncertainty in demand, usage, and price, mean that these projects are typically higher risk. As the asset is not yet operational, there is no revenue generation in the early stages.

2. Brownfield

An existing asset or structure that requires improvements, repairs, or expansion. The infrastructure asset or structure is usually partially operational and may already be generating income. This is therefore typically lower risk than greenfield projects.

3. Secondary stage

A fully operational asset or structure that requires no investment for development. This is lower risk than both earlier project stages, as the assets are fully developed and operational, generating cash flow and returns. Occasionally, a secondary stage will not be reached. This happens when mature assets require additional capital and development, resulting in a cycle of greenfield and brownfield stages.

Investment strategies

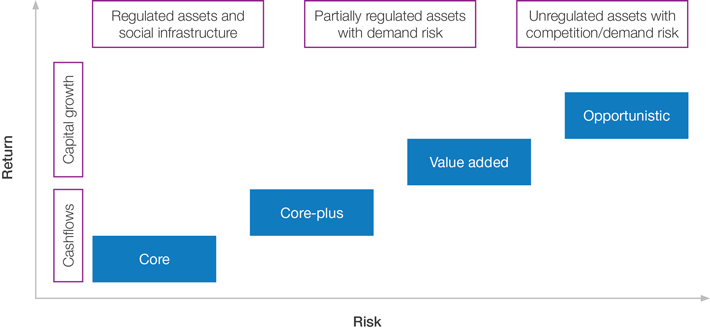

There are five key strategies for infrastructure investment, each with varying levels of risk: core, core-plus, value-added, opportunistic, and debt.

1. Core

This strategy targets essential assets with limited operational risk and assets that are typically already generating returns. These are usually secondary-stage assets, in developed countries with transparent regulatory and political environments. Key features of the underlying assets include monopoly position, demonstrable demand, and long-term stable cash flows that are more easily forecastable.

2. Core-Plus

Targeting assets in less developed markets, but with minimal construction risk. These are usually secondary stage or can be brownfield if in a developed market. These assets may also have higher sensitivity to the economic cycle and may be exposed to fluctuations in demand, although some will include features that act to limit risks, including long-term contracts, long-term government or regulatory price support, and high barriers to entry for competitors.

3. Value added

This is a moderate-to-high-risk strategy targeting assets that require enhancements. The focus will be in adding value by growing demand for the asset. Assets are typically greenfield or brownfield, potentially involving new or unproven technologies that do not have pricing power at time of investment.

4. Opportunistic

Opportunistic strategies have the highest risk/return profile of the different types of infrastructure strategies. Projects targeted typically comprise of assets which need to be developed or constructed in their entirety. The focus will be less on generating stable cash flows, and more on achieving capital growth in the value of the underlying asset.

5. Infrastructure debt

This strategy involves financing infrastructure assets through organising or acquiring loans secured by those assets. This may include mezzanine debt, preferred equity or senior loans. While the risk exposure of the strategy will depend on the type of debt provided, most infrastructure assets are typically financed by senior debt and have simple capital structures meaning they tend to be less risky than the other strategies referenced.

Infrastructure risk and return

As discussed in the section above, each of the infrastructure strategies is distinguished by the characteristics of assets targeted, exposure to risk, and the type of return achieved. The chart below summarises the risk/return profile by strategy:

The types of returns offered by infrastructure assets are broadly split into two key categories:

-

Availability assets

The owner of this type of asset receives a fixed amount, usually from a government or public body, regardless of the level of usage the asset experiences. Examples of this include most types of social infrastructure like hospitals, educational facilities, and defence facilities.

These assets usually adhere to concession contracts, where any operational or maintenance underperformance will result in lower revenue being received. Returns are typically capped by the concession contracts, though the assets can be lower risk with demand being removed as a factor. -

Toll Assets

Investors earn a return from the usage payments of a toll asset. Examples include toll roads and airports. Under this model there is a risk to the owner that if the asset is not fully utilised, returns will be negatively affected. They are also considered higher risk due to potential downturns in demand and their possible correlation with the broader economy. However, such assets can deliver higher returns if usage reaches a maximum or increased capacity.

Why invest in infrastructure?

Many different types of investors are active within the infrastructure asset class. Due to the long-term nature of these investments, the asset class is suited to institutional investors with long-term liabilities such as pension funds and insurance companies. The asset class can also play an important role within private wealth investor portfolios.

Infrastructure is widely regarded as a comparatively lower risk alternative asset class and is commonly seen as a yield play, rather than a short-term commitment focused on capital appreciation.

Preqin conducts regular surveys with investors in alternative assets. The below chart lists the most common reasons why investors allocate to private infrastructure.

| Reason | Private equity | Venture capital | Private debt | Real estate | Infrastructure | Natural resources | Hedge funds |

|---|---|---|---|---|---|---|---|

| Diversification | 68% | 47% | 72% | 64% | 75% | 62% | 63% |

| High risk-adjusted returns | 62% | 45% | 39% | 35% | 30% | 21% | 26% |

| High absolute returns | 57% | 63% | 25% | 15% | 9% | 7% | 34% |

| Low correlation to other asset classes | 20% | 9% | 32% | 36% | 41% | 24% | 39% |

| Inflation hedge | 5% | 2% | 14% | 51% | 54% | 38% | 5% |

| Reliable income stream | 6% | 0% | 58% | 55% | 55% | 10% | 0% |

| Reduce portfolio volatility | 22% | 3% | 42% | 31% | 36% | 10% | 32% |

What are the key benefits for an investor investing in infrastructure?

Portfolio diversification: Infrastructure displays a low correlation with other asset classes and public markets, particularly over the long term.

Lower volatility: The long-term nature of the asset class reduces expected volatility as it is less exposed to short-term market sentiment.

Stabilised cash flows: As monopolistic assets, providing essential services with few or no competitors, demand is stable though periods of economic weakness and contraction. This helps to ensure stable cash flows for an investor. Cash flows are also often predictable because they are determined by long-term contracts.

Protection against inflation (inflation hedge): Most infrastructure assets have a link to inflation through regulation, concession agreements or contracts with rates that are set to rise in line with, or above, inflation rates. Other assets without an explicit link often have the pricing power to deliver a similar outcome reflecting their strong market or monopolistic position.

High barriers to entry: Due to the cost and complexity of developing infrastructure assets, there are high barriers to entry. For some assets, like airports and railroads, competition may be severely restricted. This helps to ensure that assets retain a competitive advantage.

Low operating expenses: Secondary-stage or operational assets tend to have low operating and maintenance costs as a proportion of revenue generated by the assets.

Longevity: Infrastructure assets are typically less susceptible to technology obsolescence and have long life spans. Private investors in infrastructure are often incentivised by regulators and governments to ensure assets are maintained and can operate for their expected life spans.

Gearing: Infrastructure assets can typically service higher levels of debt than other assets, due to the predictable and stable long-term cash flows previously described.

Demand stabilisation: Infrastructure assets provide essential services, meaning that usage demand is relatively stable over time. Demand is usually relatively insensitive to price changes.

Other characteristics of infrastructure investments include:

Illiquid: Opportunities for investors to realise their investments can be few and far between, with a small, though growing, secondary market.

Capital intensive: Greenfield and brownfield assets are capital intensive due to planning, building, and development costs.

Test your knowledge and earn CPD

Take this short, multiple-choice quiz to test your private markets knowledge and earn CPD.

Information current as at June 2024. This content was produced by Preqin Ltd and adapted with permission by BT Financial Group. This document may contain material provided by third parties derived from sources believed to be accurate at its issue date. While such material is published with necessary permission, the Westpac Group and Preqin accept no responsibility for the accuracy or completeness of, nor does it endorse any such third party material. To the maximum extent permitted by law, we intend by this notice to exclude liability for this third party material. The content is based on the best data readily available at the time of creation, however the accuracy, completeness or timeliness of such data is not guaranteed. Content may include general financial information and examples; however, these are for illustrative purposes only, and may not be applicable to your personal circumstances or needs. The content does not constitute financial or investment advice and the content hereunder should not be considered as a substitute for professional advice. Any projections or forecasts presented may involve risk and uncertainty, and actual results may differ materially from those presented, projected or forecast. Past performance is not a reliable indicator of future performance. This communication has been prepared for use by financial planning professionals only. Except as permitted by the copyright law applicable to you, you may not reproduce or communicate any of the content on this website, including files downloadable from this website, without the permission of the copyright owner.