by Kirsten Wymer and Edwin Lung, BT Investment Solutions

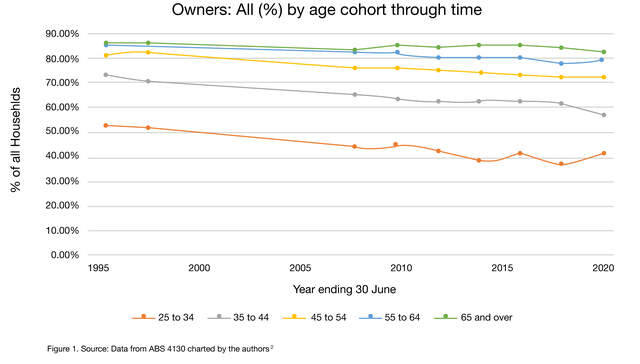

The Australian housing market is seen as increasingly unaffordable, potentially putting home ownership beyond the reach of ordinary Australians. Data from the Australian Bureau of Statistics show a declining trend of home ownership especially for the younger groups (see Figure 1 below). With 62% of Australians age 65 and over relying at least partially on the Age Pension (Age Pension - Australian Institute of Health and Welfare (aihw.gov.au)), we ask: are you better off owning your home while on the age pension?

Take the next steps

-

Explore BT Panorama

Increase efficiency and client value with online consent, our award winning mobile app and more.

-

Questions about BT Panorama?

Speak to a BDM or

call 1300 784 207

The extra asset test limit allowance for non-homeowners

The Age Pension asset test allows a certain amount of asset to be owned (excluding the principal residence for homeowners) before the Full Age Pension rate tapers down to a partial pension. For non-homeowners this asset test threshold is higher than homeowners. As of March 2021, this extra asset allowance is $216,500 for those not owning a home, and this amount is the same for both singles and couples (Assets test for pensions - Age Pension - Services Australia).

A Case Study

We explore the possible implication of this extra asset allowance with a case study of two hypothetical single retirees, both entering their retirement at age 673. Meet Doris, a renter, and Bob a homeowner. Doris could not afford to purchase a property during her working life but has saved more into her superannuation. Bob on the other hand, paid off his house in full by retirement age. We assume both start their retirement with the maximum assessable asset balance for full pension eligibility, given their homeownership status, like so:

| Assessable Asset | Doris – Non-Homeowner | Bob – Homeowner |

|---|---|---|

| Personal Effects (as declared under the Asset Test) | $50,000 | $50,000 |

| Superannuation Account Base Bucket (common to both Doris and Bob, usage not specified but assumed to be Financial Assets so have deemed income in the Income Test) | $220,500 | $220,500 |

| Superannuation Account Additional Bucket (extra savings made by Doris) – usage discussed further later | $216,500 | None |

| Total | $487,000 | $270,500 |

We represent housing costs as the median cost of housing of renters with private landlords for Doris and homeowners without a mortgage for Bob (data from Housing Occupancy and Costs, 2019-20 financial year | Australian Bureau of Statistics (abs.gov.au)). An alternative cost measure4 is included for completeness and is proposed by the ABS to capture additional home ownership costs such as body corporate fees, repairs, maintenance and dwelling insurance absent in their standard measure which captures mainly rates, general and water. As a renter receiving the Age Pension, Doris can also claim Rent Assistance (see Rent Assistance - Services Australia). As expected, Doris will have additional housing costs over Bob. While the housing costs are higher for both Bob and Doris under the alternative cost measure, the difference between Bob and Doris is similar under both measures, therefore from this point on we will only consider the housing cost differential under the standard measure.

| Assets | Doris | Bob |

|---|---|---|

| Housing Cost ABS Standard Measure (2019-20 Median at 2022 March $ figures) | $18,134 per year, or | $2,422 per year, or |

| $1,511 per month | $202 per month | |

| Housing Cost ABS Alternative Measure (2019-20 ABS Mean at 2022 March $ figures) | $22,133 per year, or | $7,321 per year, or |

| $1,844 per month | $610 per month | |

| Rent Assistance | $3,791 per year5, or $351.90 per month |

Not applicable |

| Additional housing cost borne by Doris compared to Bob – Standard Measure | $11,922 per year, or $993 per month |

Not applicable |

| Additional housing cost borne by Doris compared to Bob – Alternative Measure | $11,021 per year, or $918 per month | Not applicable |

How to fund rental costs?

Can Doris fund the extra housing costs of $11,922 p.a. with her additional superannuation savings of $216,500? We explore two hypothetical scenarios: Doris A buys an annuity, while Doris B invests this amount in an account-based pension (ABP).

Doris A - Annuity

The annuity that Doris A buys is an inflation-linked lifetime annuity which begins immediately. Indicative quotes from a market-leading Australian annuity provider suggests Doris A could receive approximately $10,6546 per year inflation-adjusted (tax-free for an annuity bought with super money after age 607) for a purchase price today of $216,500. While this covers most of her additional housing costs shown above, the Income Test reduces her age pension to a partial pension estimated to be $23,0448 p.a., lower than the full pension rate of $25,678 p.a. that Bob gets. Incorporating this reduced Age Pension payment, Doris A would still have a net housing cost gap of $3,902 per year compared to Bob.

Doris B – Account-Based Pension

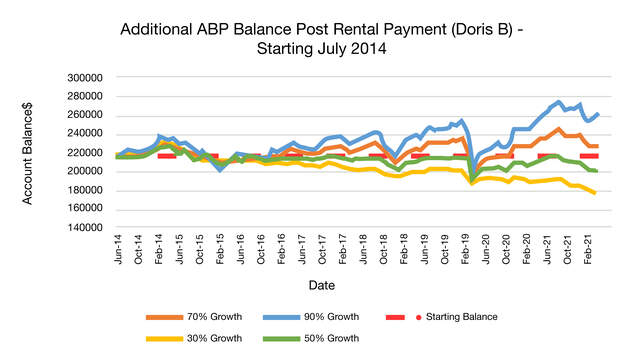

While annuity payment rates are fixed at time of purchase (albeit inflation-linked), an account-based pension will experience fluctuating returns. The key consideration for Doris B then is: what level of return, and therefore risk, does she need to take to fund her additional housing costs? We use APRA’s Simple Reference Portfolio (SRP)9 with tax-free investment earnings10 to represent ABP performance11. The SRP was a benchmark devised by APRA for MySuper funds using a simplified set of assets. Due to the Income Test, Doris B will receive a pension of $23,637 p.a., or $2,041 less than Bob (partially offsetting the Rent Assistance), resulting in an additional housing cost of $13,963 p.a. over Bob. We simulate ABP performance at several growth allocations, with a starting balance of $216,500 and rental outgoings of $1,164 per month ($13,963 p.a.), using historical SRP returns from July 2014 to Mar 2022 and adjusting the rent by historical CPI during this period12.

If Doris B wanted to fully protect her nominal capital and pay her ongoing rental costs at the same time, she would have needed to invest at 70% or 90% growth allocations. We note these are higher than the 58% growth allocation reported for representative accounts in the retirement phase in the Australian Government’s Retirement Income Review (Retirement Income Review Final Report (treasury.gov.au). Risky investments involve a trade-off between return and volatility. The investor needs to accept this especially in Doris’s case who must pay rent. Lastly, historical returns are not indicative of future performance and any future market recoveries may not occur in the same timeframe as historical experiences. We acknowledge that Doris B has a difficult decision to make, one which is faced by many retirees.

Bequest and conclusion

We end the case study with consideration of these retirees’ estates, given their different circumstances.

Assuming Doris A lives past the withdrawal date of her annuity, on her death the annuity will have no withdrawal value and so will not contribute to her estate.

For Doris B, the estate contribution from her ABP will depend on how markets perform during the rest of her life. One risk to call out is that this ABP account may run out during her lifetime if markets underperform enough, especially if she leads a long life. She would then be forced to draw on her other assets or reduce her outgoings.

Bob, as the sole outright owner and resident of his home, intends to pass it to his estate.

When viewed solely in light of the extra asset test allowance for non-homeowners, this simple case study suggests it is better to be a homeowner rather than a renter. One caveat though is that Bob was assumed to be an outright homeowner; for a mortgaged retiree the conclusion may be different.

We caution that the above example is hypothetical and highly stylised to demonstrate the possible implications of the asset test limits and investment choices. The choices discussed were not intended to be optimal solutions. While the authors have made best attempts at understanding all the social security rules and benefits available, these are complex; therefore we acknowledge a possibility that there may be omissions. Nonetheless, it points out the challenges of retirement planning, especially as real personal circumstances will be much more complex. Readers should consider seeking professional advice regarding these matters.

Author bios

Kirsten Wymer is Head of Risk Strategies and Research at BT Investment Solutions (BTIS), specialising in risk budgeting, member analysis and asset allocation modelling techniques for multi-asset portfolios. In addition to quantitative research and modelling for BTIS, Kirsten’s team also manages $6.2bn in cash and fixed income on behalf of BT, part of the Westpac Group.

Edwin Lung is Head of Quantitative Analytics at BTIS. He is passionate about the practical application of mathematics, technology and finance to investment and wealth management. He is a CFA charter holder, with over two decades of experience covering financial markets, asset management, and software development.

Whitepaper: Embracing digital technology for better client engagement

Timely action on investment decisions: the benefits of managed accounts

The transfer balance cap

Note: An earlier version of this article was originally published on firstlinks.com.au

1 Housing affordability in Australia has broadly declined since the early 1980s. The OECD’s price to income ratio index shows a 78% increase between 1980 and 2015. Source: Thomas M and Hall A, Social Policy and Alicia Hall, Housing affordability in Australia, Australian Government.

2 Australian Bureau of Statistics 4130.0 - Housing Occupancy and Costs, 2017-18

3 From 1 July 2021, the Age Pension age is 66.5, from 1 July 2023 this is 67 (Who can get Age Pension - Age Pension - Services Australia).

4 The ABS provides an alternative measure of housing costs in the Appendix of their Housing Occupancy Costs methodology (Housing Occupancy and Costs methodology, 2019-20 financial year | Australian Bureau of Statistics (abs.gov.au)), but this is only available as an average (not median and therefore more influenced by outliers) for each tenure type without the granularity of differentiating between household sizes, for instance noting that we used the Lone person household category for the case study.

5 This is the “People without Dependent Children” rate based on the Rent Assistance schedule taken as of May 2022 from Services Australia (How much Rent Assistance you can get - Rent Assistance - Services Australia).

6 Linearly interpolated for age 67 from quotes for a 65-year and a 70-year-old female, taken as of 16-May-2022. While annuity payment rates are not perfectly linear with age, it provides a reasonable approximation for this purpose.

7 Annuities - Moneysmart.gov.au

8 All Age Pension payment amount estimates in this study come from Centrelink’s online calculator at Payment Finder - Services Australia (centrelink.gov.au). Estimates include all applicable supplements. Treatment of annuities under the Age Pension Asset and Income tests are discussed on this DSS webpage Means Test Rules for Lifetime Income Streams | Department of Social Services, Australian Government (dss.gov.au).

9 APRA Simple Reference Portfolios are specified in Information Paper - Heatmap - MySuper products (apra.gov.au). They represent passive, low-cost investments in “core” asset classes only: Australian and International (non-Emerging Market) equities, fixed-interest and cash, in a simplified asset allocation.

10 ABPs have the benefit of tax-free investment earnings (Account-based pensions - Moneysmart.gov.au).

11 In this application of modelling an ABP, investment earnings tax is set to zero. Annual administration fee was set at the 2021 YourFutureYourSuper benchmark RAFE value of 0.3286% (Your Future, Your Super Frequently Asked Questions | APRA). RAFE stands for representative administration fees and expenses; the median RAFE of MySuper Products is used in the YFYS Annual Performance Test to represent the administration fees and expenses of the test benchmark.

12 For an ABP, its impact to the Age Pension will change as its balance varies due to market moves. But for simplicity and to illustrate the point, we are not looking at the changes in Age Pension eligibility through time in this simulation but focus on how it performs with a regular consumption stream under market volatility.