23 February 2026

Electronic identity verification (eIDV) enhancements

Making verifying your clients’ identification more seamless.

Since the launch of electronic identity verification (eIDV) on BT Panorama in October 2025, we’ve seen over 4,000 investors complete eIDV. During this time, we’ve also received feedback from you, on how we could make the experience better for advisers and clients.

You told us that some clients don’t like completing IDV online and would prefer advisers complete a paper-based form. So, we’ve made it easier for advisers, by making improvements to the Customer Identification Procedure (CIP) forms, including the need to only sign the form once, and be able to sign on behalf of an entity’s account holder.

We’ve also expanded the online Service Tracker capability to now accept CIP forms. You can complete the form on your clients’ behalf and submit to BT online, avoiding the need to send forms and copies of certified ID, through the post. And by submitting online, you can now track the progress of the CIP form via the Service Tracker.

This month, we’ve started to contact clients’ who are authorised signatories of an entity, such as a company or trust, that need to complete identity verification. If this applies to one of your clients, we’ll have contacted you with guidance on how to complete the IDV on behalf of your clients’ entity. Your clients’ may also elect to complete the IDV themselves.

16 February 2026

New Panorama form for Downsizer contributions

We’ve introduced a new Downsizer contribution into Panorama Super form – allowing you to make a downsizer contribution into a Panorama Super account, by either direct debit request (DDR) or electronic funds transfer (EFT).

Making a downsizer contribution by DDR

You can request us to direct debit the contribution from the account holder’s primary linked bank account. For a contribution by DDR, you must submit the new Panorama ‘Downsizer contribution into Panorama Super’ form.

Making a downsizer contribution by EFT

If making a downsizer contribution by EFT, you must provide a signed and dated form before or at the time the contribution is received into the Panorama Super account.

For a contribution by EFT, we can accept either of the following forms:

The new Panorama ‘Downsizer contribution into Panorama Super’ form, or

The ATO ‘Downsizer contribution into superannuation’ form, available on the Australian Taxation Office (ATO) website.

You can find the form by going to Service requests > Submit new request > Deposits & contributions > Downsizer contribution into Panorama Super.

For more information on downsizer contributions into Panorama Super, please go to the Downsizer contribution topic in Help & Support.

3 December 2025

Reminder: Cash consent required before the move to BT Panorama

Earlier this year, we announced that your clients’ Asgard accounts will move to BT Panorama in the first half of 2026.

BT Panorama has a different integrated cash account for investment clients called the BT Cash Management Account (BT CMA) issued by Westpac Banking Corporation (Westpac). On Asgard, your investment clients’ cash account is their eCASH or CASH Connect account and is issued by St.George Bank (a division of Westpac). The BT CMA is held by BT Portfolio Services Ltd on behalf of your clients (as the administrator of BT Panorama Investments). However, your investment clients hold their eCASH or CASH Connect accounts directly. This means we need your clients’ consent by 28 February 2026 to transfer their cash balance in their eCASH or CASH Connect accounts to BT Panorama Investments.

There are still over 4,200 advised clients who need to provide consent by 28 February 2026. We need your support to obtain consent from your clients before the move.

If a client does not provide consent, an investment drawdown will be triggered following the move to ensure the BT CMA meets the minimum cash balance for BT Panorama Investments (which is $2000).

Please review your client list and make sure your clients respond before the deadline.

If your clients have given consent, there is nothing more you need to do.

Visit the migration hub for more information and links to the relevant disclosure documents.

19 November 2025

Super accounts now available for minors

We now offer Panorama Super accounts to minors – those under the age of 18 – if the minor:

- is the recipient of a death benefit; or

- has a permanent incapacity and has received an associated payment, e.g. a personal injury settlement or a court-ordered compensation for personal injury.

Applications can be submitted using the below forms:

- to open a child death benefit account, please use the form titled “Child pension application”

- to open a Panorama Super account for a child recipient of permanent incapacity benefits, please use the form titled “Application for Panorama Super account”, along with the “Permanent incapacity and disability declaration & super benefits withdrawal” form.

You can obtain a copy of these forms by visiting the forms page or calling us on 1300 784 207 from Monday to Friday, 8:30am to 6:30pm (Sydney time).

18 November 2025

We’ve made verifying your client’s identity easier and more secure

Verifying a person's identity is important for security, compliance, and peace of mind.

BT recently launched a digital solution for completing client identity verification, using electronic ID verification (eIDV). Our secure, integrated eIDV solution provides protection against financial crime, by confirming a client’s identity with trusted sources — offering a stronger safeguard than traditional paper-based methods. The process takes only about 5 minutes to complete through your client’s BT Panorama account.

If you have clients that need to verify their identity, as part of our Know Your Clients (KYC) obligations, they’ll have received a communication from us last month, with information on how they can use eIDV to complete the request. To view your impacted clients and track their progress, log into BT Panorama and go to Tracking > Client ID & KYC reviews.

As some clients may be cautious around providing this type of information online, we’ve also launched a microsite for those wanting more information on how eIDV works and why we are seeking this additional information from them. You can access this by visiting bt.com.au/idverify.

You can expect communication from us in the coming weeks about some of your clients' entities. We’ll also be contacting the key person for the entity, with instructions on how to complete their entity verification.

To read more about identity verification please visit bt.com.au then navigate to Privacy > Supplementary Privacy Notices > Identity Verification.

Since starting our campaign, we have seen an increase in the volume of BT Customer Identification Procedure forms received. Our operations team are working through the queue diligently and will record completion on the tracking page once we have completed processing for each individual. Alternatively, clients completing eIDV through Panorama will have their IDV status updated in real time.

23 October 2025

Help us keep client accounts secure

A reminder that, as part of our Know Your Client (KYC) obligations, from October 2025 some clients (including those linked to entities such as trusts, companies and SMSFs) will receive a communication asking them to verify their identity online through BT Panorama, using electronic ID verification (eIDV).

ID verification is essential for security, compliance and peace of mind. Our secure, integrated eIDV solution offers stronger protection against financial crime than traditional paper-based ID methods and takes around 5 minutes to complete. By completing ID verification through their BT Panorama account, clients will not only have their identification information captured — their information can also be checked and confirmed with trusted sources, providing greater protection from financial fraud.

To view impacted clients and track their progress, log into BT Panorama and go to Tracking > Client ID & KYC reviews.

We’ll also be in touch later this year regarding some of your clients' entities. We’ll be contacting the key person for each account with instructions soon. If a client linked to an entity has recently completed eIDV or submitted a BT Customer Identification Procedure Form (CIP form), re-identification won’t be required.

To read more about identity verification please visit bt.com.au then navigate to Privacy > Supplementary Privacy Notices > Identity Verification.

18 September 2025

BT Panorama is now faster and future-ready

In late August 2025, BT Panorama launched Oracle Exadata on BT Panorama - a high-performance database platform, purpose-built for speed, reliability, and security. This upgrade delivers real, measurable benefits to advisers:

- Faster processing across over 900 transaction types

Advisers can save time transacting on BT Panorama. Across testing of 1,100 processes, the average performance improvement was 24%* - with some processes running close to 50% faster**.

- Significant, excess storage and processing capacity to support growth and performance

BT Panorama now has significant excess storage and processing capacity—to support the platform’s growth and performance as adviser and client numbers increase both during and after the Asgard migration.

- Earlier execution of major processes

Processes like end-of-day batch runs and managed portfolio rebalancing now occur hours earlier. For example, trades are generally ready to execute 1.5 hours earlier***, which can enable same-day unit pricing and faster fund settlement for your clients.

This investment reinforces BT’s commitment to delivering secure, award-winning technology that drives adviser efficiency and enhances your clients' experience and outcomes.

*Measured in performance load testing under a sustained peak load for 10+ hours.

**Average API response time improvements measured over equivalent 24-hour periods pre and post the introduction of Oracle Exadata on BT Panorama.

***On average since the introduction of Oracle Exadata on BT Panorama.

16 September 2025

Help us keep client accounts secure

As part of our Know Your Client (KYC) obligations, from October 2025 some clients will be asked to confirm their identity online, through BT Panorama, using a new digital tool. It’s secure, easy to use and takes around 5 minutes to complete. Identity verification helps us protect your clients’ accounts and forms part of our regulatory obligations.

If you have clients impacted, we’ll be communicating to you shortly. You can support your clients by letting them know we’ll be asking them to verify their identity.

To see a list of your impacted clients and track their progress, log into BT Panorama and click Tracking > Client ID & KYC reviews.

18 August 2025

A reminder about menu and pricing changes to Panorama from 1 October 2025

In line with our commitment to investing in our platform, so that we can continue to meet the evolving needs of you and your clients, we’re making changes to the fees and pricing for BT Panorama.

Here’s a reminder of what’s changing:

- Introducing a new menu, Focus — which will offer a substantially lower administration fee, for those with simpler investment needs.

- Adding additional managed portfolio options to the Compact menu

- Increasing the account based administration fee, and introducing a minimum asset based administration fee, for the Compact menu

- Changing fees for related groups for both Full and Compact menus

- Applying the new standard pricing to every client, including those on historical individual fee arrangements*, across Panorama Super and Panorama Investments

- Increasing the minimum transaction account balance for pension accounts from $2,000 to $4,000

- Adding a new option for clients when nominating beneficiaries, by adding lapsing 3-year binding death nominations

- Updating our PDS to remove the dollar-based expense recovery fee - and instead disclose an estimate using the amount charged for the previous financial year

For more information about these changes, please visit our dedicated webpage which includes helpful FAQs and fee calculators, designed as a guide to estimate fees based on the new pricing and different menu options, including applying account grouping.

* Excluding a limited number of guaranteed fee waivers.

17 April 2025

Enabling members to exit legacy retirement products

On 9 December 2024, the Government announced measures enabling members to exit certain legacy retirement products that commenced before 20 September 2007, albeit at the trustee’s discretion.

These include lifetime, life expectancy, and market-linked superannuation income stream products (also known as Term Allocated Pensions or TAPs).

Does BT have any of these legacy products?

Yes, we have members in the following:

- Panorama Super Term Allocated Pension

How is BT responding to this change?

Members are now permitted to make a full commutation from their TAPs for a five-year period until 7 December 2029.

Members can do this by using our Super Account Closure and Full Transfer within Panorama Super forms which have been updated to reflect the legislative change.

11 March 2025

Helping your clients optimise their super

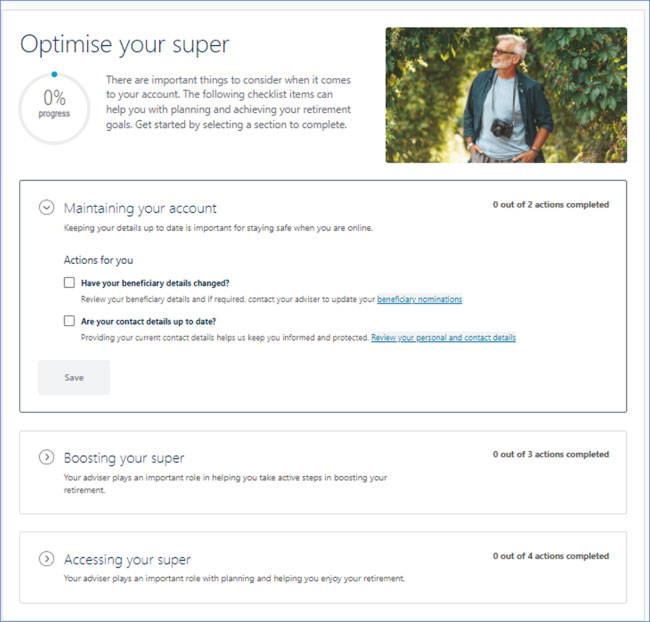

When your super and pension clients log in to their BT Panorama account, they now have access to the ‘Optimise Your Super’ page, which has a checklist to help them keep their account settings up to date and plan their retirement journey.

They will have different versions of the checklist, depending on whether they have a super or pension account. It’s not mandatory but may be something you can use with your clients in discussions about their financial plan.

Both the super and pension versions encourage your clients to review their contact and beneficiary details and provide access to tools such as calculators to help them plan their retirement or keep it on track if they’re already retired.

The checklist suggests your clients contact you about strategies regarding boosting their super or utilising their pension.

Consider using the checklist to help your clients stay focused on their goals and make the most of their retirement savings.

We’ve included a template email to support your conversations with clients. Note: if you decide to send the template email to your clients, we recommend you check your compliance with the Spam Act 2003 (Cth) before doing so.

The Optimise Your Super checklist is reset in February each year, giving your clients the chance to review their details and help keep their retirement plans on track.

For more information you can visit Help and Support > Product & investments > Manage super > Retirement planning tools on BT Panorama.

10 March 2025

An essential part of onboarding – Tax Entity Classification self-certification

When you apply for a BT Panorama account on behalf of non-individual entities, you’ll notice we’re now asking for the tax classification information up front as part of the onboarding process.

We must collect responses regarding Tax Entity Classification (TEC) under the Common Reporting Standards (CRS) and Foreign Account Tax Compliance Act (FATCA) reporting standard.

We think you’ll find this change makes the overall experience easier.

What you need to do

- Opening new accounts for private companies, SMSFs and trusts with both individual and corporate trustees

When drafting a new account application, submit the TEC self-certification details in the online form before your client reviews the application and accepts their account terms and conditions.

If you don’t enter the Tax Entity Classification details at this stage, the application won’t go through. If you currently have an application in draft, the Tax Entity Classification details will be required before the application can be submitted.

Note: You can save your application as a draft for 30 days, but Tax Entity Classification information will not be saved and must be re-entered.

- Opening an account for public companies, partnerships and associations

Entering the TEC details for these entities is different. For partnerships, associations and public companies, you’ll have to download and complete the Application for Panorama Investments account form that combines opening a new account with the tax entity classification details.

For any amendments to existing entities, you will need to use the Foreign Account Tax Compliance Act (FATCA) and Common Reporting Standard (CRS) form.

Make sure you have the appropriate sign-off for the form before submitting it to us as instructed on the form.

More information

If you need more information, navigate to BT Panorama Help and Support > Managing your clients > Opening new accounts > Open Account > Tax Entity Classification

7 March 2025

Enabling members to exit legacy retirement products

On 9 December 2024, the Government announced measures enabling members to exit certain legacy retirement products that commenced before 20 September 2007, albeit at the trustee’s discretion.

These include lifetime, life expectancy, and market-linked superannuation income stream products (also known as Term Allocated Pensions or TAPs).

Does BT have any of these legacy products?

Yes, we have members in the following:

Panorama Super Term Allocated Pension

Asgard eWRAP Term Allocated Pension

Asgard Term Allocated Pension

Asgard Elements Term Pension

How is BT responding to this change?

At present we do not allow withdrawals or transfers from TAP accounts.

We’ll be sharing more information about options for members in the coming months.

14 January 2025

The way you contact the BT Technical Services team has changed

The BT Technical Services hotline and support email service are now available to registered BT Panorama users only. This change will allow us to better serve you, in a dedicated and timely manner.

To contact our Technical Services team, email technical@btfinancialgroup.com or login to the BT Panorama mobile app to call.

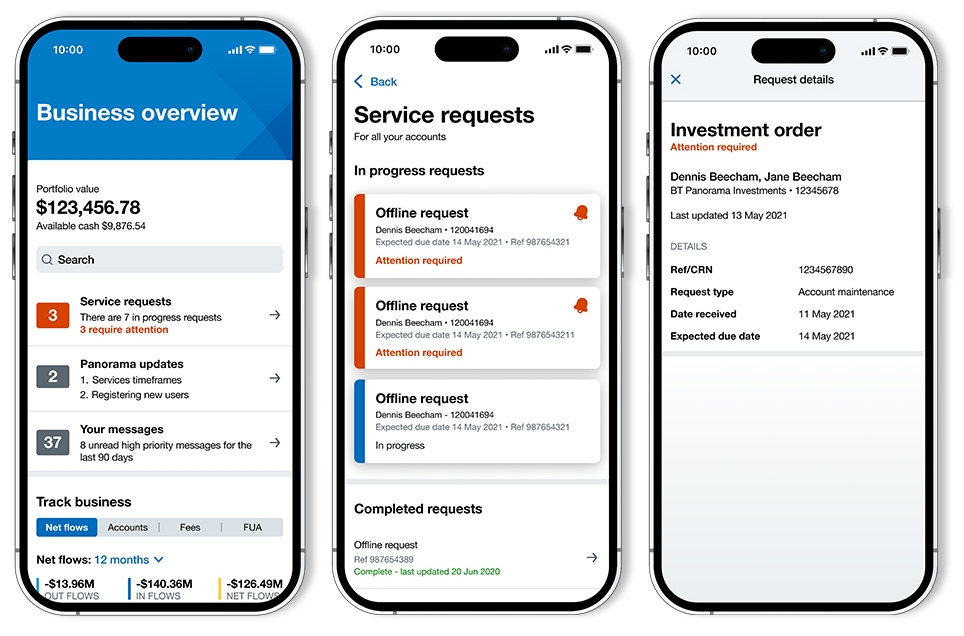

Steps to call via the app: Login to the BT Panorama mobile app > Contact BT > Ask our Technical team > Call BT Technical team.

Having trouble contacting us in the app? Follow these steps:

- Close the app fully, including checking the phone’s task manager to ensure the app isn’t running in the background

- Re-open the BT Panorama app

- Wait for 1 minute

- Close the app completely as per Step 1

- Open the BT Panorama app

- Tap on About Us

- At the bottom of the About Us page that contains the version details, it should now be at least version 22.1.33, and you should be able to see the updated Contact BT page.

2024 updates

3 December 2024

‘Floating’ model now available for BT Panorama tailored portfolios

Tailored portfolios on BT Panorama offer flexibility for Licensees, allowing them to use their own MDA licence or partner with a third-party MDA provider to create custom model portfolios. Previously, Super accounts could only utilise 'fixed' weight model construction, however we have now extended 'floating' model construction to both Super and Investment accounts. This enhancement provides greater efficiency for MDA providers, enabling them to manage a single floating model for both account types. For further enquiries, please contact our managed accounts team at managedaccounts@panorama.com.au.

2 December 2024

Upcoming changes in response to the Quality of Advice Review

Due to upcoming legislative changes resulting from the Quality of Advice Review/Delivering Better Financial Outcomes package, we are making changes to BT Panorama and Asgard disclosures and ongoing fee arrangements.

What is changing on BT Panorama?

The legislative changes provide more flexibility for the renewal of Ongoing Advice Fee Arrangements (OFA) and removes the need for clients to be provided with Fee Disclosure Statements (FDS).

We will be updating some of our forms, disclosure documents and user agreements to:

- Remove references to FDS

- Include a new mandatory section for advisers to add information about the services to be provided where there is an OFA; and

- Include acknowledgements that the proposed advice fee(s) relate to personal advice for fee arrangements (excluding one-off advice fees for Panorama Investments)

BT Panorama ongoing fee consent process – system changes from March 2025

Based on the legislative changes, BT Panorama will be updated in March 2025 to enable advisers to:

- Initiate the renewal process 60 days prior to the Next Anniversary Date (NAD);

- Obtain consent up to 149 days after the NAD (an increase from 119 days); and

- Select a new NAD within the following 12 months as part of the renewal.

These changes will be available as part of the online and offline consent process.

Ongoing fee consent process – interim changes until March 2025

From 10 January 2025 (the date the legislation takes effect) until March 2025 (the date BT Panorama is updated), advisers can follow this interim process to make use of the legislative changes:

- Cancel the existing OFA and set up a new one within the same month; and

- Ensure client consent to the new OFA is obtained before the end of that month. This is important to ensure the advice fee is effective for that month and no fees are missed.

If an adviser doesn’t wish to follow the interim process, they can continue to follow the existing OFA renewal process, under which consent must be obtained within 119 days after the NAD.

Once BT Panorama is updated in March 2025, all existing OFAs with a NAD post 10 January 2025 will then benefit from the changes. We will provide you with more information when the updated BT Panorama process is live in March 2025.

What’s changing on Asgard?

We are updating the following Asgard documents:

- Super/Pension Product Disclosure Statements – updated copies of these will be available on AdviserNET from 8 December.

- AdviserNET User Agreement – effective from 8 December 2024.

- Advice fee client consent (AFCC) forms.

What do the Asgard AFCC form updates include?

The Asgard AFCC form updates include:

- Removal of references to Fee Disclosure Statements (FDS). From 10 January 2025, the legislative requirement to provide a client an FDS has been removed.

- A new mandatory section for advisers to add information about the services to be provided where there is an ongoing adviser fee arrangement.

- Inclusion of additional acknowledgements in the relevant declaration sections.

When do the new Asgard AFCC forms take effect?

The new forms will be available and should be used from 8 December 2024.

Can the old Asgard AFCC forms still be used?

Yes, until 8 March 2025. From 9 March, the old forms will be rejected and any ‘In Progress’ or ‘Saved’ eforms will be deleted.

What does this mean for the Asgard fee renewal process?

There is no change to our process for requesting a renewal of an ongoing adviser fee arrangement. This means any new or existing ongoing fee arrangements will still be able to be renewed up to 119 days after the anniversary date following the AFCC form updates, effective from 8 December 2024.

Are we contacting Asgard and BT Panorama clients?

No, we are not contacting your clients about this matter.

18 November 2024

New Optimise Your Super support tools

We are excited to introduce new support tools, designed to help your clients get the most out of their Super.

We’re introducing the Optimise Your Super tab that includes a retirement checklist, as well as educational information, articles and calculators all designed for members to consider their retirement options and help them make the most of their retirement savings?

- From 18 November 2024, access to the Optimise Your Super content will be available on the Investor website.

- From 27 November 2024, access to the Optimise Your Super tile will be available via mobile.

Why are we making the changes?

We’re committed to improving our retirement offering to members by educating and providing tools for all our members to maximise their retirement outcomes. By partnering with advisers, we can encourage members to take an active role in their retirement planning and reach out when there are key changes in their lives, ensuring plans stay up-to-date and effective.

What do you have to do?

The checklist is not mandatory, and we will not be contacting your clients directly regarding its completion; however, it can be used as a key reference point when discussing retirement outcomes with your client each year. This also gives clients an opportunity to proactively contact you when there has been a change in their circumstances and not wait until their annual review meeting.

More information

For further details you can visit BT Panorama Help and Support > Product & investments > Manage super

15 November 2024

Place an investment order via CSV upload

We are excited to announce our new CSV upload feature on the ‘Place an order’ page.

This new feature is designed to help you enter investment order information faster, reduce errors and save valuable time. You can easily upload large datasets directly to the investment order, instead of manually entering the buy or sell information for each asset individually.

To place an investment order via CSV upload, simply download and complete the CSV template on the ‘Place an order’ page, save the data to your own files, then drag and drop to upload the file to BT Panorama. This will instantly convert the CSV data onto the ‘Place an order’ page for you to preview before submitting.

24 October 2024

New enhancements to the BT Panorama mobile app

We are excited to announce the latest update to the BT Panorama mobile app, bringing together enhanced user experiences, richer information, and a simplified design. We have listened to your feedback and made it quicker and easier than ever to navigate to the information you and your clients need.

Here’s a summary of the update:

- Investment card enhanced with income and estimated gain / loss information.

- Send digital consent reminders.

- More investment news and updates for advisers.

- Create and save your chart preferences.

If you have not done so already, please update your BT Panorama mobile app to the latest version via the app store on your smartphone and enjoy everything our award-winning mobile app1 has to offer.

19 September 2024

Improvements to our forgotten password and username processes

We have listened to your feedback and improved the BT Panorama forgotten password and username processes to make it simpler for you and your clients.

To help users recover their username or reset a password, when requested we will send a code via SMS to the mobile number on file. The message displayed on screen during this step will also now include the last three digits of the mobile number we have sent the code to.

We have also made the following enhancements:

For advisers, if you select ‘forgot password’ on the BT Panorama login screen, you are now prompted to provide your date of birth, instead of your postcode. You’re still required to provide your username and last name.

If the details you enter match our records, an SMS verification code will be sent to the mobile phone number on file. Once this code is entered successfully, you can create a new password.

For clients, we have updated our processes and now send an SMS to the mobile number on file with their username:

- Upon registration, when their username & password is set up;

- When they use the ‘forgot username’ process and successfully retrieve their username;

- If they change their username once they are logged in.

Reminder to keep login details secure

At BT, we are committed to reducing the risk of financial crime, including fraud and identity theft. Please remember that login details, including usernames, passwords and SMS codes, should not be shared with others.

18 September 2024

Digital signatures now accepted on more BT Panorama forms

We have expanded the list of available BT Panorama forms that accept digital (written and typed) signatures.

If a digital signature can be accepted, it will be specified above the signature panel on the form.

- A digital (written) signature is a digitally-submitted written signature that resembles a wet signature. An electronic signature that could be compared to or checked against an original signature, is considered to be a digital (written) signature.

- Forms with a client's typed signature must be emailed to us from their primary email address or uploaded via the Panorama ‘Service requests’ page. These forms must also be accompanied by a digital signature certificate.

21 August 2024

BT Panorama service request tracker enhancements

We received feedback that extra visibility on the status of account closures would enable further self-service and reduce the time spent chasing up the status of your closure request.

We’ve listened and have enhanced the service request tracker on both the desktop and mobile app. With additional details on progress, you can track the closure request from the initial validation stage, through to asset selldowns, and final payments.

When does this take effect?

We are progressively rolling out this enhancement. It is already available for Investment account closures submitted from August 2024 and it will apply to Super account closure requests submitted from mid-September 2024.

Is the process for closing an account changing?

There will be no change to how you request an account closure.

20 August 2024

New data capture to ensure accuracy of customer information

In the coming months, we’ll be introducing a new data capture field as part of our KYC reviews on BT Panorama.

What does the change involve?

Once the change takes effect, when you log into BT Panorama to complete your KYC reviews, we will also require you to select your client’s occupation. You can select the occupation from the supplied Australian and New Zealand Standard Classification of Occupations contained in the available drop-down menu. This aligns with the data we request as part of our onboarding process.

Why are we asking you to do this?

Maintaining client occupation information helps us ensure that the data we hold about your client is accurate and complete. It's part of our 'Know Your Customer' requirements under our Anti-Money Laundering and Counter-Terrorism Financing (AML/CTF) program, as required by legislation. Keeping the profile information of your clients up to date helps us safeguard them from financial crime.

Further information

When this change comes into effect, you’ll be notified by a ‘What’s New’ pop-up message when you login to BT Panorama. For more detail about the KYC review process, please login to BT Panorama and navigate to Help & support > Managing your clients > Opening & updating accounts > KYC review.

16 July 2024

Pension Refresh Form July update

On 22 July 2024 , we updated our Pension Refresh form, making it even easier to complete.

We now accept typed signatures from advisers when accompanied with a digital certificate . We’ve also included more clarity and direction on how to complete the form.

These enhancements make it even simpler for both you and your clients to do business with us.

The May version of the Pension Refresh form will be retired from 20 August 2024.

Visit our Service Enhancements page to find out more information or watch our updated ‘How-to video’ for instructions on how to complete the enhanced form.

13 June 2024

Updated login process

We’re now rolling out our new BT Panorama login process.

Upon login, and after entering your username and password, you must also enter a one-time code sent to your mobile phone. This is known as two factor authentication and is designed to further strengthen account security.

The new process applies to all BT Panorama users – intermediaries and their clients.

When does the new process take effect?

The new process is being rolled out progressively. It will apply to you and your clients anytime from now to the end of September 2024.

Be prepared

It’s important that each BT Panorama user has their own login, and that we hold their mobile number.

If you do not have a unique BT Panorama login, or a colleague does not, please arrange for one.

If we don’t have your mobile number, please provide it to us by calling 1300 784 207, 8:30am to 6:30pm (Sydney time), Monday to Friday.

Remember to keep login details secure

Please keep your login details secure – your password and the code sent to your mobile phone. We will never ask you for these details, nor should they be shared with others.

24 May 2024

New pension refresh process now live

On 27 May 2024, we introduced a new pension refresh process that now allows advisers to instruct BT on the end-to-end strategy on behalf of their client using a new form that includes each of the steps normally involved in a pension refresh strategy.

For the majority of pension refresh requests, you will only need to complete one form and we will do the rest for you.

There is also no need for a client signature for most request types, resulting in reduced client effort and faster implementation of advice.

For the majority of cases where BT can manage the end-to-end process for you, we estimate you will save up to 30 minutes per request.

The current Pension Reset form and process will be retired from 30 June 2024.

Visit our Service Enhancements page to find out more information or watch our ‘How-to video’ for instructions on how to complete the new form.

23 May 2024

Update: Changes to the eligibility of super funds and IDPS platforms to claim RITC on adviser fees

In February 2024, we let you know of industry changes which will impact BT’s eligibility to claim and pass on the benefit of reduced input tax credits (RITC), at 75% of the GST applied, for adviser service fees (ASF) to clients. We communicated this on the BT Panorama desktop and in our February product updates newsletter.

The new ATO guidance for super funds and investor directed portfolio service (IDPS) platforms means we will no longer be able to claim and pass on to clients the benefit of RITC for ASFs which relate to the supply of advice, from 1 July 2024. Further information can be found on the ATO website here.

What products are impacted?

Our BT Panorama Super and BT Panorama Investments products, along with tailored portfolios will be impacted by this change.

What fees are impacted and when will these changes apply?

The impacted ASFs along with effective dates by which these fees will no longer be deducted with RITC, are tabled below.

The effective dates align with our existing processes and ensure BT Panorama is compliant with the regulatory guidance. ASFs relevant to the month of June 2024 will have the benefit of RITC applied and ASFs relevant to July 2024 and beyond will not.

ASF |

Effective date |

Periodic:

*Applicable only to clients invested via a tailored portfolio, where they have consented to have a PMF apply. |

1 July 2024 Fees which relate to the June 2024 fee period will be RITC inclusive. |

Ad-hoc:

|

1 July 2024

|

What does this mean for clients?

Where RITC is no longer applied to an ASF, the amount deducted from their account will increase by 7.317%.

For example, for a fee (GST inclusive) amount of $110 and a RITC amount of $7.50 (75% of the GST):

- With RITC, the deducted amount is $102.50, $110 less $7.50.

- Without RITC, the deducted amount will be $110.

- This $110 amount deducted is a 7.317% increase over the prior $102.50 amount.

There is no change to the GST inclusive fee amount which you currently receive.

Is BT communicating this change to clients?

We will not contact your client(s) about this. Instead, we have created a template that you can use, to assist with communicating this change to your client(s) should you choose to. This template is available to download.

What do you need to do?

To ensure that fees for the supply of advice in June 2024, or prior periods, are deducted with RITC, the following needs to be completed:

- the fee must be established and consented to by the client before the end of June 2024

- in addition, there must be sufficient funds within the client’s account for the fee to be deducted

- if the client has a fee which requires a drawdown or account funding, you will need to ensure this is considered, as any fees which are deducted after the effective dates will not include RITC, and

- you should also consider a review of advice-related documentation being issued to clients, updating where references to RITC are made.

15 April 2024

BT Panorama login is changing

We’re updating our login process

The Panorama login process is changing soon. After entering your username and password, you’ll also have to enter a one-time code sent to your mobile phone. This is known as two factor authentication and is designed to further strengthen account security.

We’re putting this in place for all Panorama users – intermediaries and their clients.

When does the new process take effect?

We are rolling it out progressively. It will apply to users anytime from June to the end of September 2024.

What you need to do

In preparation for the new process, it’s important that each Panorama user has their own login, and that we hold their mobile number.

If you do not have a unique Panorama login, or a colleague does not, please arrange for one.

If we don’t have your mobile number, please provide it to us by calling 1300 784 207. Our hours are 8:30am to 6:30pm (Sydney time), Monday to Friday.

Remember to keep login details secure

Please keep your login details secure – your password and the code sent to your mobile phone. We will never ask you for these details, nor should they be shared with others.

14 April 2024

Cheque deposits no longer accepted on BT Panorama (Super and Investments)

We’re making a change to the accepted ways deposits and contributions may be made into BT Panorama accounts — that may impact your clients.

From 1 July 2024, we’ll no longer accept cheques as a method of making deposits and contributions. We’ve made this change based on the very low levels of cheque usage across our products, as well as the benefits clients have in using quicker deposit methods.

Clients currently have the option to use BPAY, direct debit, or direct credit. And super contributions may also be made through SuperStream.

These deposit methods are quicker to process and more secure for your clients. Cheques can take up to 10 working days to process, from the date it is sent, to when the money is in your client’s account.

What do you need to do?

For any deposits or contributions your client makes in the future, you or your client will need to make them using one of the electronic methods of deposit outlined below.

Payment method |

What do you need to do |

Direct debit

|

Investment accounts Log into BT Panorama, go to ‘Payments & Deposits’, then navigate to ‘Accounts & billers’ menu and select the account when making a deposit via the ‘Make a deposit’ menu. Superannuation accounts Log into BT Panorama, add the linked account via the ‘Contributions’ > ‘Linked bank accounts’ menu and then select this account when making a deposit via the ‘Cash contributions’ menu or if your client is making the deposit, via the ‘Make a contribution’ menu. |

BPAY In Superannuation accounts, BPAY is only available for Personal and Spouse contributions. |

Use the Biller Code and Reference number for the relevant BT Panorama account, to make a BPay payment into your account. You can find these details under ‘Account details’ within your client’s account when logged into BT Panorama. You can find these details under ‘Account details’ within your client’s account when logged into BT Panorama. |

Direct credit |

Use the BSB and Account number for the BT Panorama account to make a direct credit into the account. You can find these details under ‘Account details’ within your client’s account when logged into Panorama. |

Employer contributions via SuperStream |

Download the ‘Choice of super fund’ form from Service Requests when logged into BT Panorama, complete it and provide it to the employer. |

If the cheque is from a third party, such as an employer or an insurer, your client will need to contact the third party and request the deposit or contribution be made electronically in the future, using the methods outlined above.

For contributions into superannuation, ensure the contributions are classified correctly and the correct reference is included in the payment description. If a description isn’t included, the contribution will be treated as a personal contribution. More information is available on Help and support under ‘Manage contributions’ > About biller codes & bank accounts.

Also, for personal injury, downsizer or small business/CGT exemption contributions, a form must be completed and sent to us before the contribution is made.

Next steps

We’ll be contacting Dealer Groups and Advisers who have clients that have used cheques over the last 12 months, so you can help your clients update their deposit method as soon as possible, to avoid any delays in receiving their funds.

Need further information?

If you have any questions, please email us at professional@panorama.com.au or phone us on 1300 784 207 from 8:30am — 6:30pm (Sydney time) Monday to Friday. We’d be happy to help.

9 February 2024

Changes to the eligibility of super funds and IDPS platforms to claim RITC on adviser fees

The Australian Taxation Office (ATO) has recently issued new guidance to superannuation funds and investor-directed portfolio service (IDPS) platforms, which prevents passing on the benefit of reduced input tax credits (RITC) for adviser service fees (ASF), to their clients.

This change is due to come into effect from 1 July 2024. As a result, ASFs which relate to the supply of advice from 1 July 2024 can no longer claim a RITC at 75% of the GST and be passed onto clients.*

BT are in discussions with the ATO through industry channels, to collectively raise concerns about what this means for clients and the increasing cost to receive advice.

We’ll keep clients, and their advisers, updated on any further developments. In addition, we’ll provide support to assist in making this change.

For further information, please visit the ATO website.

*UPDATE: An earlier version of this notice stated that ASFs deducted from 1 June 2024 will no longer include RITC. BT has received further information from the ATO, confirming that ASF in relation to the month of June 2024 are eligible for RITC.

8 February 2024

New measures to ensure accuracy of customer information

From late February 2024 we’re introducing new measures on BT Panorama to ensure the client information we hold is current.

What do the measures involve?

We will periodically ask you to confirm that the full name, date of birth and residential address we hold on file for a client is correct. In most instances, the entire process will be done online via Panorama.

What we’ll ask you to do

Whenever we need you to confirm your client’s information, we’ll prompt you on the Panorama home page. This will appear in the ‘Pending tasks’ box under the category of ‘KYC reviews due (next 90 days)’.

By clicking the prompt, you’ll be taken to a screen displaying the client’s information. If the information is correct, you can confirm at the press of a button. Otherwise, if the information needs updating, there will be clear instructions to follow.

There may be some instances where additional information is required. If this applies to you, we’ll contact you at the time to explain.

Why we are asking you to do this

This will ensure we have your client’s current account details on file and help us meet our obligations under Anti-Money Laundering and Counter-Terrorism Financing legislation.

Further information

For more detail about this new process, please login to Panorama and navigate to Help & support > Managing your clients > Opening & updating accounts > KYC review.

7 February 2024

For seamless, secure support ensure you’re a registered user

With 75% of scams involving impersonation, as reported by Scamwatch*, safeguarding your information is vital. We prioritise your security by taking steps to prevent adviser impersonation in our Customer Care Centre. For seamless access to customer assistance, it's essential for both support staff and practice managers to be registered users of BT Panorama.

Registration is simple, and means practice managers can control the permissions of all users, in their practice. If you haven't registered, speak to your practice manager or dealer group manager.

Important reminders for registering new users:

- If you’re a dealer group manager or practice manager with ‘Update’ permission, you can manage user permissions and business entities in BT Panorama from the ‘Users & business entities’ page.

- Before you register a user, ensure you have reviewed the ‘Understand roles & permissions’ and ‘Understand restrictions’ topics. These provide descriptions of Panorama roles, permissions and associated restrictions, which will help you determine the appropriate permissions for your users.

Full instructions can be found in the Help & Support section.

*Source: https://www.scamwatch.gov.au

6 February 2024

Additional forms are now available for online submission

We’re excited to announce that the following forms can now be submitted online, with digital consent also available:

- Partial withdrawal or rollover to a super fund

- Asset transfer - Panorama Super (Contributions)

- Offline asset transfer - Panorama Super (Rollovers)

How do I submit the forms online?

You can access the forms online via Service requests > Submit new request. Follow the instructions on the screen to upload and submit the form online.

Once we receive the request you can check progress on the ‘Request Status’ page.

Grace period for previous versions of the forms

If you’re using a previous version of these forms, follow the instructions on the form to submit by email or mail. We will accept the previous version if we receive it before 7 March 2024.

New forms now available:

The following new forms have been created, for rollover to SMSF requests:

- Partial rollover to an SMSF

- Account closure – rollover to an SMSF

For account closures where funds are being rolled over to a super fund that is not an SMSF, you can continue to use the Super account closure - full withdrawal or rollover to a super fund form.

How do I submit the new forms?

You can access the new forms from Service requests > Submit new request. These forms can’t be submitted online. Follow the instructions on the form to submit the forms by email or mail.

For more information on how to manage service requests, go to Help & support > Manage service requests or call our Customer Relations team on 1300 784 207 Monday to Friday, 8:30am – 6:30pm (Sydney time).

5 February 2024

Important: how dollar-based ongoing advice fees are calculated in a leap year

With 2024 being a leap year, BT Panorama will calculate dollar-based ongoing advice fees differently.

How dollar-based ongoing advice fees are calculated and deducted in a leap year

For clients on a per annum dollar-based ongoing advice fees arrangement (‘Agreed Fee’), they’re charged on a monthly basis. We calculate the monthly deduction using the following method:

Monthly deduction = Agreed Fee ÷ number of days in the calendar year (366 for a leap year and 365 days for other years) x number of days in the month

The monthly deduction uses the actual days in the month, relative to the calendar year. If it’s a leap year, it will take into account 29 days for February.

What does this mean?

The total monthly deductions over the calendar year will always equal the Agreed Fee. However, the total monthly deductions for a 12-month fee disclosure statement period that crosses two calendar years and includes the month of February during a leap year — may be slightly greater than the Agreed Fee.

If this is the case, the total monthly deductions in the following fee disclosure statement period will be lower than the Agreed Fee, by the same amount.

Here's an example:

For an Agreed Fee of $1,000 entered on 1 July 2023:

- the monthly deductions from the client’s account through to 30 June 2024 will equal $1,001.38; and

- the monthly deductions from the client’s account for the following year, i.e. 1 July 2024 through to 30 June 2025 will equal $998.62.

In comparison, for an Agreed Fee of $1,000 entered on 1 January 2024, the monthly deductions from the client’s account through to 31 December 2024 will equal $1,000.

You should consider whether any changes may be required to the wording of your service agreements and fee disclosure statements, so it reflects how these fees are calculated.

2023 updates

6 December 2023:

Changes to the Document library

From February 2024, we’re making changes to the ‘Document library’ on Panorama to enhance the security of clients’ information.

The changes involve the automatic deletion of documents based on their type and how long they’ve been in the library.

How long are documents kept before deletion?

Documents are retained for a minimum of five years. For further information refer to Help & Support - Records Retention.

How do I check the age of a document?

You can do this by looking at the 'Uploaded on' field within the Document library.

Can a deleted document be retrieved?

No. If you wish to retain a copy past its scheduled deletion date, you’ll need to download it prior to deletion.

More information

For more information, please refer to our Help & Support menu.

17 November 2023:

New BT Panorama feature to view accounts that are closing

We’ve introduced a new feature on BT Panorama, designed to make it easier for you and your support staff to view accounts that are closing.

You can now filter by accounts pending closure on the ‘clients & accounts” page. This is along with the existing active & closed account filters when inputting details in the main search bar.

Soon we’ll be launching even more features, that will improve the visibility of the account closure process.

15 November 2023:

Changes to notifications as part of continuous improvement to our service offering

From 15 November, we’ll stop sending you confirmation emails when a Panorama pension has been reset (excluding pensions that have been migrated from BT Wrap).

The email had no action for advisers and was a courtesy email advising this had been completed.

Instead, this information is available to advisers and support staff on the BT Service Request Tracker.

We made this change based on feedback that the volume of communication was a pain point.

14 November 2023:

BT Margin Lending is changing to Westpac Margin Lending

In the coming months, the ‘BT Margin Loan’ product will be rebranded to ‘Westpac Margin Loan’.

What does this mean for customers with a Panorama account linked to a BT Margin Loan?

This change won’t impact their current or future investments, or the operation of their existing Margin Loan facility or Panorama Investments account. The Terms and Conditions and details on their Margin Loan account will remain unchanged.

In addition, BT Margin Lending account statements, and other BT Margin Lending collateral and related material will be amended to reflect the new branding.

What else do I need to know?

Following this change, all Westpac Margin Loan customers and their advisers will have access to the Westpac Margin Lending secure online portal, which will replace the BT Adviser Exchange and BT Online portals. This portal will provide you and your clients with additional functions and greater online security.

More information will be communicated directly to advisers with BT Margin Lending clients as the change date draws closer. And updates will also be added to bt.com.au, the BT Panorama desktop and within the BT Adviser Exchange and BT Online portals.

13 November 2023:

Changes to BT Panorama applications

In June and November 2023, we made changes to BT Panorama applications, aimed at strengthening our regulatory compliance and enhancing the security of clients’ sensitive information including their Tax File Number. One of these changes relates to applications that remain unapproved by clients for too long.

Applications that remain unapproved by clients for longer than 90 days are now automatically withdrawn from the system. This applies to online and offline applications.

- One-off bulk withdrawal

From 20 November 2023, all existing applications with a status of ‘Awaiting Approval’ older than 90 days were withdrawn.

- Ongoing withdrawal

On an ongoing basis, from 20 November 2023, applications with a status of ‘Awaiting Approval’ older than 90 days will be withdrawn.

Can a withdrawn application be reactivated for client approval?

No. Instead, you’ll need to create a new application.

However, you can view withdrawn applications in read-only mode. Navigate to Tracking > Account Applications. These will remain in the system as read-only unless you delete them.

Helping you manage your applications

To help manage your in-progress applications we’ve made improvements to our account opening and account tracking functionality and strengthened our Help & Support menu to support the application process.

18 October 2023:

Changes to BT Panorama applications

From 20 November 2023, we are making changes to BT Panorama applications.

These changes are a follow-on from changes made in June this year, aimed at strengthening our regulatory compliance and enhancing the security of clients’ sensitive information including their Tax File Number.

Applications which remain unapproved by clients for too long

Applications which remain unapproved by clients for too long will be automatically withdrawn from the system. This applies to online and offline applications.

One-off bulk withdrawal

On 20 November 2023, all existing applications with a status of ‘Awaiting Approval’ older than 90 days will be withdrawn. To determine if an application will be withdrawn, go to Tracking > Account Applications and search for a date older than 22 August 2023.

Ongoing withdrawal

From 20 November 2023 and on an ongoing basis, applications with a status of ‘Awaiting Approval’ older than 90 days will be withdrawn.

Can a withdrawn application be reactivated for client approval?

No. Instead, you will need to create a new application.

However, you can view withdrawn applications in read-only mode. Navigate to Tracking > Account Applications. These will remain in the system as read-only unless you delete them.

Helping you manage your applications

On 20 November 2023, we’re introducing improvements to our account opening and account tracking functionality, to help you manage your in-progress applications.

We’re also strengthening our Help & Support menu to support the application process.

17 October 2023:

Less delay and more flexibility with rollout payments

Sometimes, a client’s rollout request can be held up due to the availability of funds – illiquid assets, outstanding distributions and redemptions, corporate actions and the like.

To help in this scenario, we’re launching a couple of enhancements.

SuperStream rollout requests – expediting payments where possible

From late November, when we receive a rollout request via SuperStream, and where all funds aren’t fully available, we will default to splitting the payment, so that an initial payment is made with available funds, followed by an additional payment for remaining funds once they’ve arrived in the account.

Form-based requests – giving you added control

You can take greater control of the payment approach via a BT form-based request. Ideal if your client is setting up a pension.

From late November, using our Account Closure form or Partial Withdrawal form, you can select either of the following options in connection to both super and pension accounts:

Option 1 - Split the payment so that an initial rollover is made, followed by an additional rollover for remaining funds, or

Option 2 - Wait for all funds to be available in the account before rollover is made.

The ability to make an election – either single or split payment – is only available with a BT form-based request. It is not available if we receive a rollout request via SuperStream.

16 October 2023:

Updates to our reporting functionality

Simplify your client reporting tasks with BT Panorama's new Bulk Reporting functionality.

The new functionality will enable you to effortlessly create comprehensive report packs for multiple clients, through a simple 4 step process.

You can add accounts to a reporting group and assign a next review date to help filter clients quickly when creating report packs. Alternatively, you can select clients one by one to create a custom list.

Report pack settings can be saved making it easy for you to regenerate reports at your desired interval.

To explore this new functionality, navigate to Business > Report packs.

26 September 2023:

Taking your platform to the next level

We’re excited to introduce a range of new features to BT Panorama, designed to make it easier for you to deliver the quality of advice your clients expect. These include:

Faster approvals: Speed up processes with digital consent now available for selected online client forms, via desktop and mobile app.

Digital signatures: We’re making digital workflows easier by offering typed signatures using software such as DocuSign or Adobe Sign across a range of forms.

Simpler banking: No need for deposit verification to link a bank account – a big win for convenience for you and your clients.

Improved control: New admin controls for easier BT Panorama user management in your practice.

More information will be available in the coming weeks. In the meantime, visit our website for more information, if you have any questions please contact your Business Development Manager or request a callback .

24 August 2023:

BT Protection Plan information has moved to TAL Adviser Centre

Your clients’ BT Protection Plan information has now been moved to one user-friendly place: the TAL Adviser Centre (TAC). Email communication has been sent to you with instructions on how to login to TAC.

Your clients’ BT platforms accounts will still display the key insurance information.

If you need to update your client’s policy details, or if your client wishes to vary their policy, you will need to contact TAL. If there are any changes to your or your client’s personal details, please contact both BT and TAL to ensure that all information is up to date.

LifeCENTRAL and LifeCENTRAL+ are no longer available, and all links in the BT platforms have been redirected to TAC, for you to login and manage your clients’ insurance information.

If you have any questions about your clients’ BT Protection Plan policies, please contact TAL Life Insurance on 1300 553 764 and select Option 2 (Monday to Friday 8.30am to 6pm AEST).

23 August 2023:

New BT Panorama mobile app demo tool

We’ve added a new interactive tool to assist you in understanding the BT Panorama mobile app experience from your clients’ perspective. The new investor mobile app demo tool joins the existing investor desktop login demo site.

Both these demo tools are available now on BT Panorama. Navigate to Help & support > Resources > BT Panorama investor demo site or visit our website.

22 August 2023:

New BT Panorama user guide

We’ve created a new BT Panorama user guide, designed to provide you with helpful information on how to navigate and use the full Panorama website quickly — including tips on completing processes, that will assist you in managing your clients’ accounts. Save time looking for answers with the guide — available now via the Help & support page on BT Panorama.

21 August 2023:

Now available: BT Panorama tax statement estimator tool

Use the tax statement estimator tool, to see when a tax statement was released or the estimated tax statement delivery dates. Access the tool via the Tax Statement Estimator section of the BT Panorama home page.

12 July 2023:

Don’t forget about the potential for reduced admin fees

With the new financial year underway, this is a reminder that related groups pricing (sometimes known as ‘fee aggregation’) may be available to you and your clients on BT Panorama.

For more information, including instructions on how to set it up, please go to “Help & Support > Managing your clients > Fees > Administration fee - related groups pricing”.

11 July 2023:

Now available: BT Panorama mobile app enhancements for advisers and investors

As part of our ongoing commitment to delivering a superior experience on BT Panorama, we’re excited to share even more enhancements to the BT Panorama mobile app for advisers and investors. These enhancements aim to provide comprehensive tools, improved customisation, and seamless navigation, empowering users to manage wealth portfolios on the go.

For advisers, a new product news section means they can now be kept up to date with the latest product, news and important information from BT, on the go. Centrelink schedules can now also be requested via the mobile app.

For investors, Centrelink schedules can now also be requested via the mobile app. Investors can now also customise the way their investment portfolio holdings and “portfolio performance” and “the way money is invested” charts are displayed. In alignment with design and distribution obligations (DDO), an annual process has been added to the investor mobile app to enable direct investors to review their personal circumstances to ensure their product remains appropriate for them.

With enhancements like these it’s easy to see why the BT Panorama mobile app has been voted best mobile app five years running.1

22 June 2023:

BT Protection Plan information is moving to TAL Adviser Centre

You may have seen the recent adviser news article from TAL advising that client information, reporting, forms, and documents for your clients’ BT Life (BT Protection Plans) are being transitioned to the TAL Adviser Centre (TAC).

From 21 August 2023, BT Protection Plan information for all your clients will be held in one user-friendly place: the TAL Adviser Centre (TAC).

Access to LifeCENTRAL and LifeCENTRAL+ will cease from 19 August 2023. Links in BT Platforms to LifeCENTRAL will be redirected to TAC from 21 August 2023.

TAL will be sending you further updates in the coming month to support you through this transition and ensure you have login access to TAC and to establish all necessary settings before the transition date.

9 June 2023:

Improved accessibility for BT Panorama

Based on the feedback received, we’ve refreshed the following five pages on BT Panorama to enhance accessibility on BT Panorama. By implementing high contrast mode, improved screen readability, and enhanced keyboard navigation, we can now support a more inclusive experience for everyone who uses the full BT Panorama website.

- Capital gains (unrealised): Search and select a client account, then select 'Capital gains' from the left menu.

- Capital gains (realised): Search and select a client account, select 'Capital gains’ from the left menu, then select 'Realised'.

- Order status (account level): Search and select a client account, then select 'Investment orders’ from the left menu.

- Order status (adviser level): Select 'Tracking' and then select 'Order status’ from the left menu.

- Research: Select 'Research' and then select 'Research’ from the left menu.

8 June 2023:

An update on the latest platform enhancements

We’ve been busy working on a wide range of enhancements to deliver even better experiences for you and your clients. We’re pleased to announce that as of today, we’ve improved back-end processing to speed up the time to complete a fee consent request.

What’s the fastest way to complete a fee consent request?

The fastest way to complete a fee consent request is by using BT Panorama’s in-built digital consent process. Simply login, select a client’s account, and go to Reporting > Account fees > Advice fees to setup a new fee and associated fee consent request. Step by step instructions for the fee consent process are available from Help & Support, on your BT Panorama desktop.

Continuing to deliver

We look forward to sharing further upcoming enhancements to the BT Panorama platform soon.

20 April 2023:

Changes to BT Panorama applications

Changes to BT Panorama applications take effect from 3 June 2023. These are to strengthen our regulatory compliance and to enhance the security of clients’ sensitive information including their Tax File Number (TFN).

Older, unsubmitted draft applications will be deleted

Draft applications that remain unsubmitted for a lengthy period will be permanently deleted.

One-off bulk deletion

On 3 June 2023 we’re performing a one-off bulk deletion of all unsubmitted draft applications older than 90 days.

Ongoing deletion

From 3 June 2023 and on a rolling basis, we will permanently delete unsubmitted draft applications 30 days after the last modified date.

Can a deleted application be retrieved?

No. Instead, you will need to create a new application.

Helping you manage your unsubmitted draft applications

On 3 June 2023, to help you finalise any unsubmitted draft applications, we will automatically reset the last modified date to allow an additional 30 days. This only applies to unsubmitted draft applications less than 90 days old – those over 90 days will be bulk-deleted on 3 June 2023.

If at any stage you modify a draft application, this will reset the last modified date and provide another 30 days before the draft application is deleted.

You can view your unsubmitted draft applications in Tracking > Account Applications.

13 April 2023:

Further updates to our reporting capabilities

We’ve launched the 'Asset Class' view for both Portfolio Performance and Periodic Performance reports, following on from the initial launch to the Portfolio Valuation report in October 2022.

We use existing asset class categories reported by investment issuers, in line with industry standards. The existing 'Asset Type' view will remain, offering two ways to report to your clients.

Technology upgrades have also resulted in a significant improvement in page load and both CSV & PDF download times for the Portfolio Performance and Periodic performance reports for both Asset Class and Asset Type views.

In addition to this and based on the feedback received, we’ve redesigned the page controls for the Portfolio Performance for an improved user experience.

We’ve also refreshed the PDF design of our Portfolio performance report, providing a uniform look and feel for when we launch our bulk client reporting capabilities at the end of 2023.

To explore the new 'Asset Class' view in BT Panorama, follow these steps:

- Search for one of your client accounts

- Go to the reporting tab and click on 'Performance'

- On either the ‘Portfolio Performance’ or ‘Periodic Performance’ report pages, select the drop-down menu ‘View by asset type’ and choose 'Asset class'.

20 February 2023:

Now available: Save time and track service requests on the go from your mobile app

The BT Panorama Online Service Request Tracker is now available on the adviser mobile app, which means you can now check the status of service requests on the go.

Simply log in to the BT Panorama app to view status updates for requests you have in progress with us. Go to Business overview > Service requests.

17 February 2023:

Change to BT Panorama Superannuation Entity

- We’re changing the Registrable Superannuation Entity (RSE) for BT Panorama’s super and pension products which is currently the Retirement Wrap super fund.

- On or around 1 April 2023, we will be closing the super fund Retirement Wrap. This means we will be transferring BT Panorama Super (including badges) and BT Super Invest accounts from Retirement Wrap to Asgard Independence Plan Division Two (Division Two fund), as part of a Successor Fund Transfer (SFT).

- Last month we wrote to Advisers, and we’re now also writing to clients, to advise them what this change will mean for super and pension accounts.

What does this change mean for your practice?

- Adviser details will stay linked to their clients after the SFT to the Division Two fund.

- If clients have a personal advice arrangement with your practice, it will continue after the SFT to the Division Two fund.

- There will be no changes to the way your practice accesses BT Panorama. Your clients’ account numbers will stay the same after the transfer, and you’ll still be able to see all their account details online, including historical information.

Would you like to know more?

We’ve created a dedicated information hub, which you can check at any time to stay up to date with the transfer and what this change means for your practice. This information hub also includes a sample of the client communications we have sent to your clients.

Additional information

The information provided is factual only and does not constitute financial product advice. Before acting on it, you should seek independent advice about its appropriateness to your objectives, financial situation and needs.

BT Portfolio Services Ltd ABN 73 095 055 208 AFSL 233715 (BTPS) operates Panorama Investments and administers Panorama Super. BT Funds Management Limited ABN 63 002 916 458 AFSL 233724 (BTFM) is the trustee and issuer of Panorama Super, which is part of Asgard Independence Plan Division Two ABN 90 194 410 365. Westpac Financial Services Ltd ABN 20 000 241 127 AFSL 233716 (WFSL) is the responsible entity and issuer of interests in BT Managed Portfolios. Westpac Banking Corporation ABN 33 007 457 141 AFSL and Australian credit licence 233714 (Westpac) is the issuer of the BT Cash Management Account (BT CMA) and the BT Cash Management Account Saver (BT CMA Saver). Together, these products are referred to as the Panorama products.

A Product Disclosure Statement or other disclosure document (PDS) for the Panorama products can be obtained by contacting BT on 1300 784 207 or logging into bt.com.au/panorama. You should obtain and consider the relevant PDS before deciding whether to acquire, continue to hold or dispose of interests in the Panorama products. Conditions, fees and charges apply for the Panorama products and may change. The Panorama products are only available in Australia.

BTPS, BTFM and WFSL are subsidiaries of Westpac. Apart from any interest investors may have in Westpac term deposits, Westpac securities, the BT CMA, the BT CMA Saver or underlying bank accounts held at Westpac through their Panorama Super acquired through the Panorama operating system, an investment acquired using the Panorama operating system is not an investment in, deposit with or any other liability of Westpac or any other company in the Westpac Group. These investments are subject to investment risk, including possible delays in repayment of withdrawal proceeds and loss of income and principal invested. Westpac and its related entities do not stand behind or otherwise guarantee the capital value or investment performance of any investments acquired through the Panorama operating system.

1. Investment Trends Platform Competitive Analysis and Benchmarking Report, 2022, 2021, 2020, 2019 and 20181 Investment Trends Platform Competitive Analysis and Benchmarking Report, 2022, 2021, 2020, 2019 and 2018