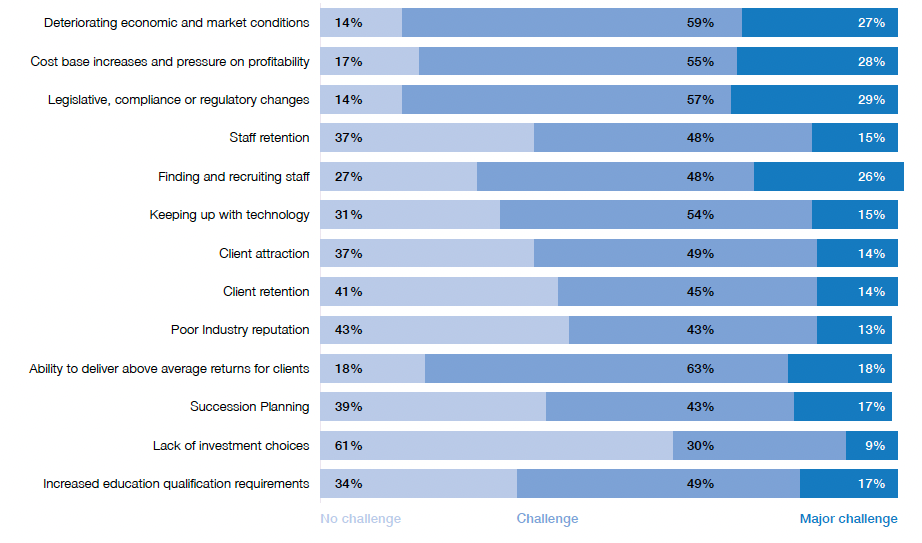

Compliance and regulations, rising cost bases, deteriorating economic conditions and finding and recruiting staff are the major challenges reported for financial advisers in Australia, according to advisers who participated in BT’s Adviser Sentiment survey for 2023.

The survey responses, which have been used to produce this year’s BT Adviser Sentiment Index, shows the major challenges in 2023 are similar to last year. But there is some good news, with advisers less worried about keeping up with technology, or about the industry’s reputation.

The survey results also show a disparity between the key challenges for advisers over the age of 40 years, and the cohort under that age.

Governance

Legislative, compliance and regulatory changes are a ‘challenge’, or ‘major challenge’, for 86 per cent of financial advisers, according to the Adviser Sentiment Index. Advisers want, and need, support from wealth management providers.

While regulations are a constant ‘challenge’, or ‘major challenge’, there are signs that members of the advisory profession are getting used to living with different regulations. Last year 36 per cent of advisers nominated legislative, compliance or regulatory changes as a ‘major challenge’, whereas this year the figure is 29 per cent.

The survey demonstrates the demand from advisers for information and support around legislation and product changes. Notably this year, understanding changes to superannuation legislation is a bigger challenge than previously. This may reflect the proposed introduction of an ‘objective’ of super, or the indexation of thresholds that commence from 1 July. There have also been changes to taxation arrangements for members with account balances of more than $3 million.

Tim Geddes, from Australian Financial Services Group (AFSG) in Perth says years of regulatory change has been difficult. But he adds: “Now I don’t think of it much. It’s just a cost of doing business.”

The second greatest challenge for financial advisers, according to the Adviser Sentiment Index, is cost base increases and pressure on profitability. While 28 per cent see it as a ‘major challenge’ – slightly lower than last year – more than 80 per cent regard it as a ‘challenge’.

The third challenge reported by advisers is deteriorating economic and market conditions. Only 14 per cent of advisers do not think the economy is a challenge.

Both responses demonstrate that financial advisers, as small and medium size business operators, constantly need to focus on running their businesses, and they want help from their wealth management providers. A number of respondents say receiving ‘good value’ service from their wealth management provider is important. Also, advisers want their provider to keep them informed.

They want relevant information, rather than masses of emails, including tips on ways to improve efficiencies in their business. They want timely market and strategic commentary that can be forwarded to clients. And they want useful information, which is concisely produced, that can provide value to their clients.

“Some are at that level and... we’ve got good relations with BT,” he says. “We want to work with someone who understands our business and can add value.”

“We want them to be strong enough to support our business. They need to have a track record and brand is important because it matters to clients’ perceptions.

“We want to work with people that are part of the industry and have been for some time. And that means size is something we look for.”

Tim Geddes, AFSG, Perth

Tim Geddes, from Australian Financial Services Group in Perth says when working with wealth management service providers, he wants them to understand and have insights into his financial advisory businesses.

“Staffing and regulation are the two biggest concerns and risk for our business,” says Damien Galle, managing director and principal advisor at Mint Financial.

“It’s very difficult to find qualified staff, and new entrants to the industry,” he says.

“From a regulation perspective, we don’t know where we’re going to be in 12 months, let alone 24 or 36 months down the track. We’ve had some heavy compliance and regulation pushed on to us over the past couple of years, and now they’re talking about unwinding it”.

Galle says while financial advisers have to roll with the changes, he fears that at some point the constant changes will put advisers out of business.

“It sounds a bit ridiculous, but the last lot of changes pushed a whole lot of advisers out of the industry. Some of the changes that had been talked about – like a flat dollar cost for setting up a pension or investing – would have destroyed some business models.”

“Eventually most advisers went one of two ways – they grew scale, or they become more specialised, which is what Mint Financial did,” Galle says.

Damien Galle, Mint Financial, Melbourne

Staffing

Finding, attracting and retaining the right people is another major challenge for financial advisers in 2023. The BT Adviser Sentiment Index shows that finding and recruiting staff (a challenge for 73 per cent of businesses) and staff retention (a challenge for 63 per cent of businesses) are constant worries for managers of financial advisory firms.

It is an area where advisers are looking for outside help training and providing timely, accurate information to teams within a firm. That might include better education tools, regular updates or short explanatory leaflets.

Some challenges are getting easier

The BT Adviser Sentiment Index also shows that some challenges aren’t as difficult as they were a year ago. A lack of investment choices is not a problem for the majority of financial advisers surveyed.

Encouragingly, advisers are less worried about the industry having a poor reputation. And while client attraction and retention is always crucial to a business, they are not among the top ranked challenges.

Keeping up with technology also falls into lower ranked challenges, though survey responses suggest wealth management providers play an important role in ensuring that technology is usable for advisers.

Advisers say that providers can support them and their clients through personalisation, education and technology.

Information and communication

Wealth management providers have an opportunity to provide clear, concise information to advisers, based on the comments from the BT Adviser Sentiment Index.

While information flow and communication is important, advisers want effective information particularly given they are provided with so much commentary. Providers could also be pro-active by engaging with advisers for feedback.

Service

Advisers, already challenged by regulatory change, the economic outlook and staffing needs, demand good service from wealth management providers.

Service is among the top mentioned attributes of a good provider. This includes competitive products and good customer service.

Advisers also want transparency in the services being offered and want to work with knowledgeable business development managers and call centre staff.

For many advisers, good service is about minimising complexity and bureaucracy, constant communication, and enabling a good adviser experience.

“The big four accounting firms are consuming graduates. Grad salaries of up to $300,000 for 21-year-olds coming out of university are being bandied around. The Googles and Canvas of the world… are telling young people to go into a finance degree and they will give them work,” says Alisdair Barr, founder and CEO of Striver.

That’s the competition facing financial adviser firms. “Talent is being paid more and demand is rising. At the same time supply has gone down,” Barr says.

It means individual firms, and the financial advice industry as a whole, has to rethink its employee value proposition. To do so, firms needs to consider what this generation of graduates want.

“They’re looking for social connection. They are looking for purpose and they are looking for their tribe or community,” Barr says. “And they are looking for tech enabled solution and flexibility in the way they work.”

“As an industry, how do we make [financial advice] attractive as a career? As an individual firm, how do you make the employee value proposition good enough to have people wanting to work in your organisation,” Barr asks.

“It breaks down to employee benefits and fair and reasonable remuneration that’s up to scratch with what the market is paying. And it’s about ongoing career progression and articulating how that’s going to evolve over time. Young people, like anyone, want clarity over their career development.”

“The good thing is that now the industry is in a competitive environment, we are focusing more on these things.”

The staffing conundrum – Alisdair Barr, Founder and CEO, Striver

Younger advisers

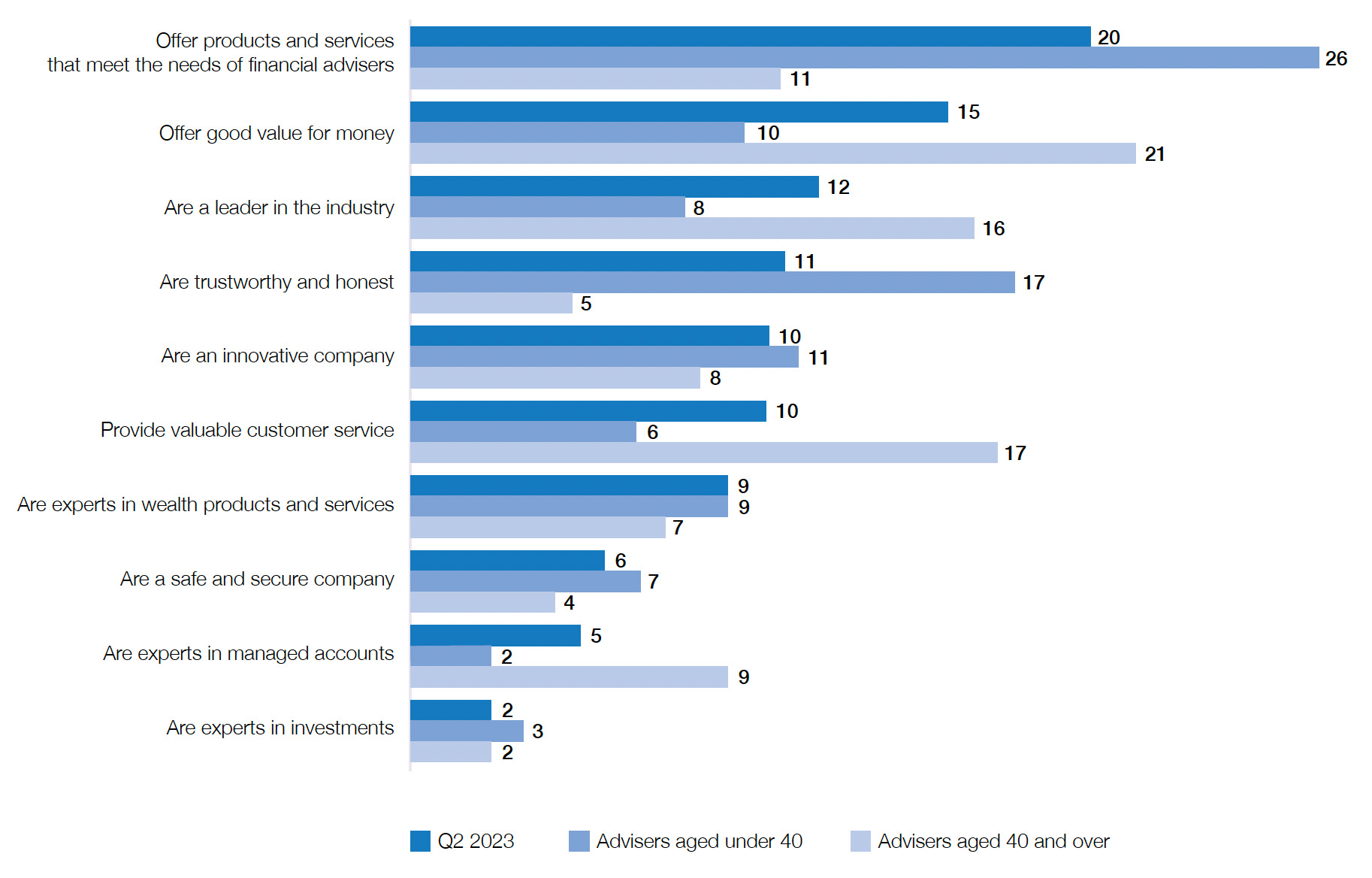

For advisers under the age of 40 years, products and services that meet their needs is the most important attribute of a wealth management provider. But providers need to do more than that to gain the respect of younger advisers. They need to be trustworthy and honest, and perhaps reflecting the advisers themselves, innovative.

Wealth management providers need to also have expertise in wealth products and services and add measurable value.

“I look at our challenges from the perspective of running a dealership and being an adviser,” says Chris Jas, National Head of Financial Services Australia at RSM.

“Attracting and retaining talent is a challenge. There’s been a massive fall in adviser numbers post the Royal Commission. That’s been well documented. What hasn’t been so well spoken of is how slow it is to bring new talent on to replace the huge outflow of advisers,” Jas says.

To get a graduate to go through the [process] to be an adviser who is not only sitting in a seat but also is a fee earner… takes a minimum of three years and more likely five years. The option is to attract top tier advisers and that is a very competitive market.”

Jas says the industry is also suffering from change fatigue, which in part reflects all the regulatory changes in the industry.

“There’s been constant tinkering of rules and regulations over many years and there’s more with the Quality of Advice Review. There’s been a roller coaster of emotions for the adviser fraternity in terms of what the regulations are, and some bits are still unknown”.

“The advisers still in the industry are feeling the weight of all that change. Advisers are an optimistic bunch of people … but they just want a clear set of guidelines that they can operate within and not have to go and adjust their systems, processes and modes of operation every five minutes in anticipation of what may, or may not, change.”

Tied in with change fatigue, Jas says, is the need for advisers to continually adapt to new digital systems and processes.

“There isn’t a one size fits all digital solution out there for the advice industry. That’s caused a lot of frustration in the industry over time.”

Chris Jas, RSM, Perth

Conclusion

Financial advisers face many challenges, including legal, compliance and regulatory changes, cost increases, deteriorating market conditions and recruiting and retaining staff.

But the severity of these challenges has lessened somewhat over the past year, according to the BT Adviser Sentiment Index, and advisers are becoming more resilient to change.

Wealth management providers offering great products and services, leadership in the industry, valuable customer service and are trustworthy and honest are best placed to help advisers in coming years.

The BT solution

Finding and recruiting staff

“Our team of BDMs work with over 2,000 practices and conduct over 12,000 agenda driven meetings with advisers every year. These include detailed fact finds about how businesses are run,” says Jason Brown, Head of Platforms Distribution at BT.

“We do this primarily to support the advisers but it also provides valuable insights into best practice and trends regarding how advisers are finding new staff, training them and retaining them. We can collate the best ideas and bring them to advisers.”

“A benefit of being a large organisation is that we have our own learning and development plans that are well documented and discussed regularly in our business. We can share those ideas with smaller business owners,” Brown says.

“When advisers do bring on new staff, we can provide access to modularised training either virtual or face-to-face, to ensure new staff can maximise the features and benefits of BT Panorama to complete their work for clients.”

Brown says BT invests in regular support staff dedicated training and development days. These events include relevant keynote speakers and give support staff the opportunity to share best practice ideas with each other.

“We also send out a monthly support staff newsletter with tips and tricks, recent developments and challenging quizzes to help embed learnings.”

Bryan Ashenden, Head of Financial Literacy and Advocacy, BT

Legislative, compliance and regulatory changes

The financial advisory sector is a very complex, intertwined environment, says Bryan Ashenden, Head of Financial Literacy and Advocacy at BT.

“With so much change happening, and so much change on the horizon, keeping up to date with it all is hard to do,” he says.

“What we do for the adviser community is run fortnightly webinars structured to deal with issues in the industry. We will talk about ethical issues arising in the industry… and we’ve been trying to look at that more from a regulatory change perspective.”

Jason Brown, Head of Platforms Distribution at BT

“A benefit of being a large organisation is that we have our own learning and development plans… We can bring some of those ideas to smaller business owners.?

Ashenden uses the example of the proposed changes from the Quality of Advice Review. “We look at questions such as is it appropriate for advisers

to have a different level of accountability for the advice they give compared to what is proposed to apply to superannuation trustees. We use these sessions to approach it from an ethical perspective rather than a strict regulatory perspective.” “By explaining and educating and putting the change

into context, hopefully the advisers don’t feel quite as overwhelmed by it. They don’t feel like they’re being disadvantaged,” Ashenden says. “If you’re not approaching it with a negative connection, it makes change easier.” BT also provides a quarterly regulatory update which looks at changes, and proposed changes, in the financial advisory space. “What are the bits that are relevant for you as an adviser. What are the bits that are relevant if you are running the licence. What are the changes going to be,” Ashenden says. “Part of what we do is making sure financial advisers don’t feel like they are alone; they don’t feel like they’re the only ones facing these issues and that as an industry we are trying to tackle these issues the best we can. “We want people to have confidence in their future and there is no doubt that people will have more confidence if they seek financial advice. We want financial advice to thrive. We want to work with advisers because we think getting financial advice is important.” To find out more and for BT’s Daily Market Report, visit bt.com.au/btacademy

“By explaining and educating and putting the change into context, hopefully the advisers don’t feel quite as overwhelmed.”

Bryan Ashenden

Head of Financial Literacy and Advocacy at BT

Matt Harvey, Investment Director at BT

Advisers navigating investments in all markets

To help advisers stay on top of ever changing economic and market conditions, BT works with its partners to provide advisers with up-to-date information about the economy.

Through its knowledge centre, BT Academy, BT provides advisers access to a daily morning report on the markets, a weekly economic round up and regular insightful videos and webinars on market themes and movements from BT experts and our fund manager partners.

Outside macro-economic commentary, BT is working with advisers to help them streamline and professionalise their processes, helping alleviate some of the complexity of running the business, says Matt Harvey, Investment Director at BT.

“[Advisers are] not getting bogged down trying to second guess what the market is doing and at the same time run a business.”

Matt Harvey

Investment Director at BT

“There’s been continued demand for managed accounts whereby an advice practice will partner with an external asset consultant to help with portfolio construction and decision making,” he says. “Those decisions are implemented through managed portfolios which are ultimately executed using BT Panorama’s technology stack.” “From an adviser’s point of view, it’s a much more efficient way to run the business. They’re not getting bogged down trying to second guess what the market is doing and at the same time run a business. It’s a very professional way to approach portfolio construction.”

About the research

The BT Adviser Sentiment survey was conducted from 5-22 April 2023 with responses from 207 qualified, practicing financial advisers from across Australia. The survey was anonymous and all individuals

quoted were contacted after the survey was concluded and have given their permission for their comments to be included.

Things you should know

This information has been prepared by BT, a part of Westpac Banking Corporation ABN 33 007 457 141 AFSL & Australian Credit Licence 233714 (Westpac) and is current as at 16 June 2023. This information does not take into account your personal objectives, financial situation or needs and so you should consider its appropriateness, having regard to these factors before acting on it.