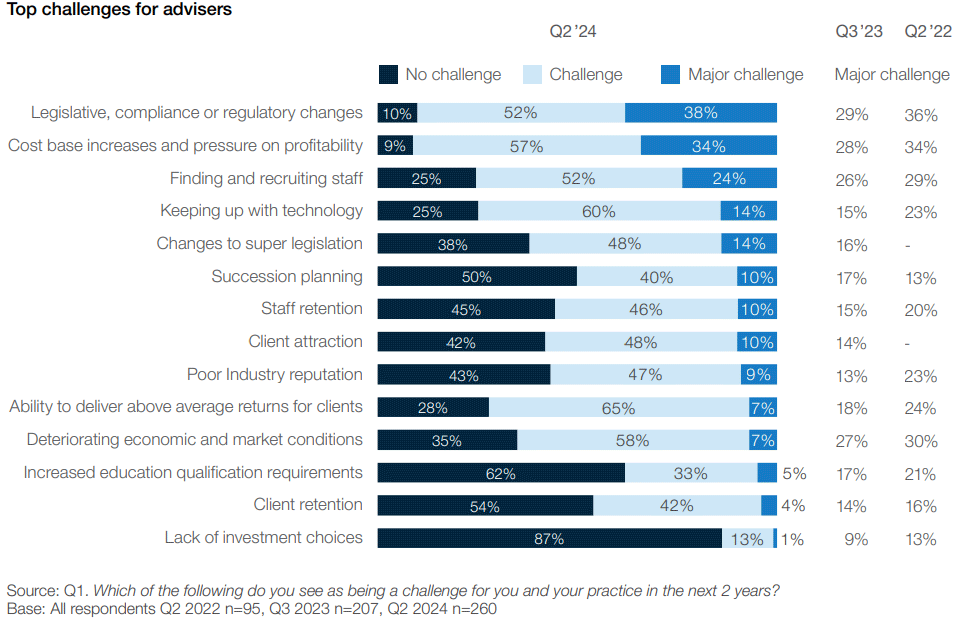

Legislative change, cost increases, and staff recruitment are the biggest challenges facing financial advisers in Australia, according to advisers who participated in the BT Adviser Sentiment Index for 2024. The uncertainty around new levies and the Quality of Advice Review have contributed to this.

The BT Adviser Sentiment Index 2024 is an annual survey of over 200 Australian financial advisers, designed to capture the challenges they face and their perspectives. At BT, we closely monitor the ongoing sentiment of advisers through this survey, as well as through our distribution and customer service teams to advocate for and support advisers in the areas where they need it most.

The survey responses, which inform this year’s BT Adviser Sentiment Index, indicate that the challenges facing advisers are broad across the industry. In addition to the top three concerns, more than half of all advisers nominate keeping up with technology, changes to superannuation legislation, client attraction, poor industry reputation, and retaining staff as key challenges.

But there is some good news. Advisers are much less worried about deteriorating economic conditions, with only 7% seeing it as a major challenge, now compared to 30% in 2022. Also, less of a concern this year are increased education qualification requirements, client retention, and a lack of investment choices.

Meanwhile, pressures on cost bases and profitability have increased markedly, with 91% citing it as a challenge or major challenge in 2024, up from 84% in 2022.

Bruce Gorry, Managing Director and Principal Advisor, Provident Advisory

“The biggest issue in the advice profession at present is the compensation scheme of last resort, otherwise known as CSLR. This impact this has on advice practices around the country cannot be overlooked if Canberra is genuine about making advice more accessible and more affordable for everyday Australians. The crux of the matter is that this well-intentioned legislation will generate the opposite effect of the intent behind the Quality Advice Review.”

Gorry says many boutique advisers are holding off investment in business growth because of this uncertainty.

“Cyber crime has also become more relevant for advisers in recent years,” Gorry says.

“The risk is real. We went through the process of establishing our own Australian Financial Services Licence (AFSL) a year ago and part of the due diligence we undertook was analysing business risk, one of which was cyber risks.

“We made a decision at business level to ensure we engage with business partners that we believe take the matter just as seriously as we do.”

Legislative, compliance and regulatory change are the top challenges for advisers operating across Australia, nominated by nine in ten advisers in the BT Adviser Sentiment Index 2024. 38% of advisers identified legislative, compliance, or regulatory changes as a ‘major challenge’ compared to 29% last year, while over half of all advisers consider the changes a ‘challenge’.

“The uncertainty around the Quality of Advice Review (QAR) is clearly worrying financial advisers,” says Jason Brown, Head of Distribution at BT.

“As the Federal Government navigates the legislation, it should provide greater clarity for advisers. We are confident that the goal of making financial advice more accessible and affordable is within reach. The QAR holds significant potential to benefit advisers and clients,” Brown added.

“We are confident that the goal of making financial advice more accessible and affordable is within reach.”

Jason Brown, Head of Distribution at BT

“One of the regulatory legislative changes which many advisers are grappling with is not actually a legislative change at all,” says Bryan Ashenden, Head of Financial Literacy and Advocacy at BT. “Rather, it is the operation of the compensation scheme of last resort.”

The scheme operates for the benefit of clients who receive poor advice and are due compensation, as determined by the Australian Financial Complaints Authority (AFCA). If the adviser or licensee no longer exists, the scheme provides payouts to the clients.

“The issue many advisers are struggling with is that a levy on advisers will fund the pool of money for payouts,” Ashenden added.

The compensation scheme levy is in addition to the current Australian Securities and Exchange Commission (ASIC) fee of $2,818 per adviser.

“This levy is particularly contentious,” Ashenden says. “Advisers agree that people should have the right to be compensated where they have received poor advice, but they are concerned about why they should have to pay for someone else’s poor advice.”

“The impact is intended to be positive, but many advisers still have questions regarding its implementation, with some debate about the introduction of a new class of financial adviser.”

Bryan Ashenden, Head of Financial Literacy and Advocacy, BT

According to the advisers surveyed, uncertainty surrounds the QAR, a Federal Government inquiry aimed at enhancing the provision of high-quality, accessible, and affordable financial advice to retail clients.

While legislation related to some of the recommendations has been tabled, for the advisers surveyed, some uncertainty remains.

“The impact is intended to be positive, but many advisers still have questions regarding its implementation, with some debate about the introduction of a new class of financial adviser,” Ashenden says.

Under the proposal, financial institutions would be able to provide personal advice about their own products through a new ‘qualified adviser’ regime, subject to compliance with minimum competency requirements. The proposal is currently undergoing a consultation process, with any changes expected to commence no earlier than 2025.

“Advisers have noted this and are considering the implications for their clients if super funds begin providing advice,” adds Ashenden.

“Advisers are concerned about the potential impact this change will have on their existing client relationships and the introduction of an additional levy. While the QAR aims to simplify and reduce costs, some advisers reported in the survey feeling that the changes may have had the opposite effect.”

The cost of running a financial advice business is another major challenge cited in the BT Adviser Sentiment Index 2024. More than one-third (34 per cent) of advisers stated that ‘cost base increases and pressure on profitability’ were a ‘major challenge’, while 57 per cent said it was a ‘challenge’. Only nine per cent stated that it was ‘not a challenge’.

Robert Zammit, partner, RSM Australia

“The Quality of Advice Review (QAR) is the biggest worry at the moment. We have had years of heartache and pain and extra regulation to clean up the profession. Now it seems like we are going backwards again,” Zammit says.

“We have advisers leave the business because of increased educational requirements, and all of a sudden we are talking about watering them down.”

“Everyone agreed that educational requirements needed to get better… but the new rules didn’t ever allow for experience. Some people [left the profession] because they had to do extra study, even though they had done nothing wrong and were highly educated and highly experienced,” Zammit says.

“Now it looks like [regulators] are going back on their word, watering down requirements and letting a whole bunch of poorly qualified advisers back into the profession. We don’t want Royal Commission 2.0 in another five or ten years.”

Stage 3 tax cuts, contribution threshold, 15% over $3 million

Other legislative changes commencing on 1 July 2024 that advisers need to consider are changes in tax rates, based on Stage 3 tax cuts legislation, and changes in the superannuation contribution threshold.

Ashenden says another significant change currently under review in Parliament, is the additional 15 per cent tax in super for those who have more than $3 million in superannuation, which will not take effect until 1 July 2025.

“This change is causing concern for advisers as they try to understand the rules – how do they apply to those with a defined benefit compared to a standard accumulation type benefit? The rules are still being developed, and we don’t have the finalised legislation yet,” he says.

“It’s still 12 months away and it likely won’t have a significant impact for another 12 months after that, but advisers want to know what they should be doing in the coming year to minimise the impact.”

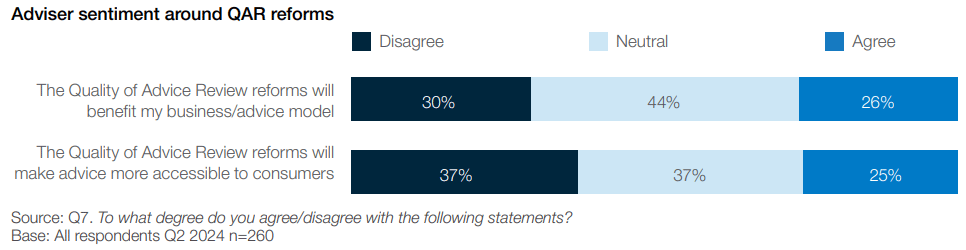

The Federal Government’s Quality of Advice Review, completed at the end of 2022 and released in 2023, aims to make advice more accessible and affordable. However, advisers surveyed for the BT Adviser Sentiment Index 2024 are uncertain whether the proposed changes will be effective.

According to the BT Adviser Sentiment Index 2024, only one-quarter (25 per cent) of advisers surveyed believe the QAR reforms will make advice more accessible to consumers, with 37 per cent remaining neutral and another 37 per cent thinking the reforms will make it harder for consumers to access advice.

Additionally, a significant portion of the advice market expressed concerns that the proposed reforms will negatively impact their businesses; 30 per cent of advisers disagree that the QAR reforms will benefit their business or advice model, with just 26 per cent agreeing, and another 44 per cent as neutral.

Qualified adviser

The Government has indicated it will adopt most of the recommendations from the QAR, as undertaken by Michelle Levy, Partner at Allens. The three ongoing streams of consultation are focused on simplifying the provision of financial advice, superannuation funds, and exploring new models for the future.

Publicly one of the most contentious proposals is the ‘qualified adviser’ regime, though BT’s Head of Financial Literacy and Advocacy, Bryan Ashenden, warns that using the term ‘qualified adviser’ may remove important context around what the Government is aiming to achieve.

“All we currently know is that these new advisers will be able to provide simple, personal advice, which is an undefined term,” Ashenden says. “Most people are thinking of it as an intra-fund advice type of model, so it’s just related to investments within a particular superannuation fund.”

Ashenden added that the proposed model could pose challenges for an adviser overseeing a client’s complete financial situation. “What if an adviser’s existing client seeks advice from their super fund? How can we be sure that’s the right advice, given it might not take into account their other circumstances?”

Ashenden welcomes the QAR intent and says that superannuation funds, and other providers, should have a role in providing their membership or clients with limited advice in a controlled way.

“It’s crucial that the limited advice is presented in a way that clearly communicates its limitations and exclusions,” Ashenden advises. “In fact, it should almost serve as a prompt for members or clients to consider seeking more comprehensive advice from a financial adviser, who could provide a broader perspective on their financial situation.”

Ashenden further explains that for individuals who currently have a strong relationship with their financial adviser, the QAR reforms are unlikely to have any significant impact . However, for those who are not currently receiving financial advice, the reforms could serve as a catalyst for making more informed and positive decisions about their financial outcomes.

“For people who have never sought advice, it could be a good stepping stone for them to appreciate the value of advice and think more broadly,” he says. “So, if the reforms are implemented properly with all the right guard rails and controls, they can work to help fully fledged financial advisers attract new clients.”

Training ground

Ashenden argues there might be another benefit of financial advice practices; attracting new talent.

“The BT Adviser Sentiment Index 2024 revealed that most people are talking about these changes in terms of intra-fund advice, but the Government’s announcement doesn’t limit these changes to a superannuation fund alone,” he explains.

“For an adviser looking at growing their business, there are opportunities. An intra-fund advice model, using people working inside a super fund, could become a breeding ground for future advisers, for example.”

“People can work in organisations like a super fund, do training, become more educated in advice, get some experience and then move into financial advice.”

Staff recruitment, platform service and employee diversity

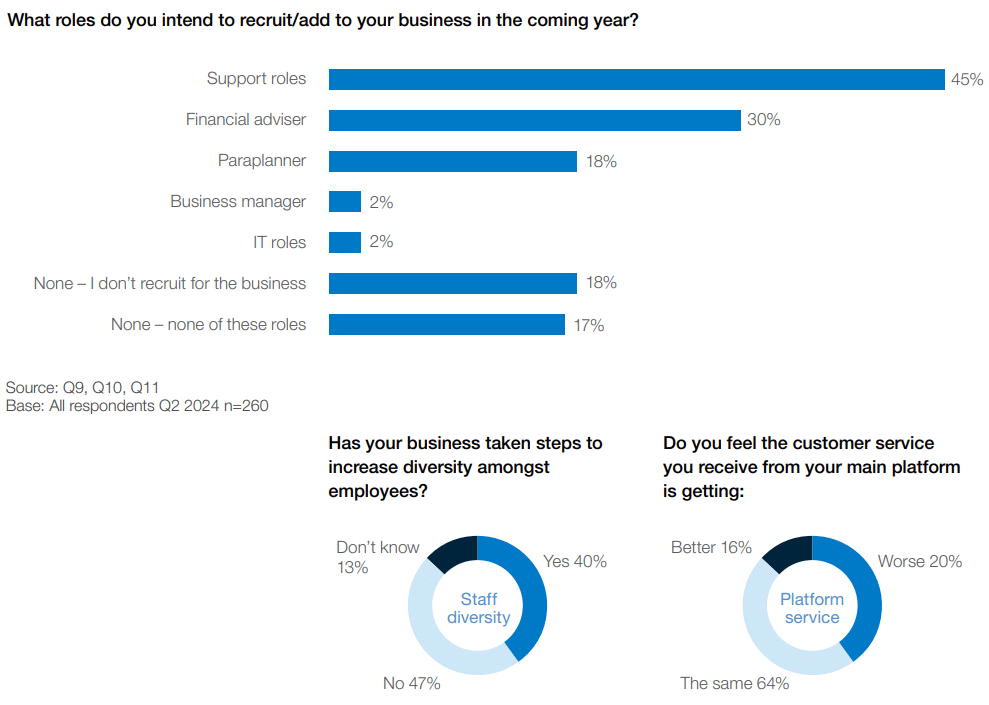

A significant number of financial advice practices have taken steps to increase diversity across their workforces as they hire new staff.

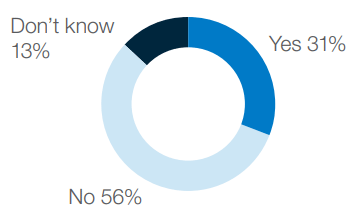

Forty per cent of participants in the BT Adviser Sentiment Index 2024 stated their businesses have moved to increase diversity, while 47 per cent have not.

Benefits of diversity

Recruiting a more diverse workforce not only addresses the main challenges faced by financial planning firms – finding and recruiting staff – but also brings a wealth of unique perspectives and experiences that can drive innovation and success.

Alisdair Barr, Founder and CEO of Striver, a specialist recruiter for the financial planning and accounting professions, encourages the industry to think broadly when recruiting.

“Find people who have skills that can be used in a financial advice practice, even if they are not financial advisers,” Barr says.

“A big problem for the industry is the low number of students studying financial planning,” Barr added. “Raising awareness of financial planning as a career path is important. I don’t think people aren’t choosing to study financial planning because they don’t like it, but rather that they don’t know about it.”

“Find people who have skills that can be used in a financial advice practice, even if they are not financial advisers.”

Alisdair Barr, Founder and CEO of Striver

Ultimately, given mandated superannuation and the need for advisers, Barr says there are enormous opportunities for people who learn about the role of a financial adviser. “When you ask people how they became financial advisers, they mostly say they fell into it,” he adds.

Employ beyond advisers

Solving the challenge of having enough financial advisers goes beyond attracting more qualified planners, Barr says.

“You have to find great people, but you also must find efficiencies in how you run your business by better utilising data and technology. There’s a combination of things that could plug this gap.”

Barr points to the BT Adviser Sentiment Index 2024 which shows that 45 per cent of firms intend to recruit for support roles over the next 12 months. That is more than the 30 per cent who plan to recruit financial planners, and the 18 per cent who are looking for paraplanners.

“What we see works best is the firms that grow their adviser numbers out of their support staff. They put them through education, training, and development; by the time they have been in the firm for a few years, they grow into advisers. They are the firms that do best,” Barr says. “The other common method is to poach someone from another advice practice. The problem with that method is it doesn’t help with the overall solution to the problem of a lack of financial advisers.”

Rules for retention

In terms of retention, Barr says it is important for firms to have good career plans for employees. “Understand where people want to go and remunerate them properly. While it isn’t always about money, it is important that you are having a conversation with them, working on their career plan, and providing them with the best opportunity to learn and grow in the business.”

Raymond Pecotic, managing director of Empire Financial Group

“My pain point right now is around recruiting adviser talent,” Pecotic says. “There just aren’t many good quality advisers on the market.”

“The industry has gone from a workforce of 30,000 advisers to 12,000, and many that are available do not have experience running a profit and loss business.”

The speed of technology change and the threat of cyber crime is also top-of-mind for Pecotic.

“We have [cyber threats] as a standing agenda item at our Monday morning staff meetings where we share examples of dodgy behaviour. And we want to be more efficient with technology because it is hard to find people. Using technology can help solve that through operational efficiency.”

He also warns that profit margins are being squeezed, due to government fees, the cost of advice, technology and an array of factors.

“We are a business that aggressively pursues growth and our turnover is increasing year-on-year. So too is our profit but our margins are being squeezed. If your business is stagnant and you are not bringing in new clients and increasing revenue, your business is going backwards.”

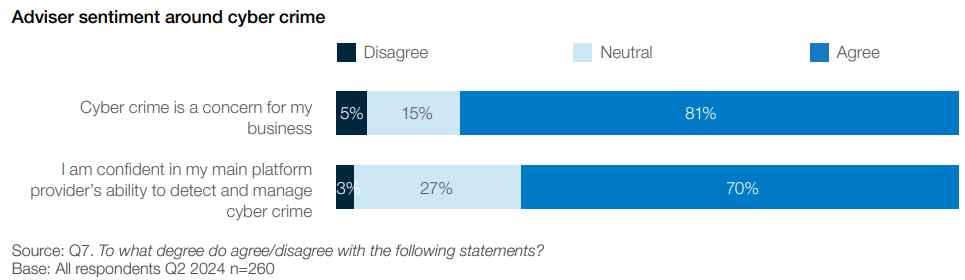

Cyber crime has emerged as another significant issue for financial advisers, with more than 80 per cent worried about the potential for criminal activity.

Almost one-third (31 per cent) of respondents in the BT Adviser Sentiment Index 2024 said that they have been targeted by cyber crime.

“Fraud always happens,” says Merryl Tidyman, BT’s Executive Manager, Fraud and Financial Crime. “It’s about putting mitigating factors in place to lessen the impact.”

“Cyber crime can encompass all sorts of different threats and streams within an environment. Historically, we looked at cyber as being something done in dark rooms with lots of data running through,” she says.

“In the modern age, it encompasses all sorts of things – from identity theft or identity takeover through to data breaches. A ‘cyber event’ literally means it happened wholly online,” she says.

“Go that extra mile, as painful as it is, to get into a rhythm and protect your clients. Put protocols in and stick with them. Eventually, they will become second nature.”

Merryl Tidyman, Executive Manager, Fraud and Financial Crime at BT

Why cyber criminals like advisers

“Financial advisers are attractive targets for cyber criminals as they have all their customers’ first, middle and last names, and could be holding copies of identification which is highly problematic, which is very fruitful information for fraudsters,” Tidyman says.

The BT Adviser Sentiment Index 2024 indicates that advisers believe preventing cyber crime is, in part, a role of their wealth platform provider. Seventy per cent agreed that they were confident in their main platform provider’s ability to detect and manage cyber crime, while 27 per cent were neutral. Only three per cent disagreed with the statement.

Steps to help prevent fraud

Tidyman stresses that preventing cyber crime is everyone’s responsibility.

“Advisers need to think about the office environment and ensure they have robust controls in place to safeguard their operations and protect their book,” Tidyman says.

“It’s crucial for advisers to stay up-to-date on their licensee compliance requirements and adhere to their platform’s user agreements, particularly those related to security,” Tidyman emphasises.

Having a cyber resilience plan is important. “It’s also worth running through a simulated cyber-attack once a year,” Tidyman says, adding that resilience plan guides are available on bt.com.au and via the Australian Cybersecurity Centre.

Advisers can guard against cyber crime by doing basic things well, Tidyman says.

“Don’t keep your password in plain sight on a post it note. Don’t share logins. Ensure support staff have their own independent logins and have been identified as per user agreements with providers.”

“At least once a week, make absolutely sure that the transactions appearing in an adviser’s book are exactly what they are expecting to see. Update your systems and apps. A critical patch you are receiving could solve for whatever small breach might have been found in a software,” she says.

“Go that extra mile, as painful as it is, to get into a rhythm and protect your clients. Put protocols in and stick with them. Eventually, they will become second nature. These are very practical steps an adviser can take.”

What to do in event of a breach

“If an adviser or their firm experiences a cyber breach, they should immediately contact their platform provider,” Tidyman says.

While the initial discussion will be at a high level, it allows the provider to take precautionary actions quickly to protect its data.

“An adviser should expect questions around whether they think their book is compromised, or if they are. They will be asked questions around behaviours and what they have been seeing from customers,” Tidyman says.

“The adviser will also have to report to their licensee governance compliance person, and they must stay watchful for any other suspicious activity. They can expect their provider to contact them regularly until things settle down.”

Tidyman recommends that all staff update passwords and user records, and the adviser or firm should have an IT forensics specialist check to see if there is any lingering malware on the company’s server.

“Data today is a huge financial commodity. We are seeing a huge lift in [cyber crime] like identity theft. Fraud and financial crime are not going away.”

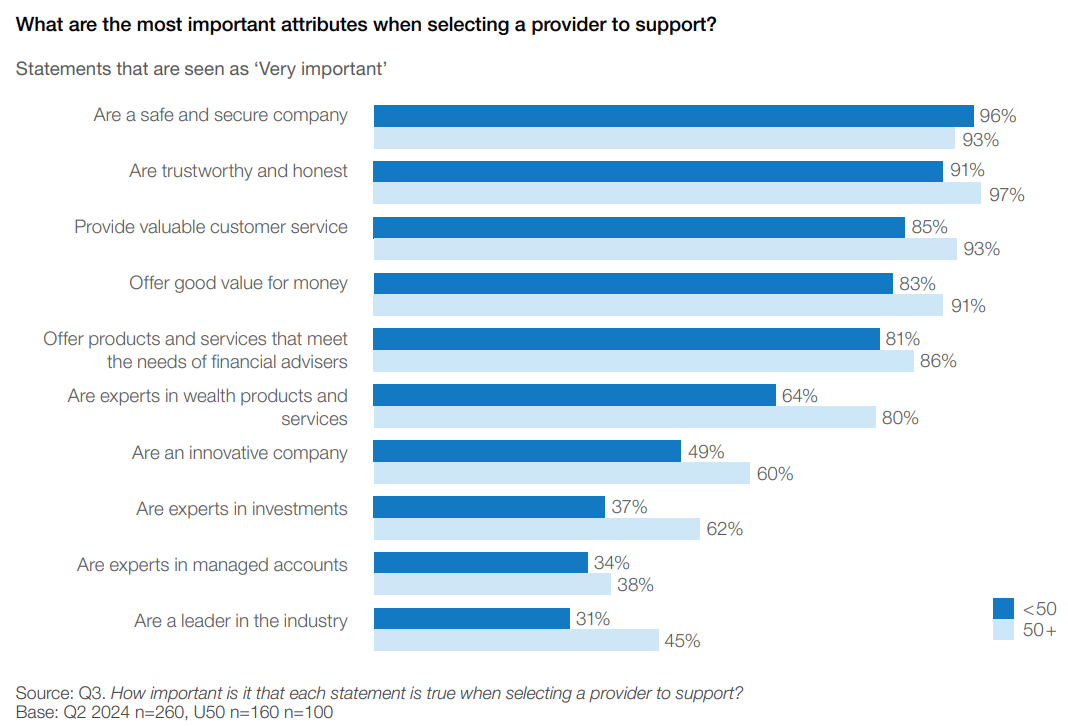

According to this year’s BT Adviser Sentiment Index, advisers want to work with wealth management brands that are ‘safe and secure’ and ‘trustworthy and honest’. They are the key attributes and necessary qualities for over 90% of advisers surveyed.

The next level of attributes includes providing valuable customer service, offering good value for money, and providing products and services that meet the needs of financial advisers.

While these attributes are important for all advisers, there is a slight disparity between planners under the age of 50 years, and those older than 50 years.

Almost all respondents in the BT Adviser Sentiment Index 2024 in the younger cohort (96 per cent) nominated a ‘safe and secure’ company as the highest ranked attribute when selecting a wealth management provider. In the case of the older group of advisers, ‘trustworthy and honest’ (97 per cent) came in as the number one-ranked attribute.

The older cohort also placed more emphasis, relative to younger advisers, on the need to ‘provide valuable customer service’, ‘offer good value for money’ and be ‘experts in wealth products and solutions’.

The survey shows that older advisers expect more from providers. In all ten categories, with the exception of ‘safe and secure company’, the proportion of older advisers ranking a specific attribute, was higher than the proportion of younger advisers.

Conclusion

Financial advisers face many challenges, including legislative, compliance and regulatory changes, cost base increases, and finding and recruiting staff. Looking to the positive, advisers are less worried about economic and market conditions, increased education qualification requirements, client retention and a lack of investment choices compared to 12 months ago.

Uncertainty around QAR reforms and the fear of a cyber attack on advisers’ businesses are an ongoing concern for advisers. Wealth management providers that can offer expert and regular updates on legislative changes, as well as security, practical solutions, and peace of mind, will gain the confidence of advisers and their clients.

While we operate in an increasingly technology-driven environment, the challenges advisers say they are facing demonstrate the continued importance of human expertise and excellent customer service in guiding advisers through the coming years.

BT solutions for your business

To help with the challenges you are facing, check out these solutions from BT.

BT Academy

Market insights and regulatory and technical updates. bt.com.au/btacademy

Cyber hub

Practical strategies and information to help enhance the way you manage your business. bt.com.au/cyberhub

BT & Striver

BT is working with Striver to help attract, engage and retain the next generation of financial advice professionals. bt.com.au/striver

About the research

The BT Adviser Sentiment Index 2024 was conducted from 3-10 April 2024 with responses from 260 qualified, practicing financial advisers from across Australia. The survey was anonymous and all individuals quoted were contacted after the survey was concluded and have given their permission for their comments to be included.

Things you should know

This information has been prepared by BT, a part of Westpac Banking Corporation ABN 33 007 457 141 AFSL & Australian Credit Licence 233714 (Westpac) and is current as at 16 June 2023. This information does not take into account your personal objectives, financial situation or needs and so you should consider its appropriateness, having regard to these factors before acting on it.