As we approach the peak of baby boomers reaching retirement, it’s important for advice firms to continue to adapt their business to stay profitable and grow sustainably. With this in mind, we recently heard from Andrew Inwood, founder and principal of CoreData, who has more than 30 years’ experience in the Australian financial services industry as well as European and American markets. While he acknowledged the costs associated with making changes, there are undoubted rewards in doing so, with $3.9tn in intergenerational wealth available.

Andrew emphasises how important it is to understand the next generation coming through and how they are different. According to him, this generation places a higher value on experiences, which needs to be reflected in offerings from advice firms. We look at how you can implement these changes, navigate the challenges and safeguard the future of your business.

The cost of doing nothing

The amount of money in the intergenerational wealth market is significant. As these assets pass from one generation to the next, this presents a significant risk to advisers, but a big opportunity too. By doing nothing, research from CoreData1 suggests advisers risk losing up to two-thirds of their funds under advice (FUA) during this phase.

This may be less of a concern for some businesses. For example, advisers intending to sell within the next few years might not see focusing on intergenerational wealth as a worthwhile investment. However, if your practice has a high proportion of baby boomers about to reach decumulation and is still relatively early on in its technology transformation, the valuation of your business might be lower than you expect. Regardless of where you are on the path to transformation, it is beneficial to embrace this change and maximise the overall value of your business.

Take the next steps

BT Academy

How do you develop an intergenerational wealth offer?

According to Andrew, developing an intergenerational wealth offer is about recognising the type of business that is likely to succeed over the next decade. As wealth passes from one generation to the next, the demographic groups in your client base will change, with a greater proportion made up of Gen X and Millennials. These younger clients can be expected to have different preferences to their Baby Boomer parents when it comes to asset allocation, risk tolerance and the way they want to interact with their investments.

So, what do Gen X and Millennials want or expect from their adviser? “ESG (Environmental, Social, and Governance) considerations often make headlines for these generations and are undoubtedly important,” says Andrew. “However, CoreData research shows these concerns may decrease when it involves their personal wealth, with ESG being one of many considerations in their investment decisions.”

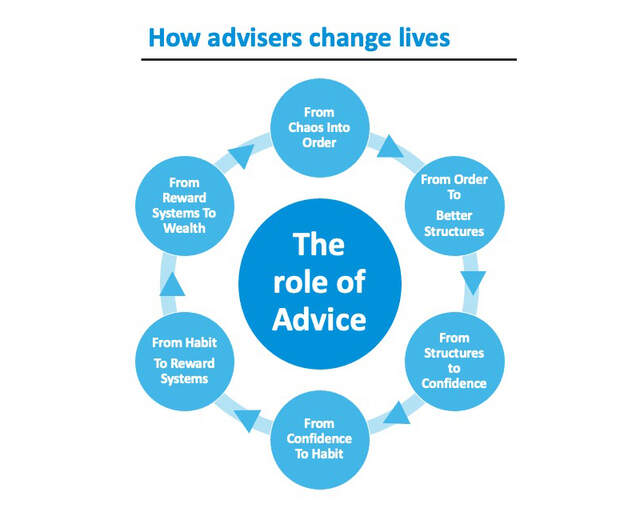

Andrew also highlights an important change between generations in their expectations from a financial advice service. “The biggest area of opportunity for Gen X and Millennials is the experience of receiving financial advice,” he says. “These clients regularly pay a premium for experiences in their life, and this is what successful advice businesses will embrace going forward – shifting from being a transaction-like meeting once or twice a year, to more of an educational journey that offers support as and when they need it.”

“What plans and processes do you have in place to ensure that when wealth is transferred, it stays in your business and continues to grow?”

Reshaping your business

These insights suggest that the goal of digital transformation should be to make your business easier to deal with and improve your clients’ experience. For example, a common situation you are likely to face in the future, and perhaps currently, is a family trying to settle an estate using multiple advisory firms. It stands to reason the one that is easiest to work with can win the business.

It starts with selecting your platform(s). Andrew shares that ‘In the UK, successful businesses have one platform relationship, compared to 2.7 platforms on average in Australia’. This forms the basis for building their technology solutions, processes and customer proposition. Deciding on one single relationship or multiple relationships is a decision for your individual business. By getting these relationships and systems in place, you will set your business up for success going forward. Not only will it improve your clients’ experience, but it will also make life easier for staff, increasing productivity and satisfaction.

Pricing your offer

Many advice firms may already have a path in mind for reshaping their business. As they’re likely to be facing several cost pressures, further investment in technology and digitisation may seem out of reach. This is often because advisers in Australia are currently charging too little for the service they provide and which can stand in the way of fully realising the gains to be made from the investment. This is why it is essential to establish the services you plan to offer and determine a fair price for each.

If you’re offering a product that is more ‘off-the-rack’, it should be priced appropriately when compared to a bespoke offering. “If you’re an adviser with 20 years’ experience, your fee should reflect the value in your knowledge, much as you would expect for any other professional service such as a lawyer or accountant,” says Andrew. “Taking these factors into account will allow you to scale pricing appropriately for the time involved in servicing clients and allow you to offer a service that is potentially more appropriate. Matching charges to the service provided can be a key driver of increased profit per client.”

People with Advisers

- Have better insurance

- Save more

- Are more confident about their future

- Retire earlier and on their own terms

- Retire richer

This is backed up by research from CoreData, which shows that absolute cost is not the most important consideration for clients. Instead, clients place much greater value on a reputable, business. So while this approach will require an investment to provide the experience clients seek, they are prepared to pay for it. “For clients seeking reassurance on your value proposition, Vanguard has done a lot of research into what they call ‘Adviser’s Alpha’,” says Andrew. “This can be helpful when having conversations with client’s children who are often talking to a financial adviser for the first time and may be inclined to question the value of your service.”

Vanguard Adviser’s Alpha*

Generally measured at 3%, Adviser’s Alpha are the additional returns advice clients receive over and above what they could expect without advice. “While this is not so significant over one year, thanks to compounding, this alpha impact becomes far more beneficial starting from year four/five.” Andrew says

Transform your business today

For advisers looking to the medium to long term growth of their business, it’s important to recognise that the advice landscape is changing and to do nothing is to put your business at risk. The change in demographic to a younger audience requires a different business proposition, switching focus to the experience offered by firms and technology, along with strategic partner relationships, are key to facilitating this. While there is a cost and no small effort involved, the reward is a chance to take a larger slice of the $3.9tn intergenerational wealth pie and set your business up for success and sustainable growth going forward.

For more insights from Andrew Inwood, CEO, CoreData, to help your business thrive, register to see the webinar on demand.

This document has been created by Westpac Financial Services Limited (ABN 20 000 241 127, AFSL 233716). It provides an overview or summary only and it should not be considered a comprehensive statement on any matter or relied upon as such. This information has been prepared without taking account of your objectives, financial situation or needs. Because of this, you should, before acting on this information, consider its appropriateness, having regard to your objectives, financial situation and needs. Projections given above are predicative in character. Whilst every effort has been taken to ensure that the assumptions on which the projections are based are reasonable, the projections may be based on incorrect assumptions or may not consider known or unknown risks and uncertainties. The results ultimately achieved may differ materially from these projections. This document may contain material provided by third parties derived from sources believed to be accurate at its issue date. While such material is published with necessary permission, Westpac Financial Services Limited does not accept any responsibility for the accuracy or completeness of or endorses any such material. Except where contrary to law, Westpac Financial Services Limited intends by this notice to exclude liability for this material. Information current as at 10 December 2021. © Westpac Financial Services Limited 2021.

1. Advisable Australian Report June 2022

* https://www.vanguard.com.au/adviser/en/advisers-alpha/quantify-your-value-tab (no longer online, see https://www.vanguard.com.au/adviser/learn/practice-management/engage-with-clients)