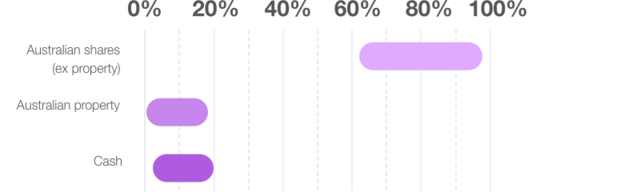

Portfolio allocation

The portfolio's objectives

To deliver outperformance relative to the benchmark by 4% p.a. before fees over a rolling three year period.

The portfolio's investments

Predominantly securities within the S&P/ASX 200 Index.

About the portfolio manager

DNR Capital Pty Ltd (‘DNR Capital’) is an Australian investment management company that delivers client-focused investment solutions to institutions, advisers and individual investors.

Founded in 2001, DNR Capital specialises in the delivery of individually and separately managed accounts in the Australian market and aims to deliver investment outperformance to investors.

DNR Capital is an Authorised Representative of DNR AFSL Pty Ltd ABN 39 118 946 400 AFSL Number 301658. DNR Capital is a signatory to the Principles for Responsible Investment (‘PRI’).

Fees

| $60 + 0.5% | + | 0.80% | + | 0.11% to 0.18%^ |

|---|---|---|---|---|

| BT Invest administration cost (p.a.) | Management costs (p.a.) | Transaction costs |

^ Generally between 0.11% and 0.18% of the transaction amount but may be as high as 0.20%.

For further information see the Fees & Costs section of the BT Investor Guide.

For example, if you made a managed portfolio investment of $25,000 during the year, you'd pay:

| $185 p.a. | + | $200 p.a. | + | $27.50* |

|---|---|---|---|---|

| BT Invest administration cost (p.a.) | Management costs (p.a.) | Transaction costs |

* The example assumes a transaction cost rate of 0.11%.

Open an account

If you're ready to get started you can apply online in about 10 minutes.

Things you should know

BT Portfolio Services Ltd ABN 73 095 055 208 AFSL 233715 (BTPS) is the operator of BT Invest. Westpac Financial Services Ltd ABN 20 000 241 127 AFSL 233716 (WFSL) is the responsible entity and issuer of interests in BT Managed Portfolios. Westpac Banking Corporation ABN 33 007 457 141 AFSL and Australian credit licence 233714 (Westpac) is the issuer of the BT Invest Cash Management Account (BT Invest CMA) (together, the BT Invest products).

This information does not take account of your individual objectives, financial situation and needs. A Product Disclosure Statement or other disclosure document (PDS) for the BT Invest products can be obtained by contacting BT on 1300 881 716 or by visiting www.bt.com.au. You should obtain and consider the relevant PDS before deciding whether to acquire, continue to hold or dispose of the BT Invest products.

BTPS and WFSL are subsidiaries of Westpac. Apart from any interest investors may have in Westpac term deposits, Westpac securities or the BT Invest CMA through the BT Invest products, the BT Invest products are not a deposit with, investment in, or any other liability of Westpac or any other company in the Westpac Group. These investments are subject to investment risk, including possible delays in repayment of withdrawal proceeds and loss of income and principal invested. Westpac and its related entities do not stand behind or otherwise guarantee the capital value or investment performance of the BT Invest products.