Background

In our previous articles on managed accounts, we have covered the issues facing financial advice firms extensively and how these challenges are driving practices to seek solutions to increase efficiency and maintain profitability. While efficiency is certainly a key benefit of adopting a managed account model, it is one of many positive impacts advice practices and their clients can expect.

This article explores examples of what advice firms have been able to achieve with the extra time available and highlights other benefits that can contribute to achieving a sustainable growth model in investment management and financial advice.

How efficiency can drive value with a managed account model

"Successful businesses are taking [the] time saved and thinking about how best to use this time for the benefit of their clients and their business.” - Jason Brown, Head of Platforms Distribution, BT

One way of providing efficiencies and improving the client experience is to move to a managed account model. Introducing managed accounts can deliver efficiencies to the business via a reduction in non-value-add tasks while enhancing the client experience through greater engagement from advisers and the potential for improved investment outcomes.

Across our advice practice clients, we are seeing businesses taking any time savings they’re experiencing as a result of adopting managed accounts and making astute choices on directing the extra capacity to support their business goals. These may deliver greater financial value from a pure profit perspective, or enhance the value proposition for advice clients, or achieve a combination of both these goals.

Take the next steps

-

Explore BT Panorama

Increase efficiency and client value with online consent, our award winning mobile app and more.

-

Questions about BT Panorama?

Speak to a BDM or

call 1300 784 207

Freeing up capacity using managed accounts

A problem we often encounter when talking to advisers is that, while they understand that moving to a managed account model should be beneficial for their business, they find it hard to quantify that benefit, making it harder to arrive at an informed decision on managed account adoption. We have been hearing examples through conversations with advisers, but studies are now able to quantify this and help advisers evaluate their own potential time and cost savings on the basis of the average for their industry.

For example, Investment Trends quantified the efficiency benefit of managed accounts through time saved in their January 2022 managed accounts report, showing that businesses using managed accounts are saving on average 15.7 hours per week, up from 13 hours two years earlier.

Using time savings to scale up an advice business

In one example, the team at BT worked with a principal adviser at an advice firm in Queensland. The team discovered that 60% of the inefficiencies were attributable to manual processes – the majority of these were related to client review meetings and portfolio changes. By implementing a managed account model, this financial advice team was able to save a combined 593 hours (78 days) in processing time per year.

Using this extra capacity to service more clients, the adviser was able to generate an estimated $115,000 per year in additional advice fee revenue from 23 new clients.

Faster response time for portfolio changes

An increase in efficiency is clearly a good outcome for an adviser, but there are also potential benefits for clients coming from this solution. Not only is the model more efficient, it’s also more responsive, with an increase in the speed at which investment decisions can be implemented across client portfolios. This can result in more equitable portfolio outcomes, improved portfolio management performance and faster rebalancing. Together these factors have a substantial and quantifiable impact on investment returns known simply as ‘the cost of delay’.

This concept is a relatively simple one and proposes that the longer it takes to implement an investment decision, the greater chance there is of not realising the full benefit of that decision. Delays in implementation are often the result of an inefficient process with excess paperwork and touchpoints involved.

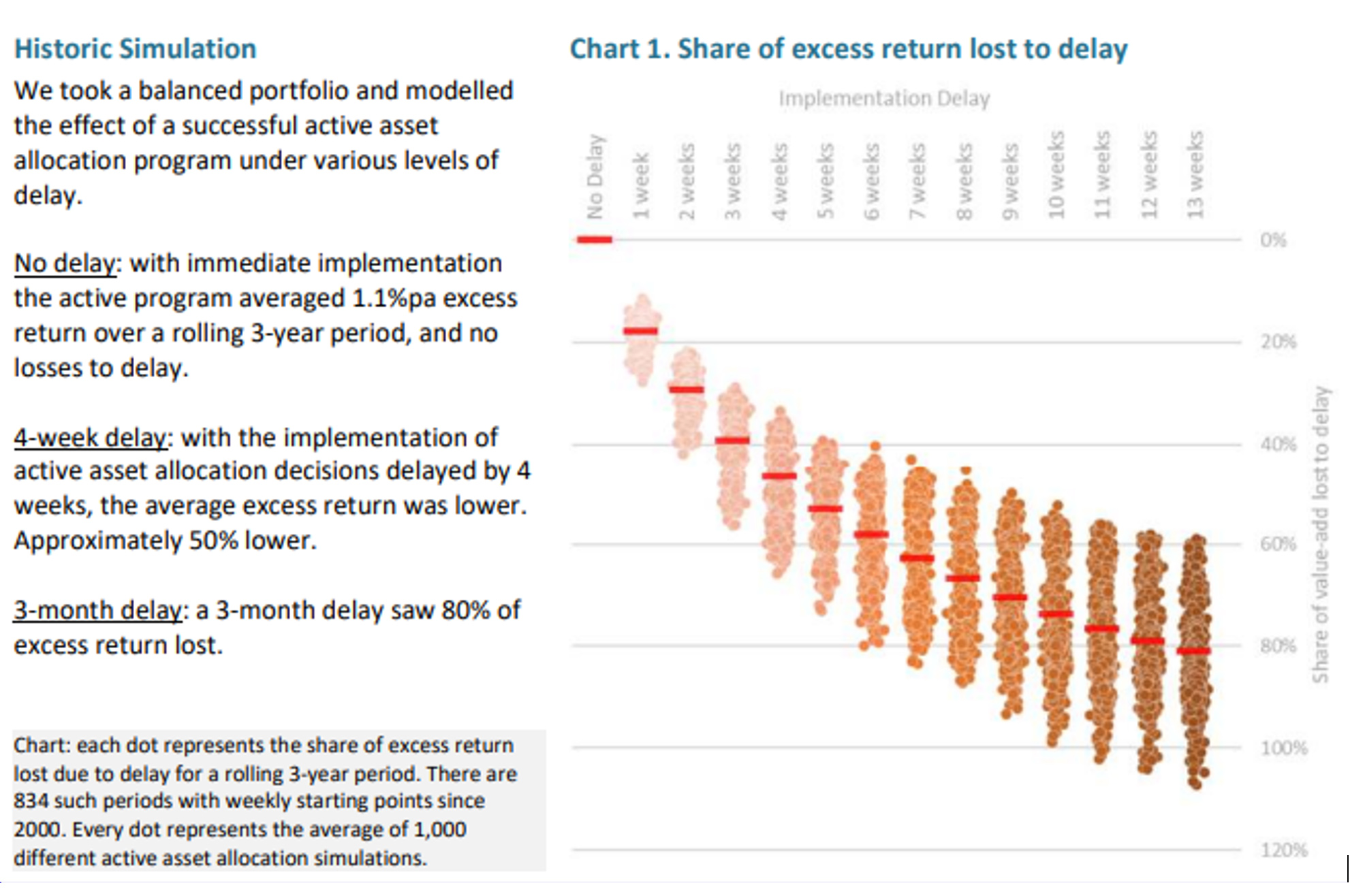

Advice firms who use discretionary managed structures, such as MDAs, can avert unnecessary delays when implementing investment decisions avoiding the lost investment returns shown in the chart below. This is because a managed account does not generally require an ROA to be provided to investors each time there is a rebalance to the model, and the change can be made for all clients at the same time without having to obtain client consent from each. This means that client portfolios can be rebalanced to reflect any changes to the model with minimal delays, resulting in a greater chance of achieving a positive investment outcome, as shown in Chart 1 below. An additional benefit is that all clients’ transactions are done at the same time achieving the same investment outcomes, therefore meeting a key requirement under the FASEA Code of Ethics to treat all clients fairly and equally.

The chart above shows how delays in implementing an asset allocation change can impact the performance outcome compared to if it was implemented with no or minimal delay. Intuitively this make sense, if you assume markets are efficient, it is not long before an area that is undervalued or likely to benefit from a change in economic conditions becomes fairly valued by the market and the window of opportunity to benefit closes.

The research findings also show the cost of delay was magnified during periods of high volatility, such as during the GFC. Market volatility can often cause asset prices to diverge from their true value, providing the opportunity for higher returns if the investment manager can act quickly to capitalise on the divergence. Trying to make these changes across a large number of bespoke portfolios in most cases would be problematic and could take days or weeks to implement, often missing the opportunity they were seeking to exploit and limiting value to clients.

This article was originally published on 31 Mar 2022.

1 https://investmenttrends.com/projects/planner-direct-equities-and-managed-accounts-report