Background

When evaluating a transition to a managed account solution, much of the focus is on business efficiencies and the time given back to advisers to spend with clients as a result. What can sometimes be overlooked is the potential for improved investment outcomes for a client, particularly in times of heightened volatility.

With 2022 signalling a shift in the financial cycle, we are likely to experience increased volatility over the short to medium term relative to the 13-year period from 2009 to the end of 2021, which saw the S&P500 Index increase by over 500%, for example. In times like these, not swiftly implementing a decision can potentially have a more significant impact on a client’s investment outcome, also known as the cost of delay. Not only that, but something as simple as the timing of a rebalance can have a much greater impact than expected. A managed account solution or an Managed Discretionary Account (MDA) model can help an advice business minimise the cost of delay as well as remove the randomness in timing for rebalancing of individual client portfolios.

The RoA delay

As previously mentioned, the initial focus on a move to a managed account solution has been a reduction in the administrative burden, for example removing the need for Records of Advice (RoAs). However, another issue with RoAs was the impact on the client’s investment outcome due to the time it takes to complete the process, particularly when clients are slow to respond.

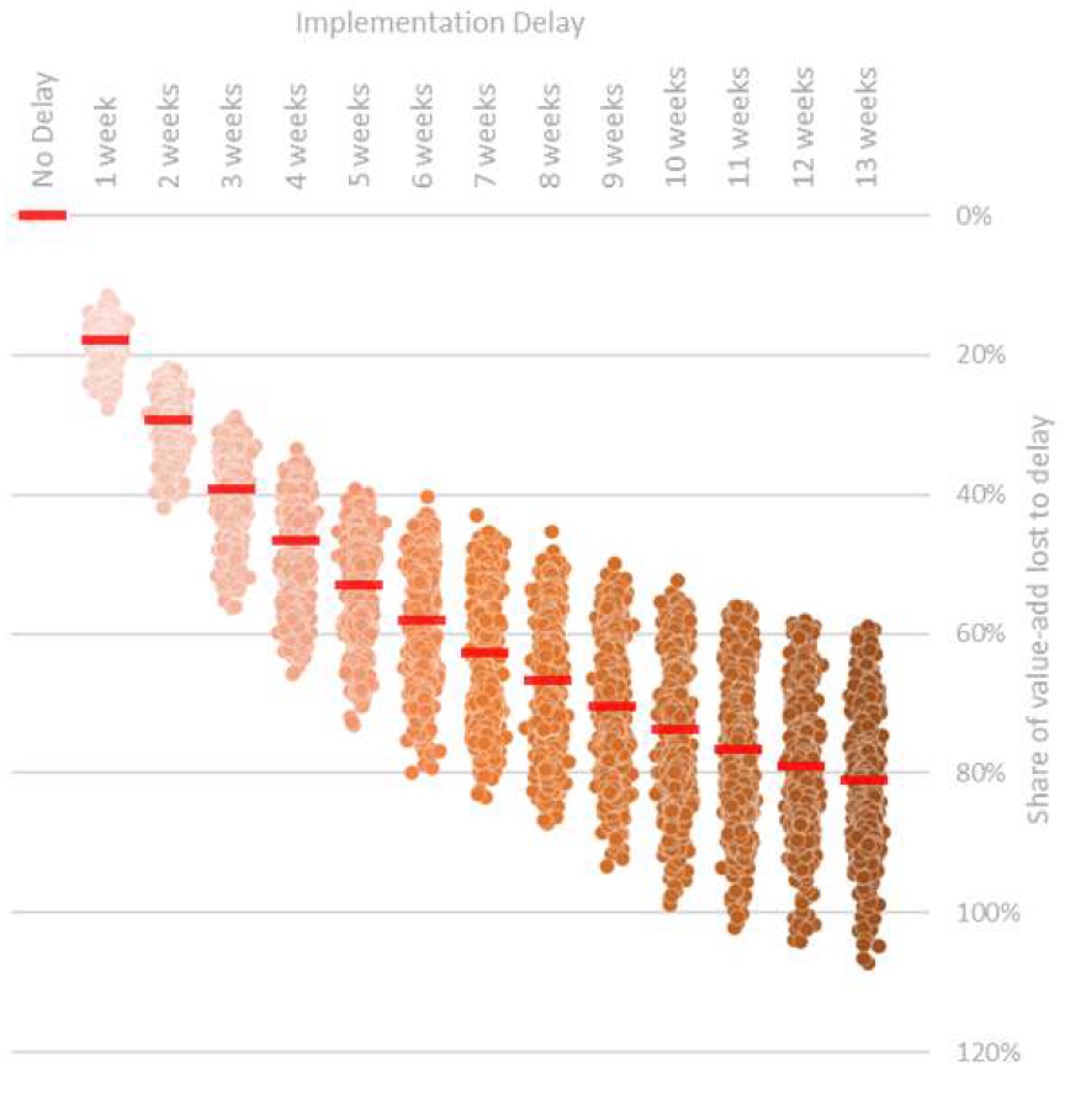

‘…a 3-month delay saw 80% of excess returns lost.’

Take the next steps

-

Explore BT Panorama

Increase efficiency and client value with online consent, our award winning mobile app and more.

-

Questions about BT Panorama?

Speak to a BDM or

call 1300 784 207

Research from Philo Capital1 showed that this cost of delay is approximately 50% of the alpha for a four-week delay, while a three-month delay saw 80% of excess returns lost (Chart 1). This is largely because of how efficient publicly traded financial markets are – it’s not long before new information is noted by the market and the price changes accordingly. As a result, the more delayed an investor is in reacting to new information, the less they are able to take advantage of it.

This concept was also observed by John Hazell, Principal Partner at Richmond Partners, who acknowledged that a potential lag in making a change to a client’s portfolio can result in the investment case no longer being there or being weaker, making it harder to justify the change. A managed account can minimise this delay by reducing the time and work required to make an investment change for a client’s portfolio.

1 The Cost of Delay: How much can prompt implementation save you? By James Freeman, CFA, Q2 2020, Philo Capital Advisers

Chart 1. Share of excess return lost to delay

The (random) rebalancing act

While the cost of delay is one part of the issue, the traditional annual rebalancing model has other consequences.

Most advice firms would traditionally rebalance client portfolios annually, following a client review. This was similar to the approach followed by Bongiorno Wealth Management before moving to an MDA model in 2018. They used a two-tier system where a security would have to be sold either immediately, or as soon as practicable in severe cases, or at next review, where deemed less urgent. This meant clients in a similar model portfolio could be on different rebalance schedules for action taken on investment decisions, depending on the timing of their annual review.

“9.8% – the difference in 1-year returns among clients in 2009 depending on the date their portfolio was rebalanced.”

Philo Capital research

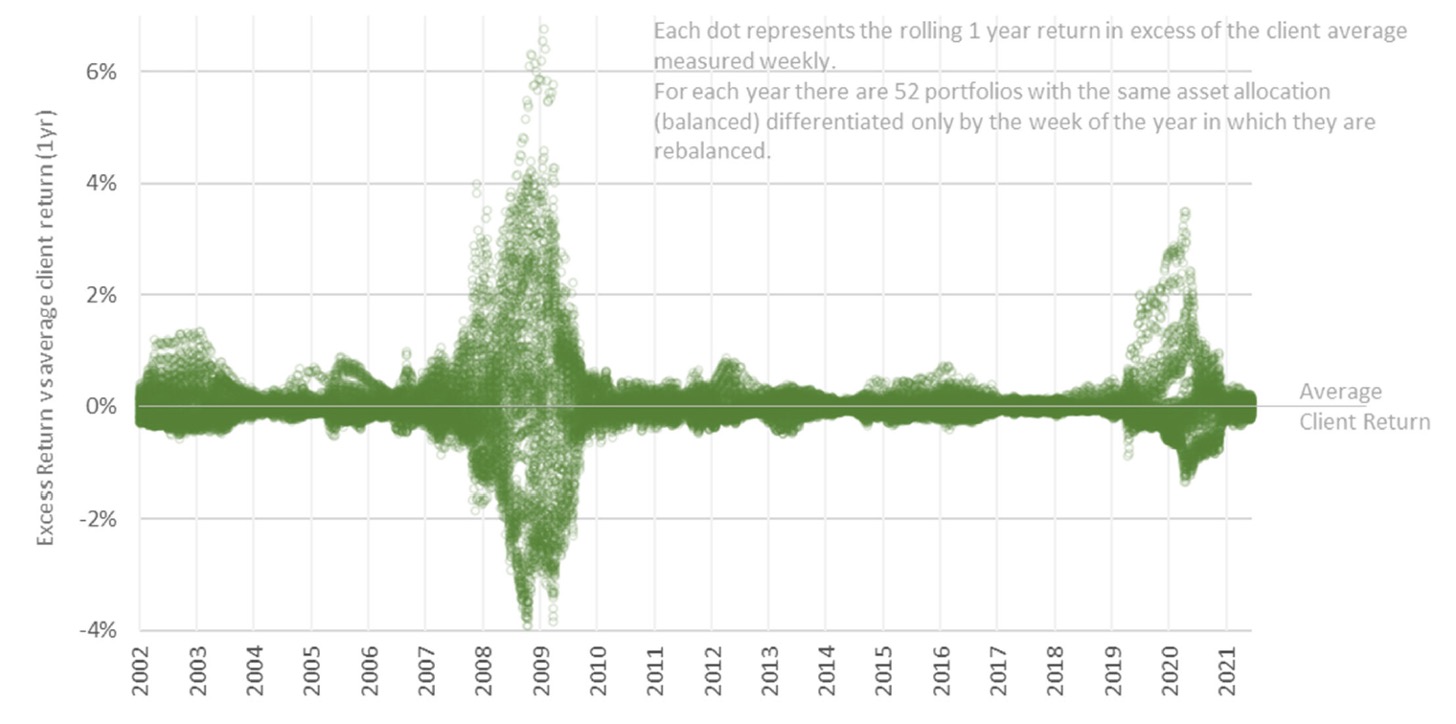

In their research into the effects of this approach on investment outcomes for advice clients, Philo Capital call this ‘random rebalancing’. They found these differences in portfolio returns can be as much as 9.8% in times of extreme market stress – the GFC for example – and as high as 1% during typical market conditions (Chart 2).

Their research was based on a traditional balanced portfolio (50:50 growth/income split), simulated over a 20-year period from 2001-2021, where the only difference was the week in which the portfolio was rebalanced.

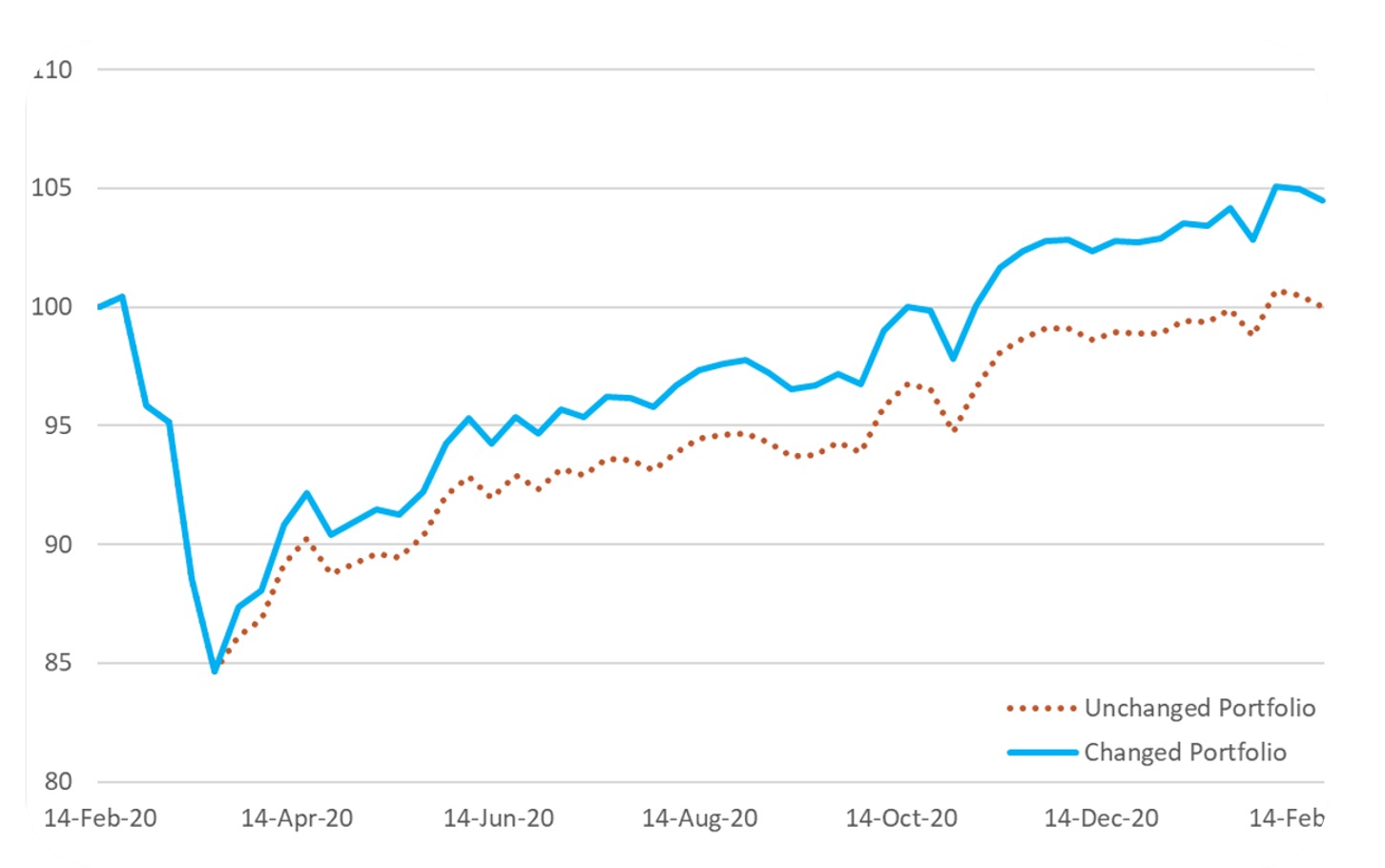

An MDA model removes this randomness and ensures client portfolios are rebalanced together when the investment manager believes it is the right time to make a change. The benefits of this were particularly important to Bongiorno advisers and clients during two major events that unsettled financial markets – the Covid-19 pandemic in 2020 (Chart 3) and the Russia-Ukraine conflict in 2022 .

Chart 2. Dispersion of client returns with Random Rebalancing dates.

Chart 3. The effect of rebalancing a portfolio during the Covid-19 pandemic.

In 2020 this MDA firm rebalanced all clients on the dip, adding over 4% with this one decision alone.

“The success of the MDA model became most apparent in the early days of Covid-19 in 2020 and again with the onset of the Russia-Ukraine conflict in 2022. With global risks being reassessed daily, the speed with which changes were made was invaluable to clients. This agility, transparency and fairness across all client portfolios is one of the biggest benefits of having an offering.”

Margaret Mote, Chief Executive Officer, Bongiorno Group

Cost of delay: comparing the experience of two advice businesses

Bongiorno Group and Richmond Partners are two advice firms that have made the transition to a managed account. Both businesses were seeking efficiency and quality of service benefits from the change and certainly achieved these soon after implementing their respective solutions. However, there were some additional benefits experienced, as outlined in the table below.

| Bongiorno Group | Richmond Partners |

|---|---|

| – Transitioned to MDA in 2018 | – Transitioned to Separately Managed Account (SMA) in 2022 |

| Primary reason for change – Wishing to outsource investment management acknowledging it requires a different skill set to providing strategic financial advice. – Create efficiencies in the advice model that benefits all stakeholders |

Primary reason for change – While performance had been good to date, there was an awareness of the research done by Philo Capital that highlighted the service to clients could still be improved. – The need to create a more efficient business model to futureproof the company. |

| Benefits to the business – Ability to add investment options such as ESG portfolios through the flexibility of the MDA structure. – Accurate and timely investment reporting. – Allowing advisers and the advice team to focus on their most valuable activities. |

Benefits to the business – Reduction in stress for employees, with a demonstrable improvement in mental health and wellbeing – Futureproofed the business model and provided John with more time to work on the business strategy as a whole |

| Improvements in client experience/outcomes – Positive investment outcomes were seen for clients who moved to an MDA, as shown in Chart 3. – Rebalancing 200 client portfolios within days compared to up to 12 months under the old model. – Client engagement with the MDA model was high, with an average of 90% of clients reading the quarterly rebalance communication over the past 18 months. This compares to an average open rate of just 21.56% for the business and finance industry, according to data from Mailchimp*. |

Improvements in client experience/outcomes – Clients were impressed that Richmond Partners had taken the initiative in delivering a better outcome and saving them money. – Introducing the SMA model also mitigated key man risk, removing this potential concern for clients. |

Three tips for firms looking to make the change

- Gain an understanding of the different types of managed accounts on offer to ensure you select one that will futureproof your advice offering with as much flexibility as possible.

- Make sure you have a clear strategy for communication with clients and your team. John from Richmond Partners suggested having an FAQ sheet for both internal and external contacts, as well as in-person sessions and webinars to ensure everyone has the information they need to understand the changes and expected benefits.

- Ensure you conduct a thorough education piece prior to the move, so employees have the knowledge and understanding to deliver a clear message to clients about the benefits of the MDA model and the reasons for the change.