Open up your investment options

Finding the next investment opportunity for your self managed super fund (SMSF) isn’t always easy.

BT SMSF is an online SMSF investment platform where you can:

-

access thousands of investments in one place

-

track your portfolio and performance.

Ready to get started

If you're ready to get started you can apply online in about 10 minutes. Call 1300 554 267 with any questions or request a callback

Thousands of investments, all on one investment platform

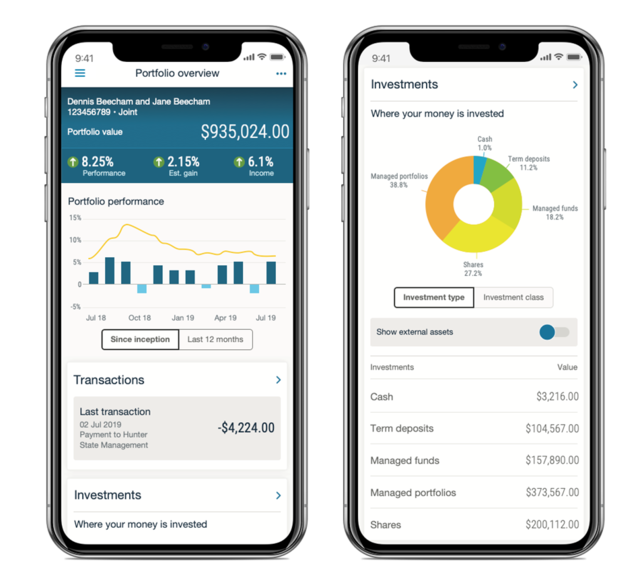

Invest in Australian shares, ETFs, term deposits and more to build your own portfolio. If you’d like a bit of help, you can also choose from a wide range of professionally managed funds or portfolios.

-

Buy and sell investments online, without the paperwork

-

Track your SMSF portfolio and performance with a simple online dashboard

-

Get market updates related to your listed securities, the latest company information and fund fact sheets

-

Save time at EOFY with an online document library, contributions and pensions tracking and optional accountant access

Images and examples are for illustrative purposes only

Fees and costs

SMSF investment platform

0.15% pa

of your total balance up to $1M

(0% above $1m)

Note: The transaction account balance will be excluded from the calculation of the Administration fee – asset based (subject to a minimum asset-based administration fee which applies to the Compact and Focus menu options, including accounts with only a transaction account balance). For further details, refer to the relevant disclosure document(s).

Full menu

$540 pa

Compact menu

$240 pa

Focus menu

$60 pa

Documents and downloads

Investment platform – opening a Panorama Investments Account

Target Market Determinations

Other important information

Additional Information

BT Portfolio Services Ltd ABN 73 095 055 208 AFSL 233715 (BTPS) is the operator of Panorama Investments. Westpac Financial Services Ltd ABN 20 000 241 127 AFSL 233716 (WFSL) is the responsible entity and issuer of interests in BT Managed Portfolios. Westpac Banking Corporation ABN 33 007 457 141 AFSL and Australian credit licence 233714 (Westpac) is the issuer of the BT Cash Management Account (BT CMA) (together, the Panorama products).

This information does not take account of your individual objectives, financial situation and needs. A Product Disclosure Statement or other disclosure document (PDS) for the Panorama products can be obtained by contacting BT on 1300 881 716 or by visiting www.bt.com.au. You should obtain and consider the relevant PDS before deciding whether to acquire, continue to hold or dispose of the Panorama products.

BTPS and WFSL are subsidiaries of Westpac. Apart from any interest investors may have in Westpac term deposits, Westpac securities or the BT CMA through the Panorama products, the Panorama products are not a deposit with, investment in, or any other liability of Westpac or any other company in the Westpac Group. These investments are subject to investment risk, including possible delays in repayment of withdrawal proceeds and loss of income and principal invested. Westpac and its related entities do not stand behind or otherwise guarantee the capital value or investment performance of the Panorama products.

For the Target Market Determination for these products please refer to www.bt.com.au/tmd.