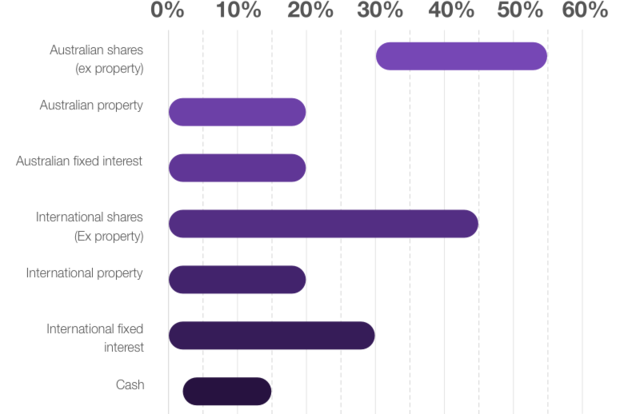

Portfolio allocation

Key features

-

$900 Minimum investment (excluding $100 min in BT Cash)

-

Investment factsheet (PDF 122 KB)

The portfolio's objectives

To deliver predominantly moderate to high growth and some income returns. The portfolio aims to track the overall return of a diversified portfolio of underlying investments.

The portfolio's investments

The portfolio can invest in Australian registered managed funds and exchange traded funds.

About the portfolio manager

BT Investment Solutions is the investment centre within BT Financial Group and provides investment products and solutions to customers, offering investment opportunities across a range of asset classes, including shares, property and fixed interest. The Responsible Entity, Westpac Financial Services Ltd (‘WFSL’), is part of BT Financial Group. WFSL will manage some of the managed portfolios by relying on the proven capability of BT Investment Solutions.

Fees

| $60 | + | 0.7% | + | NIL |

|---|---|---|---|---|

| BT Invest administration cost (p.a.) | Management costs (p.a. [max]) | Transaction costs |

For further information see the "Fees & Costs" section of the BT Invest Investor Guide and the "What are the fees and other costs?" section of the BT Managed Portfolios PDS.

For example, if you made a managed portfolio investment of $25,000 during the year, you'd pay:

| $60 p.a. | + | $175 p.a. | + | NIL |

|---|---|---|---|---|

| BT Invest administration cost | Management costs | Transaction costs |

Westpac customers

Simply log into Westpac Online Banking to open an account in minutes. No fees or costs are incurred in opening an account, allowing you to explore the available investment options. Fees only apply once you make your first deposit into your BT Invest Cash Management Account.

New customers

If you don't have a Westpac bank account, you can open an everyday banking account in 3 minutes. You can then complete your pre-filled BT Invest application via Westpac Online Banking.

Things you should know

BT Portfolio Services Ltd ABN 73 095 055 208 AFSL 233715 (BTPS) is the operator of BT Invest. Westpac Financial Services Ltd ABN 20 000 241 127 AFSL 233716 (WFSL) is the responsible entity and issuer of interests in BT Managed Portfolios. Westpac Banking Corporation ABN 33 007 457 141 AFSL and Australian credit licence 233714 (Westpac) is the issuer of the BT Invest Cash Management Account (BT Invest CMA) (together, the BT Invest products).

This information does not take account of your individual objectives, financial situation and needs. A Product Disclosure Statement or other disclosure document (PDS) for the BT Invest products can be obtained by contacting BT on 1300 881 716 or by visiting www.bt.com.au. You should obtain and consider the relevant PDS before deciding whether to acquire, continue to hold or dispose of the BT Invest products.

BTPS and WFSL are subsidiaries of Westpac. Apart from any interest investors may have in Westpac term deposits, Westpac securities or the BT Invest CMA through the BT Invest products, the BT Invest products are not a deposit with, investment in, or any other liability of Westpac or any other company in the Westpac Group. These investments are subject to investment risk, including possible delays in repayment of withdrawal proceeds and loss of income and principal invested. Westpac and its related entities do not stand behind or otherwise guarantee the capital value or investment performance of the BT Invest products.