Since the 2018 Royal Commission, two million clients have fallen out of the advice market. CoreData research states that 660,000 clients actively want a new adviser1. We spoke to CoreData’s founder and principal, Andrew Inwood, who has more than 30 years’ experience in the Australian financial services industry as well as European and American markets.

Andrew acknowledged that clients are struggling to find good advisers as many practices are already at capacity. “With these firms facing headwinds of improving their technology, increased costs and labour shortages, they are struggling to create capacity within their current model,” he says. “Streamlining operations is one potential solution that can help and has been shown to provide an average of 20% sustainable growth2 to the client base while also reducing cost per client.”

What is sustainable growth?

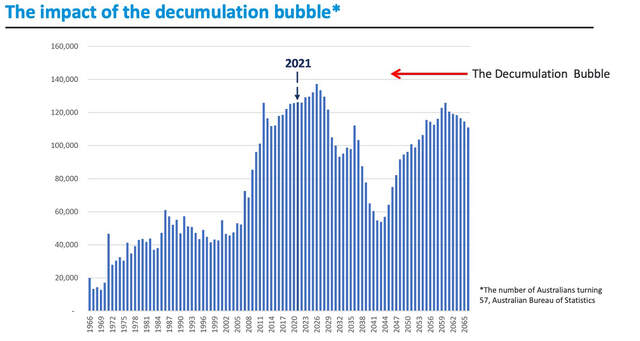

According to Andrew, many practices believe they have established successful businesses and have no need to make wholesale changes. From the outside, this may appear correct – they have a large book of wealthy clients helping the business achieve good profits each year. For many firms, the majority of clients are entering the decumulation phase, and while profitable, their cost to service each client is higher than it needs to be. As a result, the valuation of such businesses may be lower than expected.

“Sustainable growth allows you to reduce your cost to service each client while growing your client base – offering a potential solution to the 660,000 people seeking an adviser,” says Andrew. “Finding capacity for these extra clients requires efficiencies to be made. One way to achieve this is by working with external partners, such as a platform provider, to streamline and standardise your processes and your service. This can reduce your cost to onboard clients, allowing you to optimise your client base. With the extra time available advisers can increase the number of clients they can serve. This can lead to sustained growth while making your business more attractive to buyers, should you wish to sell.”

Take the next steps

Growing your revenue base without increasing your cost base

According to Andrew, there are two significant challenges to growth for advice businesses in Australia. “The average younger client is not hugely profitable, making it harder to diversify your client base by taking on younger, less immediately profitable clients that can contribute to long-term, sustainable growth,” he says. “A second issue is the challenge of hiring and retaining staff in the current environment.”

These issues are demonstrated well by Price’s law3. As Andrew explains, “Price’s law dictates that 50% of your profit is derived from the square root of your total number of clients. For the average Australian practice serving 125 clients per adviser, that means that 50% of your profit is produced by only 11-12 of those clients.” In other words, most of your clients are getting good value for money but are not particularly profitable for your business. Looking at Price’s law another way, 50% of the work is done by the square root of the total number of staff. With unemployment at historically low levels and fewer people than ever entering the financial advice workforce, the supply of skills to service clients is also putting sustainable growth at risk.

Where is best practice coming from?

When we look to best practice, we often look to the UK due to the parallels between the two markets and similar types of reforms in the last ten years, such as the Retail Distribution Review (RDR) in the UK in 2012 and Hayne Royal Commission in 2018 in Australia. The UK is further along in its reform of the sector and can provide insight into what has worked and what the Australian market can leverage to succeed in an evolving landscape.

Andrew points out that when looking to the advice market in the UK, it is important to note their offering has potentially become more generic. “In the Australian advice market, there is generally more focus on client relationships, so it’s important to decide where you want to position your business on that line,” he says. “Both strategies can be successful, and it needn’t be one or the other. You must choose the right balance for your business and, crucially, price the service accordingly.”

“Bringing their children into conversations early gives you a chance to get them to understand the value of your service to the family.”

What does success look like?

Profitable businesses have been able to achieve a good mix of clients while also reducing their cost base to service each client. According to Andrew, one of the simplest ways to access the next generation of clients is to talk to your current client’s children about money. “Bringing adult children into conversations early gives you a chance to get them to understand the value of your service to the family,” says Andrew. “This will give them peace of mind that their assets will be well managed, as well as bringing benefits to their children and increasing the likelihood that the children will choose to maintain the relationship, keeping the family’s assets with the adviser.”

With this in mind, while having just existing baby boomer clients can present a risk to your business, they are also represent an important opportunity for securing younger clients as one element of sustainable growth. Research suggests that an adviser will, on average, lose two-thirds of the funds under advice (FUA) as this money moves intergenerationally. Those advisers that can create a sustainable growth model and demonstrate the value of their offer to the next generation are in a strong position to compete for this intergenerational wealth, measured at $3.9tn according to CoreData modelling.

From a quantitative standpoint, according to Andrew, a successful and sustainable business in the UK has on average150 clients per adviser, generating $8,000 per client, per year on average. They most often form a strong relationship with a single platform and their progress towards digitisation is well advanced. As a result, the net cost to serve can decrease, setting businesses up for sustainable growth in the future.

Transform your business today

Overall, the strategy for advisers looking to create a sustainable business is quite simple: you need a lower cost to serve and a better mix of clients. By leveraging platform technology, developing relationships with external providers, and improving systems and processes within your business, you can decrease the cost to serve while also reducing your overall risk.Second, by having conversations early with your client’s children, you can achieve a better mix of clients while also increasing your chances of maintaining your FUA. Both of these strategies can result in transformational growth for your business.

While there is an immediate cost both in time and new systems, data from the UK shows this investment is already starting to pay dividends4.

For more insights from Andrew Inwood, CEO, CoreData, to help your business thrive, register to see the webinar on demand.

This document has been created by Westpac Financial Services Limited (ABN 20 000 241 127, AFSL 233716). It provides an overview or summary only and it should not be considered a comprehensive statement on any matter or relied upon as such. This information has been prepared without taking account of your objectives, financial situation or needs. Because of this, you should, before acting on this information, consider its appropriateness, having regard to your objectives, financial situation and needs. Projections given above are predicative in character. Whilst every effort has been taken to ensure that the assumptions on which the projections are based are reasonable, the projections may be based on incorrect assumptions or may not consider known or unknown risks and uncertainties. The results ultimately achieved may differ materially from these projections. This document may contain material provided by third parties derived from sources believed to be accurate at its issue date. While such material is published with necessary permission, Westpac Financial Services Limited does not accept any responsibility for the accuracy or completeness of or endorses any such material. Except where contrary to law, Westpac Financial Services Limited intends by this notice to exclude liability for this material. Information current as at 10 December 2021. © Westpac Financial Services Limited 2021.

1. CoreData - State of Advice Research January 2022

2. CoreData Adviser Efficiency Report December 2021 UK

3. Price’s Law: competence is linear, incompetence is exponential. https://salesmetry.com/en/blog/11

4. CoreData UK Platforms Research