BT SMSF through Panorama Investments is a way to manage your clients' SMSF more efficiently, allowing advisers and accountants to collaborate to invest and administer their fund and keep it compliant – all in one place.

-

Access a transactional account and a range of investments

-

Integrated insurance options with a selection of insurance provider options

-

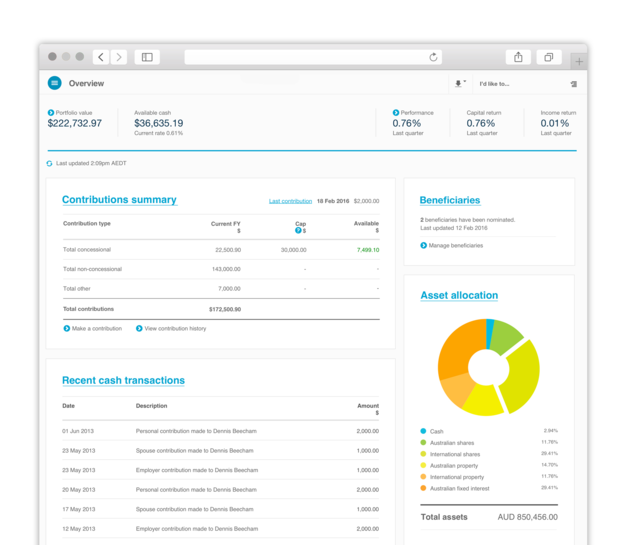

A single view of all key information at a glance

-

Opening an account and transitioning clients from accumulation to pension phase is easy and streamlined

-

Manage everything online in one place

-

Leverage the investment and portfolio management benefits of Panorama Investments for a broad range of investment options

Ready to get started?

Speak to a BDM

Find out how BT’s super solutions can meet your clients' retirement needs at any life stage.

Speak to a BDM

Find out how BT’s super solutions can meet your clients' retirement needs at any life stage.