The views and opinions expressed in this article are those of RARE and may not reflect the views of BT (part of Westpac Banking Corporation) or any other company in the Westpac Group.

Cautious investors who seek some growth and a stable income tend to take one of several paths. This may include a selection of domestic stocks chosen for their high dividends and franking credits, real estate investment trusts or global equity income funds. Each has its own merits, but, added to this list should be global listed infrastructure. While there are several global listed infrastructure funds available in the Australian market, and stable cash-flow is a compelling investment characteristic of this asset class, only a specialist infrastructure manager can tailor a portfolio that focuses specifically on delivering attractive and growing income through infrastructure investing.

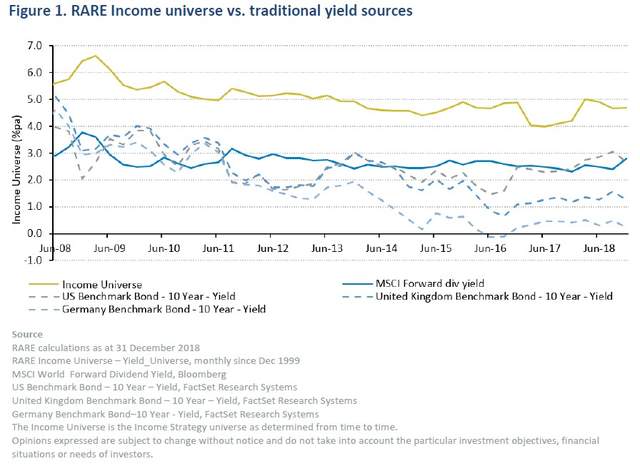

Listed infrastructure’s popularity as an income solution comes from its track record of consistently delivering a higher yield than global equities and 10-year bonds, demonstrated in the chart in Figure 1, which shows the RARE Infrastructure Income Universe vs traditional yield sources.

Stable inflation-linked revenue has meant the listed infrastructure sector has also displayed defensive growth characteristics over the past 12 years1. For example, the S&P Global Infrastructure Index participates in around 70-75% of the Beta of global equities both in months when markets rise as well as when they fall, providing a level of defensiveness during times of market uncertainty. A carefully tailored universe and portfolio construction approach can seek to improve both the income generation and defensive characteristics of a global listed infrastructure portfolio.

What companies make up the listed infrastructure universe?

Specialist global listed infrastructure manager RARE uses their own proprietary universes to select securities that they view most closely meet their definition of infrastructure. RARE’s Income Universe comprises the largest and most liquid infrastructure companies that generate a sufficient level and quality (level, growth and cash flow coverage) of dividend yield. Drawing on circa 3.6% of the companies in the MSCI AC World Index, and a few others outside, the Universe predominately includes utility stocks such as water, electricity and gas transmission and distribution companies, as well as high dividend paying infrastructure stocks such as toll roads, airports, and railways. Compared to the rest of the MSCI AC World Index, most of these companies are characterised as having stable revenue due to the essential nature of the services they provide. This means they are less likely to be impacted by economic recessions or booms. Furthermore, population increases and government initiatives to build more infrastructure are more likely to cause such companies to invest in their asset bases, which in turn drives revenue growth.

For those that believe we are now in a late cycle stage of the global economic cycle, this could be tactically important. In the US, we currently see the constraints of very low unemployment, wage growth and inflation coming through. However, recent forecasts from the OECD are downbeat on global growth. The OECD’s November outlook paper Growth Has Peaked Amidst Escalating Risks cited removal of stimulus by central banks and a slowdown in China as being likely to reduce global growth. Potential weakness in the local Australian economy could also see traditional sources of equity income come under pressure.

Investing for income

There are two key skills in creating listed infrastructure income portfolios. The first is ensuring that an absolute total return in excess of your return hurdle is achieved over time. Income targets should not be at the expense of long-term total return.

Secondly, there is the importance of understanding the sustainability of income. The stability of income is assessed by looking at the volatility of a company’s cash flows over time, capital structure and a company’s plans for use of cash and how these intersect to impact the dividends to investors. The quality of a company’s assets and the regulation or contracts that govern them needs to be front and centre in this process.

Another key step is global diversification. The most mature and reliable income-paying infrastructure stocks tend to be utilities from a broad range of developed countries. However, a specialist approach is prudent to understand the true value of such companies that sit outside the MSCI AC World Index, particularly those in emerging markets. The inclusion of emerging market infrastructure stocks is valuable to a global listed infrastructure strategy, as yields tend to be stronger in selected developing countries, reflecting higher local inflation and interest rates and emerging markets exposure has a positive diversification benefit to portfolios.

Conclusion

A range of income strategies is useful when matching clients’ risk profiles, liabilities and needs. Some sacrifice predictability of income for greater long-term growth, some sacrifice growth for predictability of income.

As we approach what we view as the end of the economic cycle, investors should be alert to managing current market uncertainty. Australian investors, in particular, who are tempted to focus on local stocks and franking credits, should be mindful of the country-specific and political risks that this also entails. Investment in globally listed infrastructure can provide investors with global diversification, defensive growth and inflation-linked income.

1. Calculations monthly from 31/08/2006-31/12/2018. Source: S&P Global Infrastructure – Gross, Local, FactSet Research Systems (Index Code – SPLO_G:STRGLIFX), monthly from MSCI AC World – Gross, Local, FactSet Research Systems (Index Code – MSCI:892400).

5 ways to demonstrate value to your clients

This article has been prepared by RARE Infrastructure Limited (ABN 84 119 339 052) (AFSL 307727 (RARE) and is current as at October 2019.

This information does not take into account your personal objectives, financial situation or needs and so you should consider its appropriateness, having regard to these factors before acting on it. Your individual situation may differ and you should consider obtaining advice from a professional tax and financial adviser before making any financial decision. Past performance is not a reliable indicator of future performance. Investing is subject to risk, including market risks. This article contains material provided by third parties derived from sources believed to be accurate as at its issue date. While such material is published with necessary permission, no company in the Westpac Group accepts any responsibility for the accuracy or completeness of, or endorses any such material. Except where contrary to law, we intend by this notice to exclude liability for this material. The views and opinions expressed in this article are those of the individual contributor(s) and do not necessarily reflect the official policy or position of BT or any company in the Westpac Group, its entities, or any other entity, on the matter discussed.