Sadly, this supply and demand imbalance can create problems as well as opportunities for firms looking to grow, especially if they’ve been too caught up in ‘being busy’ to prepare their business for greater capacity.

So, what do firms need to do to ensure they are positioned to take full advantage of this significant demand? We’ve partnered with specialist business coaches Elixir Consulting to bring you insights and ideas to help you make the most of this growth opportunity. In our Best Practice webinar series, Elixir delve into strategies to help you increase capacity and efficiency, and ensure your pricing is structured well to position you for sustainable growth.

There are some critical steps to follow before getting to the tactical detail, however. When opportunities abound, the key requirements are good planning and a clear focus.

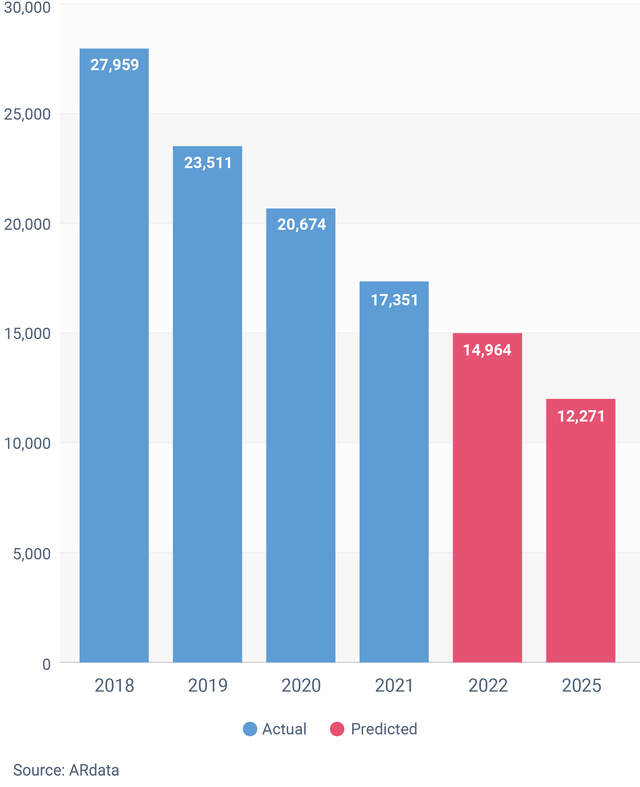

Adviser numbers: then, now and the future

Take the next steps

-

Explore BT Panorama

Increase efficiency and client value with online consent, our award winning mobile app and more.

-

Questions about BT Panorama?

Speak to a BDM or

call 1300 783 143

As shared by Graham Burnard and Sue Viskovic from Elixir in the first webinar of the series, “the most successful firms that we deal with have two things in common. They all have clarity about where they are going and how they plan to get there.”

It starts with clarity of purpose

A clear and compelling purpose is a great way to attract and motivate the right kind of people to your business and becomes a clear guiding star when having to make key decisions. To define this it can be helpful to ask yourself - why are you in the business of financial advice?

A clear vision

These successful firms also have clarity on what success looks like. They know where they want to be in 3, 5 and even 10 years. You can’t tell a builder to build you a house and expect to get what you want if you don’t give them your vision for what the end result should look like. The same goes for your business. If you are not clear about what you are trying to build how do you know you’re making the right decisions in your business? This is particularly important when there are multiple stakeholders in the business. Alignment around a common goal is critical, and if there is a different vision of success, better to find this out early so it can be resolved.

A plan for success

With clarity of vision, the successful firms then build out their strategic plans, setting business goals and major deliverables necessary to make the vision a reality. It is critical that this is a ‘whole of business’ plan. There are four key elements to a successful strategic plan:

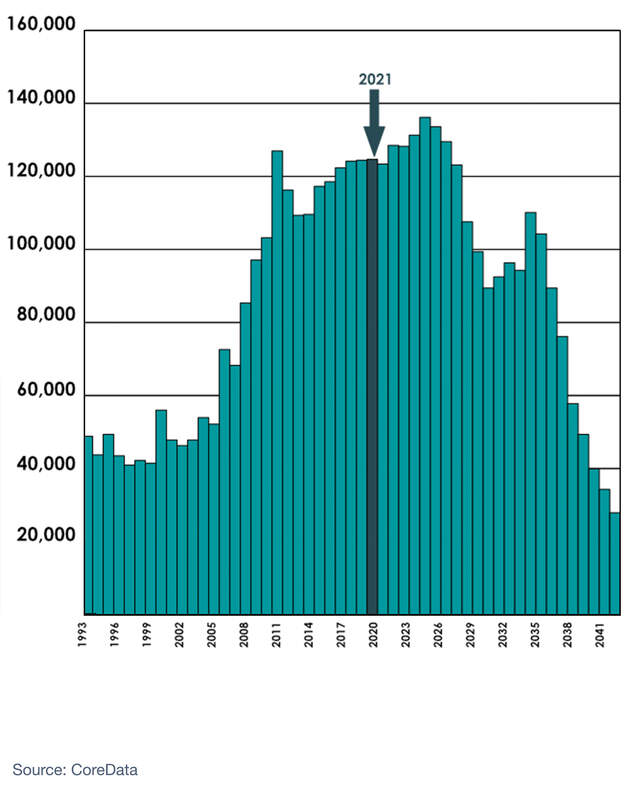

Australians reaching Age 65

1. The Economic Engine. Elixir often see firms with good plans around what they call the Economic Engine. This would be the financial planning advice you deliver along with other services that clients will pay for. The important consideration here is to ensure that each stand-alone offer you provide – e.g., financial advice, risk advice, aged care support, perhaps accounting etc), has a clear proposition and is economically viable in its own right. You may need to determine whether it is in the best interests of the business to do this in-house or should it be outsourced or done at all?

2. Culture is the foundation for any long-term successful firm as this underpins everything that happens in the business. Taking time to define the type of culture you want and then thinking deliberately how you will create this if it doesn’t already exist is critical, especially in a growing business. All too often culture is just a by-product of the environment rather that it being a deliberate business objective to create the culture you want.

3. Organisational design is how the business operates. A good organisational design will mean there is clarity for each role in the business with clearly defined measures of success. In addition, all systems and processes are documented and applied across the business.

4. Financial security represents the focus on sound financial management with robust reporting on business performance. This is critical for identifying challenges early and to ensure the business is on track to meet its financial goals. This also encompasses access to funding if acquisitions are planned and clear succession planning for all the key roles in the business.

The importance of focus

With unprecedented levels of opportunity, it’s more important than ever to be clear on the types of clients you want to deal with and the services you want to provide them. One of the strongest influencers of profitability can be clarity of target market. In Elixir’s opinion, those firms with a clear view of their market and the discipline to remain focused on this market typically have a higher EBIT (Earnings before interest and tax) than those that find it hard to say “no”.

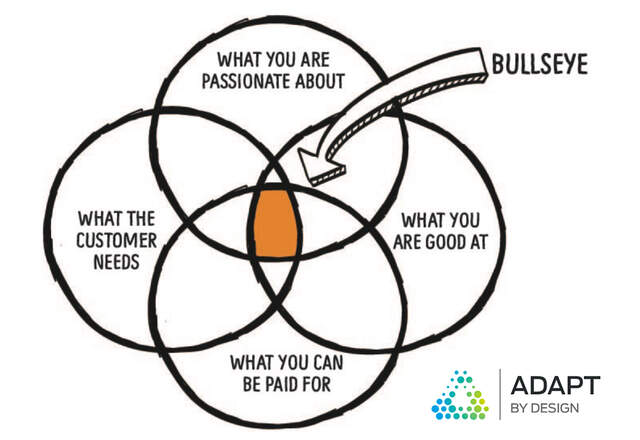

If you don’t already have clarity of where to focus, Elixir suggests a simple exercise to identify your bullseye.

1. What are you passionate about? What is your purpose, what is it about the business that you love?

2. What are you good at? What are the technical skills you and your team have?

3. What do your clients need? What are the challenges and areas of advice that you can address for your ideal clients?

4. What can you be paid for? What is it you do that clients will value the most?

Where these intersect is your Bullseye. Elixir say they find that the most successful firms have clarity of their bullseye in terms of their target market and the services they will provide and are disciplined about saying no to people that sit outside this segment or require services and advice not core to the business.

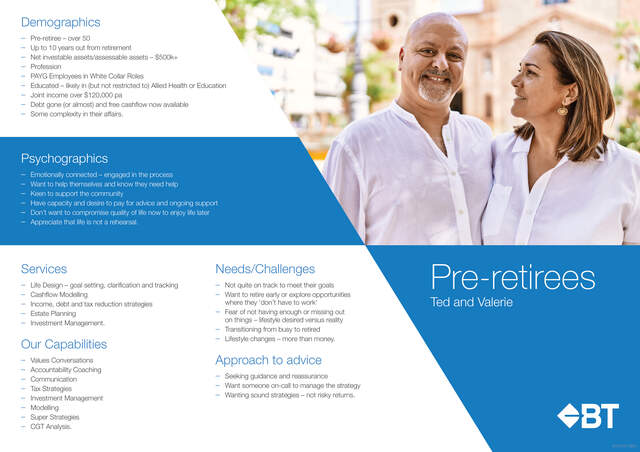

It can be helpful to document a client avatar to bring to life this ideal client and make it easy for your team and your referral partners to identify the type of people you want to work with and the issues you can address. Here’s a sample of a ‘client avatar’ as suggested by Elixir Consulting.

A 12-month tactical plan

Elixir recommends capturing all of these elements discussed as a long-term strategic plan, along with some forecasts of what the firm will look like size-wise in 3, 5, even 10 years’ time. These plans are just as important for a small 2-3 person firm as they are for a large firm.

Elixir’s Graham Burnard says “One of the most important hallmarks of the successful firms we work with is that they have a clear plan for the 12 months ahead. They know exactly what numbers the business is shooting for, the changes they want to make to the business and what milestones they need to hit during the course of the year.”

This tactical plan is not War and Peace, in fact creating “a plan on a page can help you create a plan that’s simple, clear and focused.

With the plan in place the next step is to make time at least once a month to work on the business, to review the progress to plan and determine when and how to course-correct if necessary.

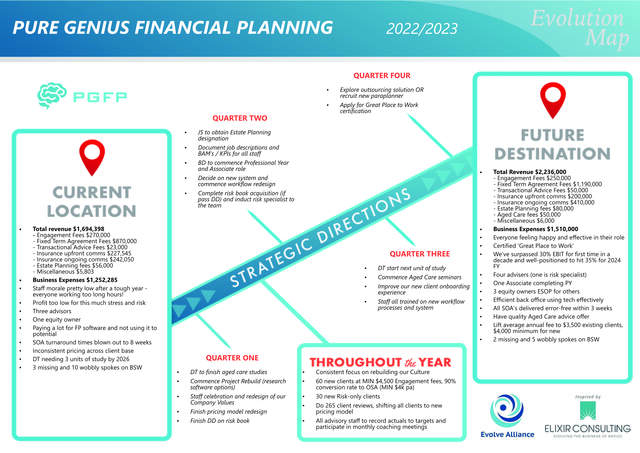

Here is an example of what a plan on a page can look like Elixir call this their Evolution Map as, like a map, it defines your starting point, your end point and the path you need to take in order to achieve the end goal.

In summary, we are entering a period where there should be outstanding opportunities for financial advice businesses to grow and to achieve great outcomes for all their stakeholders. But with so much opportunity, the need for clarity of direction, focus and a clear plan for success is more important than ever. Those businesses that spend the time working on the business to build the vision, the point of focus and the plans to support the business should be in a perfect position to ride the wave of success rather than being swamped by it.

For more insights from our panel to help your business thrive, register to watch the webinar on demand.

Disclaimer:

Information current as at 31 March 2023. The information contained in this publication provides an overview or summary only and should not be considered a comprehensive statement on any matter or relied upon as such. This information does not take into account your personal objectives, financial situation or needs and so you should consider its appropriateness, having regard to these factors before acting on it. This may contain material provided by third parties derived from sources believed to be accurate at its issue date. While such material is published with necessary permission, the Westpac Group accepts no responsibility for the accuracy or completeness of, nor does it endorse any such third party material. To the maximum extent permitted by law, we intend by this notice to exclude liability for this third party material. This communication has been prepared for use by advisers only. It must not be made available to any client and any information in it must not be communicated to any client.