About Mercer Super

Mercer Super has a wealth of local superannuation expertise and is committed to delivering strong retirement outcomes for Australians. Mercer’s global team of approximately 1,300 investment professionals strive to seek out the best investment opportunities in Australia and around the world to help grow and protect members' super balances.

Find out more

Visit the dedicated Mercer Super hub at mercersuper.com.au/bt, which provides you information about the transfer to Mercer Super.

The hub includes information about Mercer Super, answers to frequently asked questions and Mercer Super’s investment options and fees.

Getting to know Mercer Super webinar

During the webinar, Tim Barber, Chief Executive Officer, Mercer Super and Kylie Willment, Chief Investment Officer Pacific, Mercer Australia answered the top questions members have asked us since the merger announcement, and we shared some details of what’s coming up next for members in the lead up to the transfer.

The running time for the webinar is approximately 48 minutes, however, you can select individual ‘chapters’ and watch particular topics of interest. During the recording of the live webinar, we experienced some minor audio issues. Most of the webinar is clear, but please accept our apologies for any loss in sound quality at times.

- BT Super

- BT Super for Life

- BT Super for Life – Westpac Group Plan

- BT Super for Life – Transition to Retirement

- BT Super for Life – Retirement

Securing the future for BT members

The BT Super Trustee engaged broadly across the industry and underwent a robust and competitive process to find the right future partner who shares our passion to help members have the best possible retirement.

Learn more about the steps that were taken to ensure the best financial outcomes for members in this Westpac Wire interview with the BT Super Trustee Chair, Gai McGrath.

What are the potential benefits from the merger?

By being part of a much larger fund, members and employers will have the potential to benefit from:

Benefits for members

-

Stronger performance

Mercer Super’s default investment option, Mercer SmartPath®, has achieved returns above the Default Options Median spanning three, five and seven years** for the majority of members. -

Lower fees

Most members will enjoy a fee reduction. -

A wide range of investment options

Members will have access to an expanded investment choice menu for those who want to take control of choosing their own investments, backed by Mercer Super’s access to a diverse range of investments options. -

Broader member services

An Australian-based team will be available to answer your calls and provide limited advice over the phone. -

Access to insurance cover

Generally, if members have insurance cover, the amount and cost of any insurance cover held will not change as a result of the transfer.

Frequently asked questions

About the merger

Why is BT Super merging with Mercer Super?

The BT Super Trustee engaged broadly across the industry and after a robust and competitive process believes this merger will create a larger superannuation fund with the potential to deliver stronger performance, lower fees and broader member services.

Why did the Trustee choose Mercer Super?

The Trustee undertook a robust and competitive process, to find the right future partner who shares our passion to help members have the best possible retirement.

Mercer Super Trust has been operating for over 25 years and has more than 280,000 members. The merger will increase the scale of Mercer Super Trust to become one of the 15 largest super funds in Australia^^ – creating more opportunities that’ll benefit members.

We’re pleased that like BT Super, Mercer is focused on its members and people. Mercer’s core business is superannuation, and they are keen to invest and provide better outcomes for members and our people.

Your Trustee is confident that the terms agreed on will enable both parties to execute the merger, our members to retain their benefits and performance objectives for their investments, and suitable outcomes will be made available for our people.

Which products does this merger include?

This announcement only affects you if you have a BT Super, BT Super for Life, BT Super for Life – Retirement, BT Super for Life – Transition to Retirement or BT Super for Life – Westpac Group Plan account.

All other BT accounts are not affected by the intention to merge with Mercer Super.

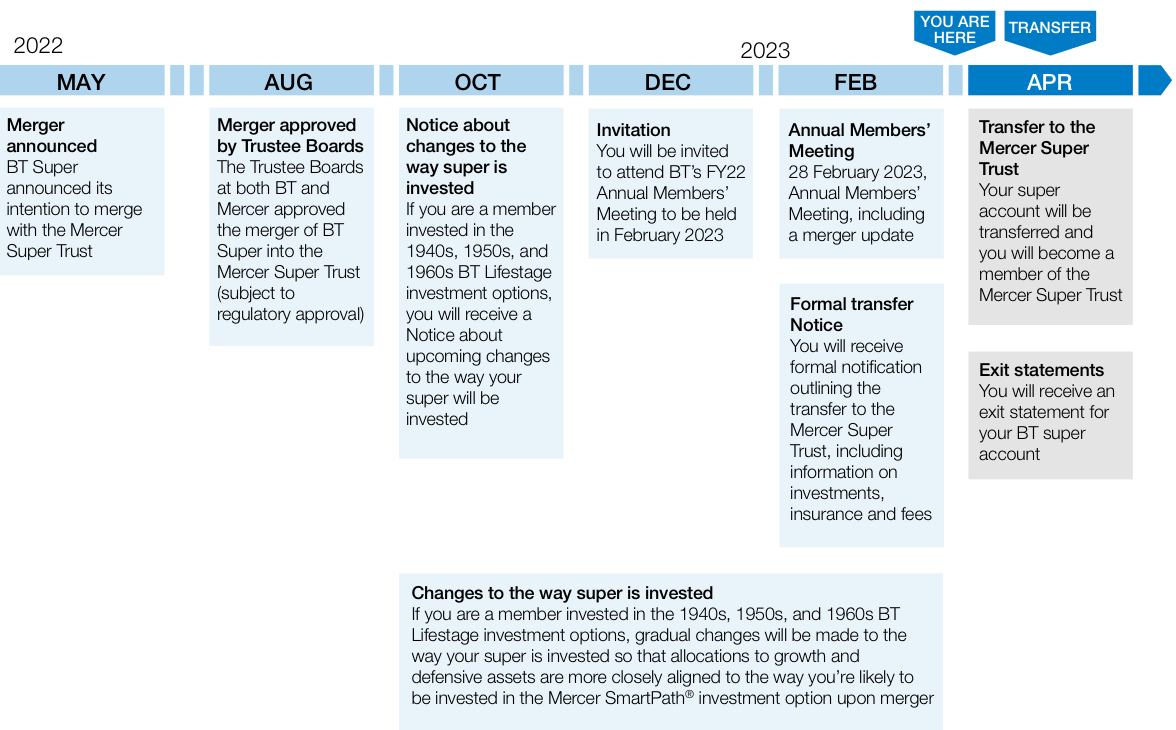

When is the merger happening?

BT Super has entered into an agreement with the intention to merge into Mercer Super on or around 1 April 2023. These dates are subject to change. Please bookmark this page for updates.

About your super account

Will my fees change?

Most members will pay lower fees and costs following the transfer to Mercer Super. This includes the removal of the dollar-based administration fee and reduced percentage-based administration and investment fees. There will be no fees incurred to transfer your account balance to Mercer Super.

Will my investments change?

Mercer Super has a range of investment options available to members. Your account balance will be transferred to an equivalent or similar investment option(s) in Mercer Super.

Will my insurance arrangements change?

AIA Australia Limited (AIA) continues to be the group insurer for insurance cover provided through BT Super and BT Super for Life (including Westpac Group Plan) accounts.

Following the merger, your insurance will still be provided by AIA and your insurance arrangements (such as insurance cover and costs) will -remain the same and- continue in Mercer Super. -Trust until the end of the current rate guarantee period (which is 30 June 2023).-

Until the merger, please continue to call us if you wish to apply for or change your insurance cover or should you need to claim on the insurance cover in your super account.

Are there any costs when transferring my super to Mercer Super?

No – Mercer Super Trust has offered to meet one-off costs associated with the Successor Funds Transfer for BT Super members.

How will I access my super account online?

You will receive your new online access details for your Mercer Super account after the transfer is completed.

Mercer has a dedicated member online portal and the Mercer Super app, allowing you to manage your super online, including:

- Checking your account balance, account activity, and download statements;

- Updating your investment options online;

- Reviewing your insurance cover (if available);

- Checking beneficiaries and updating or making a beneficiary nomination online;

- Consolidating any other super (including lost super) online;

- Estimating your retirement income using an online tool.

When will I have all the details about how this affects my super account?

We will send you a Significant Event Notice outlining all the changes for your super account before your super is transferred to the Mercer Super Trust in February 2023.

What will happen to my Sims Group Defined Benefit account?

Your Defined Benefit account will be transferred to Mercer Super Trust in the first half of on or around 1 April 2023.

Please be assured that your defined benefit arrangements will not be changed.

Retaining your defined benefits is a requirement of the transfer to Mercer. After the transfer into Mercer Super, your defined benefits will be provided from the Mercer Super Trust which is overseen by their Trustee, Mercer Superannuation (Australia) Limited (MSAL).

About getting advice

Can I get advice about my super?

You might also consider seeking financial advice from a professional financial adviser if you think this would be appropriate. If you don’t have a financial adviser, you can refer to the government’s website at moneysmart.gov.au (then click on >Tools and resources > Choosing a financial adviser) to find out more about choosing a financial adviser.

Other

Is Westpac selling another business?

Westpac entered into an agreement to sell its Advance Asset Management business (Advance) to Mercer Australia.

The sale is of Advance, a multi-manager investment business which provides specialist funds management services and products, including for certain investment options available through BT Super’s personal and corporate superannuation funds.

The sale of Advance will add additional asset management capability for Mercer that will leverage Mercers’ global manager research reach, and the scale and expertise as one of the largest multi manager businesses in the world.

Things you should know

^ These dates are subject to change. Please bookmark this page for updates.

^^^ SmartPath cohorts that make up the 84% of members (born 1964-1968, 1969-1973, 1974-1978) compared to the median of all default funds reported in SuperRatings Fund Crediting Rate Survey 30 June 2022 – Default Options.

**SuperRatings Fund Crediting Rate Survey – Default Options as of June 2022.

This information is current as at 17 October 2022. The information is prepared by BT Funds Management Limited ABN 63 002 916458, AFSL 233724, RSE No. L0001090 (BTFM) who is the issuer of BT Super, BT Super for Life and BT Super for Life – Westpac Group Plan, which are part of Retirement Wrap ABN 39 827 542 991. BTFM is a subsidiary of Westpac Banking Corporation ABN 33 007 457 141 AFSL and Australian Credit Licence 233714 (Westpac).

The information provided has been prepared without taking account of your personal objectives, financial situation or needs. Because of this you should, before acting on this information, consider its appropriateness, having regard to your objectives, financial situation and needs.

A Product Disclosure Statement (PDS) (including the Guides) is available for BT Super and can be obtained by visiting bt.com.au/btsuper. A Product Disclosure Statement (PDS) and Financial Services Guide (FSG) for BT Super for Life can be obtained by visiting bt.com.au/superforlife. A PDS or FSG for BT Super for Life – Westpac Group Plan can be obtained by calling 1300 776 417 or signing into your account online.

You should consider the PDS before deciding to acquire, continue to hold or dispose of interests in BT Super, BT Super for Life and/or BT Super for Life – Westpac Group Plan. AIA Australia Limited ABN 79 004 837 861, AFSL No. 230043 is the issuer of insurance cover offered through BT Super for Life and BT Super for Life – Westpac Group Plan.

An investment in BT Super, BT Super for Life and/or BT Super for Life – Westpac Group Plan is not an investment in, deposit with any other liability of Westpac Banking Corporation ABN 33 007 457 141 or any other company in the Westpac Group. It is subject to investment risk, including possible delays in repayment of withdrawal proceeds and loss of income and principal invested. Westpac and its related entities do not stand behind or otherwise guarantee the capital value or investment performance of BT Super, BT Super for Life and/or BT Super for Life - Westpac Group Plan.