“Not even the safest investment is without risk and some element of speculation.”

Bernard Baruch, US financier and WWI chairman of the War Industries Board

Take action

Risk is a familiar part of our daily lives, from crossing a busy road to planning an overseas adventure — everyday activities require us to make nuanced judgments balancing risks against rewards.

But when it comes to investing, sometimes it can feel as if we are all at sea.

Yet the principles guiding investment risk are not so different from those we use in our everyday lives. Crossing a busy road carries the risk of an accident, but the reward of reaching our destination. Travelling abroad comes with uncertainty, but the lure of new experiences.

In the investment sphere, that link between risk and reward holds true. Different investments carry different levels of risk and reward. But what is investing risk? How does it differ between different investments? And what can we do to manage it?

Investment risk

Fundamentally, investment risk refers to the chance of losing money or of not having enough money to achieve your goals. Every investment has the potential for gain or loss — some are safer, and some are riskier.

There are several different types of risk:

Market risk: the risk that the entire investment market will decline, broadly affecting assets. This could be because of events like recessions, political instability or changes in interest rates.

Company risk: the risk that an individual investment performs poorly or fails.

Interest rate risk: the risk posed directly by changes in interest rates. For example, when interest rates rise, bond prices typically fall.

Inflation risk: the risk that investment growth will fail to keep pace with rises in the cost of living.

Liquidity risk: the risk that an investor may not be able to buy or sell an investment quickly enough for their needs.

The key to investing is in understanding that risk and return are intimately linked.

Risk = return

Why is this true? Essentially, it’s simply because investors will only take on higher risk on the promise of higher returns.

The insight that risk equals return has powerful implications for investors.

Higher risk, Higher potential return: investments that carry a higher level of risk typically offer the potential for higher returns because investors need to be compensated for taking on more risk.

Lower risk, Lower potential return: investments with lower risk usually offer lower returns. The canonical example here is government bonds that are considered low-risk investments because they are backed by the government, but they carry lower returns as a result.

Risks across asset classes

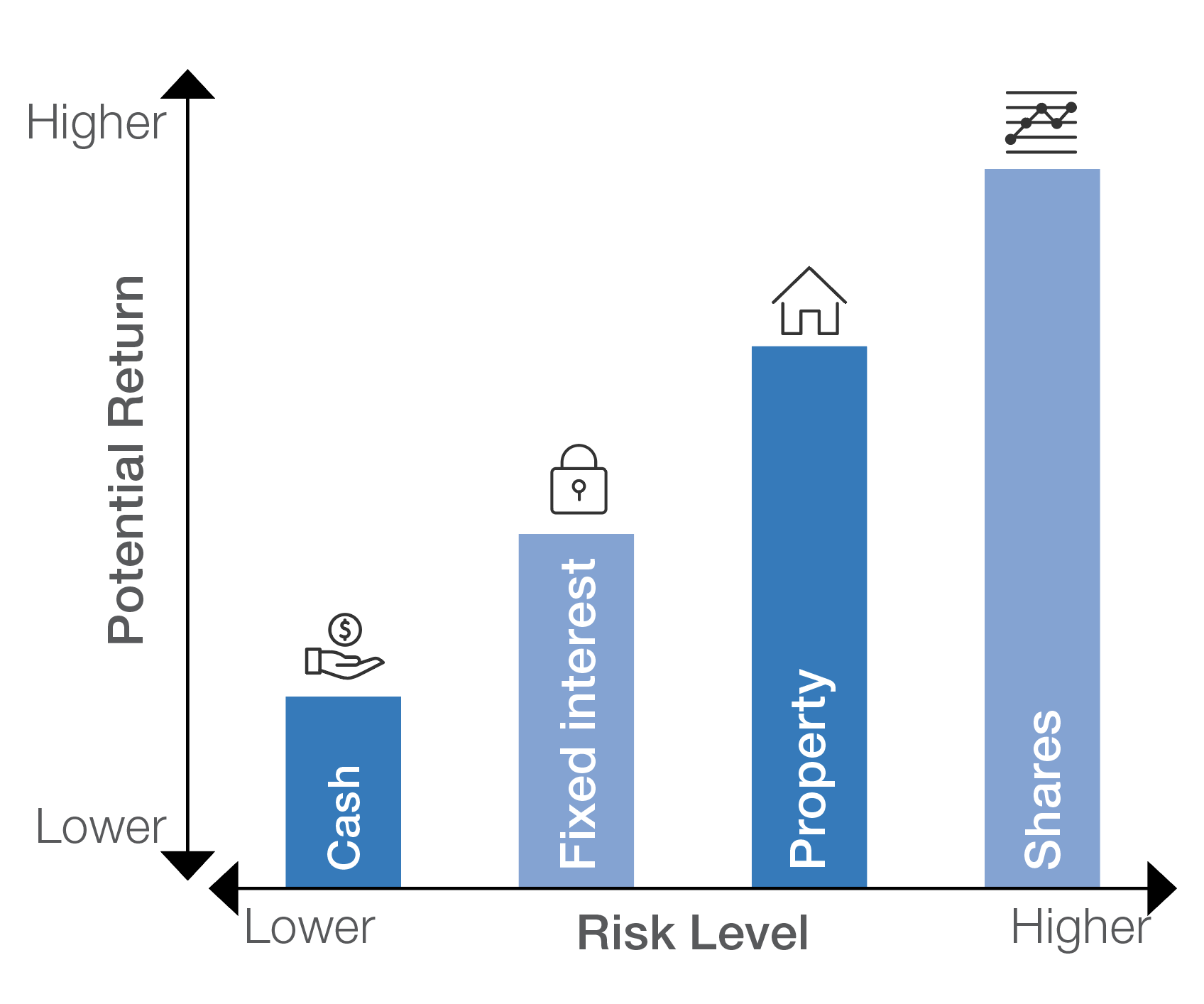

Building on this knowledge of risk, we can broadly grade different types of investments according to their risk. A simple way to understand risk is to look at an investment class’s likely returns. Investments that promise higher returns come with higher risk.

Let’s look at the major asset classes in turn:

Cash

Cash is one of the lowest-risk asset classes. Bank deposits and high-interest savings accounts are guaranteed up to a balance of $250,000 and money is usually available at call with low (and often no) fees for withdrawing money. This means the risk of losing money held in cash is very low. However, that also means returns are low. Banks typically pay low interest rates on cash and there is no potential for capital growth. That means the chief risk to your savings is inflation — unless you earn more than the rate of inflation, after tax, and reinvest those returns, the rising cost of living will steadily lower the purchasing power of your money.

Fixed interest

Fixed interest (or fixed ‘income’) assets include many different types of corporate and government backed bonds. Essentially a loan from you to the issuer, they pay a regular income stream over a specified period of time and promise return of capital at a future date. These are higher risk (and typically offer higher return) than cash but provide greater certainty of income than shares. The main risk associated with fixed interest investments is changes in the level of interest rates — if rates rise, the value of fixed interest investments fall. There is also a risk that the issuer fails and is unable to make income payments or return capital at maturity.

Shares

Shares (also called equities or stocks) represent an ownership stake in a company. They are considered a higher-risk asset class compared to cash and fixed interest. Share investments carry market risk, which means their value fluctuates due to changes in the overall stock market, and company risk, as specific factors affecting individual stocks is reflected in share prices and dividends. However, this means shares also have the potential for higher returns over the long term, as they offer the opportunity to participate in the growth and profitability of business.

Alternatives

A catch-all term for investments that are not cash, fixed interest or shares, alternative investments include assets such as real estate, art and collectibles, commodities, hedge funds, private equity and cryptocurrencies. As a result, the risk profiles of alternative investments vary widely. Probably the most popular of the alternatives with Australian investors is real estate. Real estate investments include residential and commercial property along with pooled investment funds. Real estate investments are exposed to market fluctuations and interest rate risk, property-specific risks and often come with liquidity risks, which means they can be difficult to sell on short notice. The trade-off for these risks is historically higher returns in the form of rent and capital growth.

Handling investment risks

All investments carry some form of risk — and higher investment returns come with higher risk. But everyone is different, and we all have different requirements for how much return we need and when we need it.

Understanding your personal tolerance for risk and your personal requirement for returns is the foundation of successful investing.

Your risk tolerance is a factor of your time horizon, your financial situation and your investment objectives.

A young person in full time work has less need for immediate income and time to ride out market downturns. A retiree reliant on their portfolio to live may want to give up potential capital gains in return for certainty of income. A couple saving for a deposit to buy a home may want to keep their savings secure rather than seek higher returns by taking on more risk.

Acknowledging that we all have different risk tolerances, here are some strategies to mitigate risk:

Diversification: Diversifying your investment portfolio means having money spread across a range of different investments. It is perhaps the most powerful tool investors have to manage risk. Different risks mean different assets move in different ways – by spreading your money across investments, you reduce the impact of any single investment's performance on your overall portfolio.

Asset allocation: Asset allocation is the process of dividing funds between asset classes based on your financial goals and risk tolerance matched to the risk profile of each asset class. Knowing the relative risks of each asset class allows you to balance potential risks and returns across different assets to build a portfolio that meets your needs.

Regular rebalancing: As investments change in value, it is important to regularly review your portfolio to ensure things stay aligned with your desired allocations. This can mean selling assets that have risen in value and buying more of ones that have become underrepresented.

Gearing: Borrowing money can magnify investment gains and losses. Ensuring that the level of borrowed money — known as gearing — in your portfolio is kept to an appropriate level is an important way to manage risk.

Conclusion

Understanding and managing risk is an essential aspect of saving and investing.

All investments come with risk — and risk is necessary to achieve returns.

The key to success is knowing the different types of risks inherent to different types of investments and understanding your own personal risk tolerance.

Diversification, asset allocation and regular monitoring are the keys to keeping investment risk under control and safely maximising the returns from your investments.

A financial adviser can help.

Financial advisers provide personalised advice, help assess your risk tolerance and develop a tailored investment plan that suits your needs – and helps you achieve your goals.

Working with a financial adviser can help you map out what you need to do with your money to achieve the things you want to achieve in life, and what mix of assets will help you get there.

This document has been prepared by BT, a part of Westpac Banking Corporation ABN 33 007 457 141 AFSL and Australian Credit Licence 233714 (Westpac) and is current as at 19 July 2023. The information in this document regarding taxation and legislative change is based on policy announcements which are yet to be passed as legislation and may be subject to future change. This information does not take into account your personal objectives, financial situation or needs and so you should consider its appropriateness, having regard to these factors before acting on it.