Regarding assets, the key limits as at 1 July 2025 are as follows:

To receive a full pension, assets (excluding the value of the primary residence) must be less than:

|

Homeowner |

Non-homeowner |

Single |

$321,500 |

$579,500 |

Couple, combined |

$481,500 |

$739,500 |

1. Indexed every 1 July. Source: Australian Government Services Australia.

To receive at least a part pension, assets must be less than:

|

Homeowner |

Non-homeowner |

Single |

$704,500 |

$962,500 |

Couple |

$1,059,000 |

$1,317,000 |

Couple - separated by illness |

$1,247,500 |

$1,505,000 |

1. Indexed every 20 March, 1 July and 20 September. Recipients of Rent Assistance will have higher thresholds. Source: Australian Government Services Australia.

It’s important to note that if you get Rent Assistance, your cut off point will be higher. Use the Payment and Service Finder to find out your cut off point.

Asset reduction strategies

There are a number of strategies that may be used to reduce asset levels, which may result in qualifying for a part pension or increasing the current pension amount received.

However, before reducing your assets it is important to bear in mind whether your remaining savings can support any shortfall in your retirement income needs, as any increased pension amount may still be inadequate. Personal circumstances can also change and increase the reliance on your reduced savings. For example, future health issues may require a move into aged care, which can bring increased expenses.

With that in mind, here are six possible asset reduction strategies to help boost your pension:

1. Gift within limits, for more than 5 years before qualifying age

If there is a desire to provide financial assistance to family or friends, gifting can reduce your assessable assets. The allowable amounts a single person or a couple combined may gift is the harsher $10,000 in a financial year or $30,000 over a rolling five financial year period. Any excess amounts will continue to count under the asset test (and deemed under the income test) for five years from the date of the gift. This is called deprivation.

If you are more than five financial years away from reaching your age pension age or from receiving any other Centrelink payments, you can gift any amount without affecting its eventual assessment once you reach age pension age.

2. Homeowners can renovate

Your home is an exempt asset and any money spent to repair or improve it will form part of its value and will also be exempt from the assets test.

3. Repay debt secured against exempt assets

Debts secured against exempt assets do not reduce your total assessable assets. An example is a mortgage against the family home, regardless of what the borrowed funds have been used to purchase. However, using assessable assets to repay these debts can reduce the overall assessed asset amount. Crucially, you must make actual repayments towards the debt; depositing or retaining cash in an offset account will not achieve this outcome.

4. Funeral bonds within limits or prepaying funeral expenses

If you wish to set aside funds or pay for your funeral costs now, there are a couple of ways to do this which may reduce your assessable assets.

A person can invest up to $15,750 (as at 1 July 2025) in a funeral bond and this amount is exempt from the assets test. Members of a couple can have their own individual bond up to the same limit each. By contrast, if a couple invests jointly into a funeral bond, this must not exceed $15,750 i.e. it is not double the individual limit2.

In comparison, there is no limit to the amount that can be spent on prepaid funeral expenses. For the expenses to qualify, there must be a contract setting out the services paid for, state that it is fully paid, and must not be refundable. Importantly, both methods of paying for funeral costs are designed purely for this purpose and preventing assets from being accessed for any other reason.

5. Contribute to younger spouse's super and hold in accumulation phase

If you have a younger spouse who has not yet reached their Age Pension age and is eligible to contribute to super, contributing an amount into their super account may reduce your assessable assets. The elder spouse can even withdraw from their own super, generally as a tax-free lump sum, to fund the contribution.

Investments held in the accumulation phase of super are not included in a person’s assessable assets if the account holder is below Age Pension age. Before using this strategy, any additional costs incurred should first be considered. Holding multiple super accounts may duplicate fees. Shifting funds into an accumulation account may increase the tax on the earnings on these investments to as much as 15%. Alternatively, earnings on the funds are tax-free if invested in an account-based pension or potentially even personally.

Additionally, contributing to a younger spouse who is under Age Pension age, and still working, will 'preserve' these funds. They should also ensure they do not exceed their contribution caps3.

6. Purchase a lifetime income stream

Lifetime income streams such as an annuity purchased after 1 July 2019 may be favourably assessed, according to the Social Services and Other Legislation Amendment (Supporting Retirement Incomes) Bill 20184. Where eligible, only 60% of the purchase price is assessed. This drops to 30% once the latter of age 85 (based on current life expectancy factors) or five years occurs.

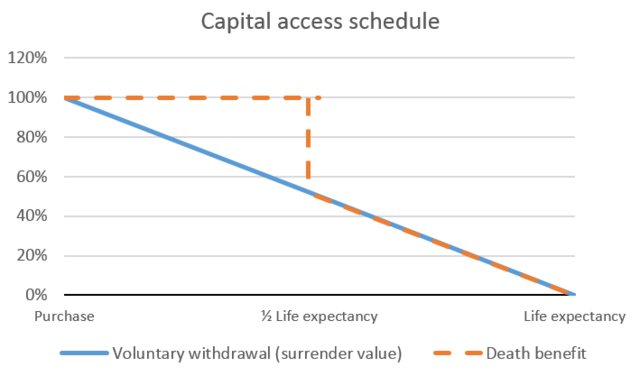

To receive concessional treatment, the lifetime annuity must satisfy a 'capital access schedule' which limits the amount that can be commuted voluntarily or on death4. This is illustrated below:

4. Source: Parliament of Australia.

Voluntary commutations must follow a 'straight-line' declining value, falling to nil at life expectancy. The death benefit can be up to 100% until the investor reaches half of their life expectancy, at which point it will follow the voluntary withdrawal value4.

Conclusion

Reducing your assessable assets5 within the relevant assets test threshold can provide many benefits such as increasing your existing pension or allowing you to qualify for a part pension, if you are currently above the upper asset test threshold.

While it is tempting to intentionally reduce your asset levels to gain these benefits, it is important to remember the Age Pension payment rate is determined by applying both an income and assets test. The test that results in a lower entitlement determines the amount receivable. If the income test is the harsher test, reducing your assessable assets may provide little or no benefit.

If the assets test is harsher, you should not lose sight of the fact that any reduction in your assets means there are fewer assets for you to call upon if required.

References

1. https://www.servicesaustralia.gov.au/assets-test-for-age-pension?context=22526

2. https://www.servicesaustralia.gov.au/funeral-bonds-and-prepaid-funerals?context=22526

3. https://www.ato.gov.au/individuals-and-families/super-for-individuals-and-families/self-managed-super-funds-smsf/contributions-and-rollovers/contribution-caps

4. https://parlinfo.aph.gov.au/parlInfo/search/display/display.w3p;query=Id%3A%22legislation%2Fems%2Fr6224_ems_58c16ce0-95fa-4ef6-afe4-668b3e41fb62%22

You might also be interested in

Planning for Retirement Guide

Thinking about retirement, but not sure where to start? Get tips and information in our Planning for Retirement guide, to help you get started today.

Looking for a financial adviser?

Connect with a financial adviser who is familiar with BT Panorama by using our BT find an adviser tool.

How to determine asset allocation

How much do I need in retirement?

Prioritising health and wellbeing in retirement

Things you should know

Information current as at 1 July 2025. The article was prepared by BT, a part of Westpac Banking Corporation ABN 33 007 457 141 AFSL and Australian Credit Licence 233714 (Westpac). This information does not take into account your personal objectives, financial situation or needs and so you should consider its appropriateness, having regard to these factors before acting on it. This information provides an overview or summary only and it should not be considered a comprehensive statement on any matter or relied upon as such.

This information may contain material provided by third parties derived from sources believed to be accurate at its issue date. While such material is published with necessary permission, the Westpac Group accepts no responsibility for the accuracy or completeness of, nor does it endorse any such third party material. To the maximum extent permitted by law, we intend by this notice to exclude liability for this third party material.

Superannuation is a means of saving for retirement, which is, in part, compulsory. The government has placed restrictions on when you can access your investments held in superannuation. The Government has set caps on the amount of money that you can add to your superannuation each year and over your lifetime on both a concessional and non-concessional tax basis. There will be tax consequences if you breach these caps. For more detail, speak with a financial adviser or registered tax agent or visit the ATO website.

BT cannot give tax advice. Any tax considerations outlined in this document are general statements, based on an interpretation of current tax laws, and do not constitute tax advice. As such, you should not place reliance on any such taxation considerations as a basis for making your decision with respect to the product. As the tax implications of investing in this product can impact individual situations differently, you should seek specific tax advice from a registered tax agent or registered tax (financial) adviser about any liabilities, obligations or claim entitlements that arise, or could arise, under a taxation law. If you need more information to complete your tax return, please consult your accountant or tax adviser to obtain professional tax advice.